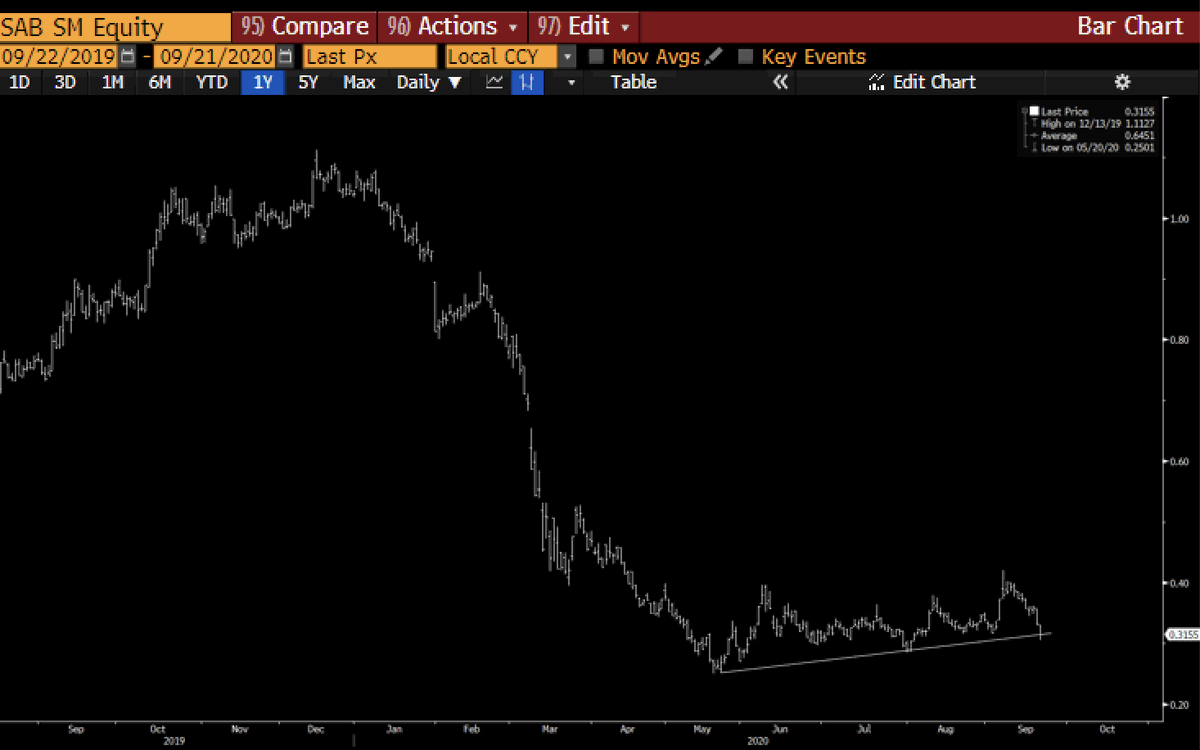

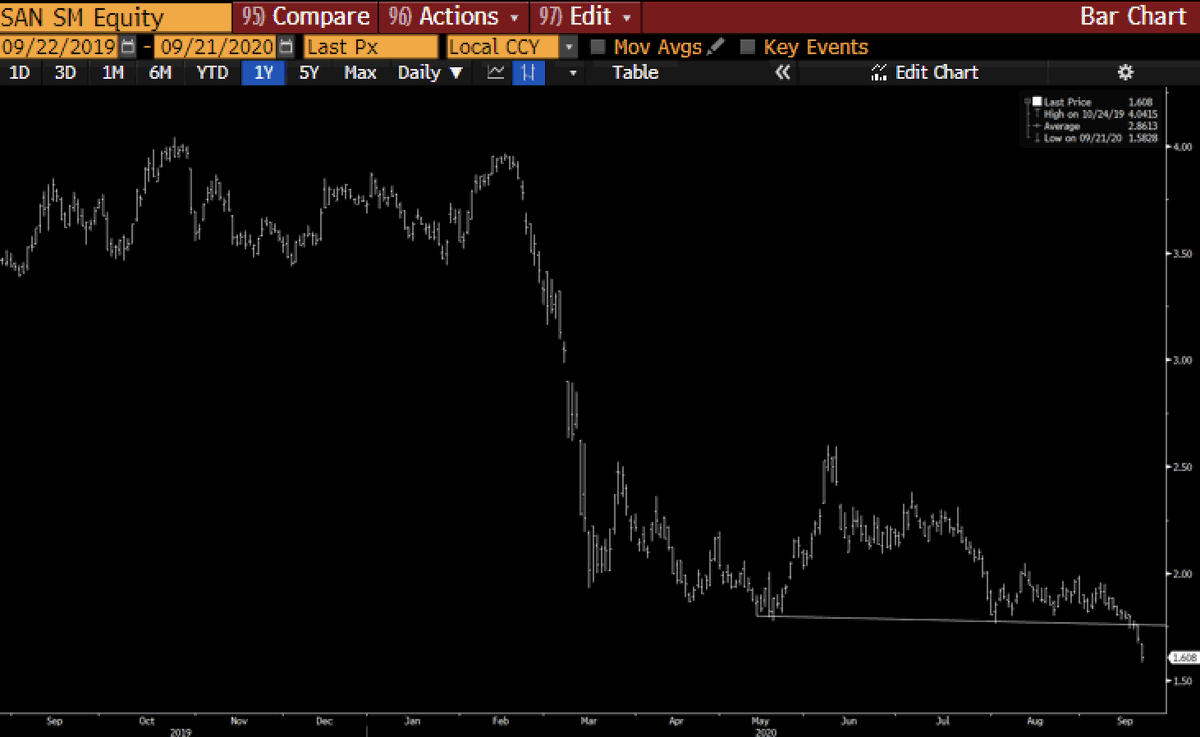

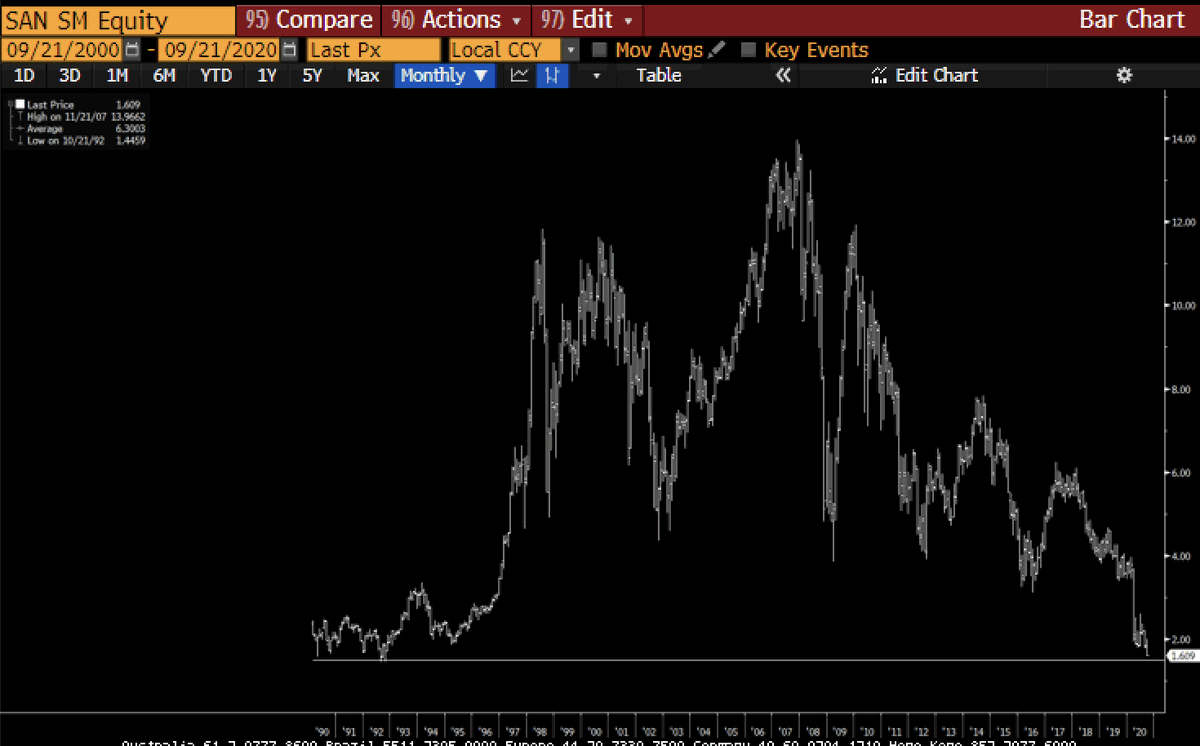

Well, it's that time again to talk about the Spanish banks (I could talk about all banks in Europe but I'll choose Spain since I know it better and they are the worst).

The Spanish summer of tourist revenues was cut short and was very bad over all. The window of opportunity to

The Spanish summer of tourist revenues was cut short and was very bad over all. The window of opportunity to

rebuild cash flows for business and households has passed. COVID complications will cause more economic pain and The Insolvency will become prevalent over the autumn and winter.

Last week the EU gave $73bn in help for the EU banks but that failed - they are down 14% since then.

Last week the EU gave $73bn in help for the EU banks but that failed - they are down 14% since then.

The merger of Caixa and Bankia just turns an ok bank into a shit bank. I still continue to fear that a large part of the equity of the EU banks is going to zero and ends up in state hands.

Meanwhile, the Ibex looks like a horror story...

Meanwhile, the Ibex looks like a horror story...

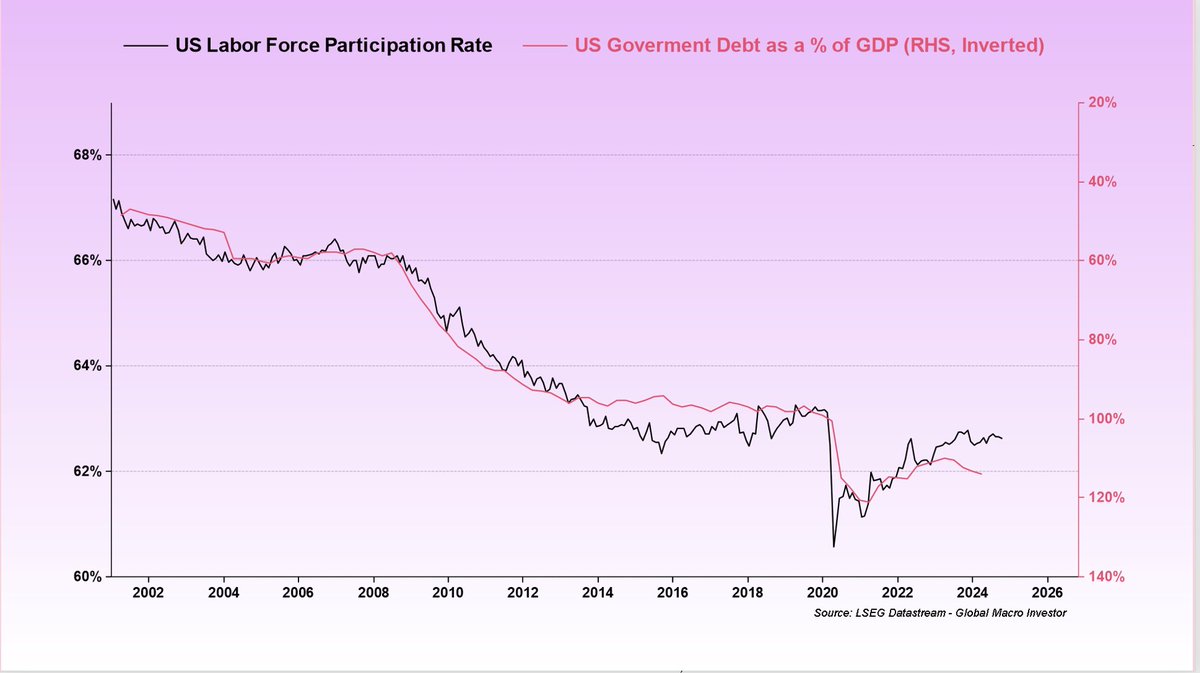

It doesn't feel like the right time to be record-long the Euro... but that is the markets position, or therein there-a-bouts.

Welcome to The Insolvency.

Welcome to The Insolvency.

• • •

Missing some Tweet in this thread? You can try to

force a refresh