How to get URL link on X (Twitter) App

Also, "But P/E ratio's are at bubble valuations!" narrative doesnt take into account the fact the during debasement the P rises (due to debasement) more than E (anchored by GDP growth in general). If debasement is 11% and GDP is 2% trend over same period then P/E rises by 9% p.a

Also, "But P/E ratio's are at bubble valuations!" narrative doesnt take into account the fact the during debasement the P rises (due to debasement) more than E (anchored by GDP growth in general). If debasement is 11% and GDP is 2% trend over same period then P/E rises by 9% p.a

OTHERS (Outside of Top 10... purest form of Alts season where all shit rises). Still in the waiting room but longer to launch...

OTHERS (Outside of Top 10... purest form of Alts season where all shit rises). Still in the waiting room but longer to launch...

We had the exact same correction in 2017 caused by the same reaction to Trump policies (higher dollar and higher rates which then reversed). 2/

We had the exact same correction in 2017 caused by the same reaction to Trump policies (higher dollar and higher rates which then reversed). 2/

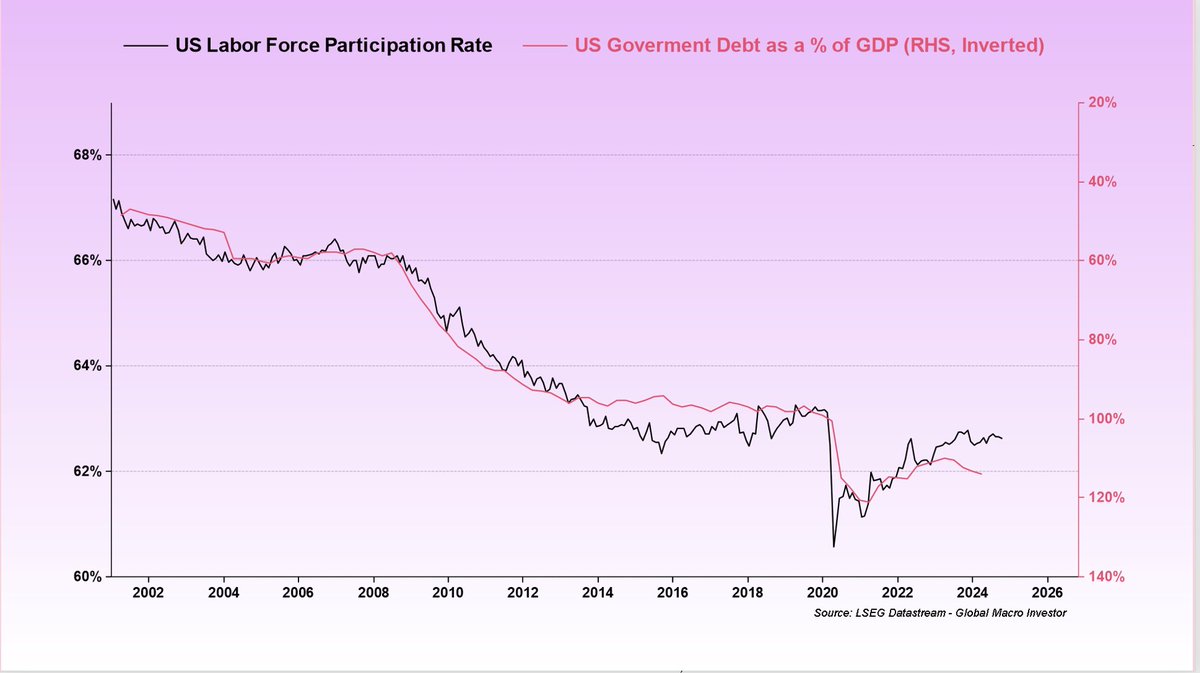

2. Government Debt to GDP ratio is just a function of the working population. It offsets the weak growth and pays for the compunding interests on the debts. This is THE most important chart in macro.

2. Government Debt to GDP ratio is just a function of the working population. It offsets the weak growth and pays for the compunding interests on the debts. This is THE most important chart in macro.

But more importantly, it has broen the downtrend vs $SOL (and all the top 20 tokens). Its relative strength in a sideways market is worth paying attention to.

But more importantly, it has broen the downtrend vs $SOL (and all the top 20 tokens). Its relative strength in a sideways market is worth paying attention to.

Why since 2008? Well, back then the worlds all reset their interest payments to zero and they debt maturity to 3 to 4 years, creating a perfect macro cycle.

Why since 2008? Well, back then the worlds all reset their interest payments to zero and they debt maturity to 3 to 4 years, creating a perfect macro cycle.

And that is driven by liquidity, which bottomed at the end of 2022... macro summer and fall are all about liquidity rising and is a core part of The Everything Code thesis...

And that is driven by liquidity, which bottomed at the end of 2022... macro summer and fall are all about liquidity rising and is a core part of The Everything Code thesis...

ISM + 5 Months:

ISM + 5 Months:

Made worse by the fact that asset prices keep going up. Equities have risen in real terms by 2.5% per year and has compounded in a loss of purchasing power by workers of 83%

Made worse by the fact that asset prices keep going up. Equities have risen in real terms by 2.5% per year and has compounded in a loss of purchasing power by workers of 83%