In 1719, an economist named John Law enriched himself and many others in France by selling the dream of the magical abundance of the Mississippi Valley.

By 1721, he was forced to escape the country disguised as a woman.

Who's up for a story?

👇👇👇

By 1721, he was forced to escape the country disguised as a woman.

Who's up for a story?

👇👇👇

1/ John Law was born in Edinburgh, Scotland in 1671.

The son of a family of bankers and goldsmiths, Law had a reasonably privileged upbringing.

In 1685, he joined the family banking business, where he remained until his father died in 1688.

But Law dreamed of grander pursuits.

The son of a family of bankers and goldsmiths, Law had a reasonably privileged upbringing.

In 1685, he joined the family banking business, where he remained until his father died in 1688.

But Law dreamed of grander pursuits.

2/ After a brief stint on death row - Law had killed another man in a duel over their shared affections of a woman - he began traveling around Europe and writing on the topics of money and credit.

His ideas were revolutionary. He advocated for paper money to replace gold.

His ideas were revolutionary. He advocated for paper money to replace gold.

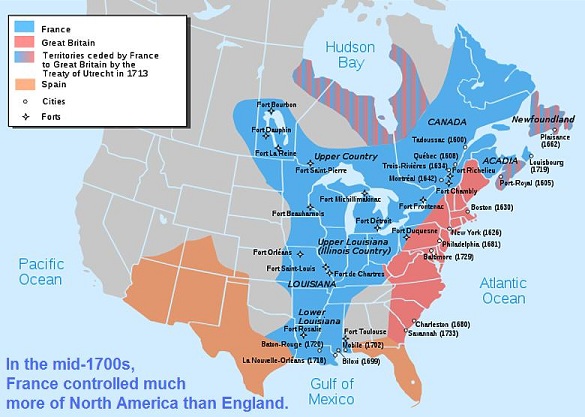

3/ Early 18th century France was in dire straits. A series of wars waged by King Louis XIV had left the country completely broke.

John Law saw opportunity.

In 1716, he convinced the French leaders to allow him to establish Banque Générale Privée, which would issue paper money.

John Law saw opportunity.

In 1716, he convinced the French leaders to allow him to establish Banque Générale Privée, which would issue paper money.

4/ The bank, which became the Banque Royale in 1718, began issuing paper money purportedly linked to gold in its reserves.

Commerce picked up as credit expanded. Money was flowing.

But the French national debt remained burdensome, so John Law dreamed up a scheme to fix that.

Commerce picked up as credit expanded. Money was flowing.

But the French national debt remained burdensome, so John Law dreamed up a scheme to fix that.

5/ He formed The Mississippi Company - a trading company with a monopoly on all activities in the Mississippi Valley.

The public could trade in their French government bonds for shares in this exciting new venture.

This was when Law - a master marketer - went to work!

The public could trade in their French government bonds for shares in this exciting new venture.

This was when Law - a master marketer - went to work!

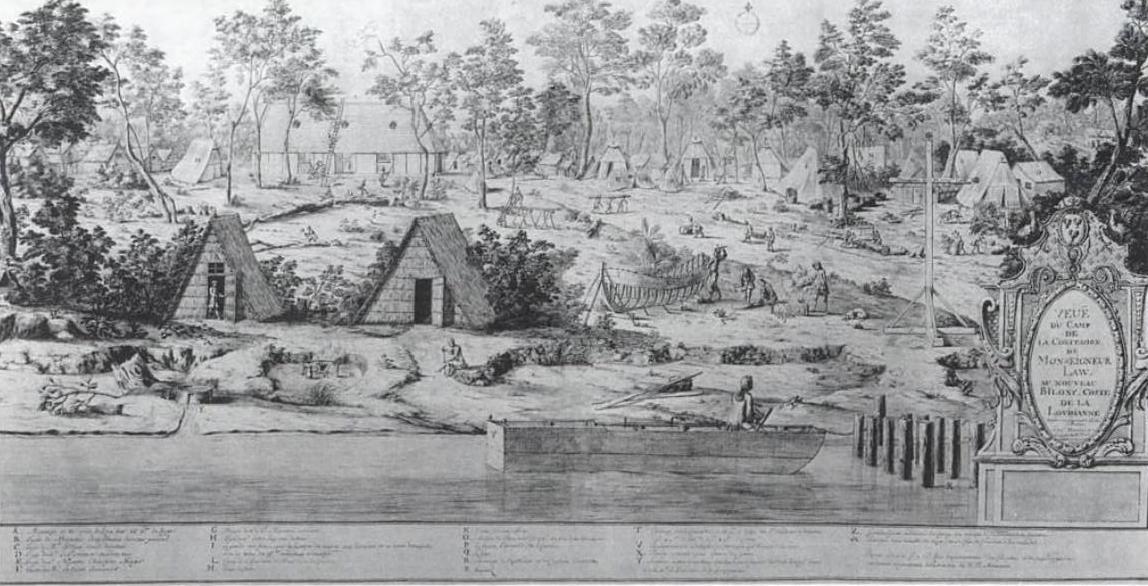

6/ He launched an all out blitz of marketing efforts aimed at driving public excitement around The Mississippi Company shares.

The Mississippi Valley and Louisiana was a land of untold riches and potential (according to his pitch).

The reality? It was an undeveloped swampland.

The Mississippi Valley and Louisiana was a land of untold riches and potential (according to his pitch).

The reality? It was an undeveloped swampland.

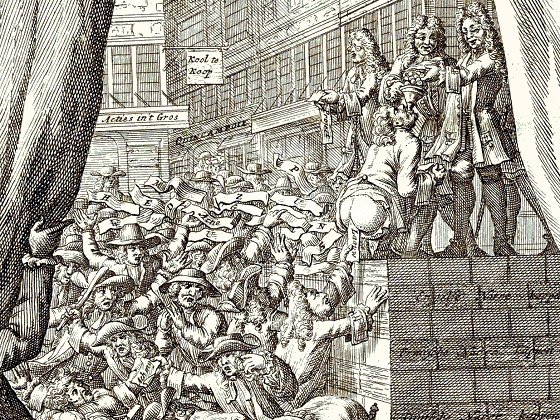

7/ But alas, the people of France fell into Law's well-designed trap.

They traded in their government bonds en masse, allowing the government to consolidate its national debt.

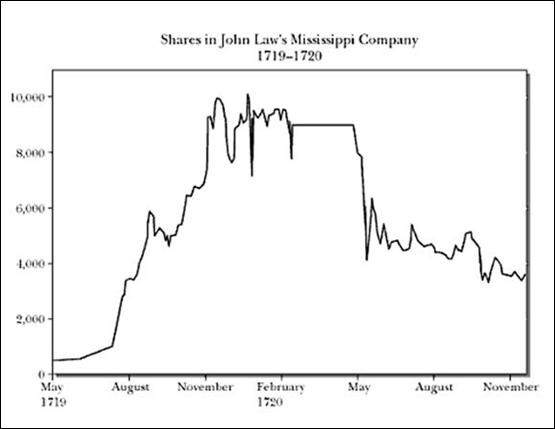

The value of the company shares skyrocketed.

They traded in their government bonds en masse, allowing the government to consolidate its national debt.

The value of the company shares skyrocketed.

8/ The frenzy in full effect, Law and the French leaders sought to take advantage.

The Banque Royal started printing more and more paper money to allow the public to buy the company shares in the open market.

They even allowed people to buy shares on margin through the bank.

The Banque Royal started printing more and more paper money to allow the public to buy the company shares in the open market.

They even allowed people to buy shares on margin through the bank.

9/ The shares continued to rise through 1720, reaching 10,000 livres (a 20x increase in 1 year!).

The term "millionaire" was coined, referring to the speculators who earned millions of livres from their trading of the shares.

Dear reader, if you can see how this ends, bravo...

The term "millionaire" was coined, referring to the speculators who earned millions of livres from their trading of the shares.

Dear reader, if you can see how this ends, bravo...

10/ In early 1720, a prince entered Banque Royale and asked to have gold in exchange for all of his paper money.

This was the deal, after all!

As it turned out, Law and others had gotten over their skis. There was only enough gold for 1/5 of the paper money in circulation.

This was the deal, after all!

As it turned out, Law and others had gotten over their skis. There was only enough gold for 1/5 of the paper money in circulation.

11/ After an initial attempt to limit redemptions failed, panic ensued.

The public was suddenly aware that The Mississippi Company had no meaningful business activity to speak of.

The share price tumbled into 1721. The paper money became worthless without its tie to gold.

The public was suddenly aware that The Mississippi Company had no meaningful business activity to speak of.

The share price tumbled into 1721. The paper money became worthless without its tie to gold.

12/ Many millionaires found their wealth short-lived. Thousands were completely bankrupted by the bubble.

John Law was similarly ruined. As public enemy #1, he escaped France disguised as a woman.

He had once been very wealthy, but he would live out his days as a pauper.

John Law was similarly ruined. As public enemy #1, he escaped France disguised as a woman.

He had once been very wealthy, but he would live out his days as a pauper.

13/ The story of The Mississippi Bubble is one of failed monetary policy as well as speculative, frenzied market activity.

As I'm sure you've noticed, it has many modern parallels...

A good rule of thumb: if something seems too good to be true, it probably is.

As I'm sure you've noticed, it has many modern parallels...

A good rule of thumb: if something seems too good to be true, it probably is.

14/ If you enjoyed this story, I recommend checking out this book by @awealthofcs, which covers a history of interesting financial scams and bubbles. amzn.to/3iOR2CU

15/ And for more educational threads on money, finance, and economics, check out my meta-thread below!

https://twitter.com/SahilBloom/status/1284583099775324161?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh