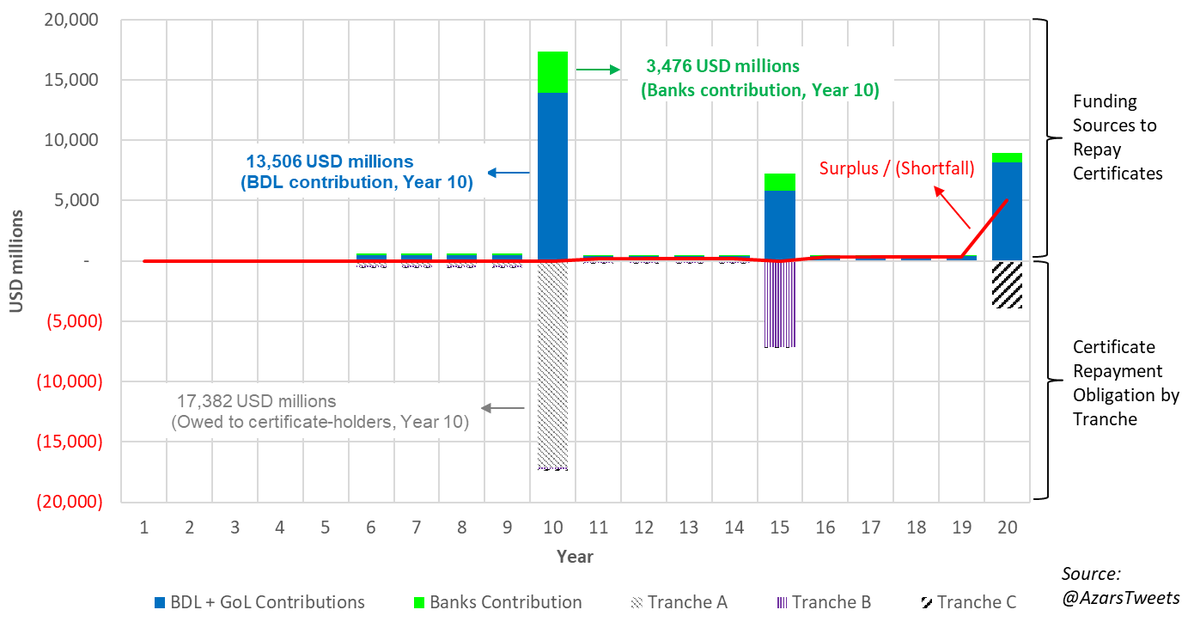

1/ The appointment of 3 political cronies w/ no expertise to coordinate technical & investigative work of the BDL auditors means millions of your $ deposits will be squandered, months we don’t have will be wasted, & forensic audit (with all its limitations) is fully politicized.

2/ It isn’t just the forensic audit. Remember a regular financial audit is being done at the request of IMF and donor countries. This is technical work and requires a competent technical team to coordinate and oversee. MOF is undermining future IMF negotiations & financial rescue

3/ The audits should be suspended & any forensic audit results rejected completely until a committee of independent professionals is appointed and all of the other issues we’ve raised are addressed.

4/ All this while people are drowning in the sea, desperate to escape this broken country. We have no time nor money to waste, people are dying. They just don’t care, the 2 parties fighting over the forensic audit installed incompetent cronies to undermine the entire workstream.

• • •

Missing some Tweet in this thread? You can try to

force a refresh