The offer to purchase: a thread:

When you like a property and you consider buying it, you need to have bargained for a price lower than the asking price. Remember, people push up the price to be above market value.

When you like a property and you consider buying it, you need to have bargained for a price lower than the asking price. Remember, people push up the price to be above market value.

Once accepted, you need to sign a legally binding contract. This is the offer to purchase (OTP). You need to make sure you're covered, as the OTP from the agents are biased towards the seller, you need to consider a few things

Firstly, try and negotiate that you appoint the electrician to do the COC - this is a certificate to prove that the property's electricity is compliant with electrical standards. I have historically reported an electrician who issued the COC illegally.

Make sure you get all the statements from the body corporate (for sectional title places). Make sure that you write in the OTP that you have 14 days to analyse them, and confirm that you will have the right to not proceed if they are not to your liking.

Don't buy into a bankrupt scheme!

Make sure you know what you're buying.

Maybe have someone check the structure and roof for any issues. add that to the OTP.

Make sure you know what you're buying.

Maybe have someone check the structure and roof for any issues. add that to the OTP.

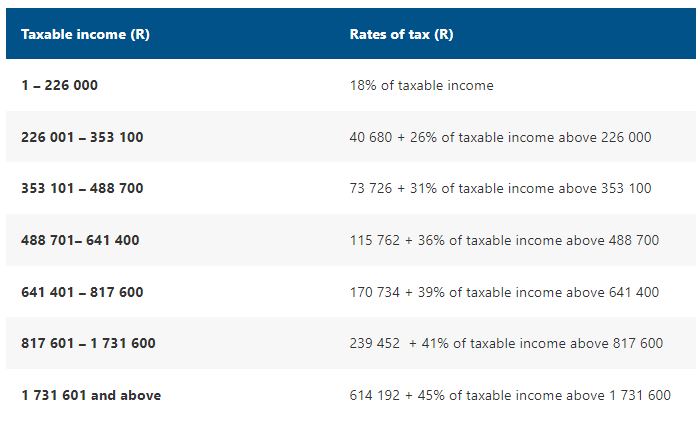

Have enough exit clauses, such as you need to approve the rate of the home loan as appropriate and to your liking. This is incase you realise halfway that there are issues.

Above all, buy Frugal a coffee or send software development work his way, as he is not getting paid to be frugal ;)

• • •

Missing some Tweet in this thread? You can try to

force a refresh