Follow me for valuable insights on personal finance and investing in rental property. I'm a coder with a weekly blog post. Call me Sbu! 💰🏠💻

2 subscribers

How to get URL link on X (Twitter) App

1. "Spend each day trying to be a little wiser than you were when you woke up."

1. "Spend each day trying to be a little wiser than you were when you woke up."

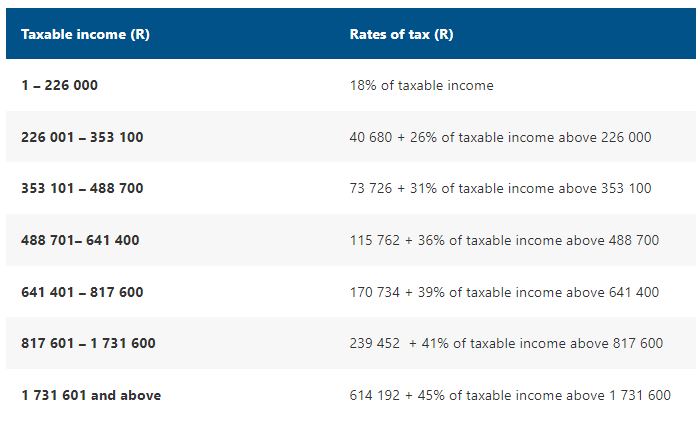

So, as you might know, rental income is taxed at your normal income tax rate. This means, if you're in the 36% bracket, you will be paying 36% income tax on all income made from property rentals.

So, as you might know, rental income is taxed at your normal income tax rate. This means, if you're in the 36% bracket, you will be paying 36% income tax on all income made from property rentals.

2. Turkey: very cheap, amazing food, good coffee and worth just walking around Istanbul. We had a food checklist. Also, check out prices before you buy. Shop around. Avoid touristy places, but do try a Hammam for a scrub!

2. Turkey: very cheap, amazing food, good coffee and worth just walking around Istanbul. We had a food checklist. Also, check out prices before you buy. Shop around. Avoid touristy places, but do try a Hammam for a scrub!