Weekly live look-in at 416 Active Listings 👀

Bit less Freehold inventory than last couple of years.

Way more Condo inventory than last couple of years.

Let's look a bit deeper... /1

Bit less Freehold inventory than last couple of years.

Way more Condo inventory than last couple of years.

Let's look a bit deeper... /1

The following two charts are on the same scales. Amount of 30+ day listings are in the same ballpark, but you can see percentage of "fresh" listings is a lot higher on Freehold (30.6% vs. 23.8%). /2

Rolling 30 days of sales held even for Condos, but listings rose again, so MOI edged up. Now highest since May 19, when it was on the way down from COVID peak. Freehold held same as R30 sales +3.5% from last week, and listings +2.4%. /3

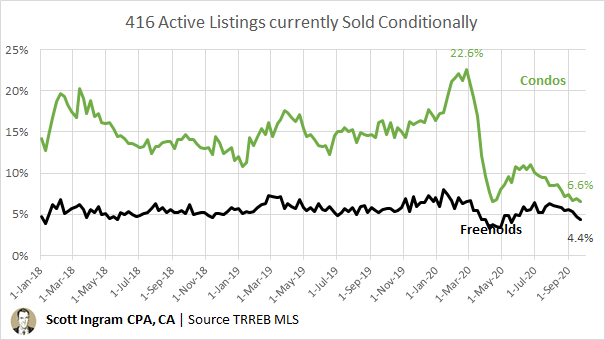

Somebody was asking me about Sold Conditionally (SC) in the last week. In Condos, I've found low number correlates to weaker market, and high number (like that 22.6%) corresponds to hotter market. Worst week in last 3 years was 6.5% back on Apr 14. Pretty much back at that. /4

And we're seeing highest share since Jan 2018 of Condos on a price change. So story continues to be several weak signs in Condo market, but Freeholds still looking okay. /5

• • •

Missing some Tweet in this thread? You can try to

force a refresh