Another 1.5 million people applied for unemployment insurance (UI) last week. That includes 870,000 people who applied for regular state UI and 630,000 who applied for Pandemic Unemployment Assistance. 1/ dol.gov/ui/data.pdf

A reminder: Pandemic Unemployment Assistance (PUA) is the federal program for workers who are not eligible for regular unemployment insurance, like gig workers. It provides up to 39 weeks of benefits but is set to expire at the end of this year. 2/

Last week was the 27th straight week total initial claims were far greater than the worst week of the Great Recession (GR). If you restrict to regular state claims (b/c we didn’t have PUA in the GR), initial claims are still greater than the 3rd-worst week of the GR. 3/

We’ve hit a grim milestone. Most states provide 26 weeks of regular benefits. That means last week was the first week many workers had exhausted their regular state UI. However, data on continuing claims for regular state UI is delayed a week, so we can't see the drop yet. 4/

The good news is that after an individual exhausts regular state benefits, they can move onto Pandemic Emergency Unemployment Compensation (PEUC), which is an additional 13 weeks of regular state UI (and is only available to people who were on regular state UI). 5/

(Note: PEUC, the 13 week extension of benefits for people on regular state UI, is different from Pandemic Unemployment Compensation, or PUC, the now-expired $600 additional weekly benefit, which anyone on any UI program had been eligible for.) 6/

With people moving from regular state benefits onto PEUC, I expect PEUC began to spike up dramatically last week. However, because of reporting delays for PEUC, we won’t actually get PEUC data from last week until October 8th. 7/

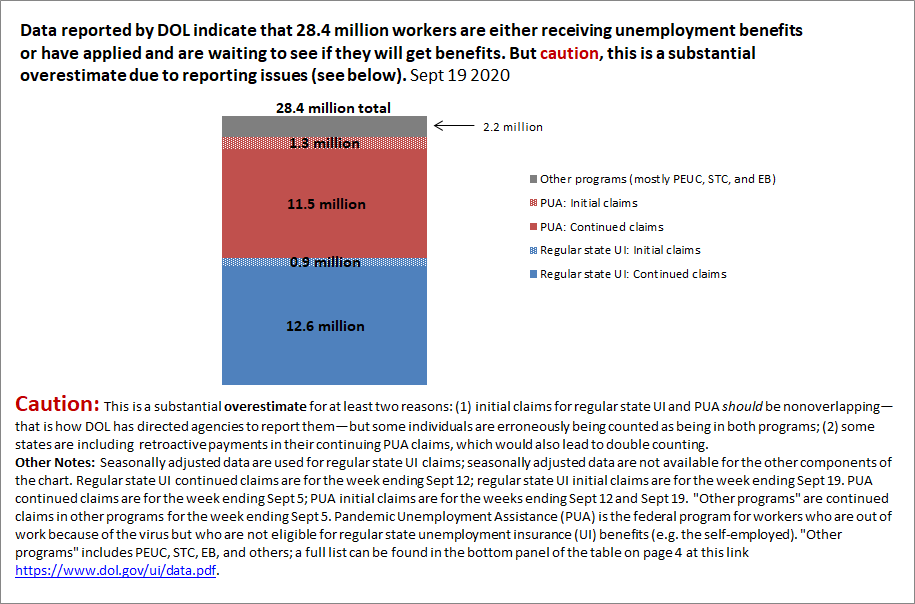

Available data reported by DOL indicate that right now, a total of 28.4 million workers are either receiving unemployment benefits or have applied and are waiting to see if they will get benefits. 8/

🛑But MAJOR caution here.🛑The above chart is a substantial overestimate for 2 reasons. 1st, initial claims for regular state UI & PUA should be nonoverlapping—that is how DOL wants agencies to report them—but some folks may be erroneously counted as being in both programs. 9/

And some states are including retroactive payments in their continuing PUA claims, which would also lead to double counting. This story has good info on that. 10/ nytimes.com/2020/09/16/bus…

The upshot is that—astoundingly—nobody knows exactly how many people are receiving unemployment insurance benefits right now. This is a grim reminder that we need to invest heavily in our data infrastructure and technology. 11/

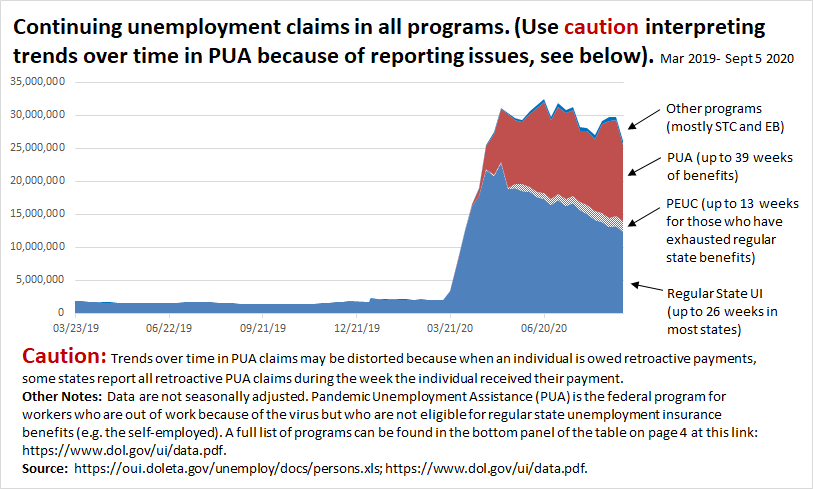

This chart shows continuing claims in all programs over time (the latest data for this are for Sept 5). Continuing claims are more than 24 million above where they were a year ago. (But use caution interpreting trends over time for the last 6 mos b/c of reporting issues.) 12/

Two weeks from today, when we get complete data from last week for the chart in the previous tweet, I expect to see the regular state benefits line drop, and the PEUC line jump up, reflecting people exhausting regular state UI and moving on to PEUC. 13/

Republicans in the Senate allowed the across-the-board $600 increase in weekly UI benefits to expire at the end of July. Last week was the eighth week of unemployment in this pandemic for which recipients did not get the extra $600. 14/

That means most people on UI are now are forced to get by on around 40% of their pre-virus earnings. It goes without saying that most folks can’t exist on 40% of prior earnings without experiencing a sharp drop in living standards and enormous pain. 15/

This is a great piece from @LilyRoberts12 and @Just_Schweitzer showing that there is *nowhere* a worker can afford to live on unemployment insurance alone. 16/

americanprogress.org/issues/economy…

americanprogress.org/issues/economy…

In early August, Trump issued a joke of an exec memorandum. It’s supposed to give recipients an extra $300 or $400 in benefits, but in reality even this drastically reduced benefit is delayed, is only available for a few weeks, and is not available at all for many. 17/

This chart from @TCFdotorg shows how much less in benefits people are getting under Trump’s executive memorandum than they did under the across-the-board $600 benefit. 18/ tcf.org/content/report…

The executive memorandum’s main impact was to divert attention from the only thing that can provide the needed relief—increasing benefits through legislation. Congress must act, but Republicans in the Senate are blocking progress. 19/

Blocking the $600 is terrible economics. The $600 was supporting a huge amount of spending by people who now have to make drastic cuts. The spending made possible by the $600 was supporting 5.1 million jobs. Cutting that $600 means cutting those jobs. 20/ epi.org/blog/cutting-o…

The labor market is still 11.5 million jobs below where we were before the coronavirus recession. Now is not the time to cut benefits that support jobs. 21/ epi.org/press/six-mont…

But what about the supposed work disincentive effect of the $600? Rigorous empirical studies show that any work disincentive effect of the $600 was so minor that it cannot even be detected. 22/

For example, a study by Yale economists found no evidence that recipients of more generous benefits were less likely to return to work. 23/ news.yale.edu/2020/07/27/yal…

Case in point: in May/June/July —with the $600 in place—9.2 MILLION people went back to work. A large share of those were making more on UI than they had made at their prior job, but it did not keep them from going back. People need jobs more than temporary benefits. 24/

Further, there are 8.3 million more unemployed workers than job openings, meaning millions will remain jobless no matter what they do. Blocking the $600 cannot incentivize people to get jobs that are not there. 25/ epi.org/chart/economic…

Cutting the $600 is also exacerbating racial inequality. Due to the impact of historic & current systemic racism, Black and Brown workers have seen more job loss in this pandemic, and have less wealth to fall back on. They are being hurt worse by the expiration of the $600. 26/

This is particularly true for Black and Brown women and their families, because in this recession, these women have seen the largest job losses of all. The Senate must extend the UI provisions of the CARES Act. 27/

And here's your regular reminder that people haven’t just lost their jobs. An estimated 12 million workers and their family members have lost employer-provided health insurance due to COVID. 28/ epi.org/publication/he… @joshbivens_DC @benzipperer

And this is basically this tweet thread in the genre of blog post. 29/ epi.org/blog/many-work…

• • •

Missing some Tweet in this thread? You can try to

force a refresh