Full @resfoundation analysis of the Chancellor's Winter Economy Plan (with thanks to the team for sleep loss overnight). The short version: the policy does not match the rhetoric on protecting "viable jobs". A thread... resolutionfoundation.org/publications/t…

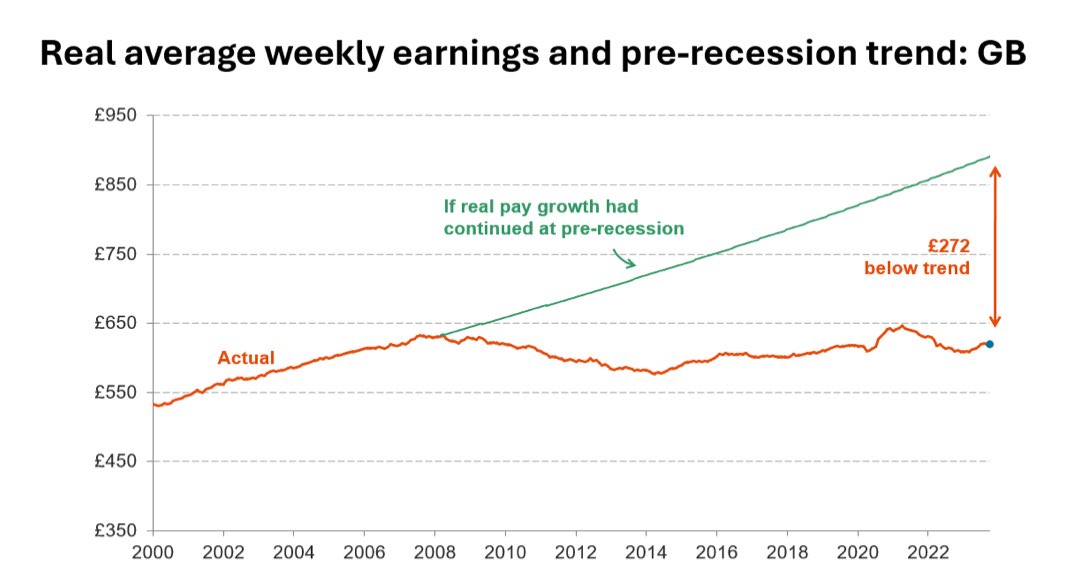

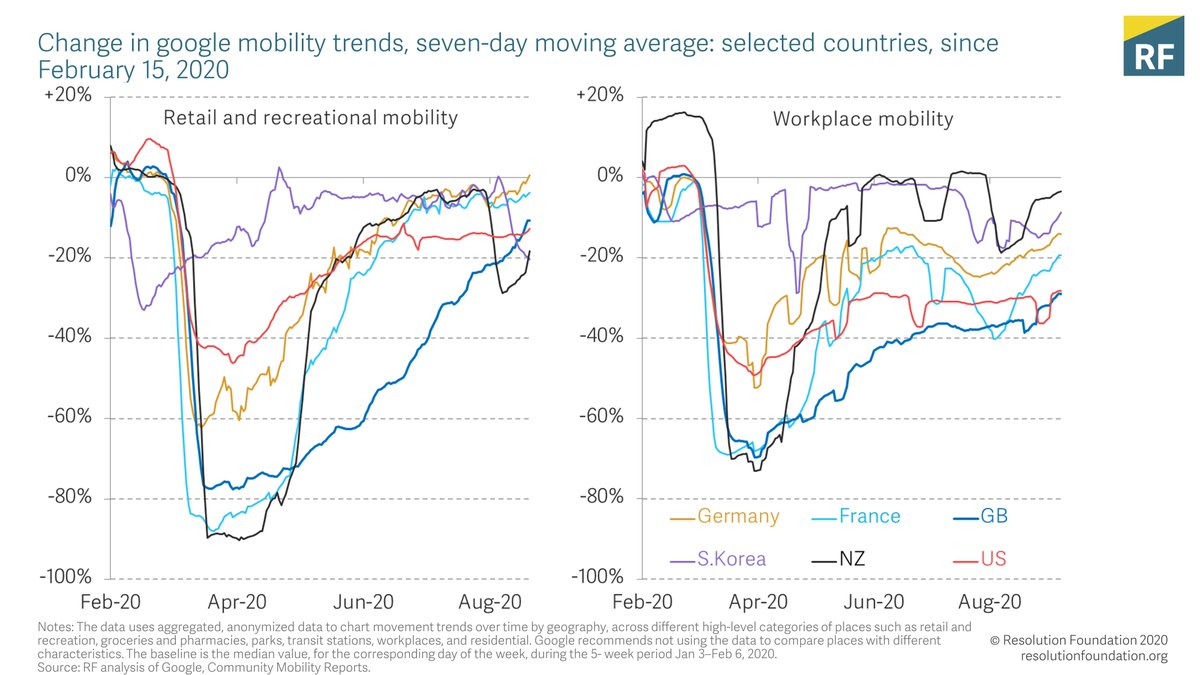

Economic context matters here - we're not living a V-shaped recovery. After swift bounce backs from total economic stagnation in lockdown, the recovery was slowing before the return of rising virus cases & social distancing restrictions confirmed difficult months lie ahead

The Chancellor job was therefore to bring economic policy back in line with both economic reality and social distancing restrictions - which he rightly did by extending support for firms and workers beyond cliff-edges at end October/early November

Centre piece of Chancellor's measures = 'new' Job Support Scheme which really = extended flexible furlough scheme. In considering it's impact it's REALLY important to separate out impact on employees and employers

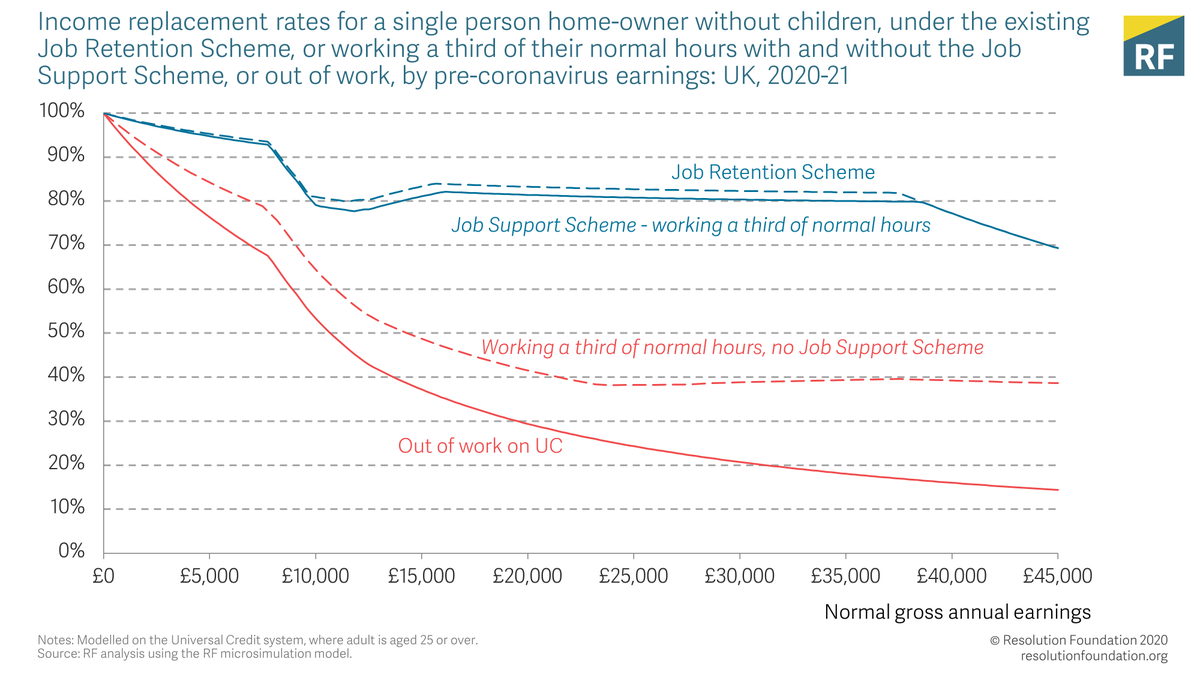

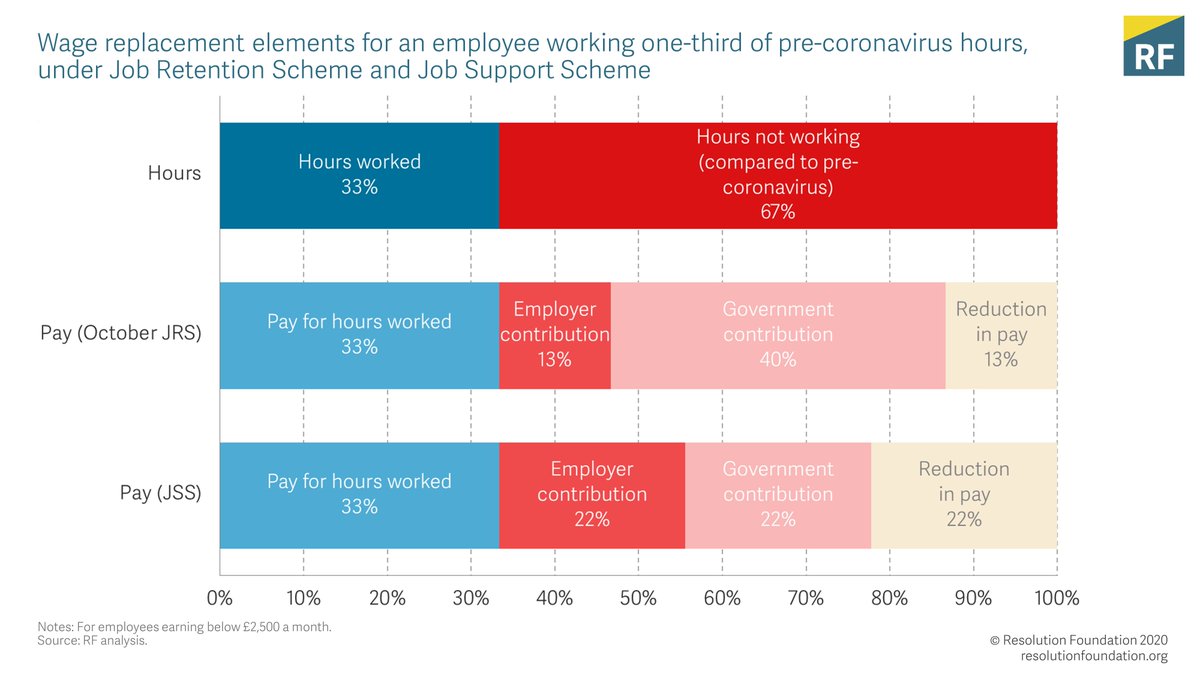

JSS is generous to employees: by protecting 2/3 of lost wages from reduced hours (so long as they still work 1/3 of previous hours) it is inline with similar schemes elsewhere and the income protection of the full furlough scheme (slightly less than previous partial furlough)

BUT while @The_TUC and others rightly focus on generosity for employees IF they end up on the scheme it is largely the incentives on employers that decide whether any employees will actually be on the scheme...

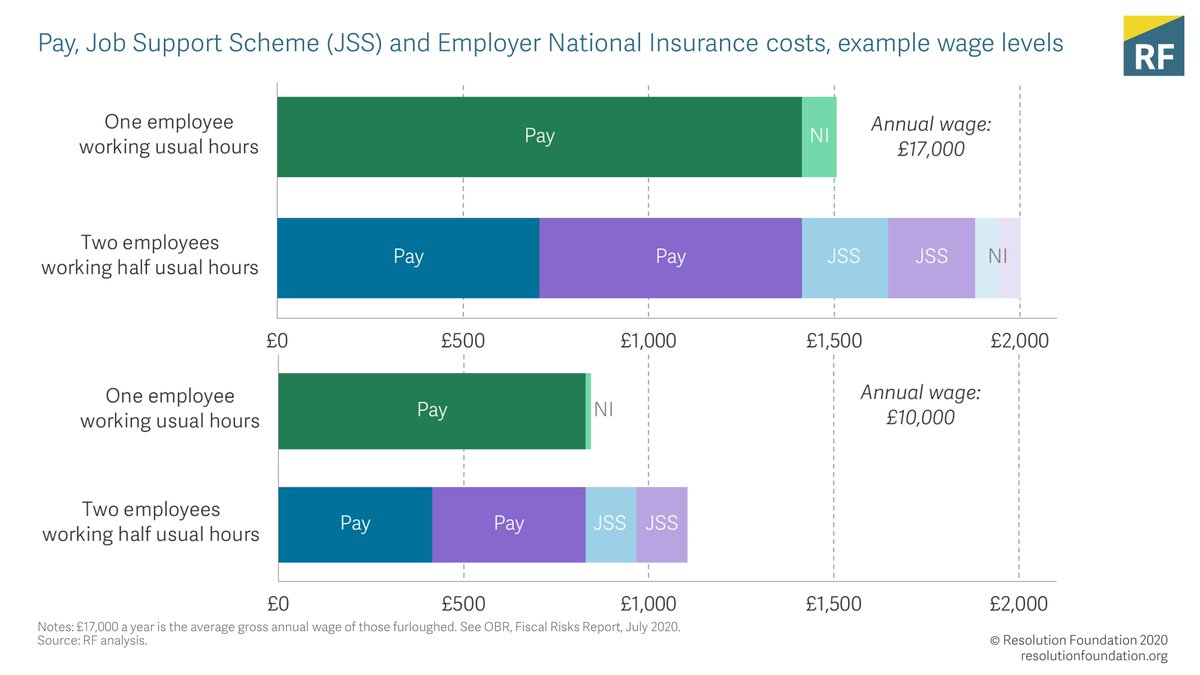

The JSS is NOT generous to employers. It asks them to cover not only the wages for hours worked but half the costs of the support to workers for hours not worked (e.g to get someone working 33% of previous hours they have to pay 33% of previous wages)

This means the JSS cannot be what all the papers this morning wrongly say it is - a version of the German 'Kurzarbeit' scheme (which asks employers to pay 0 for hours not worked).

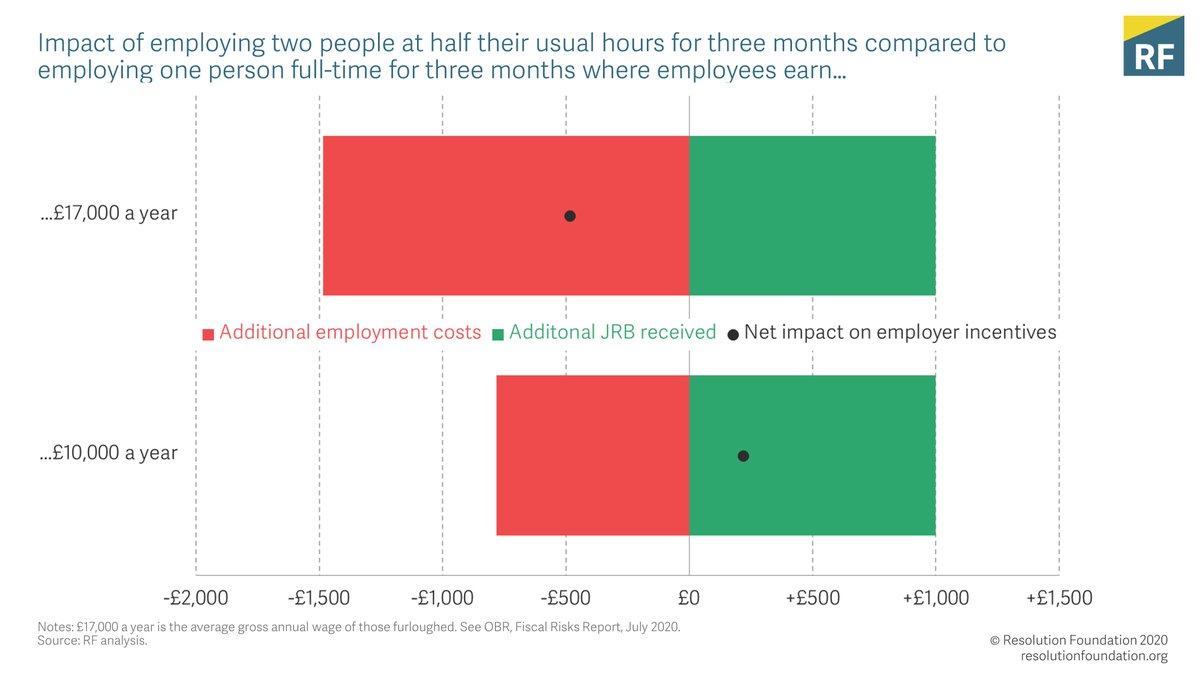

Specifically it doesn't give firms an incentive to cut hours instead of jobs because it costs firms more to pay two workers to work half time than one to work full time

Interaction with £1k Job Retention Bonus is... messy. Sometimes it & JSS will encourage short hours. But only until January AND only if you have low enough earnings that £1k > employer costs of JSS BUT not so low that you don't qualify for JRB. Good luck firms working that out...

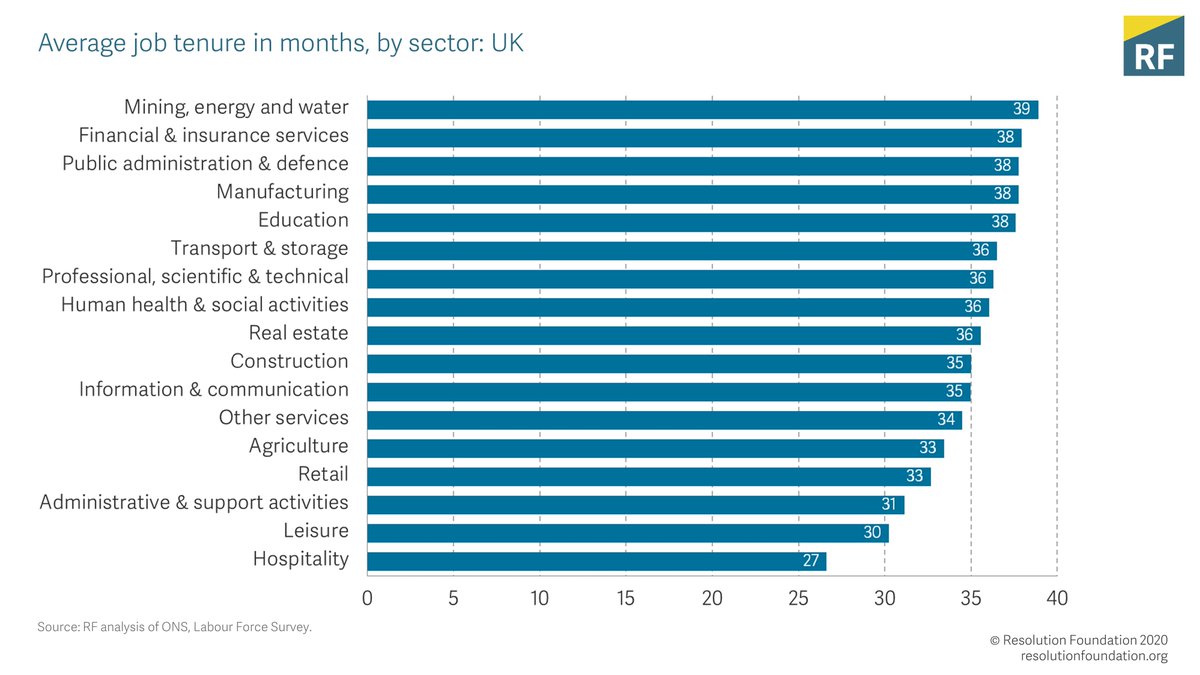

So what is the JSS? A scheme to support firms with less work today AND strong (non-JSS) incentives to hold on to staff (think skilled manufacturing with high training/recruitment costs). The problem? These are not the bulk of the workers in the firing line of this crisis....

What the JSS is not = encouraging hours rather than jobs cuts where it matters - in hospitality and leisure - to slow the mass shake out of workers that is about to happen. Those sectors rely most on JRS + have least attachment between firms/workers so JSS incentives matter

In designing this scheme, and in the excessive welcome for it from unions/business and even the opposition, is excessive focus on higher paid jobs in the likes of manufacturing rather than on the real problem of this crisis: the disaster it is posing to employment of low earners

This can be fixed and without spending more money- scrapping the £7.5bn Job Retention Bonus (that literally no-one thinks is a good policy) would be enough to reduce the employer costs of the JSS hugely - transforming firms incentives to save jobs. We really should do it.

Much more in the full @resfoundation report resolutionfoundation.org/publications/t…

55% of the previous wages - obviously!

• • •

Missing some Tweet in this thread? You can try to

force a refresh