MP for Swansea West. Great Britain? How We Get Our Future Back: https://t.co/crkenPsge0 @torstenbell.bsky.social

13 subscribers

How to get URL link on X (Twitter) App

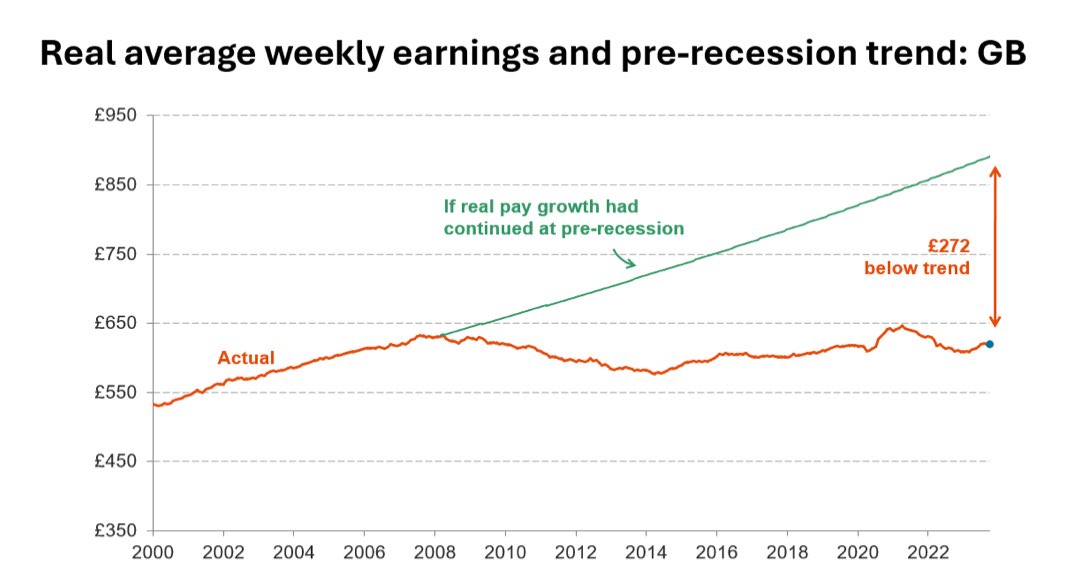

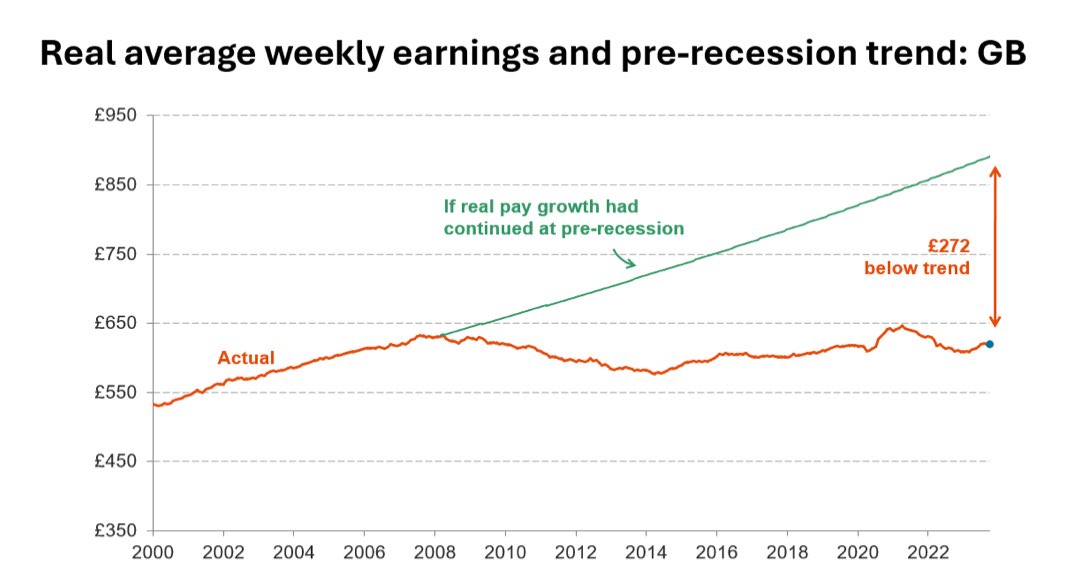

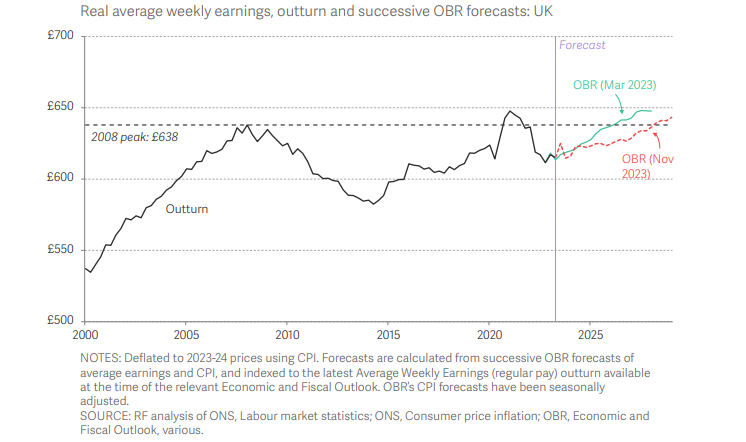

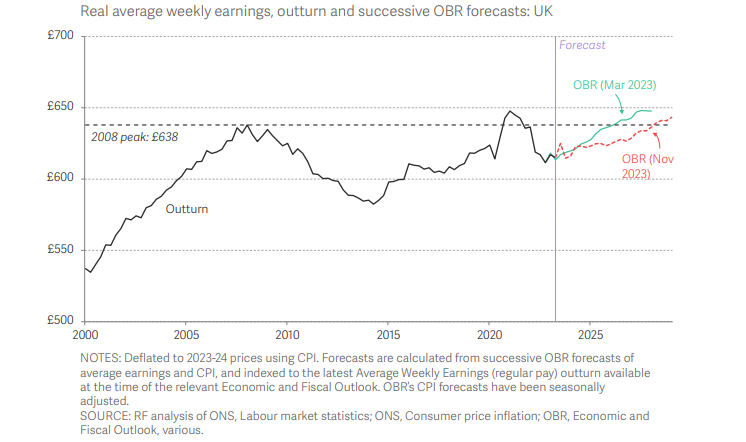

That same growth failure post-financial crisis is why the OBR has downgraded productivity growth in their latest forecasts - it’s a verdict on the past not an inevitable future

That same growth failure post-financial crisis is why the OBR has downgraded productivity growth in their latest forecasts - it’s a verdict on the past not an inevitable future

https://twitter.com/hendopolis/status/1795197625055990114This is yet another example of total tax policy chaos - this proposal is to reintroduce the exact same higher tax allowance for pensioners that George Osborne abolished a decade back. As with the personal allowance & corporation tax it’s going back to square one (ie Gordon Brown)

https://twitter.com/PickardJE/status/1785554802300129473Here's @PickardJE list of what he thinks @AngelaRayner programme is. Let's take each in turn

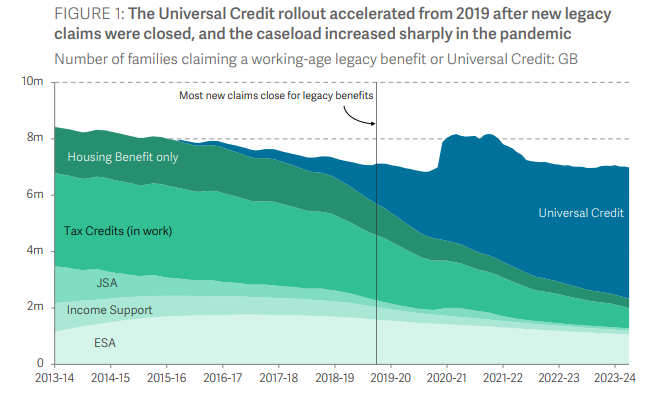

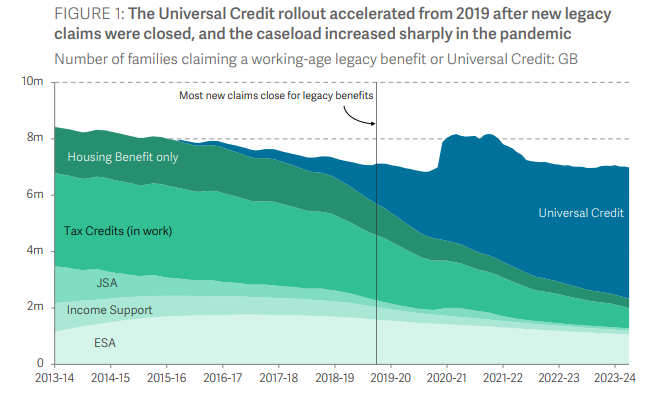

In 2019 the debate was whether to scrap Universal Credit, as Labour proposed. This time is very different. The pandemic showed UC had big advantages (processing millions of claims fast) and the roll-out has gone way too far to be reversed. So we should focus on its impact

In 2019 the debate was whether to scrap Universal Credit, as Labour proposed. This time is very different. The pandemic showed UC had big advantages (processing millions of claims fast) and the roll-out has gone way too far to be reversed. So we should focus on its impact

https://twitter.com/ONS/status/1768608088892846146Overall, young people growing up in Hartlepool are less likely to get a degree than the national average. You already knew that. Let's get to what's interesting

https://twitter.com/Steven_Swinford/status/1764961787101823232Osborne tax policy was:

https://twitter.com/faisalislam/status/1709124387889107298Confusion 1: does anyone really think the problem is we've tried too hard to make the economies of Manchester/Birmingham/Leeds etc successful? Every single one has below average productivity (when big cities in advanced economies generally drive productivity for their countries)