The 5 "Technical Analysis" Charts I use every day

⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️

⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️

1) 5-Year Performance vs. $SPY

Winners keep on winning

It's a great sign if a stock has beaten the market over the last 5 years

It's a warning sign if it has lost badly

$MKTX ✅

$MNKD 🚫

Winners keep on winning

It's a great sign if a stock has beaten the market over the last 5 years

It's a warning sign if it has lost badly

$MKTX ✅

$MNKD 🚫

2) Long-term Revenue Growth

Recurring revenue is the gift that keeps on giving

Consistent revenue growth -- especially through recessions -- indicates greatness

Inconsistent revenue growth = avoid

$MA ✅

$XOM 🚫

Recurring revenue is the gift that keeps on giving

Consistent revenue growth -- especially through recessions -- indicates greatness

Inconsistent revenue growth = avoid

$MA ✅

$XOM 🚫

3) Margins

Ideal: Gross / Operating / Net Margin all consistent/expanding over time

Avoid: Gross / Operating / Net Margin all declining over time

$VEEV ✅

$GME 🚫

Ideal: Gross / Operating / Net Margin all consistent/expanding over time

Avoid: Gross / Operating / Net Margin all declining over time

$VEEV ✅

$GME 🚫

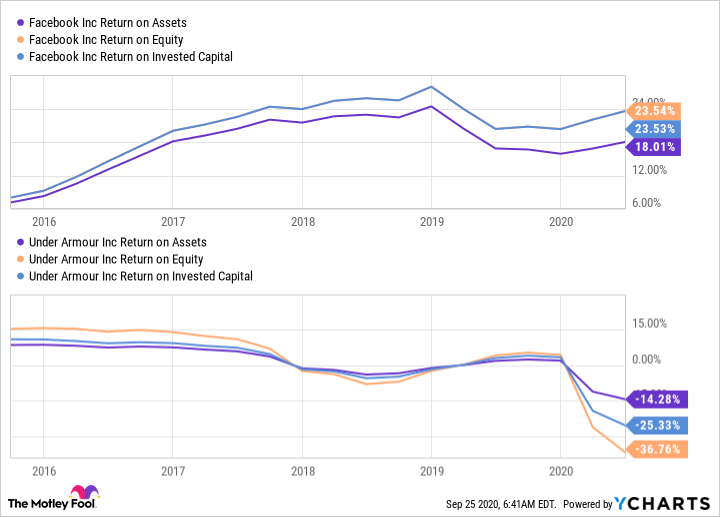

4) Returns on capital

Great businesses create value by investing at high rates of return

Bad businesses destroy value by investing at low or negative rates of return

I check ROE, ROA, ROIC

Ideal: Double-digit and expanding

Bad: Negative and declining

$FB ✅

$UA 🚫

Great businesses create value by investing at high rates of return

Bad businesses destroy value by investing at low or negative rates of return

I check ROE, ROA, ROIC

Ideal: Double-digit and expanding

Bad: Negative and declining

$FB ✅

$UA 🚫

5) Dilution

Shares outstanding rising through stock-based comp = bad

Shares declining because of stock-buybacks = good

I'm OK with <3% dilution per year if growth is high

>5%/year is bad

$VRSN ✅

$CRM 🚫

Shares outstanding rising through stock-based comp = bad

Shares declining because of stock-buybacks = good

I'm OK with <3% dilution per year if growth is high

>5%/year is bad

$VRSN ✅

$CRM 🚫

Bad performance in any of these categories doesn't exclude investment

Lots of great companies have negative returns on capital and high share dilution in the beginning

Still, always worth looking at

All data from @ycharts

Lots of great companies have negative returns on capital and high share dilution in the beginning

Still, always worth looking at

All data from @ycharts

• • •

Missing some Tweet in this thread? You can try to

force a refresh