🔎 I Teach Investors How To Analyze Businesses | Author & Financial Educator | 20+ Years Investing Experience | Free Investing eBook (Link) ⬇️

269 subscribers

How to get URL link on X (Twitter) App

1) GOODWILL WRITEDOWN

1) GOODWILL WRITEDOWN

1: Markets are volatile. Never invest unless you are sure a "margin of safety" exists.

1: Markets are volatile. Never invest unless you are sure a "margin of safety" exists.

The P/E ratio's flaw is that the "earnings” can be misleading.

The P/E ratio's flaw is that the "earnings” can be misleading.

Let's say Tom's portfolio is worth $100,000 in the middle of a bull market.

Let's say Tom's portfolio is worth $100,000 in the middle of a bull market.

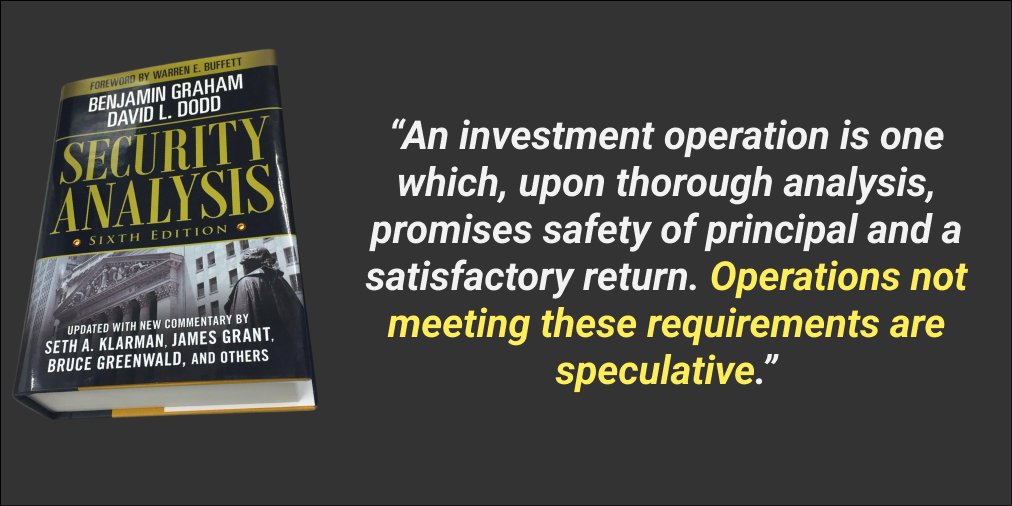

1. Investing versus speculating

1. Investing versus speculating

The P&L (or Income Statement) shows a company's profitability at multiple levels over a period of time using accrual accounting.

The P&L (or Income Statement) shows a company's profitability at multiple levels over a period of time using accrual accounting.

1: Thesis Busted

1: Thesis Busted

1: Don’t haggle

1: Don’t haggle

https://twitter.com/unusual_whales/status/16080730243679109122: Buffett on predicting the short-term price of a stock:

https://twitter.com/GrahamStephan/status/1574819661895856128