Attention token holders. Another week of unfulfilled promises & silence from @koeppelmann & @StefanDGeorge. Seems to be a trend.

Meanwhile, @arca continues to get feedback from holders who support our Tender Offer plan.

When will you respond @gnosisPM? Thread 👇

Meanwhile, @arca continues to get feedback from holders who support our Tender Offer plan.

When will you respond @gnosisPM? Thread 👇

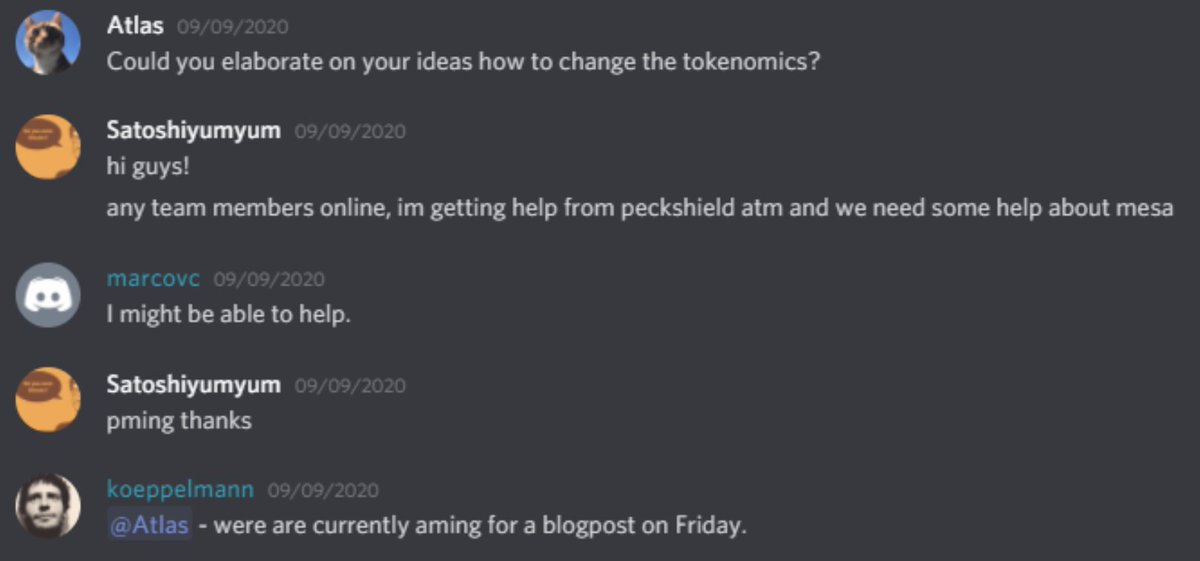

2) @koeppelmann & @gnosisPM still have not released a formal plan for community review on updated tokenomics, or on the Gnosis DAO that they teased. They stated in their discord that this was going to be released on Sept 9th. This is starting to feel like more empty promises.

3) It is increasingly clear that the community is begging for a plan, whether that be a rebuttal to ours or a new token economic structure altogether. We encourage Gnosis to do right by tokenholders and take this responsibility seriously.

4) Unlike Gnosis, @arca has not been silent. We continue to fight for tokenholder rights.

You can listen to our thoughts on here:

You can listen to our thoughts on here:

https://twitter.com/nic__carter/status/1308779226066231296

6) And you can read our further thoughts here:

https://twitter.com/CoinDesk/status/1308090350238674946

7) @lex_node understands

"Creators can either start agreeing to some real accountability mechanisms now, thus maintaining a strong voice in the conversation, or they can run from it, in which case semi-clueless judges & regulators will do it for them"

"Creators can either start agreeing to some real accountability mechanisms now, thus maintaining a strong voice in the conversation, or they can run from it, in which case semi-clueless judges & regulators will do it for them"

https://twitter.com/lex_node/status/1308977085566930951?s=20

8) How many holders are there @pulpmachina ? Enough to make a difference.

We encourage every one of them to speak up & put pressure on @koeppelmann & @gnosisPM to actually provide the promised tokenomics plan or give holders their money back.

We encourage every one of them to speak up & put pressure on @koeppelmann & @gnosisPM to actually provide the promised tokenomics plan or give holders their money back.

https://twitter.com/pulpmachina/status/1307042160076902401

9) Investors holding projects/founders accountable should not be viewed negatively by founders. Our goals are aligned - create value. We encourage both the @gnosisPM team & everyone else in the digital asset ecosystem to read this report from @McKinsey

mckinsey.com/business-funct…

mckinsey.com/business-funct…

10) Our goal, as stated, is to create real, positive change & institute a standard of governance that holds projects accountable to the tokenholders who believe in them. We see this as an opportunity for @gnosisPM to do right by tokenholders & rebuild their lost community.

11) This should be a priority for @gnosisPM & its board members. cc: .@ethereumJoseph .@OldDawgNewTrix .@Consensys

Be leaders of change by proactively working and listening to your tokenholders and create a better dynamic between companies and their tokenholders.

Be leaders of change by proactively working and listening to your tokenholders and create a better dynamic between companies and their tokenholders.

12) If they do not, this is a HUGE missed opportunity for @gnosisPM, who has a chance to listen to feedback & make positive change. ANY transparency would be applauded. Gnosis still hasn't put out an official response or timeline about a new tokenomics plan - this is disgraceful

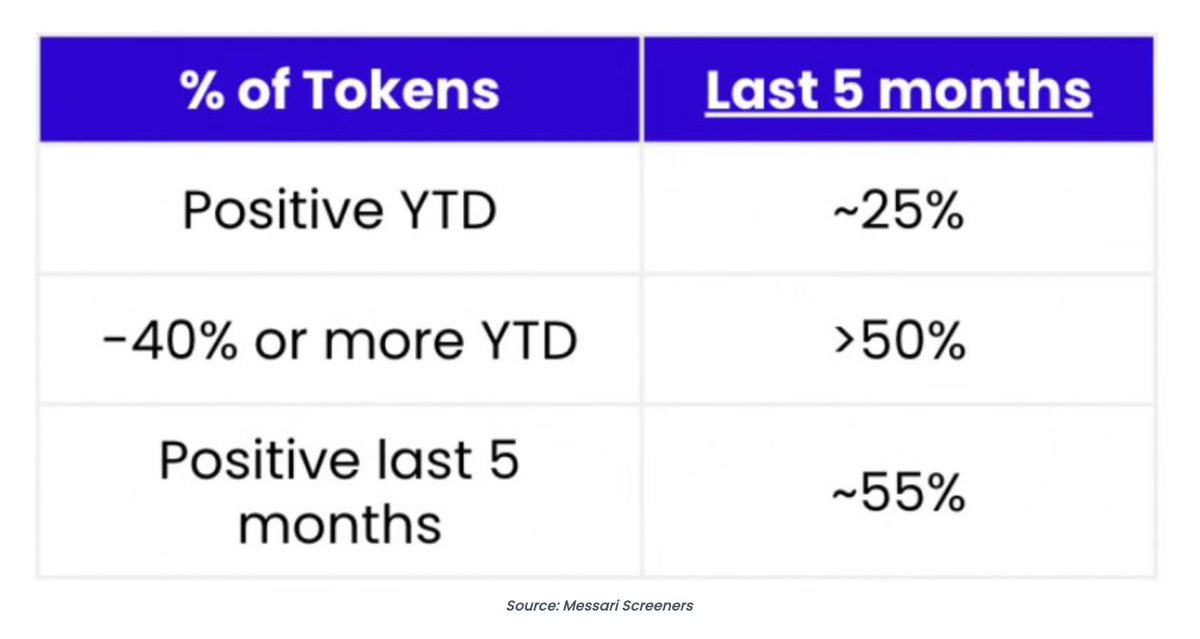

13) This past week lost $25 million in market value. Meanwhile, Gnosis burned an estimated $144,000 due to its insanely high $7.5 million annual cash burn.

Will @gnosisPM continue to burn money instead of addressing the issues presented by their tokenholders & community?

Will @gnosisPM continue to burn money instead of addressing the issues presented by their tokenholders & community?

14) At today's prices of & , the book value of Gnosis' Treasury is worth $140/GNO token, and Arca's fair tender offer proposal is worth $75/GNO token, representing between 85% and 250% upside.

This is your money GNO holders; don't let @gnosisPM get away with silence.

This is your money GNO holders; don't let @gnosisPM get away with silence.

15) For those who want to understand @arca 's initial proposal and request for change at @gnosisPM, start here:

https://twitter.com/jdorman81/status/1303417453662199808

• • •

Missing some Tweet in this thread? You can try to

force a refresh