We all have certain biases when it comes to decision making. This holds true for personal finance as well. And it's important we understand them as at times they can endanger our hard-earned wealth. So here is a list of 5 biases that affect financial decision making

*A THREAD*

*A THREAD*

#1 Loss Aversion Bias

Loss aversion is the tendency to avoid loss over maximizing gains. Humans are wired in a way that a loss of say Rs. 100 gives us more pain than a profit of say Rs. 200. This behavior forces us to often invest in safer options even for our long-term goals.

Loss aversion is the tendency to avoid loss over maximizing gains. Humans are wired in a way that a loss of say Rs. 100 gives us more pain than a profit of say Rs. 200. This behavior forces us to often invest in safer options even for our long-term goals.

How to overcome this bias? The easiest way to avoid this bias is to adopt an overall portfolio perspective and not look at investments individually. When focusing on an overall portfolio level, you generally do not see extreme losses or volatility.

#2 Herd Mentality Bias

It is a phenomenon where we follow what others are doing rather than charting our own path. This behavior is often driven by fear of missing out. For Ex: if the markets go up and everybody joins the race to make quick gains, we too feel the need to do so

It is a phenomenon where we follow what others are doing rather than charting our own path. This behavior is often driven by fear of missing out. For Ex: if the markets go up and everybody joins the race to make quick gains, we too feel the need to do so

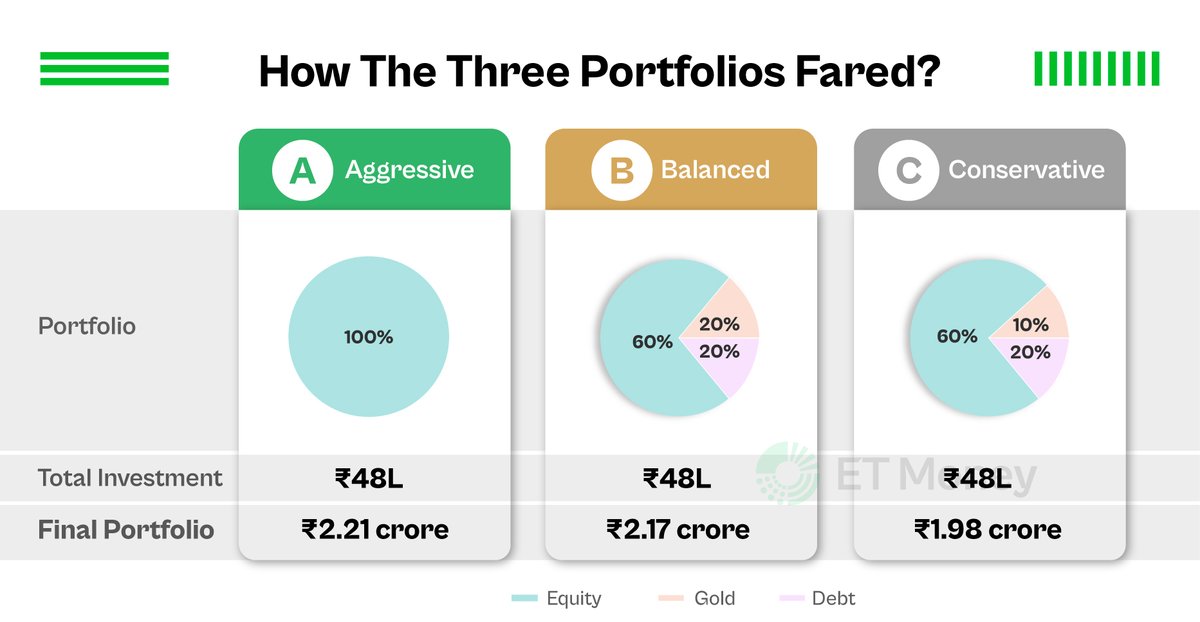

How do we free ourselves from this bias? Two words - Asset Allocation. Asset classes move in cycles and no single asset class continues to outperform or underperform. So build a portfolio with an allocation to each asset class.

#3 Mental Accounting

This is one bias that doesn't get much attention. In simple words, it means that we treat money from one source as more important than another. And this behavior is also experienced while investing and can make you take illogical decisions.

This is one bias that doesn't get much attention. In simple words, it means that we treat money from one source as more important than another. And this behavior is also experienced while investing and can make you take illogical decisions.

So how can you keep this bias in check? The best way, which actually helps you use this bias to your advantage, is following a goal-based investment approach. Once you attach a goal to a particular investment, you mentally allocate that money to a particular purpose.

#4 Availability Bias

It is the human tendency to think of events that come readily to mind; thus making such events more representative than is actually the case. In investments, negative events that have led to severe market corrections are always at the top of investor’s minds

It is the human tendency to think of events that come readily to mind; thus making such events more representative than is actually the case. In investments, negative events that have led to severe market corrections are always at the top of investor’s minds

To deal with it, you need to look past all the noise and then act. Sure, market correction hurt. But after every fall comes rise and if you want to make the most when the markets bounce back, then look at the fall as an investment opportunity and not a reason to exit.

#5 Recency Bias

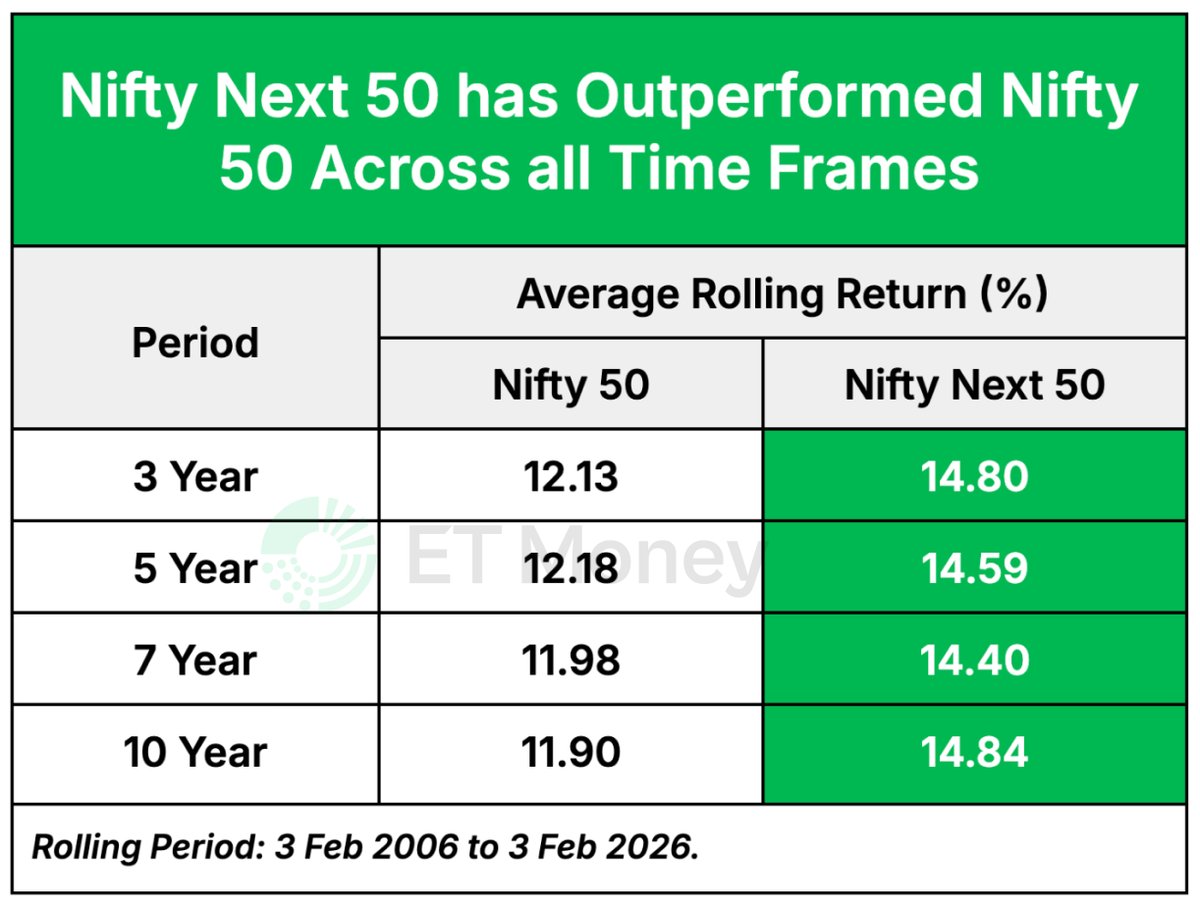

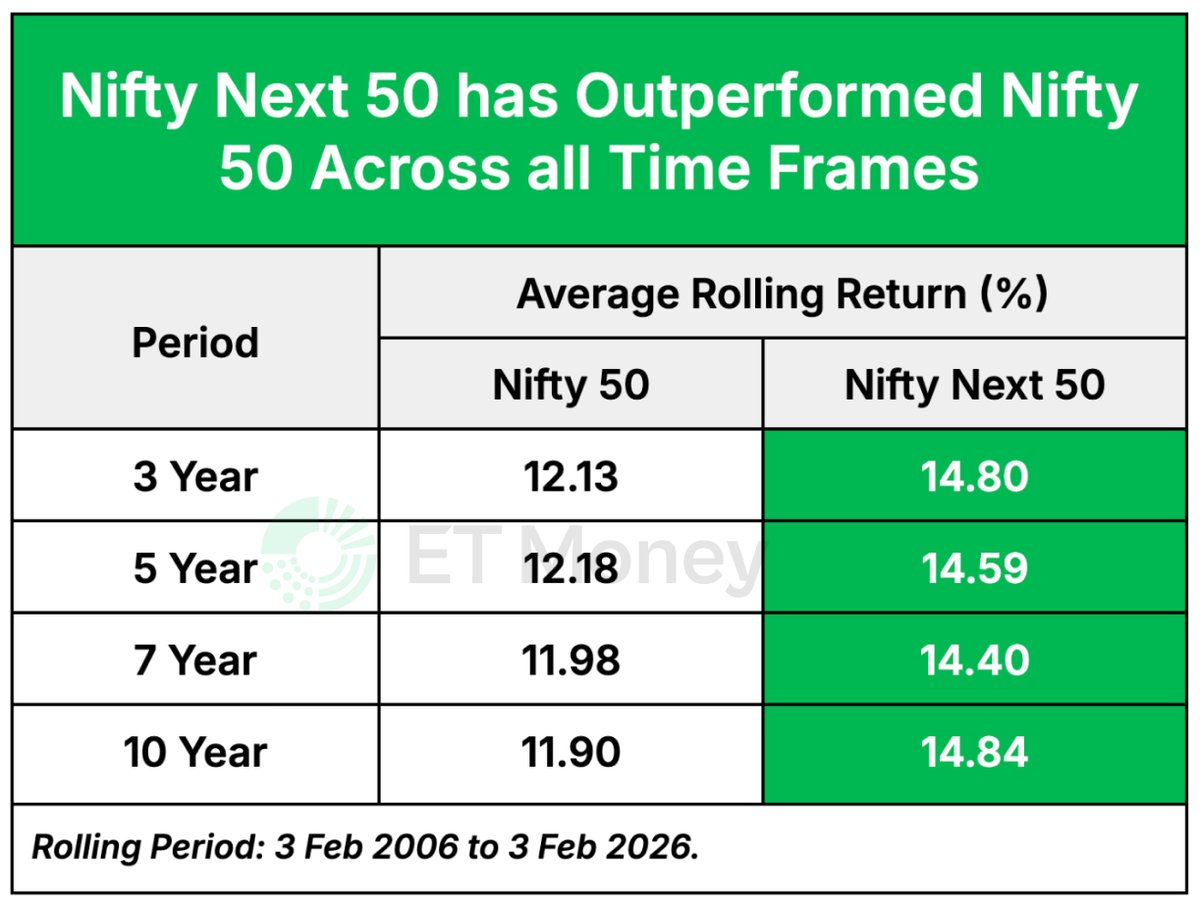

Recency Bias is our tendency to weigh recent events more heavily than earlier events. We often overemphasize on more recent events than those in the near or distant past and shift our focus towards the asset class in favor of today.

Recency Bias is our tendency to weigh recent events more heavily than earlier events. We often overemphasize on more recent events than those in the near or distant past and shift our focus towards the asset class in favor of today.

To overcome, the first thing you need to do is to understand that looking at the past track record of things to ascertain their future is not the right thing to do. An asset class performing well today might not do well tomorrow.

You can also watch our video to understand these biases in detail -

• • •

Missing some Tweet in this thread? You can try to

force a refresh