How to get URL link on X (Twitter) App

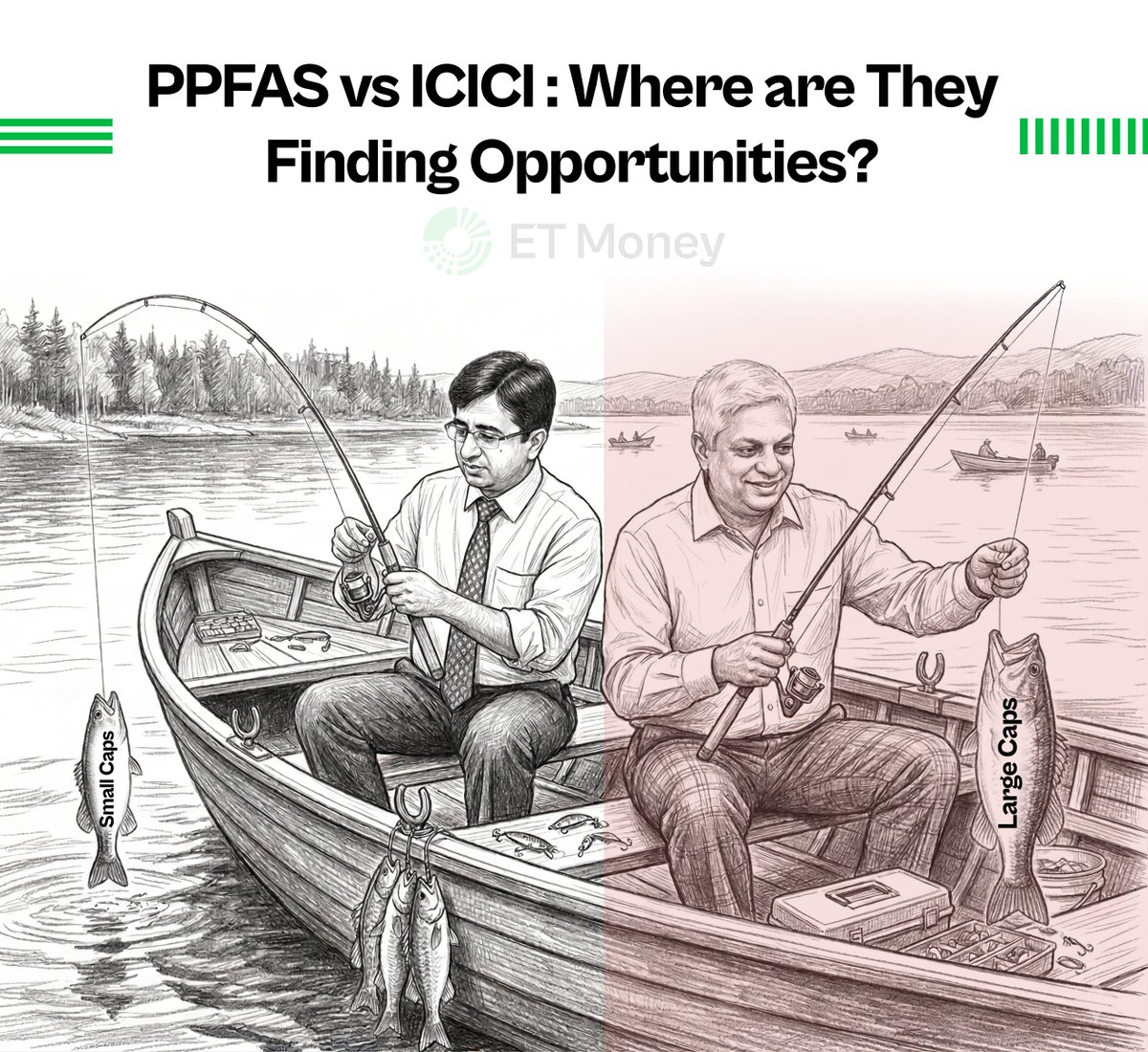

1) CASH HOLDINGS

1) CASH HOLDINGS

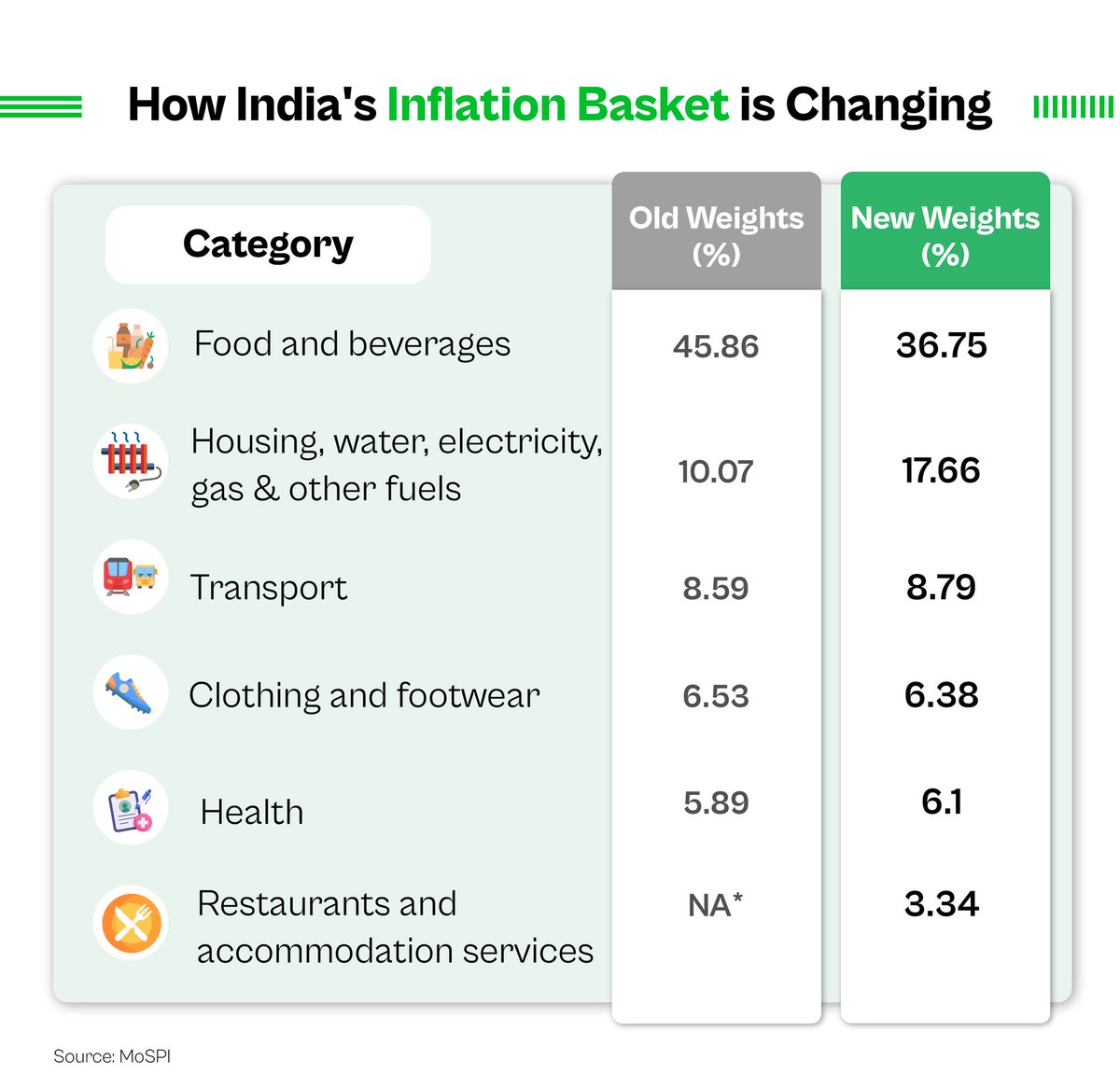

Inflation is measured using the Consumer Price Index, or CPI.

Inflation is measured using the Consumer Price Index, or CPI.

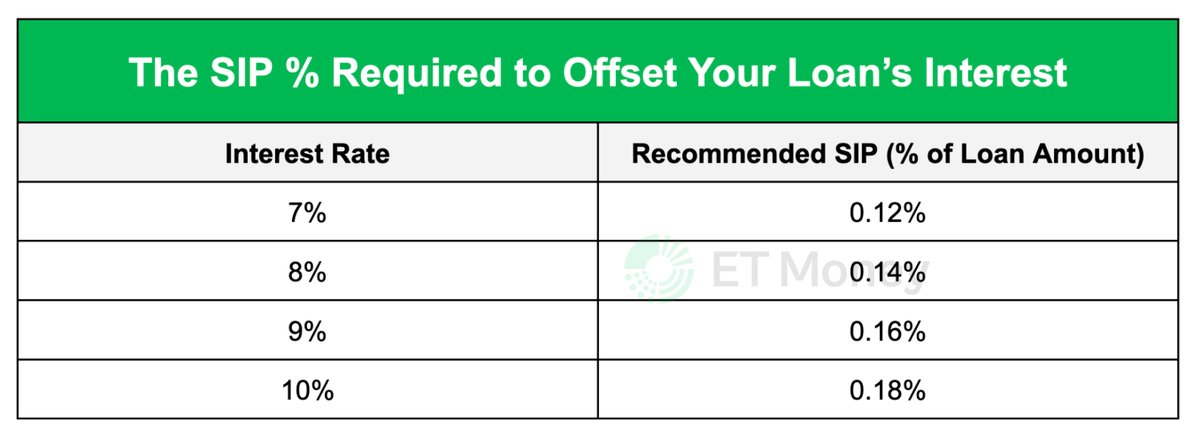

Let’s start with the basics.

Let’s start with the basics.

https://x.com/ETMONEY/status/1907458665839226935

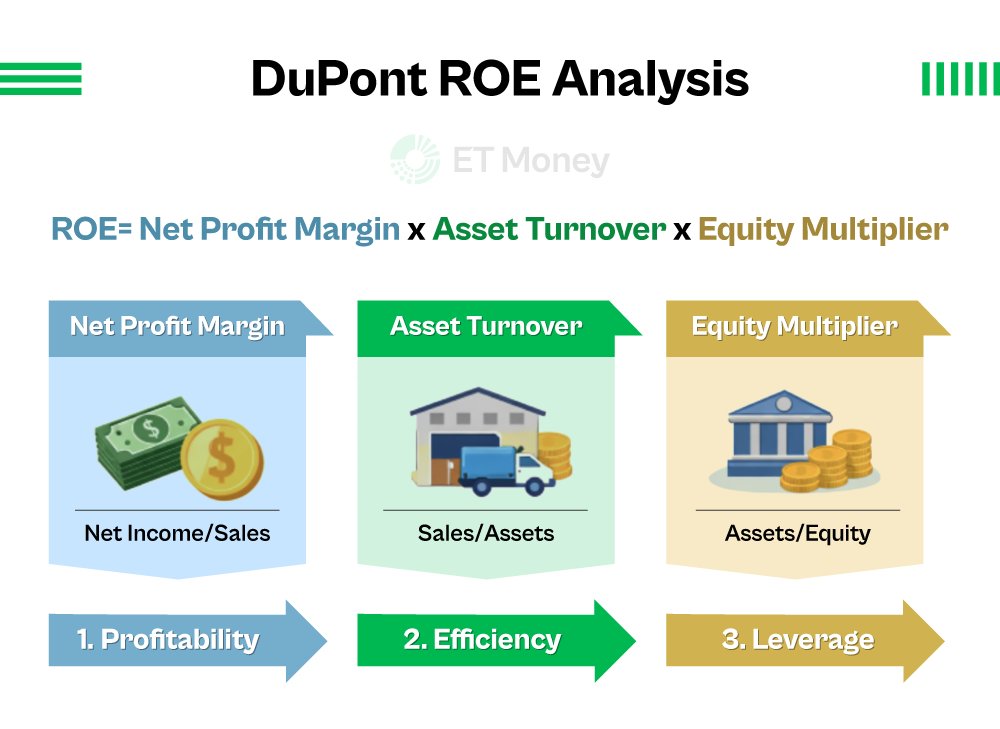

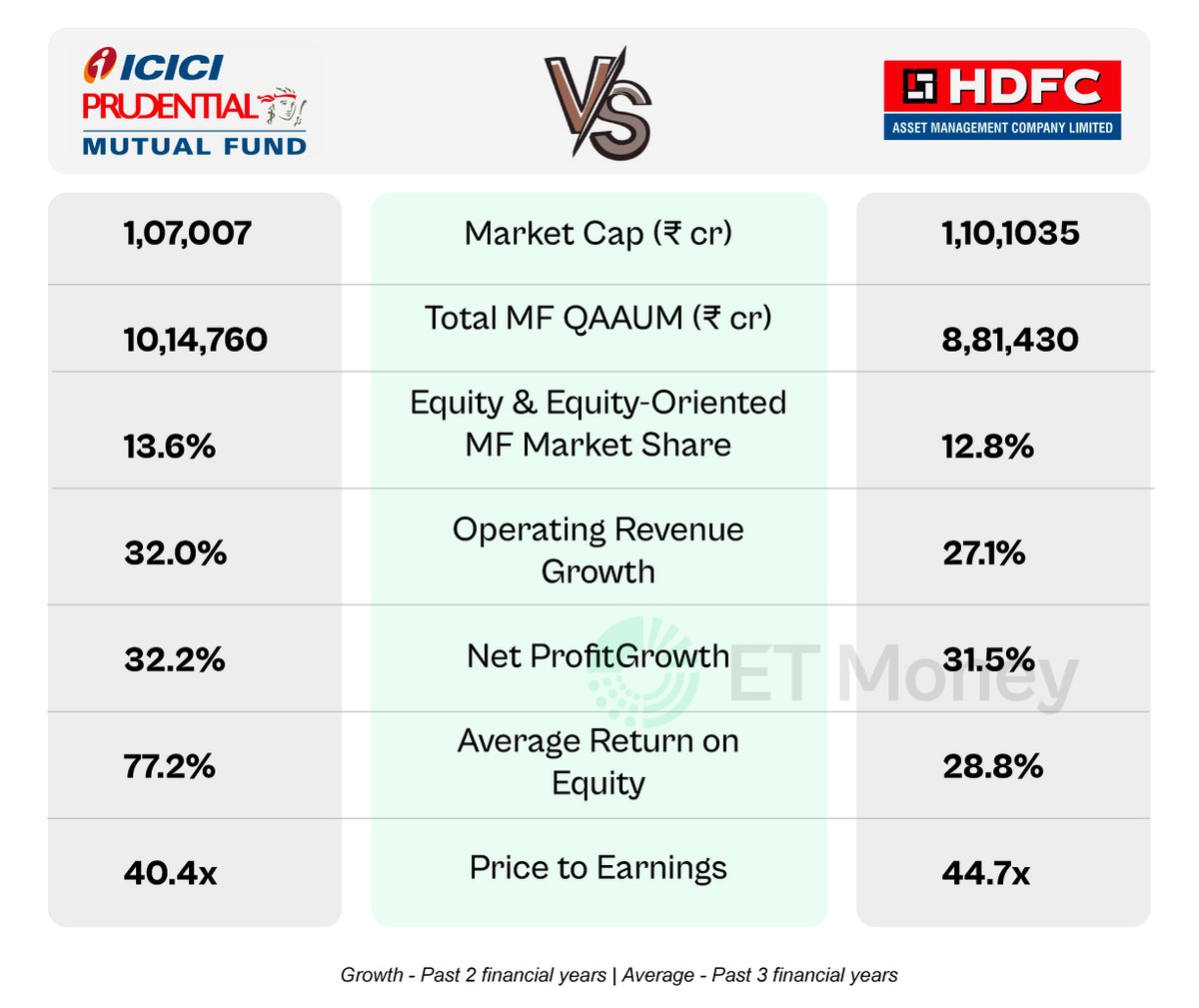

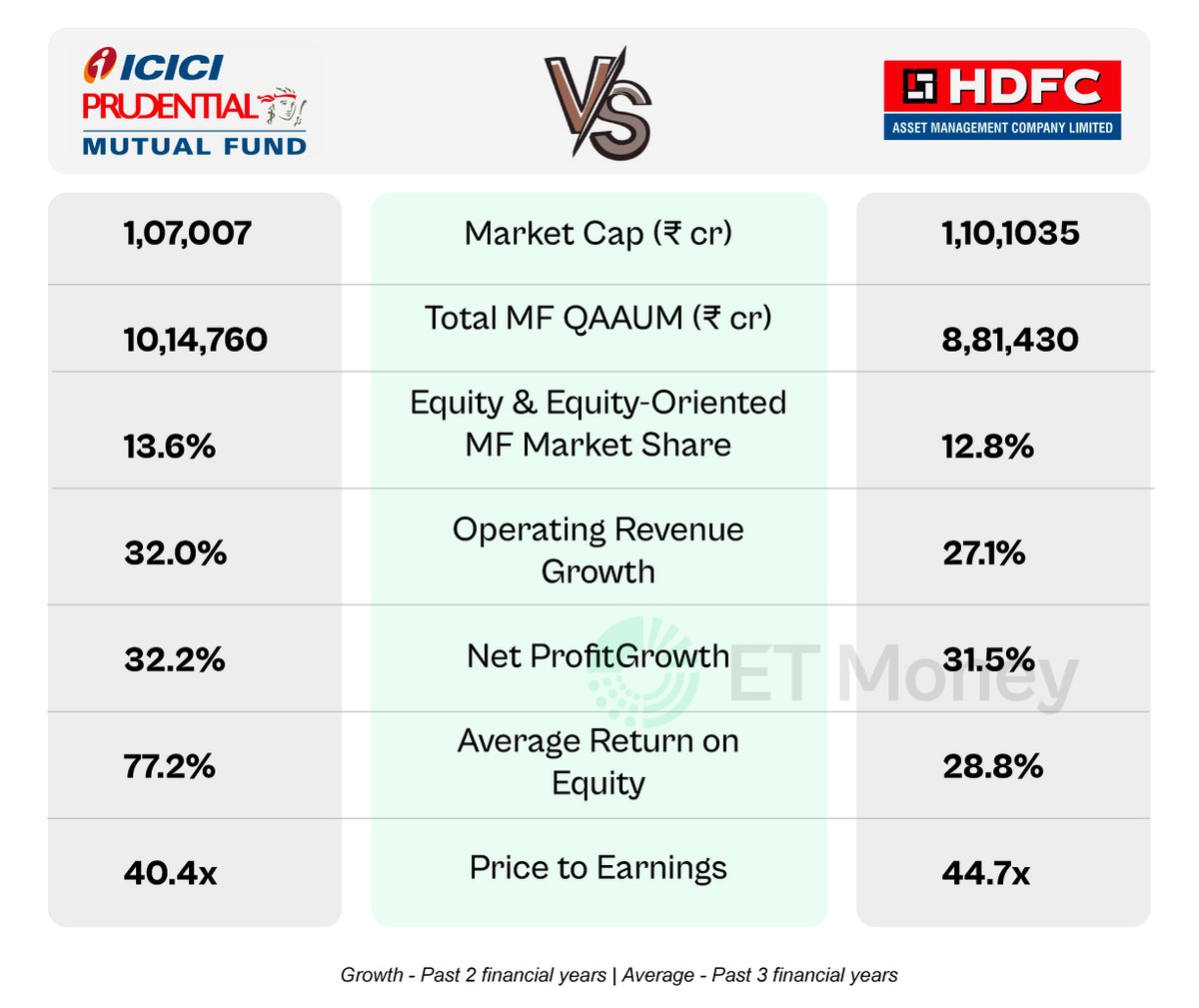

1. BUSINESS MODEL

1. BUSINESS MODEL

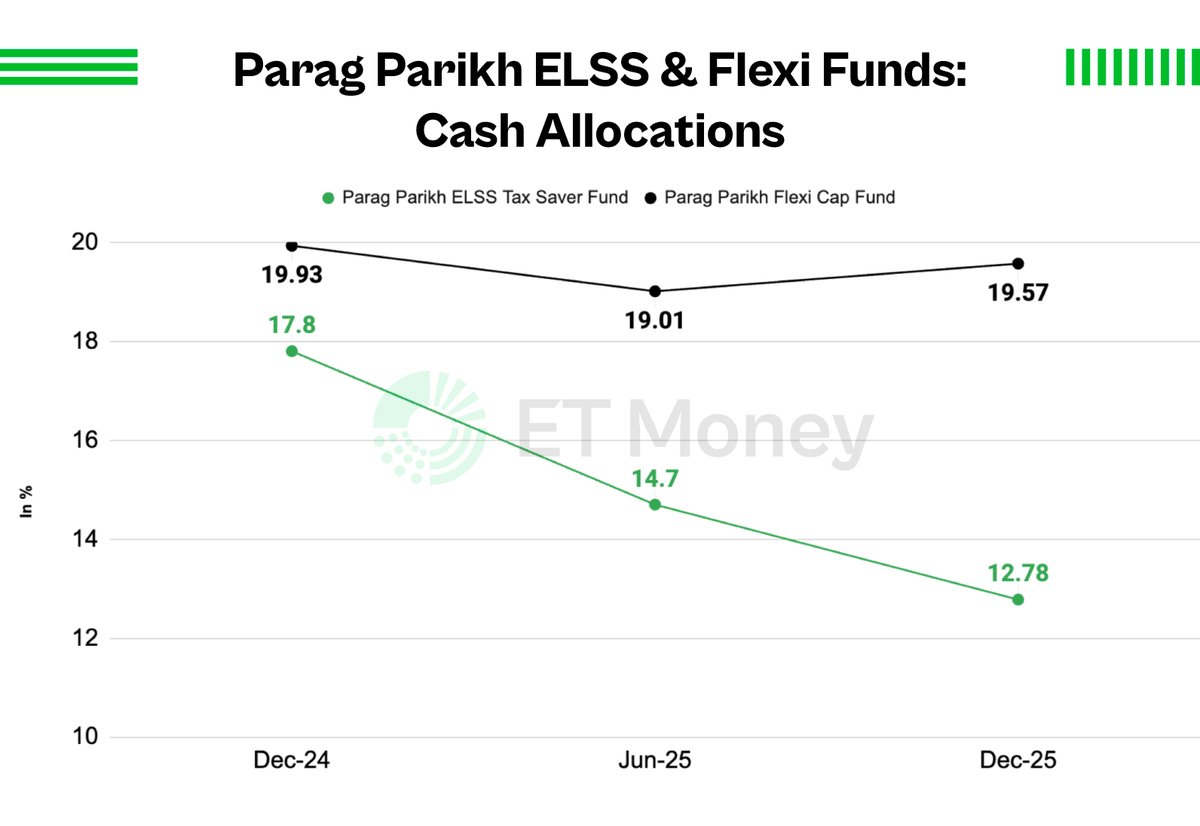

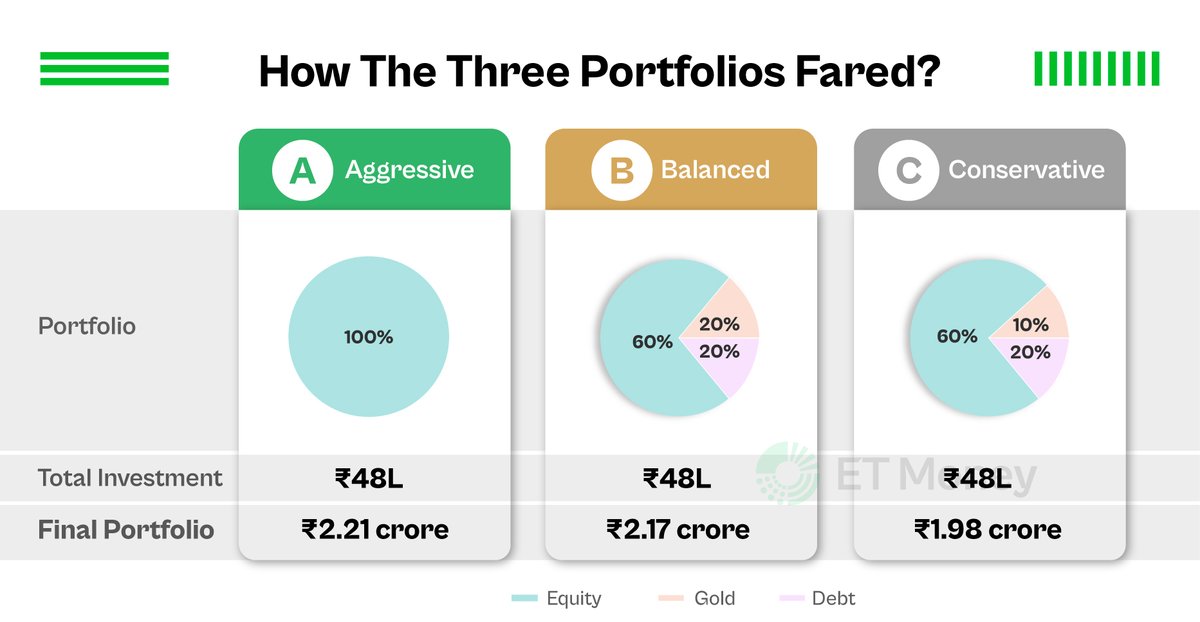

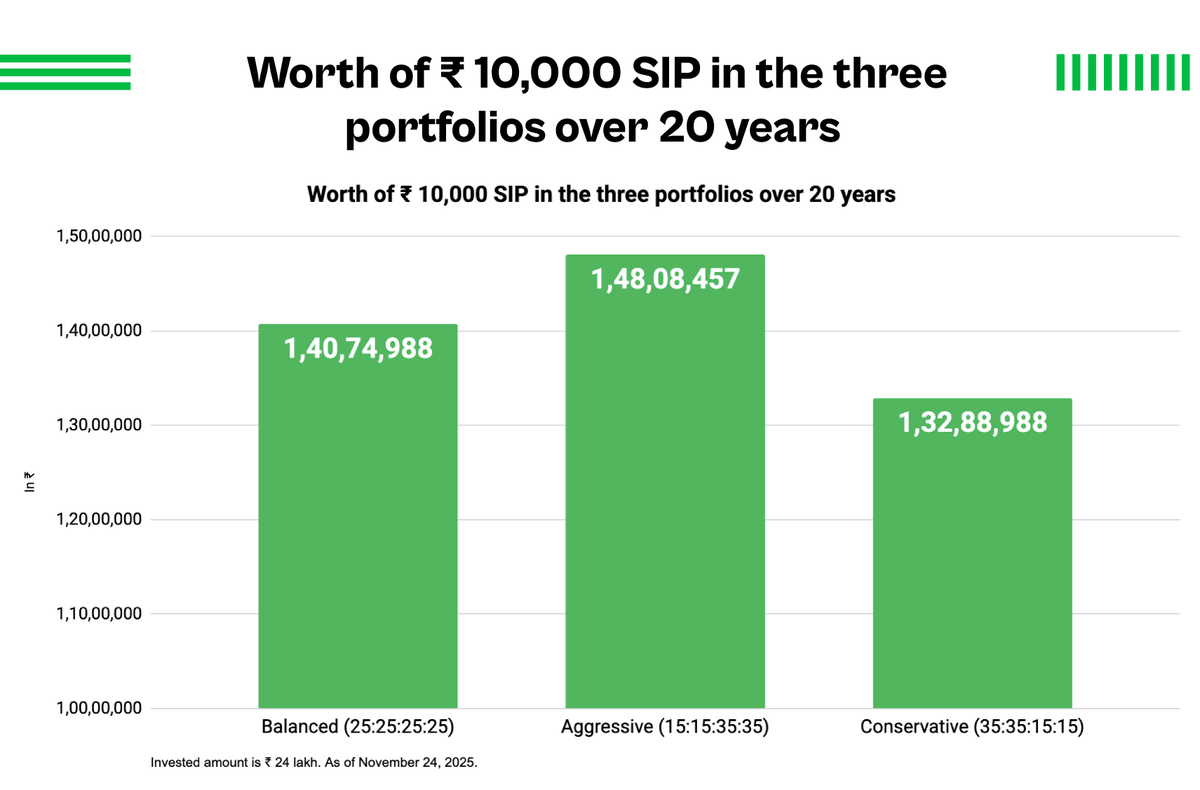

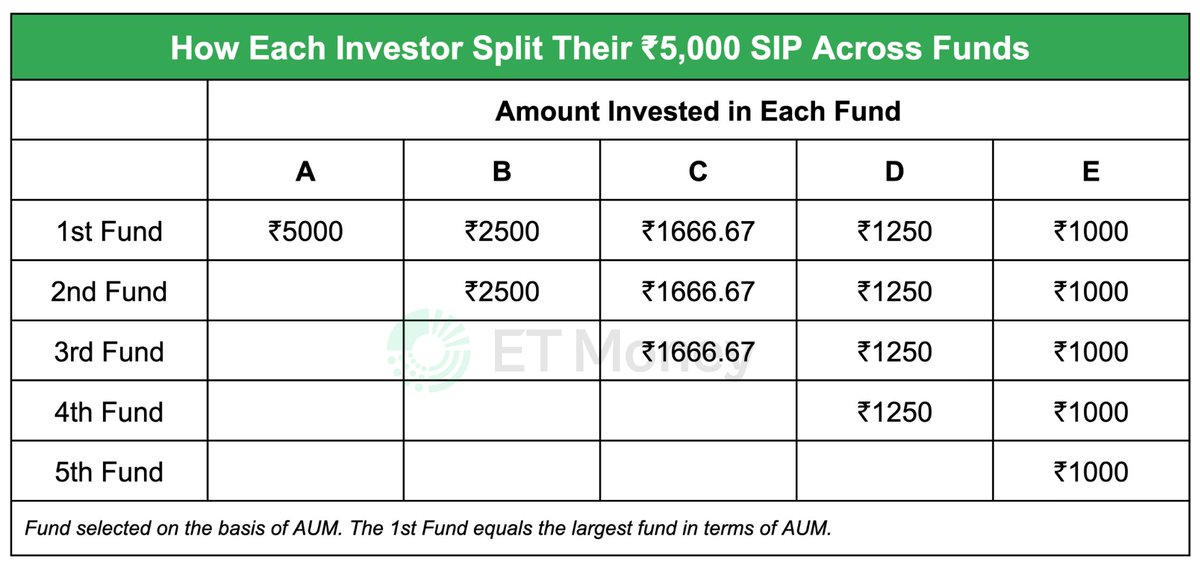

Friend C, who invested in 3 funds, earned the highest returns.

Friend C, who invested in 3 funds, earned the highest returns.

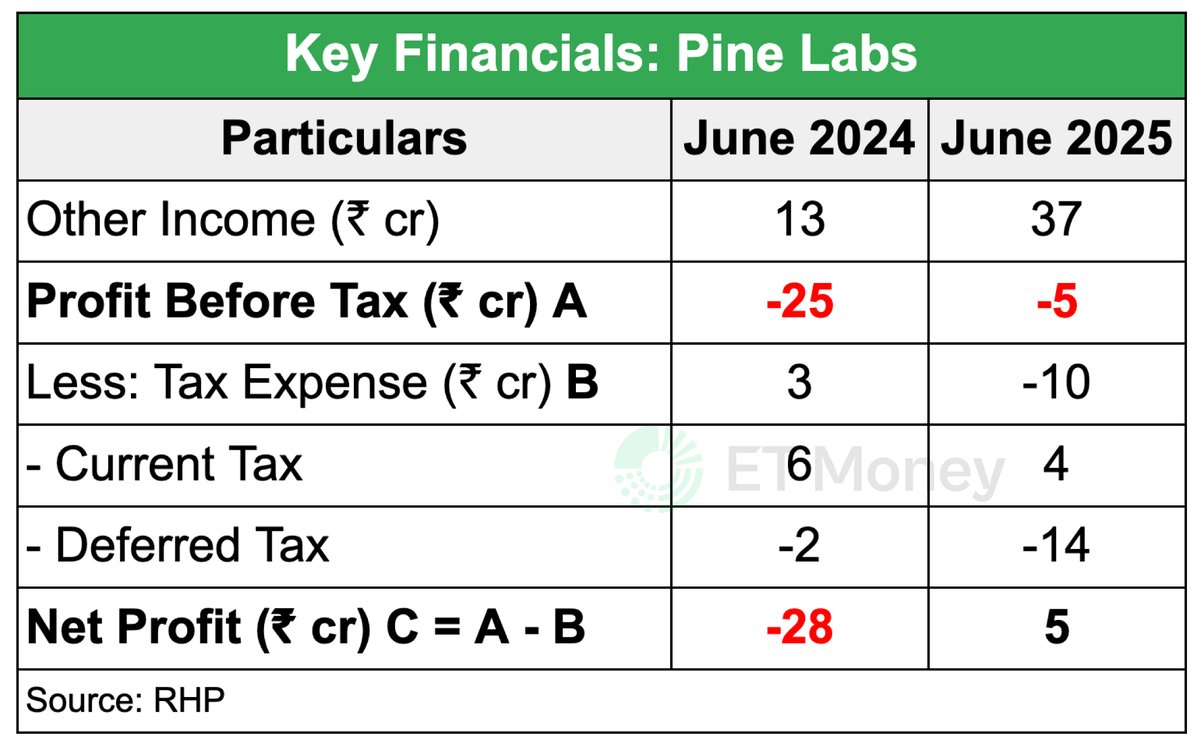

1. Pine Labs

1. Pine Labs

To understand these changes clearly, you first need to know how mutual fund expenses work.

To understand these changes clearly, you first need to know how mutual fund expenses work.

A RECORD-BREAKING RALLY

A RECORD-BREAKING RALLY