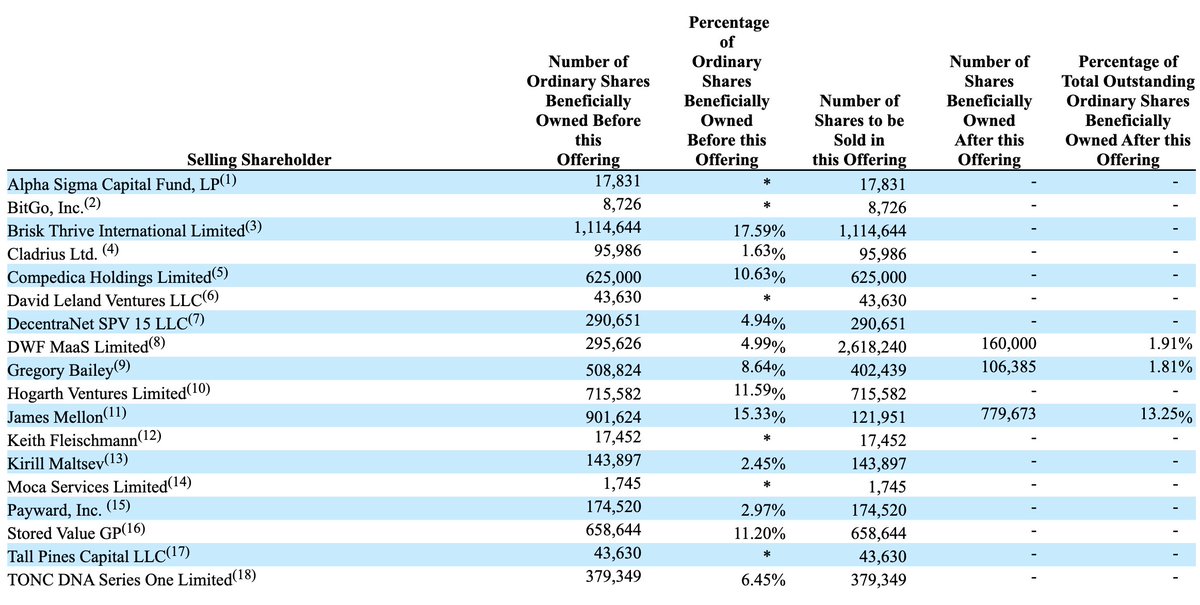

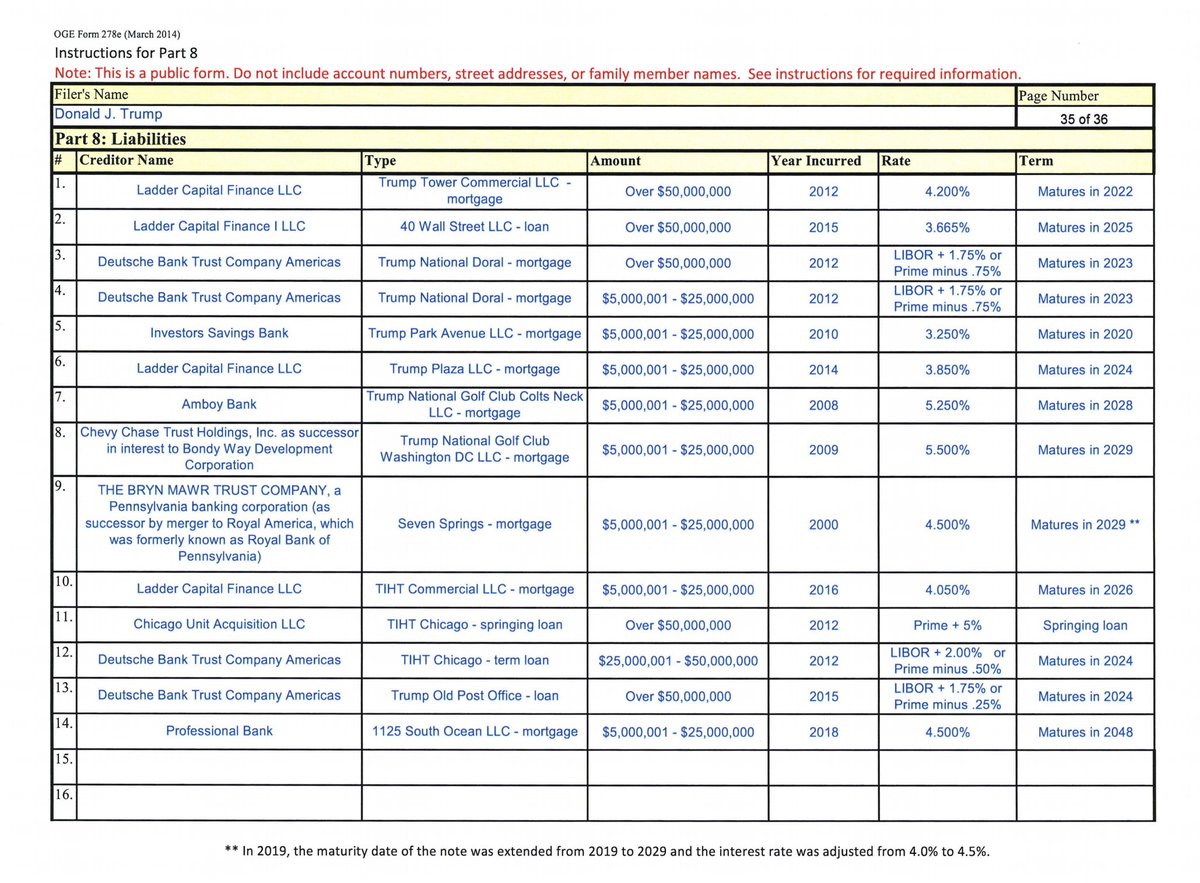

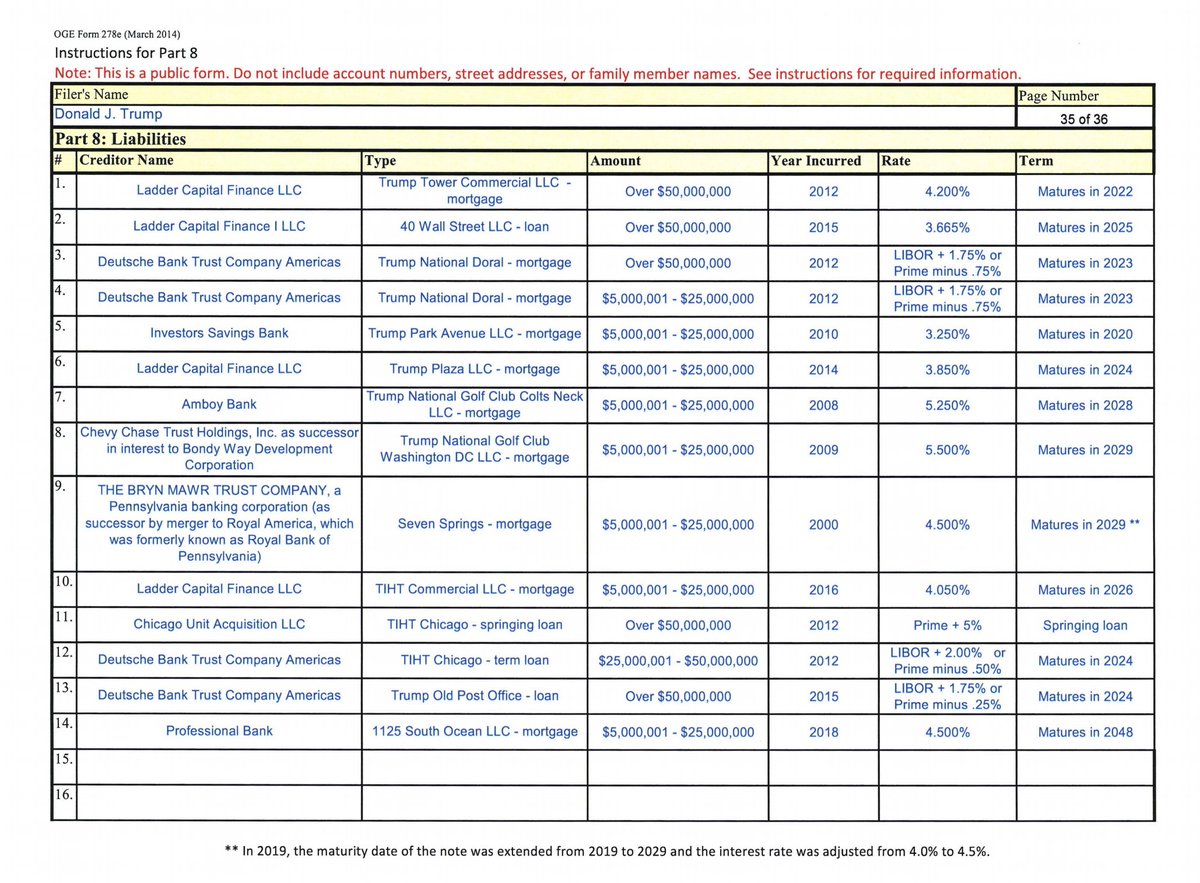

Trump's financial disclosure includes 2 loans for Trump Int’l Hotel & Tower (TIHT) Chicago

1) a springing loan made by Chicago Unit Acquisition LLC in 2012 for over $50 mil

2) Deutsche(DBTCA) loan of $25-50mil from 2012

Thread w/some info & questions on DBTCA Chicago loans

1) a springing loan made by Chicago Unit Acquisition LLC in 2012 for over $50 mil

2) Deutsche(DBTCA) loan of $25-50mil from 2012

Thread w/some info & questions on DBTCA Chicago loans

In 2014 DBTCA refinanced $69 mil for TIHT Chicago

@clliday found that on Nov 9, 2016 (after the election) there was a partial release of $53,730,977.65 (which presumably left balance of approx $15mil)

I'm adding some updates on prior thread below

@clliday found that on Nov 9, 2016 (after the election) there was a partial release of $53,730,977.65 (which presumably left balance of approx $15mil)

I'm adding some updates on prior thread below

https://twitter.com/WendySiegelman/status/1301930965233815553?s=20

I created the table below of the loans and major filings I found on Cook County website for TIHT Chicago starting in 2004 from Fortress & DBTCA (springing loan is not available)

ccrecorder.org/recordings/go_…

The bottom yellow sections show 2 DBTCA loans that raise a few questions

ccrecorder.org/recordings/go_…

The bottom yellow sections show 2 DBTCA loans that raise a few questions

Trump disclosure shows TIHT Chicago DBTCA loan incurred 2012, matures 2024

Of 2 DBTCA loans I found that are not fully released (paid off) one is from 2012, the other matures 2024 - it appears they may be linked & listed in one line in Trump’s disclosure

assets.documentcloud.org/documents/7011…

Of 2 DBTCA loans I found that are not fully released (paid off) one is from 2012, the other matures 2024 - it appears they may be linked & listed in one line in Trump’s disclosure

assets.documentcloud.org/documents/7011…

In Nov 2012 DBTCA provided four loans, 2 for $45mil and 2 for $53,730,977 - in May 2013 three of the loans were released

The 4th loan for $45 million (yellow) is the only one from 2012 that does not have a related doc showing a ‘release’ of the mortgage

ccrecorder.org/recordings/rec…

The 4th loan for $45 million (yellow) is the only one from 2012 that does not have a related doc showing a ‘release’ of the mortgage

ccrecorder.org/recordings/rec…

Several articles, like 2019 WaPo story below, described a June 2014 “$69 million loan to refinance an existing Trump hotel in Chicago”

But I have not seen reporting on the @clliday finding of Nov 9, 2016 partial release of $53,730,977.65 on the 2014 loan

washingtonpost.com/politics/trump…

But I have not seen reporting on the @clliday finding of Nov 9, 2016 partial release of $53,730,977.65 on the 2014 loan

washingtonpost.com/politics/trump…

Link to June 2, 2014 $69 million mortgage

ccrecorder.org/recordings/rec…

Link to Nov 9, 2016 partial release of $53,730,977.65 that references the mortgage dated June 2, 2014, and mentions remainder of “Mortgage not specifically released” HT @clliday

ccrecorder.org/recordings/rec…

ccrecorder.org/recordings/rec…

Link to Nov 9, 2016 partial release of $53,730,977.65 that references the mortgage dated June 2, 2014, and mentions remainder of “Mortgage not specifically released” HT @clliday

ccrecorder.org/recordings/rec…

If $69 mil June 2014 refinanced mortgage is only outstanding loan from DBTCA and $53,730,977.65 was released Nov 9, 2016 - presumably balance would be approx $15 million

But Trump’s disclosure lists $25-50 mil DBTCA TIHT Chicago loan (3rd row from bottom)

assets.documentcloud.org/documents/7011…

But Trump’s disclosure lists $25-50 mil DBTCA TIHT Chicago loan (3rd row from bottom)

assets.documentcloud.org/documents/7011…

The 2014 $69 mil mortgage 'Agreement' section describes "Amended and Restated Term Loan Agreement" vs the 2012 mortgage 'Agreement' section which describes "Term Loan Agreement (Hotel)"

However, I could not find anything in the 2014 agreement that mentions the 2012 mortgage

However, I could not find anything in the 2014 agreement that mentions the 2012 mortgage

It's possible that Trump's OGE financial disclosure merges two separate outstanding loans into one line, and accurately reflects the balance of $25-$50 million

However, it does not appear that the 2014 $69 mil loan is the only one outstanding if $53.7 mil was partially released

However, it does not appear that the 2014 $69 mil loan is the only one outstanding if $53.7 mil was partially released

I wanted to share out info above as a reference for anyone looking at TIHT DBTCA loans

A separate item I saw while reviewing filings is the original $640 million construction loan Trump received Feb 7, 2005 was from Deutsche Bank Trust Company Americas

ccrecorder.org/recordings/rec…

A separate item I saw while reviewing filings is the original $640 million construction loan Trump received Feb 7, 2005 was from Deutsche Bank Trust Company Americas

ccrecorder.org/recordings/rec…

A quick note on mysterious 2012 springing loan from Chicago Unit Acquisition LLC (aka Trump) to TIHT Chicago which @Fahrenthold @russchoma & others have covered extensively

In Scotland intercompany loans are interest free so it's odd springing loan interest is a high prime +5%

In Scotland intercompany loans are interest free so it's odd springing loan interest is a high prime +5%

A quick clarification - the 2005 $640 mil loan lists DBTCA as "agent for lenders"

https://twitter.com/WendySiegelman/status/1310348490040651778?s=20

2017 chart of Trump loans from Deutsche Bank and Ladder Capital Finance

medium.com/@wsiegelman/tr…

medium.com/@wsiegelman/tr…

• • •

Missing some Tweet in this thread? You can try to

force a refresh