1/ There seems to be a common misconception that AMMs won't work because LPs can be constantly arbitraged

Let's clear that up.

Let's clear that up.

2/ First of all, yes LPs constantly get taken by arbitragers. There was rough analysis pre-DeFi explosion, that 70%+ of Uniswap volume came from arbitrage.

There is a lot more soft flow from directional traders these days, but significant volume still comes from arbitragers

There is a lot more soft flow from directional traders these days, but significant volume still comes from arbitragers

3/ The is one false logical assessment that the misconception threads back to:

- Arbitragers make profit from taking from Uniswap LPs

- Uniswap LPs suffer IL from trades

- Trade volume predominantly come from arbitrageurs

-> Therefore, IL is value from arbitrage profit

- Arbitragers make profit from taking from Uniswap LPs

- Uniswap LPs suffer IL from trades

- Trade volume predominantly come from arbitrageurs

-> Therefore, IL is value from arbitrage profit

4/ To understand why this is not true, consider a situation where the Uniswap ETH-USDT pool consists of only 1 LP.

T0 = $350

T1 = $400

T2= $350

Did arbitragers make a profit on the way up and down? Yes

Did ETH-USDT LPs suffer IL?

No IL + Fee revenue

It's really that simple.

T0 = $350

T1 = $400

T2= $350

Did arbitragers make a profit on the way up and down? Yes

Did ETH-USDT LPs suffer IL?

No IL + Fee revenue

It's really that simple.

5/ So where does arbitrage profit come from?

It comes from market participants (any traders, including MMs) that execute trades without utilizing Uniswap liquidity

E.g. Bid/Ask on CEXs move from 349.95/350.05 to 351.95/352.05. Uni @ $350

Arber takes from both Uni and CEX

It comes from market participants (any traders, including MMs) that execute trades without utilizing Uniswap liquidity

E.g. Bid/Ask on CEXs move from 349.95/350.05 to 351.95/352.05. Uni @ $350

Arber takes from both Uni and CEX

6/ In this scenario, the MM got "arbitraged" but does that mean he lost money? No. In fact most MMs are "arbitraged" all the time from bids/asks on exchanges they aren't plugged into

You can't really even differentiate between these arbitrage trades and other types of flow

You can't really even differentiate between these arbitrage trades and other types of flow

7/ The most efficient MMs are plugged into as many exchanges as possible, but there are many profitable MMs that only trade on a subset of exchanges as well

As long as volumes are high with takers crossing the bid/ask spread, MMs can make a profit. The same applies for AMMs.

As long as volumes are high with takers crossing the bid/ask spread, MMs can make a profit. The same applies for AMMs.

8/ So where does IL come from? It comes from "changing deltas". Essentially your net exposure to each asset changing as price moves on each trade. LPs sell winners on the way up, and buy losers on the way down.

Just read this to understand the math:

medium.com/@pintail?sourc…

Just read this to understand the math:

medium.com/@pintail?sourc…

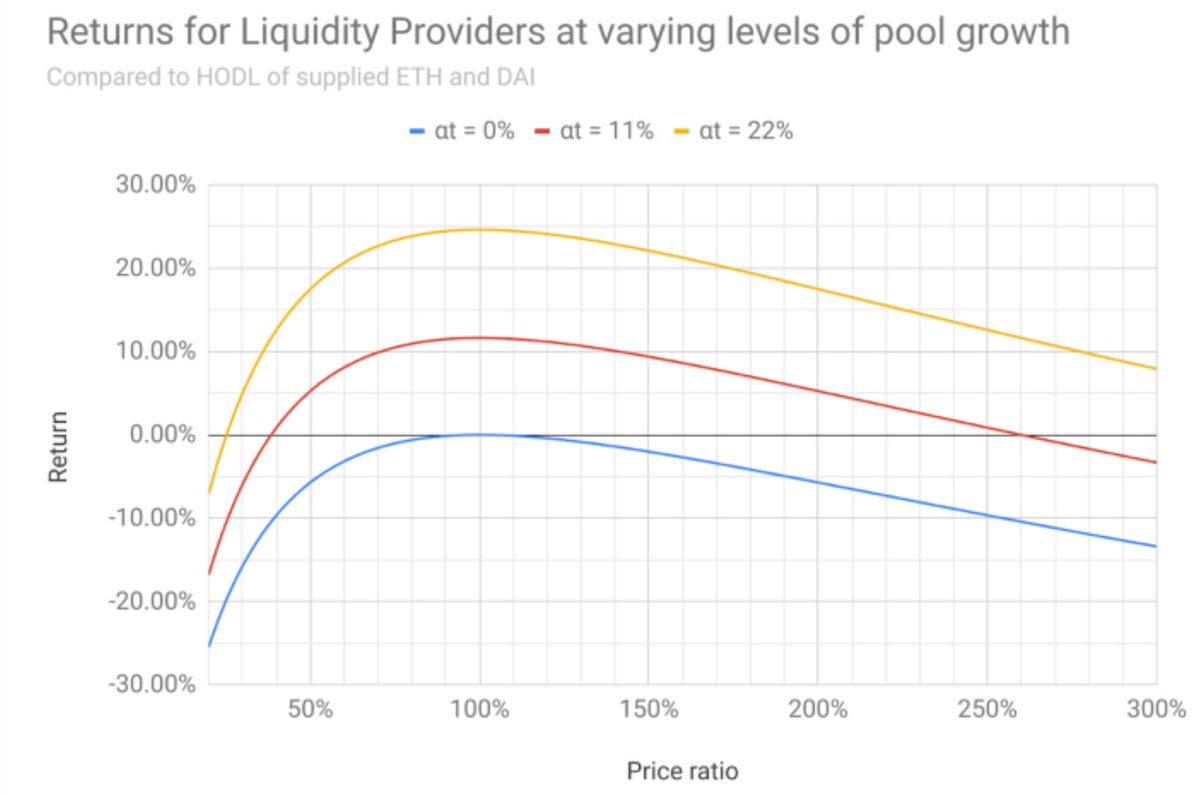

9/ The most important graph is shown here. The point is that as long as you get hit with enough volume, you can still absorb IL and still be in profit.

10/ Some people might pushback and say well in real-world settings AMMs don't really work and they are only profitable because of liquidity mining rewards

See below the return profile (IL adjusted) of ETH-USDT over a 90 day period where ETH appreciated 60%+

See below the return profile (IL adjusted) of ETH-USDT over a 90 day period where ETH appreciated 60%+

11/ Some of this was basic AMM 101, but it's important to understand where IL and arbitrage profits come from as it's not immediately clear.

Some AMM teams have even built flawed AMM designs because of the misconception stated in tweet 3/ .

Hope this is helpful

Some AMM teams have even built flawed AMM designs because of the misconception stated in tweet 3/ .

Hope this is helpful

• • •

Missing some Tweet in this thread? You can try to

force a refresh