How to get URL link on X (Twitter) App

https://twitter.com/Rewkang/status/18693971935155123112/ “A rollup is said to be based, or L1-sequenced, when its sequencing is driven by the base L1. More concretely, a based rollup is one where the next L1 proposer may, in collaboration with L1 searchers and builders, permissionlessly include the next rollup block as part of the next L1 block.” – Justin Drake

Also, Robinhood has partnered with Arbitrum for swaps so I don’t think a listing would be unlikely

Also, Robinhood has partnered with Arbitrum for swaps so I don’t think a listing would be unlikely

https://twitter.com/rewkang/status/1764497095266799809

Ngl I wouldn’t be surprised if a Doge ETF got more net inflows during a similar one year time period than the ETH ETF

Ngl I wouldn’t be surprised if a Doge ETF got more net inflows during a similar one year time period than the ETH ETF

I wrote about why low float high FDV was bad in 2021. Back then projects started to copy the Serum model of 1% circulating - I pushed that projects should have at very minimum 15-20% circulating on TGE. Now I believe even that is too low. The standard should be 65-75%+

I wrote about why low float high FDV was bad in 2021. Back then projects started to copy the Serum model of 1% circulating - I pushed that projects should have at very minimum 15-20% circulating on TGE. Now I believe even that is too low. The standard should be 65-75%+https://x.com/Rewkang/status/1366486243064770560

https://twitter.com/elonmusk/status/1767752570162778502

$PEPE is extremely bullish from a Holderbase perspective since they went through a handful of serious FUD events to leave only Diamond hands.

$PEPE is extremely bullish from a Holderbase perspective since they went through a handful of serious FUD events to leave only Diamond hands. https://twitter.com/avax/status/1740538202346381605Think you see this strategy replicated across all chains/foundations in the future, just as all of them launched DeFi incentive programs

2/ 2023 was the year of big launches and announcements

2/ 2023 was the year of big launches and announcements

1/ At $5B and $2B TVL, Aave and Compound are currently the largest money markets in crypto

1/ At $5B and $2B TVL, Aave and Compound are currently the largest money markets in crypto

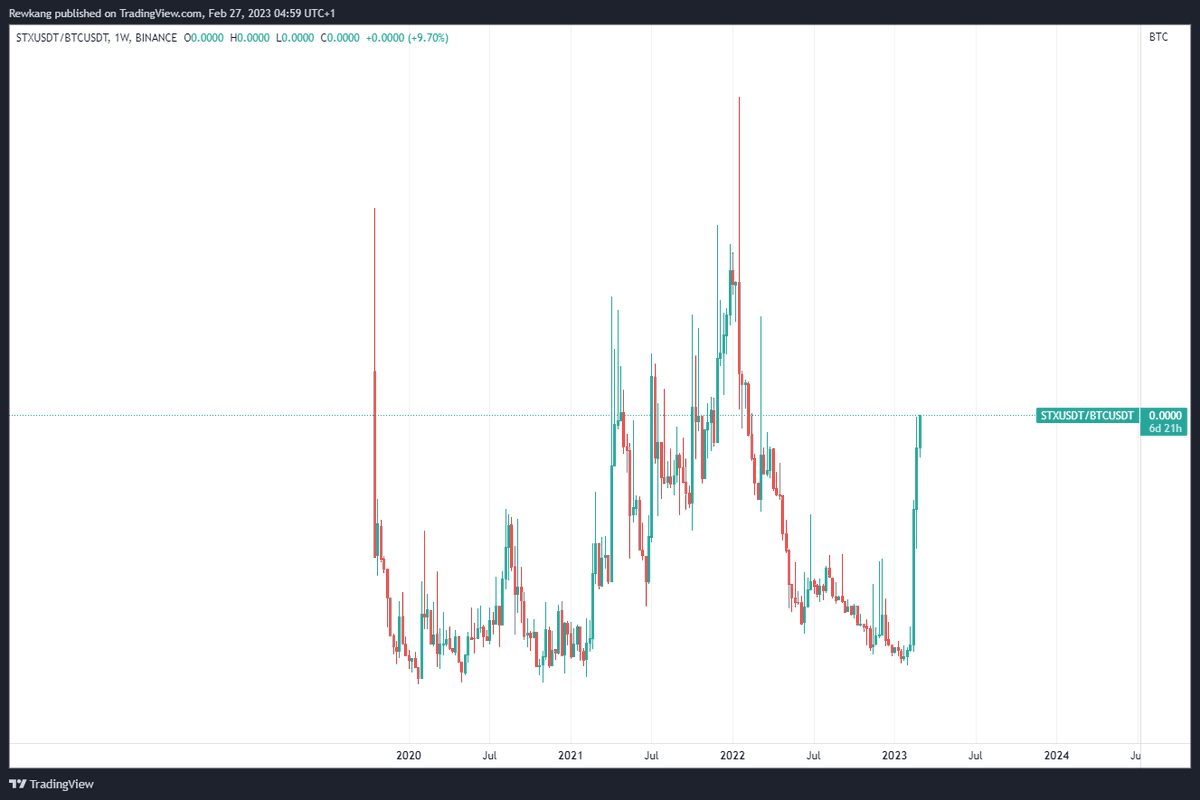

https://twitter.com/NorthRockLP/status/1629490053692149760Main catalyst is the Bitcoin Halving in a year and I think Hal's comparison to LDO & the merge is pretty apt

Yes, the Macro situation is not inspiring (for the US), but after an 80% drawdown, it seems to be overly priced in

Yes, the Macro situation is not inspiring (for the US), but after an 80% drawdown, it seems to be overly priced in

/2 From a TA perspective, we have just given every person that considers technicals in their trading/investing reason to start to look for long exposure. $BTC & $ETH have broken above diagonal trendlines & MAs, started weekly momentum crossovers, reclaimed important supports

/2 From a TA perspective, we have just given every person that considers technicals in their trading/investing reason to start to look for long exposure. $BTC & $ETH have broken above diagonal trendlines & MAs, started weekly momentum crossovers, reclaimed important supports

The only cross that didn't result in a >100% gain was from Jan 2020 but this rally was likely prematurely cut short by the covid market nuke black swan

The only cross that didn't result in a >100% gain was from Jan 2020 but this rally was likely prematurely cut short by the covid market nuke black swan

Disclosure: Long $CVNA & $CVNA call options

Disclosure: Long $CVNA & $CVNA call options

https://twitter.com/Rewkang/status/1595056307769430016

Lots of longs in profit from the last week and those with cash remaining are ultra conservative types that I don't think you can expect to chase. Think you can buy these coins lower again in the next 2 weeks

Lots of longs in profit from the last week and those with cash remaining are ultra conservative types that I don't think you can expect to chase. Think you can buy these coins lower again in the next 2 weeks

Zues Capital

Zues Capital

Since market doesn’t have a lot of deriv longs to liquidate at these levels, it creates danger for confirmation based short traders that pile on late

Since market doesn’t have a lot of deriv longs to liquidate at these levels, it creates danger for confirmation based short traders that pile on late

https://twitter.com/Rewkang/status/1592772838045659136Ok maybe you survived Luna or 3ac nuke by having some cash on hand. Only down 60-70%? Can still find a way to operate and have hope to crawl out of the hole