A thread of mini-canals, which are quite prominent in many Japanese cities.

https://twitter.com/wrathofgnon/status/1280031573547483137

They're less prominent in Tokyo but e.g. Meguro River outside my front door looks like this for two weeks every year and is pleasant year round.

(Grabbed a photo for illustration. Source: timeout.com/tokyo/things-t… )

(Grabbed a photo for illustration. Source: timeout.com/tokyo/things-t… )

Not just an indulgence for large or tourist-seeking cities, by the way. If you need drainage, you can have a canal.

Here's one of several in Ogaki:

flickr.com/photos/cyber05…

Here's one of several in Ogaki:

flickr.com/photos/cyber05…

And yeah that's cheating a little bit because absolutely any landscape looks better in sakura season but in the dog days of summer that's still a relatively cool path to take a walk on due to partial shading and the water. (Bring bug spray.)

These also act as a somewhat natural traffic regulator; the two streets adjacent to the canal are less attractive to car traffic than e.g. one street out, due to the constrained-by-bridges turn opportunities, so they're generally walkable *without being closed to traffic.*

Free lunches in urbanism, etc etc.

There is sometimes a question about why Japan is "just so nice" and while there are extremely complicated answers to it, a necessary part of it is simply Will To Have Nice Things.

"We're building a university on the hill."

"Awesome that will help a lot with public traversability at the outer edge of campus. Adding shade?"

"Naturally."

"How about a water feature?"

"Not in the budget."

"It's in somebody's. Ask the neighborhood; some company good for it."

"Awesome that will help a lot with public traversability at the outer edge of campus. Adding shade?"

"Naturally."

"How about a water feature?"

"Not in the budget."

"It's in somebody's. Ask the neighborhood; some company good for it."

Darn it that isn't on Google yet. I suppose I know where I'm going for lunch now. Give me 90 minutes, Internets, I'll get you a photo.

(Continuing an imagined conversation)

"So we're building a college on the hill and were wondering if you could chip in for a water feature at the edge."

"By the police box?"

"No by the old bamboo grove."

"It gonna be passable now?"

"Yes we're putting in steps."

"Of course!"

"So we're building a college on the hill and were wondering if you could chip in for a water feature at the edge."

"By the police box?"

"No by the old bamboo grove."

"It gonna be passable now?"

"Yes we're putting in steps."

"Of course!"

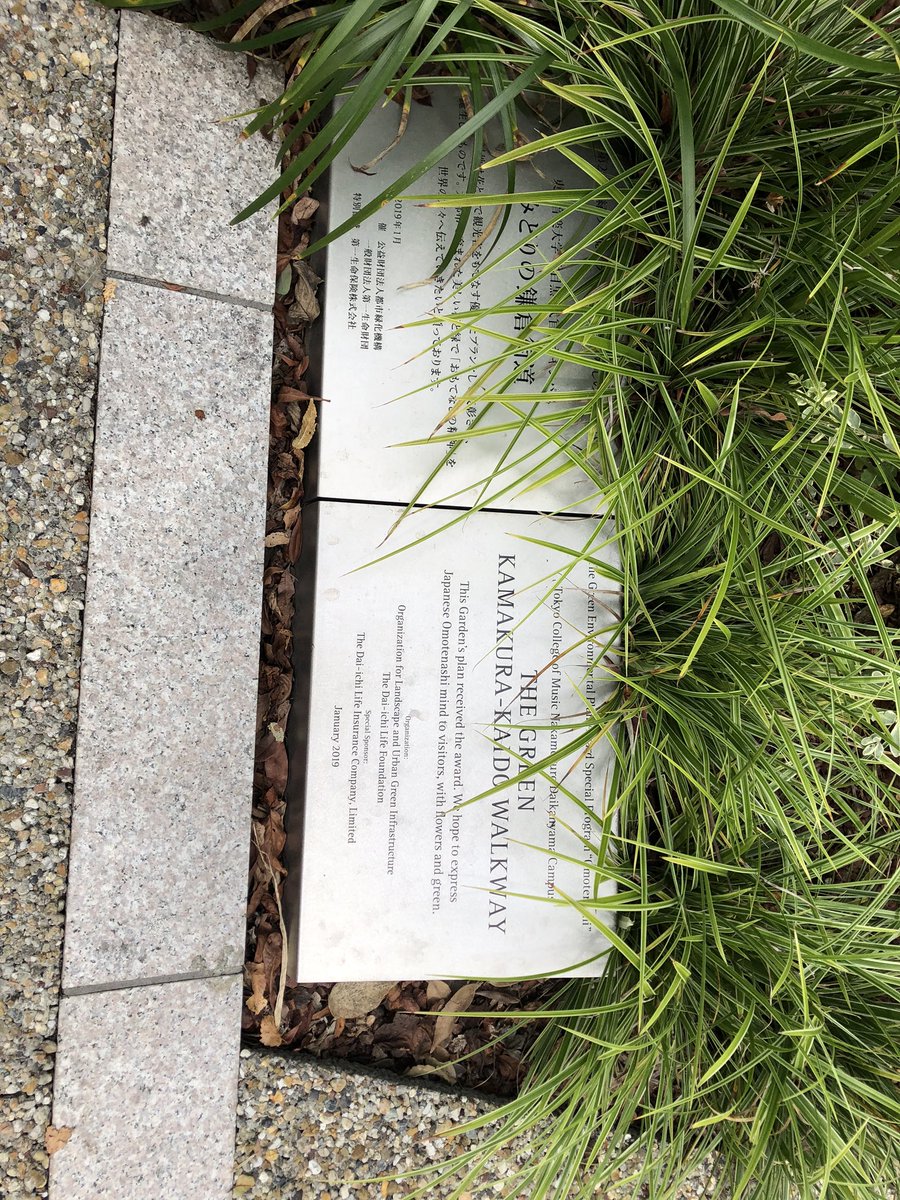

The company named on the plaque is some distance from the hill, but they're In The Neighborhood (TM), and when you've been in the neighborhood for a hundred years of course it is proper for you to feel a certain sense of responsibility as far as the old bamboo grove.

A quick walk up the path next to Tokyo College of Music.

Funding for the water feature from Dai-Ichi Life Insurance, which I am doing my level best to repay by not dying while my term life is in force.

They’re a very large company and have some property (not HQ, AFAIK) in the neighborhood.

They’re a very large company and have some property (not HQ, AFAIK) in the neighborhood.

And in front of the cafe there is a fairly frequent feature of Tokyo developments which is sometimes mandatory: public open space on private property, generally improved with greenery and benches. Functions similar to a park; also eases movement to adjacent parcels via foot.

Anyhow, back to lunch and then the software salt mines. Apologies for the brief foray into urbanism influencer.

Once we’re in more settled times you should come visit Tokyo. It’s the best city on earth.

Once we’re in more settled times you should come visit Tokyo. It’s the best city on earth.

• • •

Missing some Tweet in this thread? You can try to

force a refresh