our CDC and WH are now pushing for “younger kids have lowest risk of spreading COVID19”, based on extrapolated data from spring and summer when schools are CLOSED.

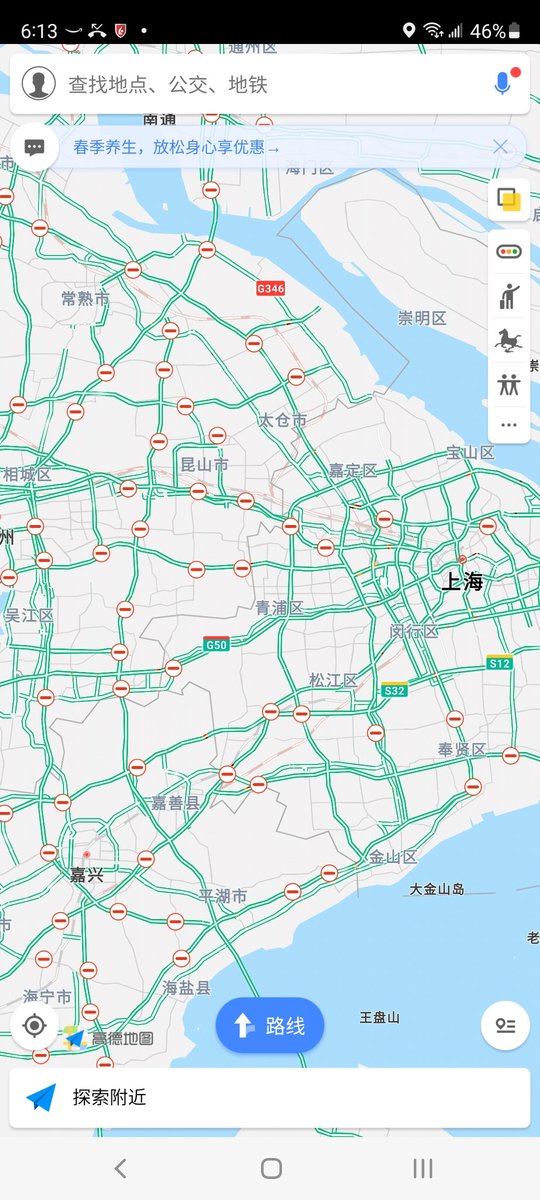

In contrast, major cities in China, e.g. Shanghai, impose stricter quarantine rules for school kids for their upcoming holiday week:

non-student adult can travel domestically without restrictions, while school kids who leave their residence city have 14-day mandatory quarantine

non-student adult can travel domestically without restrictions, while school kids who leave their residence city have 14-day mandatory quarantine

Part of their risk management:

Adults can be quickly traced and notified with their cell phone QR systems, should an outbreak occur

School kids don’t have cell phones, are more prone to asymptomatic spread, and are packed in classrooms with poorer ventilation (higher risk)

Adults can be quickly traced and notified with their cell phone QR systems, should an outbreak occur

School kids don’t have cell phones, are more prone to asymptomatic spread, and are packed in classrooms with poorer ventilation (higher risk)

Basically many of my friends in China are unable to travel next week, because they can’t take their kids with them.

• • •

Missing some Tweet in this thread? You can try to

force a refresh