PhD. Swing trader in index options, Fed watcher. Tweets reflect my personal observations. No investment advice. No medical advice.

11 subscribers

How to get URL link on X (Twitter) App

They probably need to do a little more than just tweaking the discount window, since $SIVB collapse is getting close to the scale of Bear Stearns, when it collapsed during the week of March 14 2008.

They probably need to do a little more than just tweaking the discount window, since $SIVB collapse is getting close to the scale of Bear Stearns, when it collapsed during the week of March 14 2008.

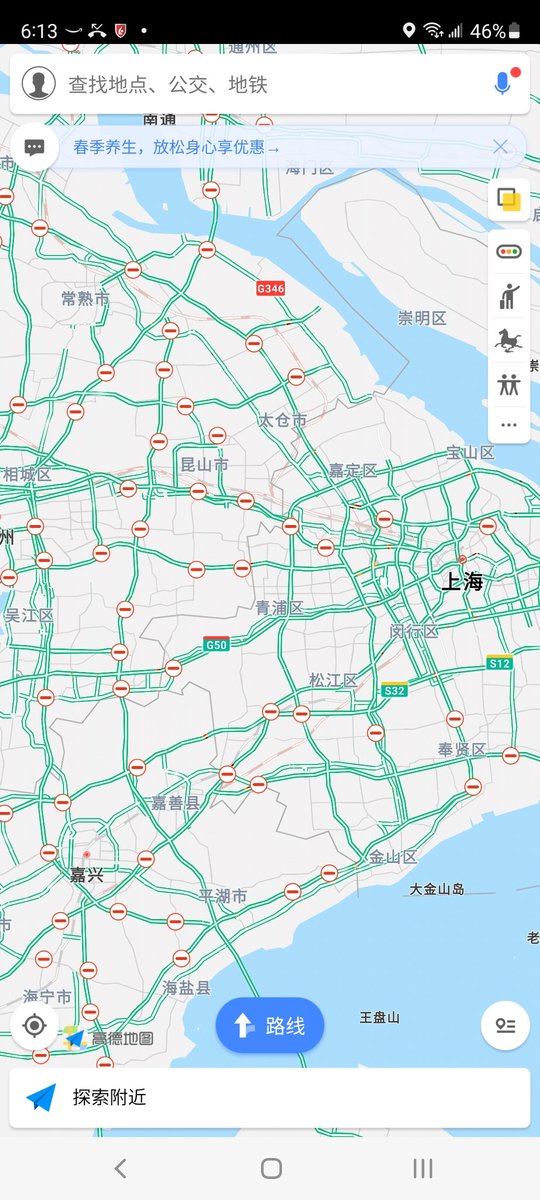

Political rhetoric is starting to get in the way for the government to accurately identify and rectify what has NOT been working in this covid wave in Shanghai.

Political rhetoric is starting to get in the way for the government to accurately identify and rectify what has NOT been working in this covid wave in Shanghai.

2. monthly MBS roll-off will be less than $35Bn very soon. (only $38Bn when 30Y rate was still <5%) So we may never hit the MBS monthly cap any way. So a 2nd shoe will drop when the Fed releases the plan of MBS sales in Sept/Oct?

2. monthly MBS roll-off will be less than $35Bn very soon. (only $38Bn when 30Y rate was still <5%) So we may never hit the MBS monthly cap any way. So a 2nd shoe will drop when the Fed releases the plan of MBS sales in Sept/Oct?

The rough translation: her family owns 5 condos in Shanghai: 4 paid off, 1 with a mortgage. her parents live in 2, and 3 are rented out to pay for the mortgage. Her husband's family owns 3 condos in Shanghai, all paid off.

The rough translation: her family owns 5 condos in Shanghai: 4 paid off, 1 with a mortgage. her parents live in 2, and 3 are rented out to pay for the mortgage. Her husband's family owns 3 condos in Shanghai, all paid off.

2/ so not sure who qualifies as small business any more.

2/ so not sure who qualifies as small business any more.

2/ They don't want to hold bank reserve at EOQ, so the fastest way is to quit doing Repos (taking in bank reserve and lend out UST/MBS etc)

2/ They don't want to hold bank reserve at EOQ, so the fastest way is to quit doing Repos (taking in bank reserve and lend out UST/MBS etc)

fish oil in the shop today is probably made 2-3 months ago from salmons caught 4-5 months ago... so it's still relatively safe.

fish oil in the shop today is probably made 2-3 months ago from salmons caught 4-5 months ago... so it's still relatively safe.

The "travel ban" only applies to non-US residents.

The "travel ban" only applies to non-US residents.

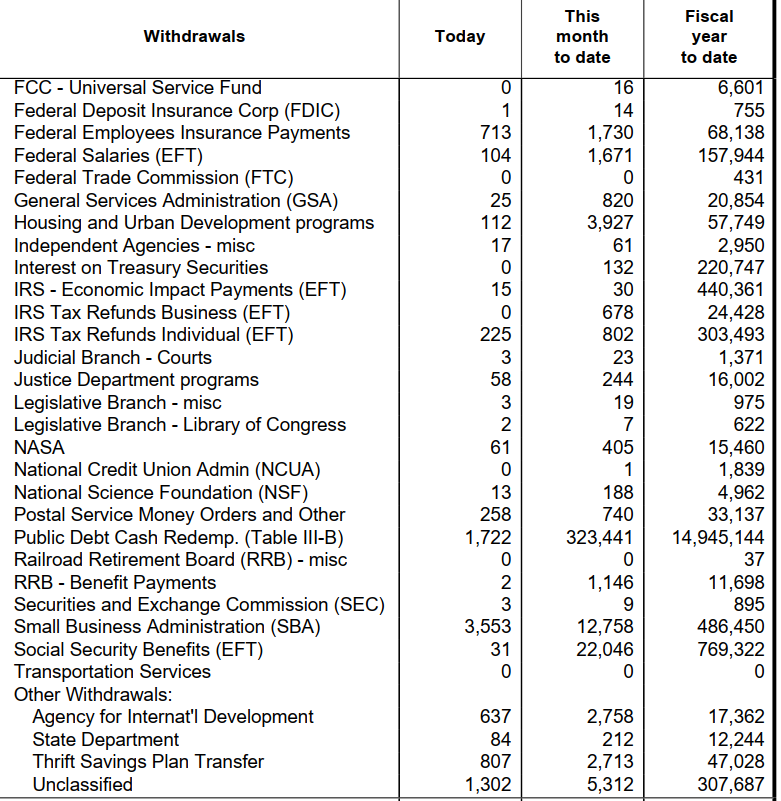

Plugging in the current USG spending model along with EOQ TGA target of $800Bn, I ended up with this:

Plugging in the current USG spending model along with EOQ TGA target of $800Bn, I ended up with this: