1/n

Short notes from the book 'Dead Companies Walking' by Scott Fearon.

I think this is a must read book for all investors to understand when to stay away from a company even if you don't want to short it.

Short notes from the book 'Dead Companies Walking' by Scott Fearon.

I think this is a must read book for all investors to understand when to stay away from a company even if you don't want to short it.

2/n Things go wrong more often than they go right. Failure is actually a natural - even crucial - element of a healthy economy. And the people who are willing to acknowledge that fact can make a hell of a lot of money.

3/n One of the most enduring & important business traditions is failure

4/n Failure arises from one or more of these 6 common mistakes

1. Learnt ONLY from recent past

2. Relying on ONLY formulas

3. Didn't understand customers

4. Victim to a mania

5. Failed to adapt

6. Emotionally or physically removed from company

1. Learnt ONLY from recent past

2. Relying on ONLY formulas

3. Didn't understand customers

4. Victim to a mania

5. Failed to adapt

6. Emotionally or physically removed from company

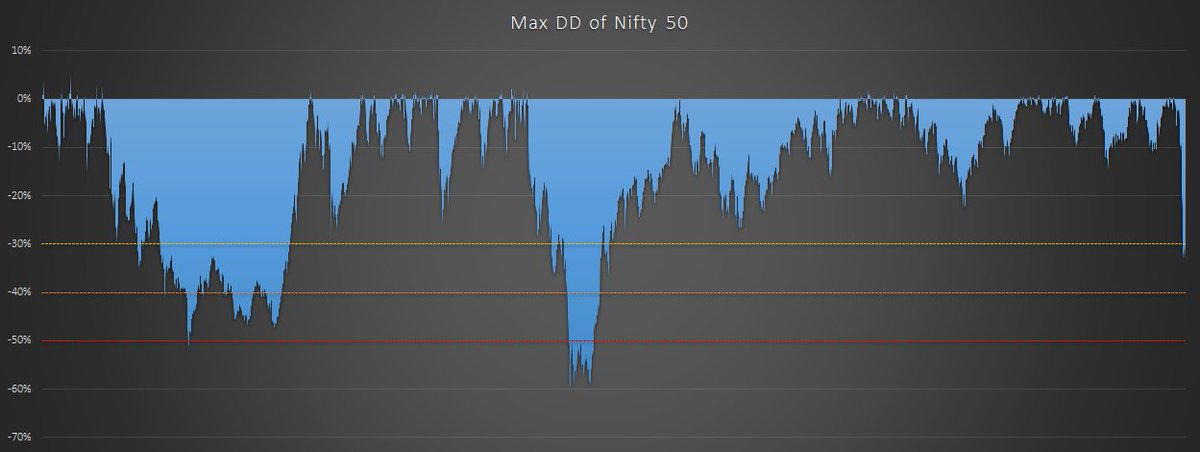

5/n If your data predicts something hasn't happened before does not mean it cannot happen in the future. Call this historical myopia.

6/n It's ok to be wrong; it's not ok to stay wrong.

7/n Failure *terrifies* people. They'll do whatever they have to do to downplay it, wish it away, and just plain pretend it doesn't exist.

8/n The idea of quitting or giving up is almost unpatriotic. But when it comes to business and also investing, this kind of excessive optimism can do more harm than good.

9/n Management instead of adjusting their strategies chose to believe things would naturally work out for the best and they make up all sorts of comforting rationalisations to prove their rosy predictions.

10/n Self delusion is a powerfully democratic force. It cuts across all social classes. You can be richer, smarter and more successful than anyone else. But if you're not brutally honest with yourself about your own potential for failure then you might lose a lot of money.

11/n People in business and investments overvalue competitiveness. It's actually one of the worst qualities to have because it puts too much faith in one's abilities. Competitive types think they can will their way to success no matter what.

12/n Investors perform in irrational ways sometimes and even junk stocks can live on well past their expiration dates.

13/n The average analyst or institutional salesperson is three things: young, affluent and hyper-competitive.

14/n Most important advice in investing: Quitting is very important when you're buying and selling stocks. Be a good quitter.

15/n Effective money managers do not go with the flow.

16/n Businesses need to accept that sometimes their industry fundamentally or permanently changes. This is crucial for survival.

17/n People don't like to face bad news, especially when it means admitting they've made stupid decisions. They invent all kinds of rationalisations to keep from owning up to their culpability. Worst of all they tend to blame anything & everyone but themselves for their failures.

18/n Intelligence doesn't guarantee success. Peter Lynch's success rate was 6 out of 10.

19/n You can't have friends on Wall Street

20/n The misplaced faith in the investment world is the cult of the Guru. Someone who projects to know the hidden formula. The people who actually possess these kinds of insights almost never share them.

21/n The financial world suffers from an inherent flaw: the people who work in it, by and large, are terrible investors.

22/n The people in the financial world have spent their whole lives going to get along. They are hyper-competitive. They worship rich and powerful people.

23/n If you're an individual investor, you should not under any circumstance trust your money to a Wall Street brokerage or investment management company.

24/n There are countless tricks that brokers and money managers have mastered to pad their stats and separate their clients from their money. New ones get invented all the time.

25/n Conclusion: If you want to be a good investor, learn to be a good quitter. Quit early and quit often.

• • •

Missing some Tweet in this thread? You can try to

force a refresh