@CashApp has been one of the most remarkable companies in fintech and often underfollowed. Currently worth $30B+ in value, with $1.5B+ run-rate revenue. Read more below 👇

1/ Cash App launched in 2013. The service was free with virtually no monetization.

Most investors (including myself) didn’t understand what Jack Dorsey was building then.

Most investors (including myself) didn’t understand what Jack Dorsey was building then.

2/ Jack saw an opportunity to democratize financial services for the underbanked. Cash App used free P2P as the flywheel to bring on consumers. They were savvy with marketing through social media, influencers, and music artists to gain virality in the early days.

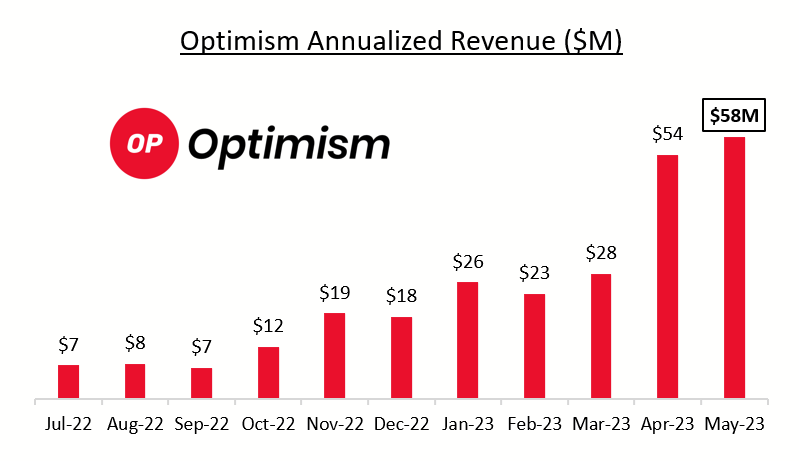

3/ Since then, Cash App has grown from 1M users in 2015, to 30M+ actives in Q2'20. They have ~$1.5B in run-rate revenue (excluding bitcoin pass-through).

Revenue is growing >100% at scale. It’s likely worth half of $SQ's $80B market cap today.

Revenue is growing >100% at scale. It’s likely worth half of $SQ's $80B market cap today.

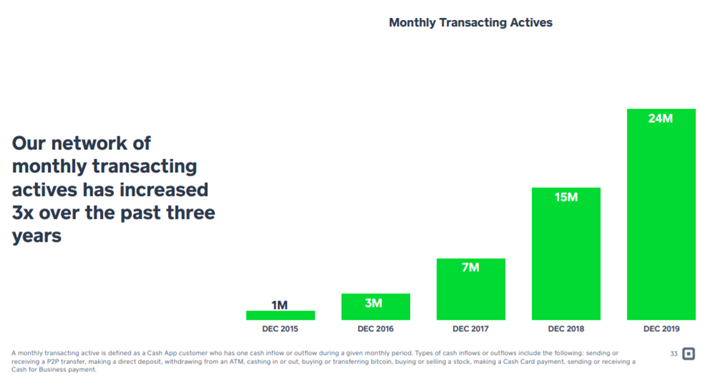

4/ @jack Dorsey is a product visionary of our generation and has always built around ecosystems. He and Brian @Grassadonia (Head of Cash App) were laser focused in building out a suite of financial services for @cashapp with 1-2 key product introductions each year.

5/ Product cycle over the last several years:

2017 – Cash Card

2018 – Boost Rewards, Bitcoin Trading

2019 – Fractional Investing, Direct Deposit

2020 – Lending, Cross-Border Remittance

2017 – Cash Card

2018 – Boost Rewards, Bitcoin Trading

2019 – Fractional Investing, Direct Deposit

2020 – Lending, Cross-Border Remittance

6/ By having multiple touch points, Cash App acquires customers efficiently, and keeps them engaged within the ecosystem. This results in higher customer lifetime value.

With a growing user network, they are building a moat which traditional banks and prepaid cards lack.

With a growing user network, they are building a moat which traditional banks and prepaid cards lack.

7/ Cash App today makes ~$45 ARPU across instant deposit and debit interchange (~1.5% take rate). That can grow though existing product uptake & new products.

Instant deposit has some LT risk, but they are actively driving Cash Card adoption for more durable revenue stream.

Instant deposit has some LT risk, but they are actively driving Cash Card adoption for more durable revenue stream.

8/ And on last quarter's earnings call, Square mentioned interest expanding both internationally and into SMB banking. Both are large new markets to enter & ripe for change.

9/ Management plays a huge part in the success and Square's team is exceptional. @jack and @AmritaAhuja are the types of leaders I want to side with. They are passionate, mission-driven, and willing to play the long game.

• • •

Missing some Tweet in this thread? You can try to

force a refresh