How to get URL link on X (Twitter) App

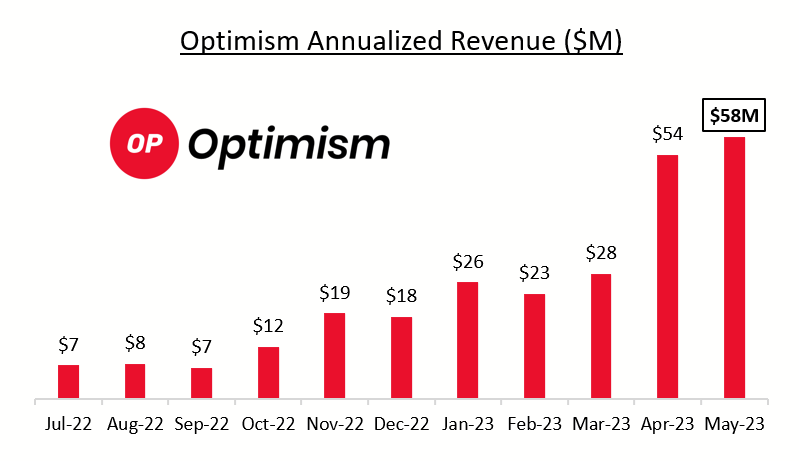

2/ Optimism on similar trajectory with ~$60m annualized fees (roughly half of $ARB run rate)

2/ Optimism on similar trajectory with ~$60m annualized fees (roughly half of $ARB run rate)

2/ Huge number of crypto protocols have expanded to multiple layer 1 chains - Aave, Lido, Curve, Frax, OpenSea, Magic Eden, GMX, Gains, Trader Joe, Ribbon, Sushi, UXD etc

2/ Huge number of crypto protocols have expanded to multiple layer 1 chains - Aave, Lido, Curve, Frax, OpenSea, Magic Eden, GMX, Gains, Trader Joe, Ribbon, Sushi, UXD etc

Big prize to be won - SOL NFTs have picked up significant momentum this year

Big prize to be won - SOL NFTs have picked up significant momentum this year

2/ In the early 2010s - LinkedIn still felt a bit weird and not fully normal. College classmates of mine (incl me) would make fun of ppl that wrote "Incoming XXX Analyst" on their LinkedIn *before* graduation.

2/ In the early 2010s - LinkedIn still felt a bit weird and not fully normal. College classmates of mine (incl me) would make fun of ppl that wrote "Incoming XXX Analyst" on their LinkedIn *before* graduation.https://twitter.com/jasoncwarner/status/15317242882307604482/ Anecdotally the startups with big cash war chest have tended to elect for larger cash comp route (rather than issue too much more sbc / addt'l dilution) - to win over prospective hires

2/ High growth fintech multiples now down 50% from 2021 avg (47x ->23x EV/GP). Trading ~15% below pre covid levels.

2/ High growth fintech multiples now down 50% from 2021 avg (47x ->23x EV/GP). Trading ~15% below pre covid levels.