I quibble with that, too. Trump's finances from 2008 onward aren't "mundane." He defaulted on the only bank lending him money, then obtained >$500m in credit despite inadequate collateral, then liquidated >99.5% of his stocks & bonds. That's unusual. /1

https://twitter.com/adamdavidson/status/1310912837720702977

Litigation is common in business. The surprising part here is how, as of 2008, Deutsche Bank was the only bank that would loan him money (and only with a personal guarantee), but he nonetheless defaulted. Standing alone, it makes little business sense. /2 chicagotribune.com/news/ct-xpm-20…

The 2008 sale of Trump's Palm Beach home to the bad guy from TENET has always been odd, but perhaps Rybolovlev is just bad with money. 🤷♂️ Either way, it coincides with a sharp rise in Trump condos being bought through shell companies and/or with cash. /3

buzzfeednews.com/article/thomas…

buzzfeednews.com/article/thomas…

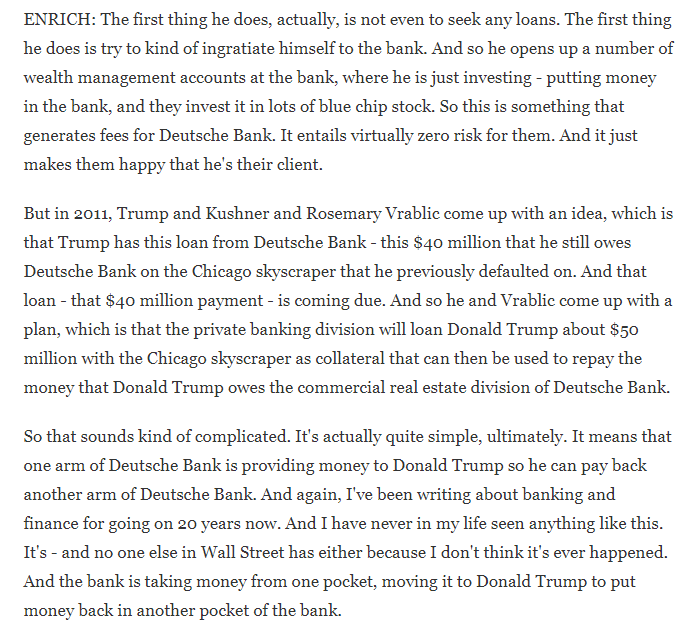

In 2011, the private-wealth group at DB agrees to loan Trump $48m, of which $40m is paying off the debt to DB's real estate group that prompted lawsuits—a startling transaction nobody at DB or on Wall Street had seen before. /4

nytimes.com/2020/02/04/mag…

npr.org/2019/05/09/721…

nytimes.com/2020/02/04/mag…

npr.org/2019/05/09/721…

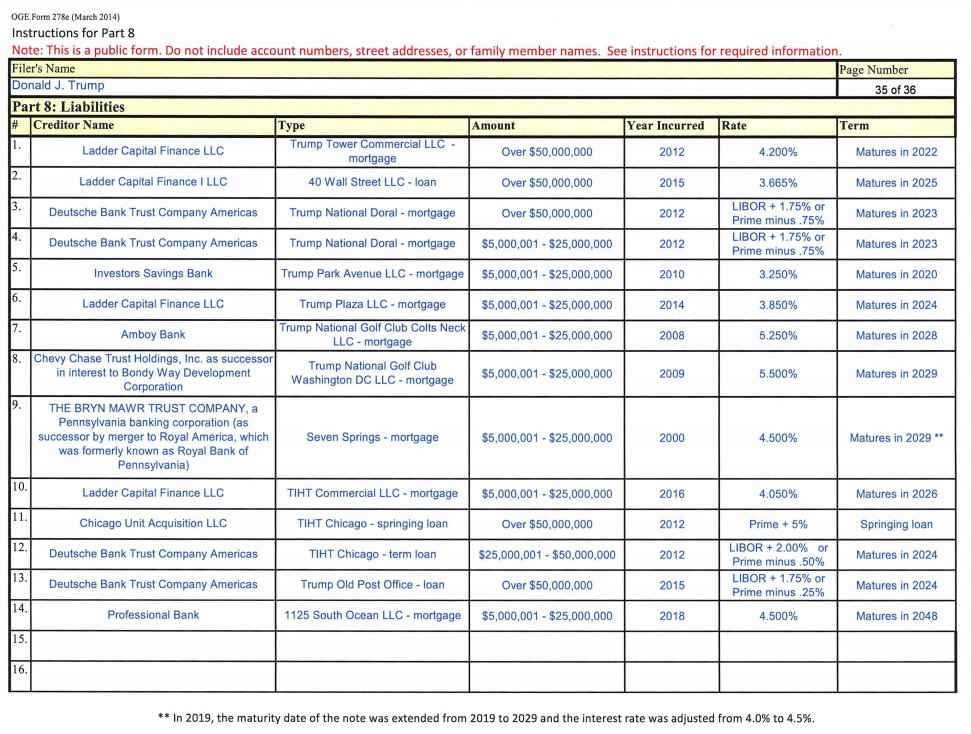

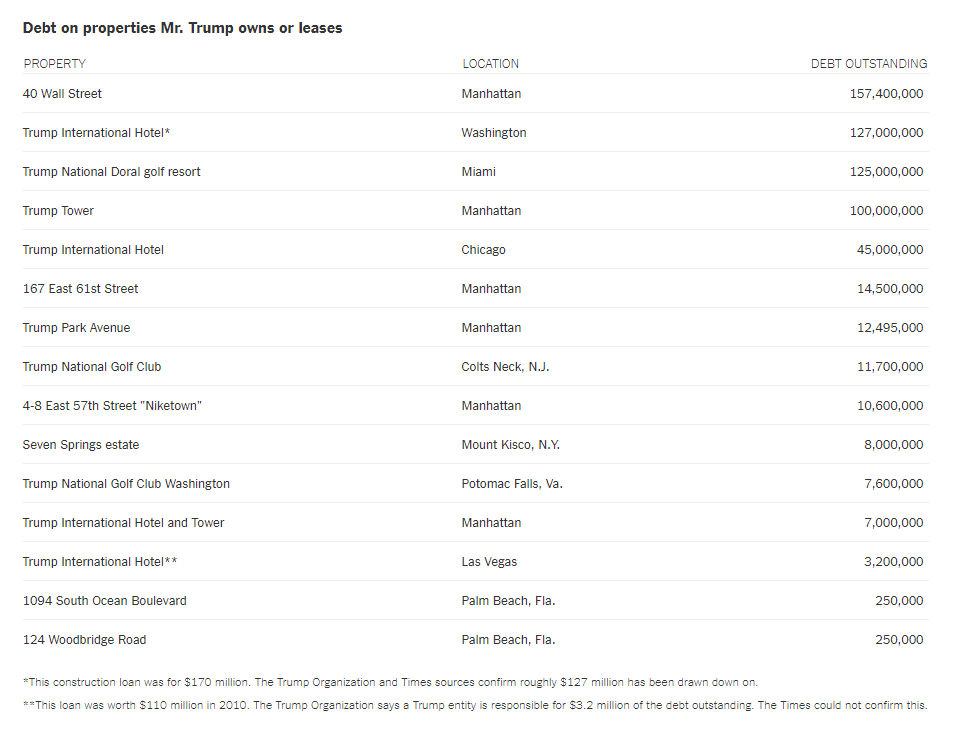

Then come massive debts:

2012 - Doral, $125m debt (DB)

2012 - Trump Tower, $100m debt (Ladder)

2015 - 40 Wall Street, $157m debt (Ladder)

2015 - Trump DC, $127m debt (DB)

Latest disclosure: s3.amazonaws.com/storage.citize…

Debt as of 2016: nytimes.com/interactive/20…

It gets weirder.

/5

2012 - Doral, $125m debt (DB)

2012 - Trump Tower, $100m debt (Ladder)

2015 - 40 Wall Street, $157m debt (Ladder)

2015 - Trump DC, $127m debt (DB)

Latest disclosure: s3.amazonaws.com/storage.citize…

Debt as of 2016: nytimes.com/interactive/20…

It gets weirder.

/5

In 2014, the self-described "king of debt" purchases Turnberry for $60m in cash. The financing for this is completely unknown, but we do know that Turnberry, which has lost nearly £43m ($55m), owes £115m ($147m) to a trust with Trump's name on it. /6

https://twitter.com/MartynMcL/status/1310607174062800899

The Aberdeen golf course, which Trump bought in 2006, owes £43.1m ($55m) to Trump and his companies. It is also a huge money sink, but not in the way a tax shelter normally works. The reported value of it goes *up,* even while money disappears. /7

https://twitter.com/adamdavidson/status/1310934009510273025

And then there's "Chicago Unit Acquisition LLC," which Trump's disclosure says in 2012 imposed a "springing loan" for "over $50,000,000"—and also says Trump owns, though he reports a $0 value for it. Maybe it's a fake debt to avoid taxes. /8

https://twitter.com/Fahrenthold/status/1196498901198626817

Which brings us back to "mundane." Trump didn't have sufficient collateral for his loans, hence personal guarantees to DB and Ladder Capital: motherjones.com/politics/2016/…

This is where the "theories of secret payments" come in, to explain what otherwise makes little sense. /9

This is where the "theories of secret payments" come in, to explain what otherwise makes little sense. /9

At the same time of Trump's inexplicable return to good credit, he was financially connected to multiple apparent money laundering schemes involving figures from the former Soviet Union. One "theory" is that such a figure co-signed his loans. /10

https://twitter.com/adamdavidson/status/1310914050407239680

Without a co-signer, it's hard to see how Trump gets the $48m loan in 2011 or $100m mortgage in 2012; again, he didn't post sufficient collateral, hence the personal guarantee.

Links to Russia are unproven but plausible. /11

buzzfeednews.com/article/anthon…

vox.com/world/2018/11/…

Links to Russia are unproven but plausible. /11

buzzfeednews.com/article/anthon…

vox.com/world/2018/11/…

On the other hand, Wall Street is filled with foolish bankers who take absurd risks, because our system rewards them.

And Trump has sources of cash, but some of them raise more questions: since 2014, he has liquidated >$220m in stocks and bonds, leaving him with <$1m left. /12

And Trump has sources of cash, but some of them raise more questions: since 2014, he has liquidated >$220m in stocks and bonds, leaving him with <$1m left. /12

It's hard to imagine a sound reason for liquidating over 99.5% of a $220 million securities portfolio and dumping the money into massively unprofitable businesses but, well, that's what the filings suggest Trump has been doing these past 6 years. /13

Maybe there's a good answer for all of this. Trump's finances are of course complicated, but not unknowable, and nothing stops him from disclosing everything and explaining it all. What we see, however, suggests huge losses, money laundering, and an increasing cash crunch. /end

• • •

Missing some Tweet in this thread? You can try to

force a refresh