#marketupdate

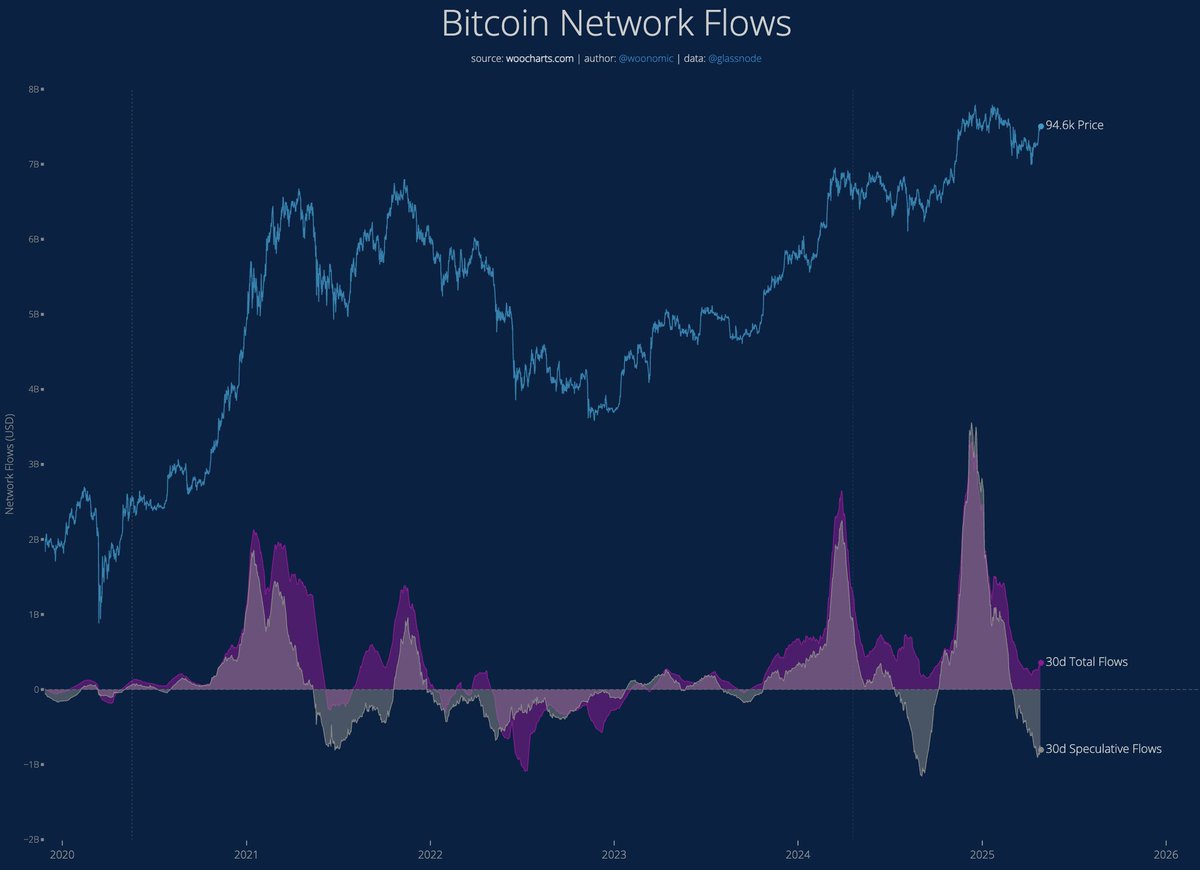

We're seeing a spike in activity by new participants coming into BTC not yet reflected in price, it doesn't happen often. This is what traders call a divergence, in this case it's obviously bullish.

Chart by @glassnode

We're seeing a spike in activity by new participants coming into BTC not yet reflected in price, it doesn't happen often. This is what traders call a divergence, in this case it's obviously bullish.

Chart by @glassnode

We're seeing another impulse of coins changing hands completing.

My interpretation is that the last pulse was take profit, halting the downward move; this impulse should be the one that drives us upwards.

My interpretation is that the last pulse was take profit, halting the downward move; this impulse should be the one that drives us upwards.

The other interpretation is it's an impulse to push us downwards, but that seems unlikely given OBV (an indicator looking at volume movements) is showing quiet accumulation is taking place.

Short term traders should exercise caution as there's a gap of lowish spot market liquidity down to $10k. If we go there, I expect that to be snapped up quickly like the other times we tested the price bottom (see candle wicks every time we went sub 10k)

Zooming out to the 3 month time frame, the difficulty ribbon has completed a compression and has started a healthy expansion signalling a bullish run to come.

Overall: bullish the next 3 weeks, also bullish over next 3 months.

IMO a good time to build a long term multi-month long position, or deploy new capital if you're thinking to increase BTC exposure.

IMO a good time to build a long term multi-month long position, or deploy new capital if you're thinking to increase BTC exposure.

• • •

Missing some Tweet in this thread? You can try to

force a refresh