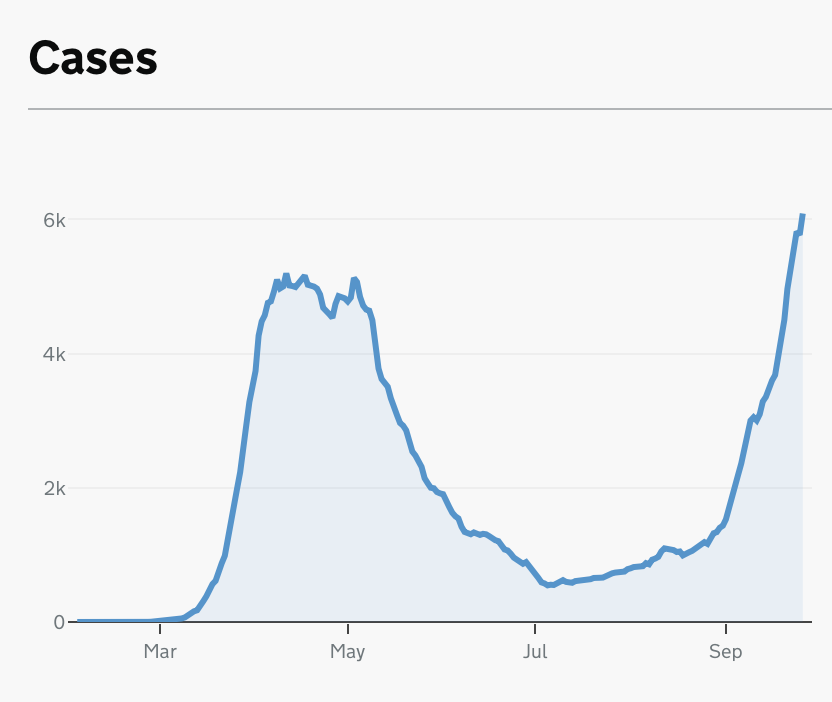

One problem with using #COVID19 trajectories to work out where we may be heading is question marks over the data - something illustrated brilliantly by this chart via @AlexSelbyB. Official case numbers look v v high now, but we weren't measuring cases v well back in spring.

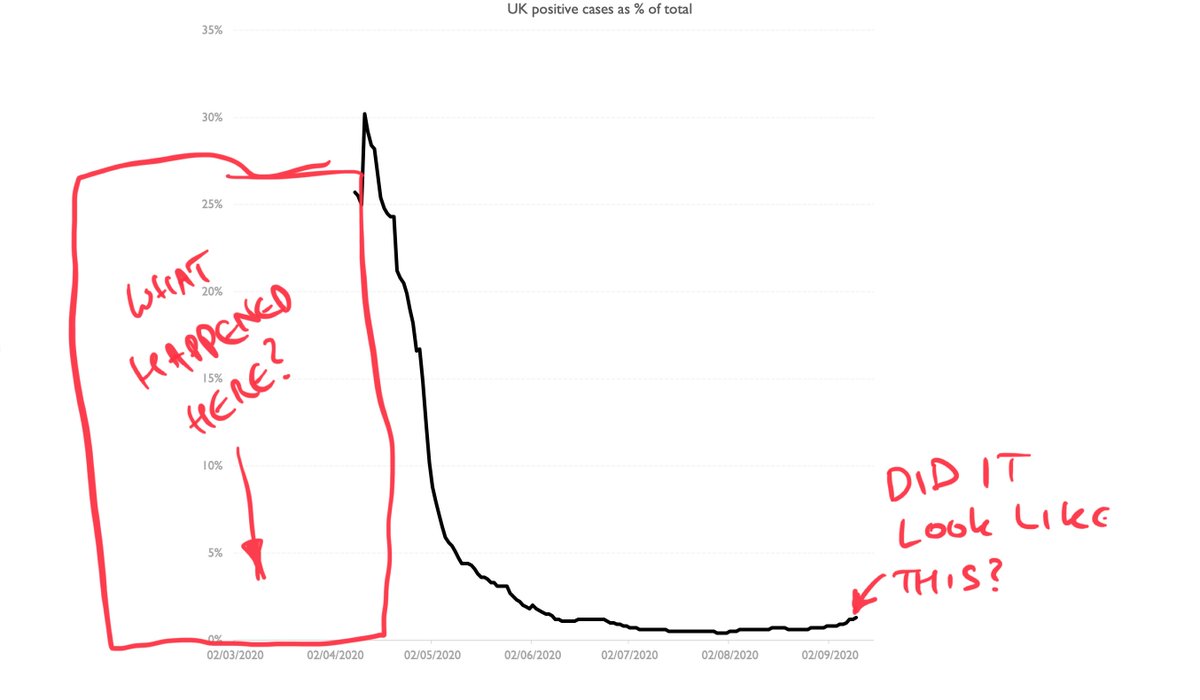

Upshot is charts of cases alone are of limited use - and this is before you get to questions about whether the testing figs are reliable. We could look at positive tests as % of total (chart 2). It adjusts for fact we're doing more testing. But is that early data reliable?

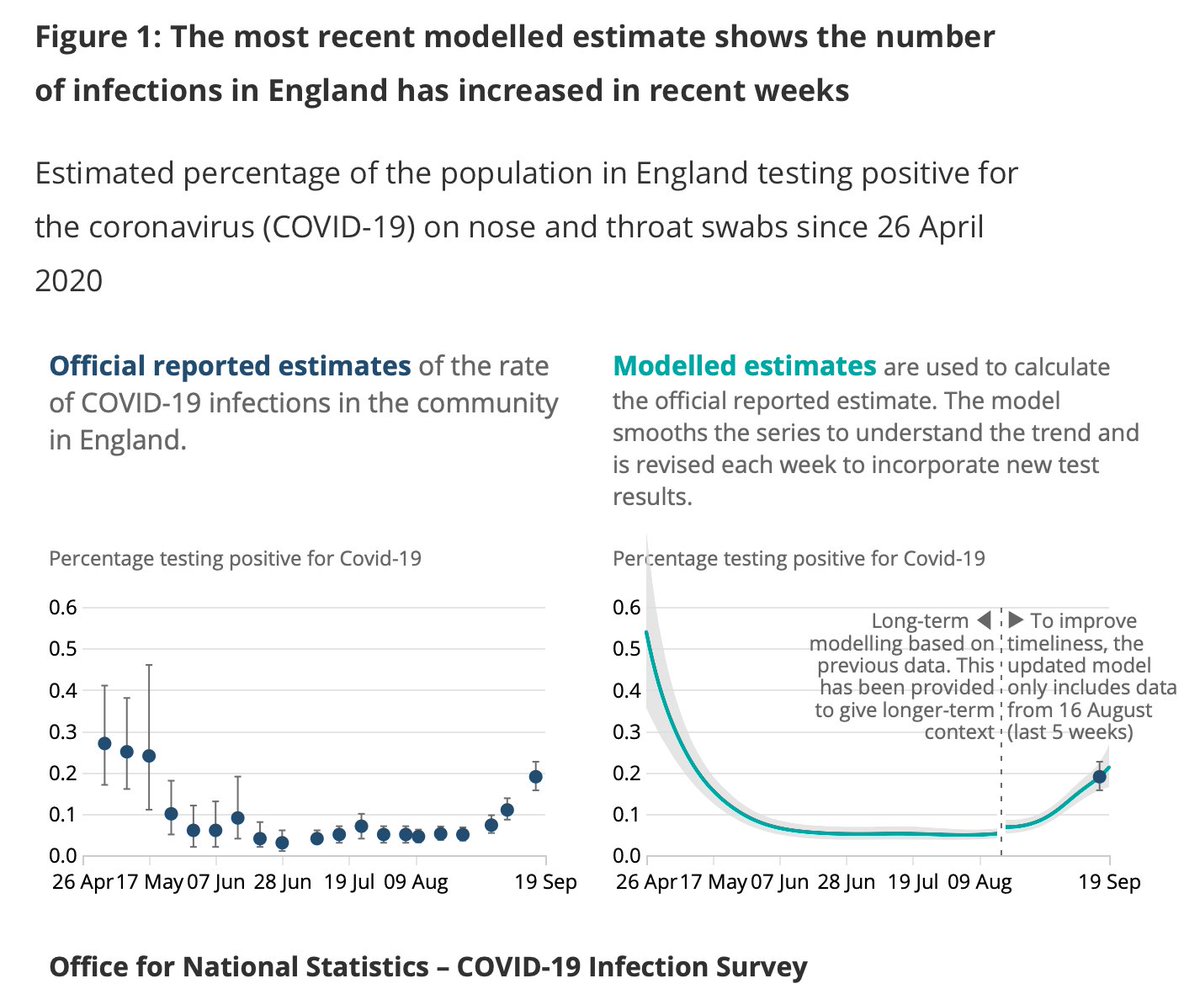

The best measure of #COVID19 prevalence in England is prob the @ONS infection survey but again: it started after the peak. And right now what we REALLY need to gauge is not post peak but the run up to the peak

The great unknown (and there are theories abt this but not much data) is whether the bit BEFORE the data we have on cases/positivity looked anything like what we are going through NOW. To me - someone watching this purely through a data prism - this seems really, really important

Now, eventually we will know because the early data on deaths are far more reliable (for all their faults) than the case data. The problem is by the time we notice we're on the same path it will almost certainly be too late. So we certainly shouldn't just focus on deaths.

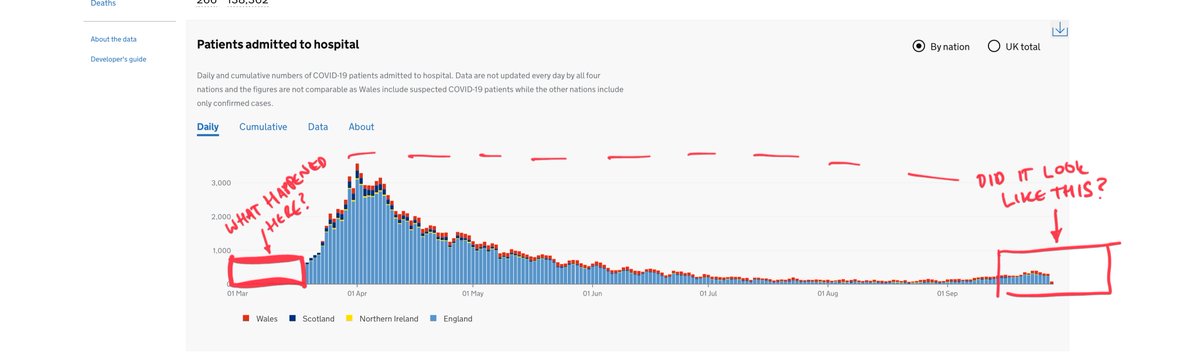

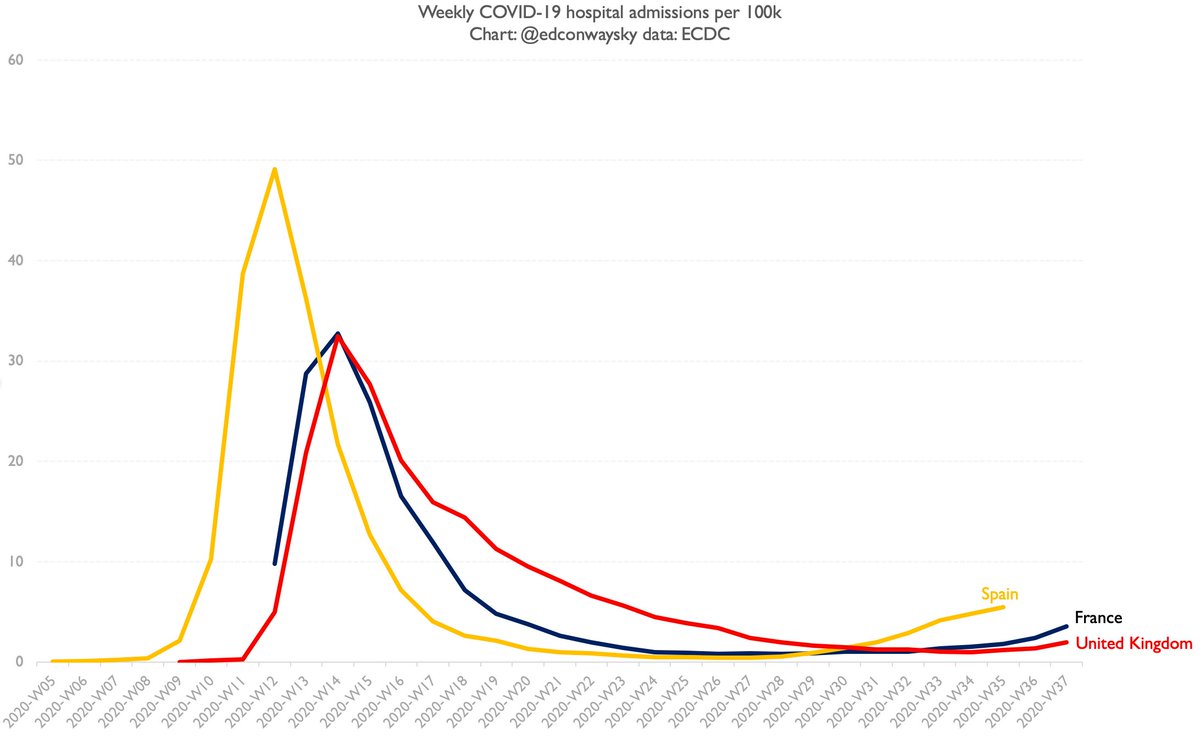

What about hospitalisations data? Again, a bit patchy since there's a big gap at that start which begs the same question again: what was happening in those early weeks? Is it similar to what we're going through now or v different?

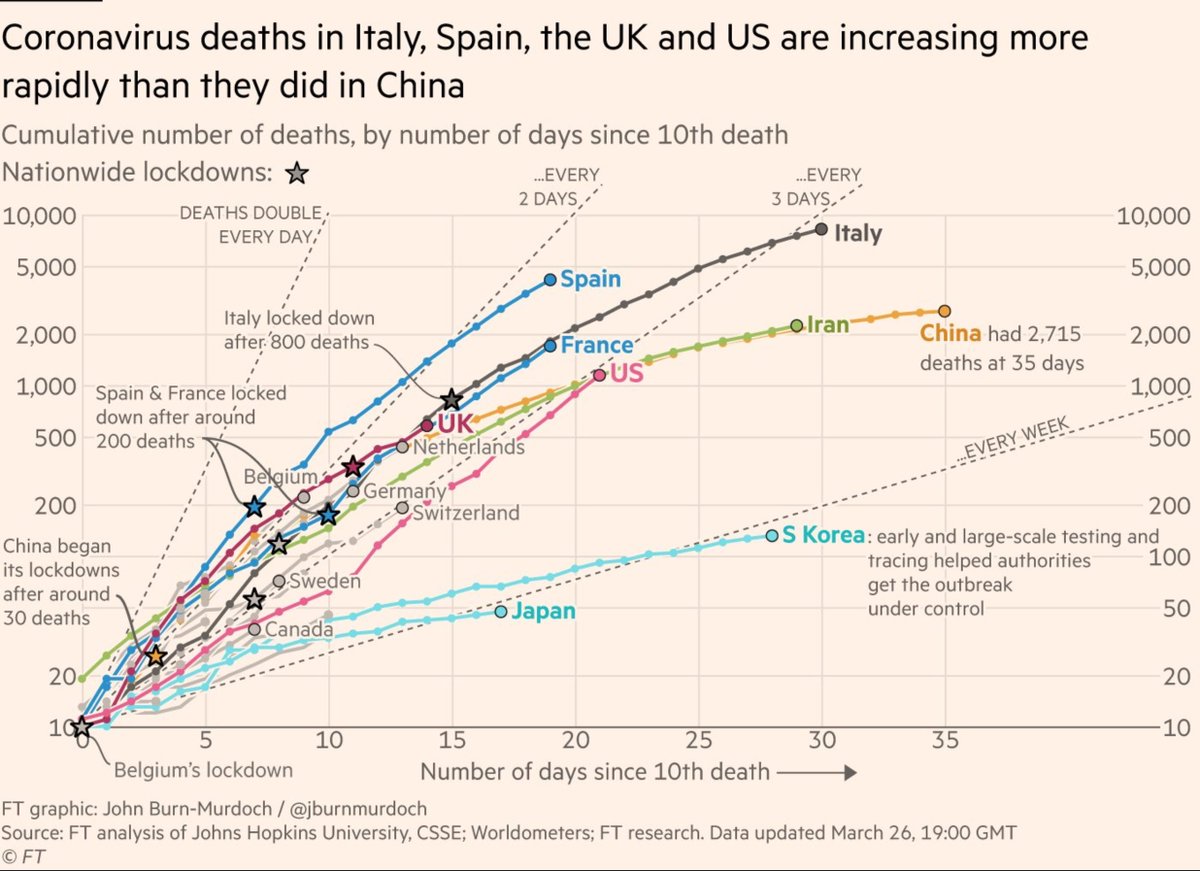

All of these unsettling gaps are why it's also worth looking not just at our own past but at our plausible future. This is why we focused so much on Spanish/Italian trajectories last time around. The disease seems to spread in the same way in most medium-sized countries.

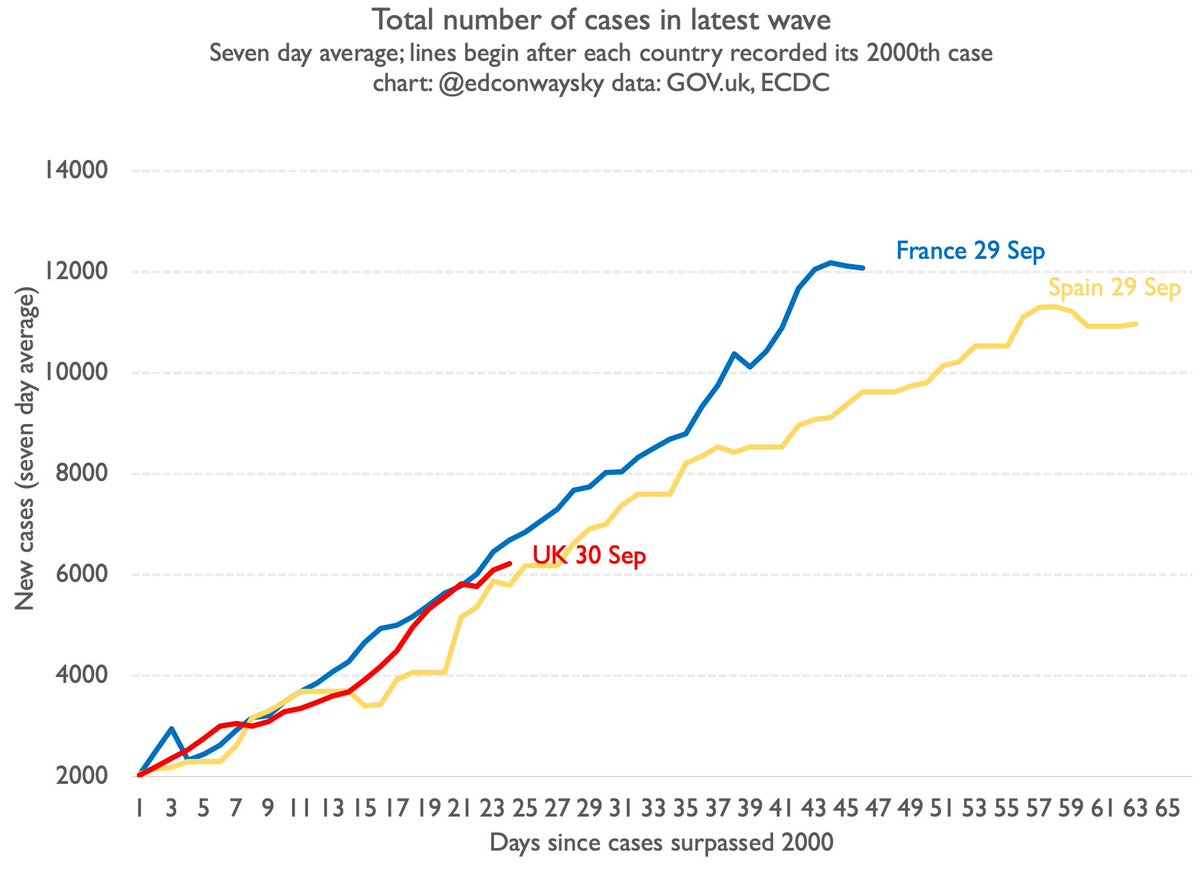

Sadly last time around the most reliable cross-country comparisons were of deaths because of those 👆data gaps. This time around the case data is better (not brilliant, but better), so we can compare our trajectory to other countries going through similar outbreaks.

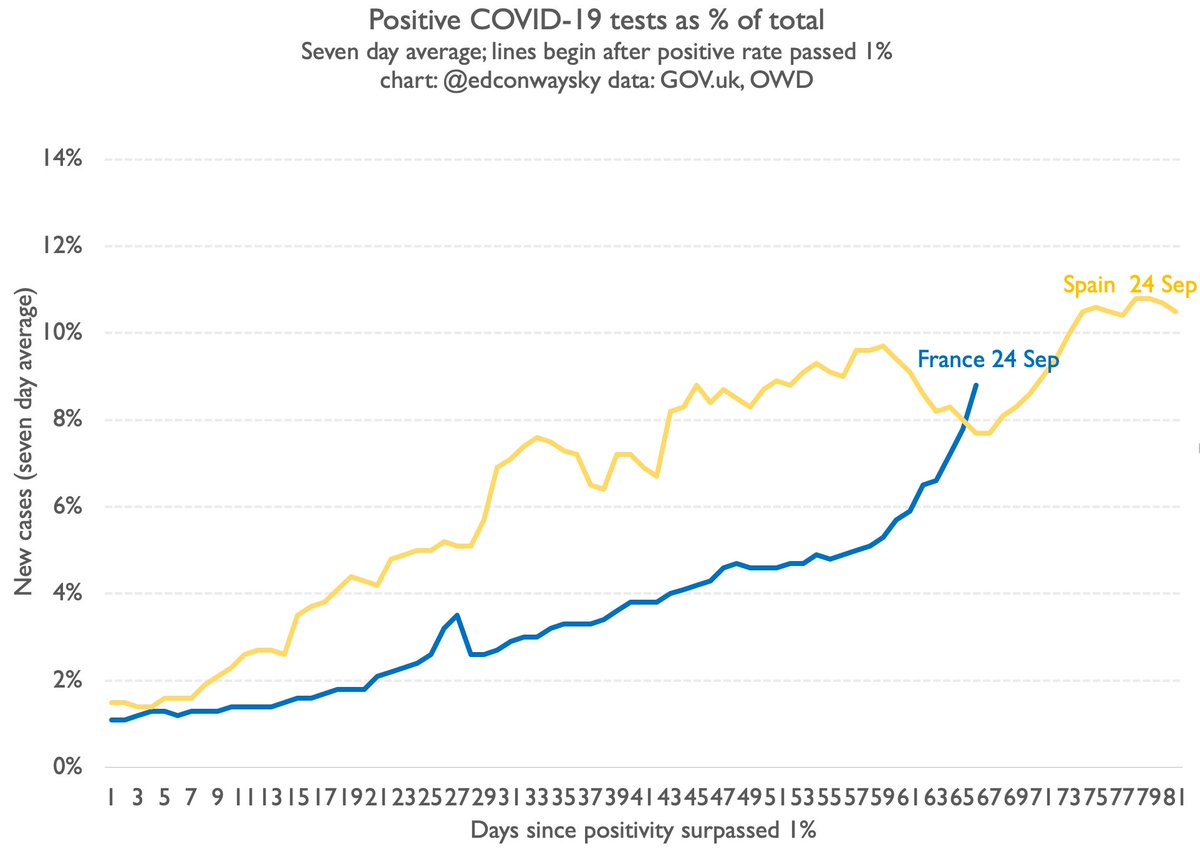

All of which is a long winded way of explaining why I keep updating this chart. And why I was a bit sceptical about @uksciencechief's chart last week suggesting the UK outbreak could go in a v different direction. From early on in this outbreak we've been following France/Spain

If this continues - and it's a big if, but it is what happened in the last outbreak and seems to be happening thus far this time too - we can potentially look at other data from France/Spain to try to fill in those gaps in the cases/hospitalisations charts above...

So far the paths they're following in France/Spain look different to spring. Look at hospitalisations. Crucially, these data should be more reliable at depicting those intense spring months than case data. And the increase in recent weeks is more gradual than Feb/March

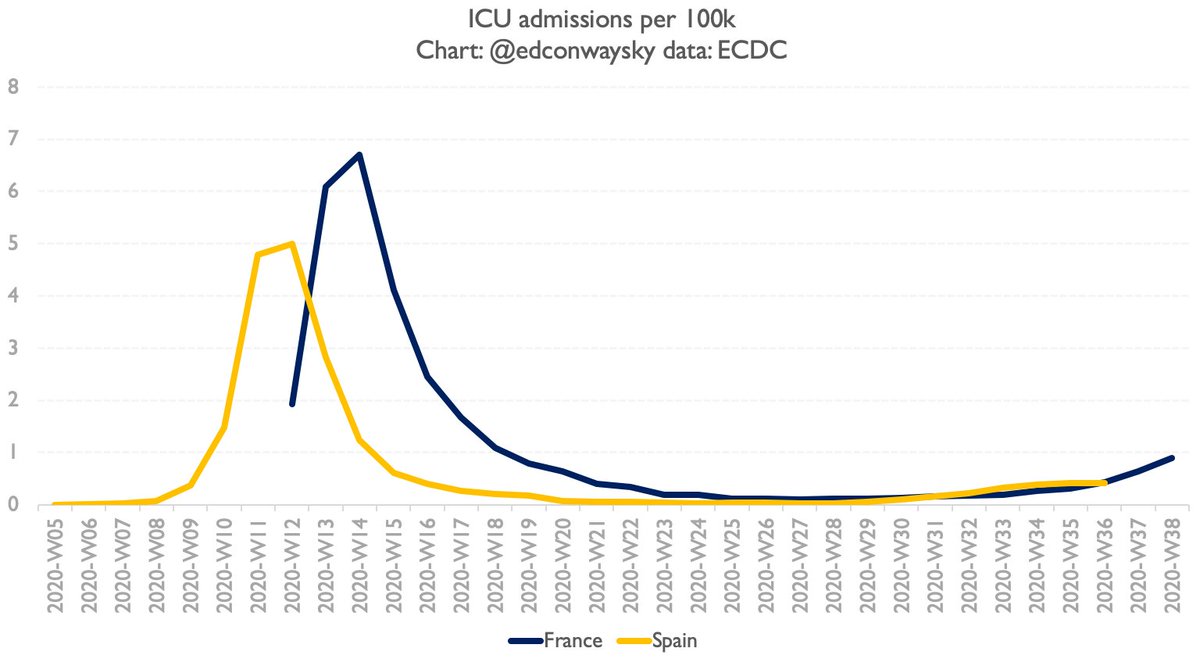

Here's ICU admissions. Similar picture. Now I don't think these charts alone fill in the gaps we have in that early data yet. But in a few weeks they might have. If they start to spike then it looks probable UK will too. If they don't then UK may not.

Early signs are broadly promising: the 7day average daily new cases in France and Spain is no longer rising and has actually fallen a bit in the past day or two. In Spain the % of positive tests also seems to have peaked. Then again it's still rising fast in France

It's too early to be certain this is not a repeat of the first wave. But much of the data thus far seems to be consistent with that. Why? Restrictions? Mask wearing? Better treatments? Better shielding? Or way too early to say? My vote is def for the latter...

Most striking thing from today's press conference? @CMO_England admitting the govt underestimated the doubling time of #COVID19 in the first wave. It's true. And I'd argue it was in part because they paid too little attention to what was happening in Italy/Spain/France.

The next question is whether the response to having messed up last time is to swing entirely in the other direction (assume cases are heading through the roof) or to pay more attention to European epidemiology. I'd argue the latter - as I lay out in the thread above. 👆

• • •

Missing some Tweet in this thread? You can try to

force a refresh