The House Judiciary Committee is holding a hearing right now on proposals to change the antitrust laws.

Critics of the current laws want to make it easier to break up Big Tech.

Re-sharing my thread about the 10 myths related to tech & antitrust that you need to know.

Critics of the current laws want to make it easier to break up Big Tech.

Re-sharing my thread about the 10 myths related to tech & antitrust that you need to know.

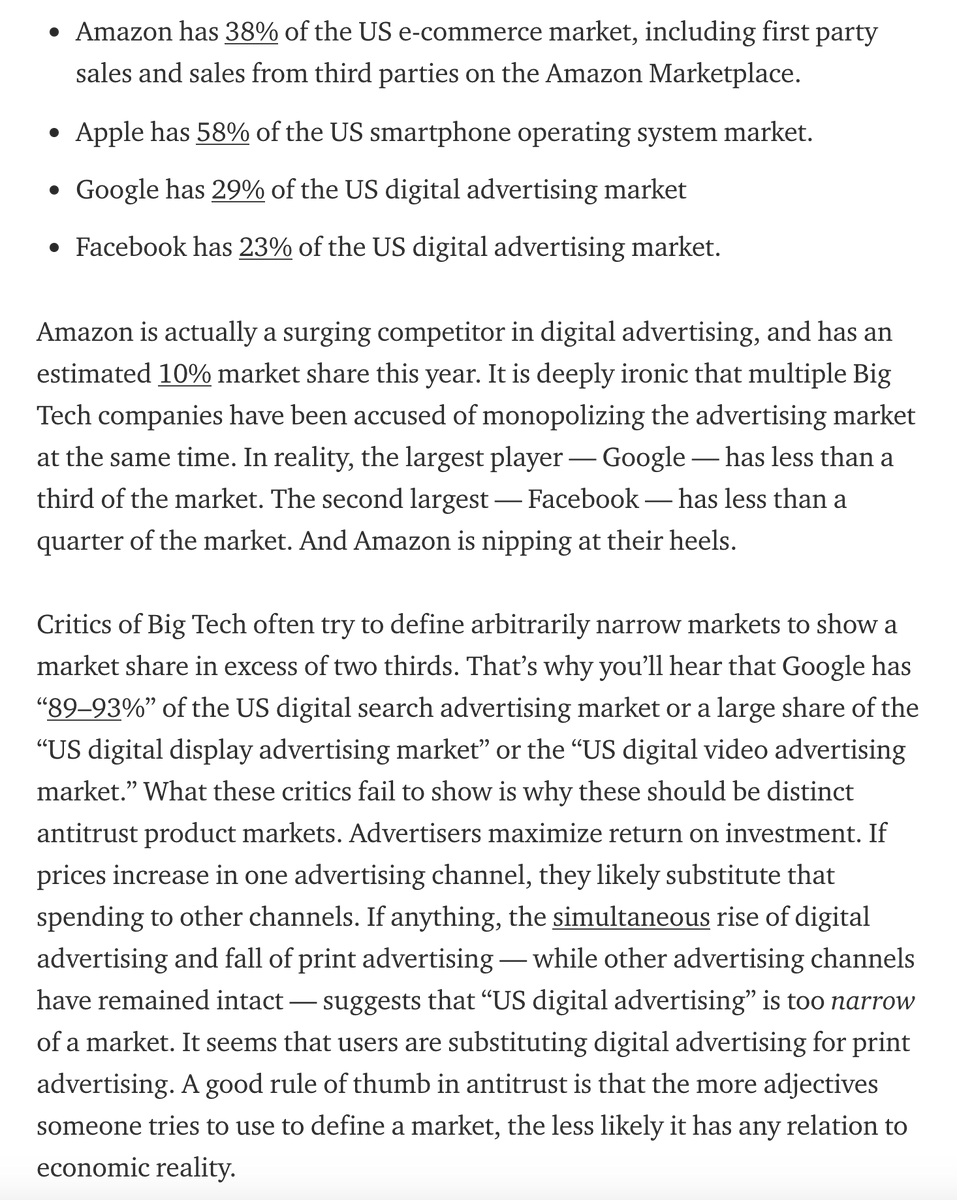

Myth #1: “Big Tech companies are monopolies”

People use this term loosely (which I get!) to mean that a company is big or dominant, but when it comes to an actual monopolization case, the legal meaning of the word really matters.

People use this term loosely (which I get!) to mean that a company is big or dominant, but when it comes to an actual monopolization case, the legal meaning of the word really matters.

According to DOJ guidelines, it’s “a market share in excess of two-thirds.”

The tech companies likely don’t exceed that threshold in any antitrust product market.

- Amazon 38% of ecommerce

- Apple 58% of US smartphone OS

- Google 29% of digital ads

- Facebook 23% of digital ads

The tech companies likely don’t exceed that threshold in any antitrust product market.

- Amazon 38% of ecommerce

- Apple 58% of US smartphone OS

- Google 29% of digital ads

- Facebook 23% of digital ads

Myth #2: “Big Tech harms consumers”

According to DOJ, an antitrust enforcer must show “harm society by making output lower, prices higher, and innovation less than would be the case in a competitive market.”

But prices in the relevant markets have been falling (or at zero).

According to DOJ, an antitrust enforcer must show “harm society by making output lower, prices higher, and innovation less than would be the case in a competitive market.”

But prices in the relevant markets have been falling (or at zero).

Myth #3: “Big Tech doesn’t innovate”

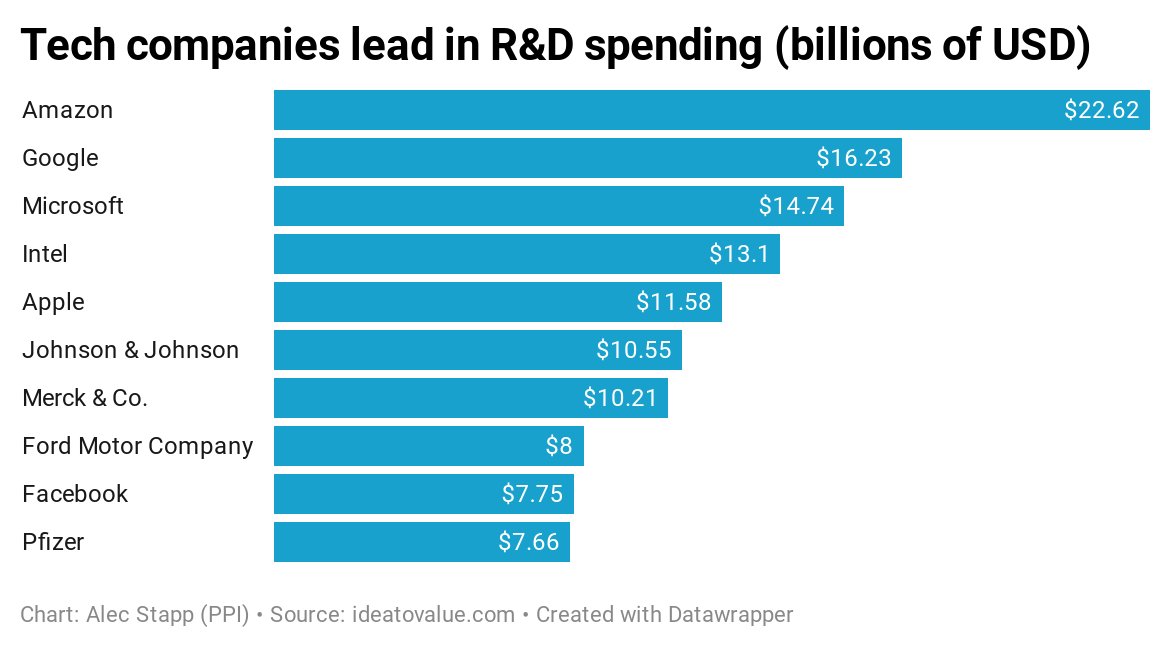

Innovation is hard to measure directly, but we can look at R&D spending as a proxy.

The Big Tech companies are all in the top 10 for most spending on R&D in the US.

Innovation is hard to measure directly, but we can look at R&D spending as a proxy.

The Big Tech companies are all in the top 10 for most spending on R&D in the US.

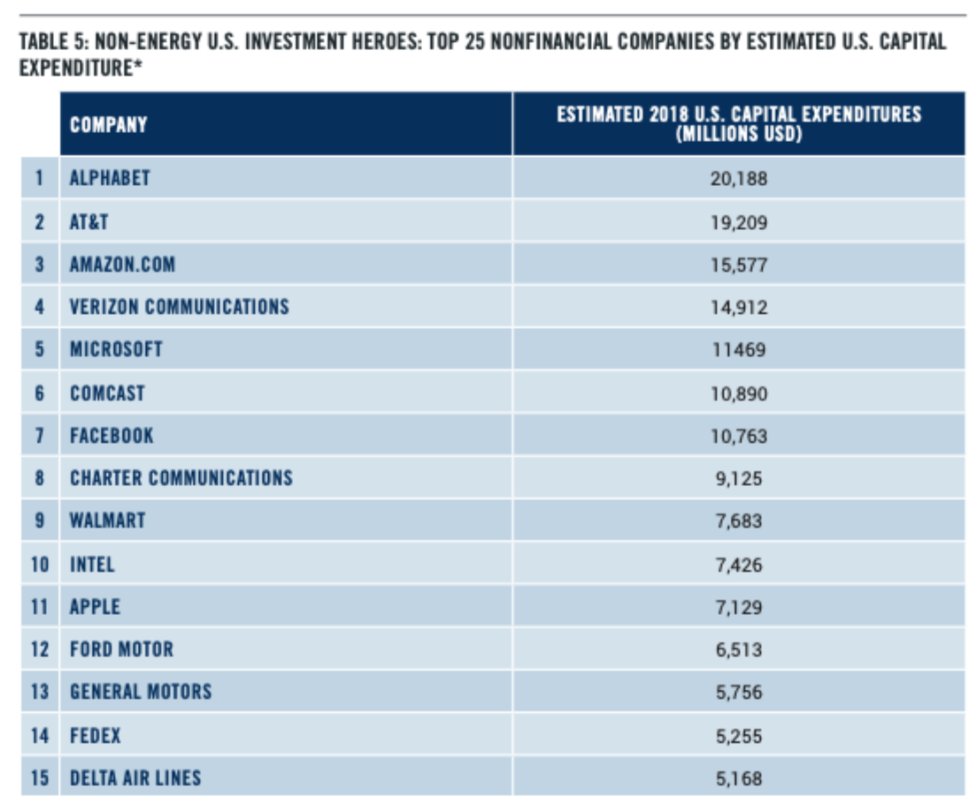

We can also look at capital expenditures. Complacent monopolists would rather distribute profits to shareholders than make risky investments. Large capital expenditures suggest the companies are worried about competition.

Big Tech also leads the country in capex.

Big Tech also leads the country in capex.

Myth #4: “Network effects make Big Tech unbeatable”

Network effects mean a service gets more valuable to users the more other users join it. Some people think this is special to tech, but it isn’t (a telephone is only valuable insofar as there are other people who own phones.)

Network effects mean a service gets more valuable to users the more other users join it. Some people think this is special to tech, but it isn’t (a telephone is only valuable insofar as there are other people who own phones.)

Three important points:

1. Network effects are nothing new.

2. Network effects can confer market power, but also consumer benefits from positive spillovers. Breaking up networks destroys both.

3. Network effects work in reverse too (dominant networks can quickly unravel).

1. Network effects are nothing new.

2. Network effects can confer market power, but also consumer benefits from positive spillovers. Breaking up networks destroys both.

3. Network effects work in reverse too (dominant networks can quickly unravel).

Myth #5: “Big Tech is killing the startup ecosystem”

Critics say Big Tech smothers startups.

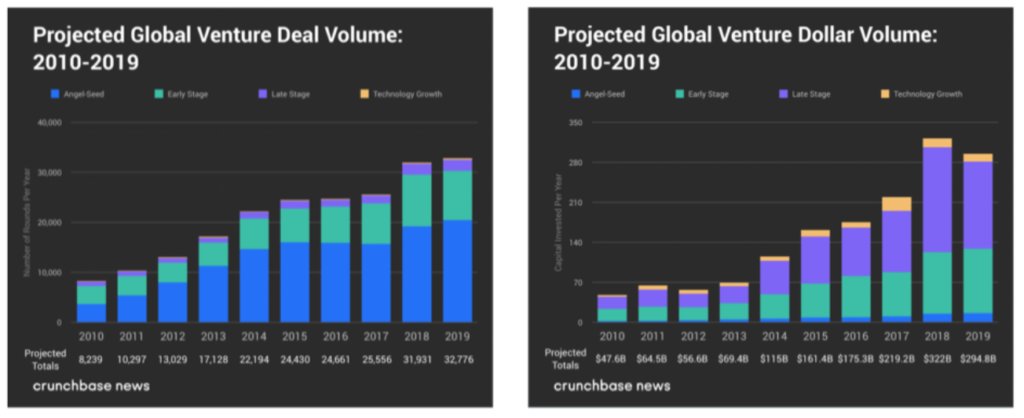

But VC investment is at all-time highs in terms of number of deals. It’s near all-time highs in terms of dollars invested.

Critics say Big Tech smothers startups.

But VC investment is at all-time highs in terms of number of deals. It’s near all-time highs in terms of dollars invested.

Also, even if VCs are hesitant to fund a direct competitor, competition has a funny way of evolving over time. Check out this story from @WillRinehart about Google’s founding:

Myth #6: “Big Tech companies only compete in one market”

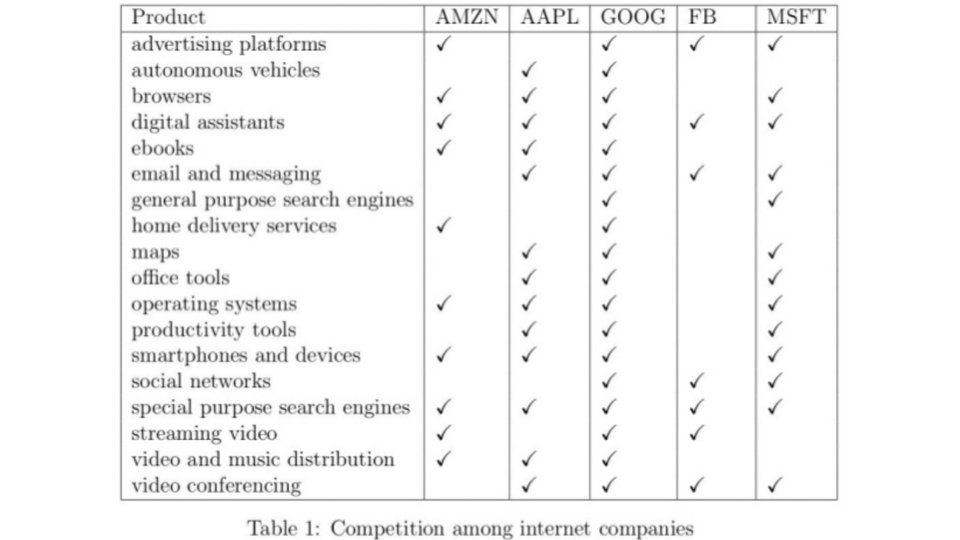

An underrated source of competition for the tech giants is each other. While each of the Big Five has its core area of strength, they are constantly making incursions on each other’s territory and jockeying for position.

An underrated source of competition for the tech giants is each other. While each of the Big Five has its core area of strength, they are constantly making incursions on each other’s territory and jockeying for position.

Myth #7: “Data is a significant barrier to entry to competing with Big Tech”

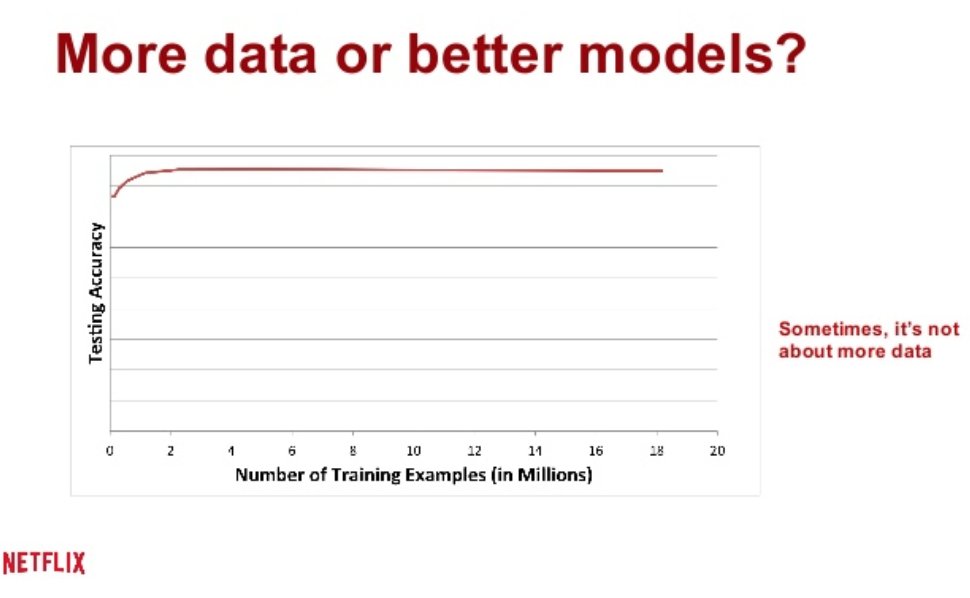

Training data for ML algorithms has rapidly diminishing returns.

Once you clear a certain threshold, the key differentiator is the quality of the model. You need to hire top-level ML engineers for that

Training data for ML algorithms has rapidly diminishing returns.

Once you clear a certain threshold, the key differentiator is the quality of the model. You need to hire top-level ML engineers for that

Myth #8: “Stock market concentration is at an all-time high due to Big Tech”

The NYT and FT are pushing this narrative (as you can see in the chart on the left).

But the top 5 largest companies in the S&P 500 regularly accounted for more than 20% of the index in the 60s and 70s

The NYT and FT are pushing this narrative (as you can see in the chart on the left).

But the top 5 largest companies in the S&P 500 regularly accounted for more than 20% of the index in the 60s and 70s

Myth #9: “The American public hates Big Tech (‘techlash’)”

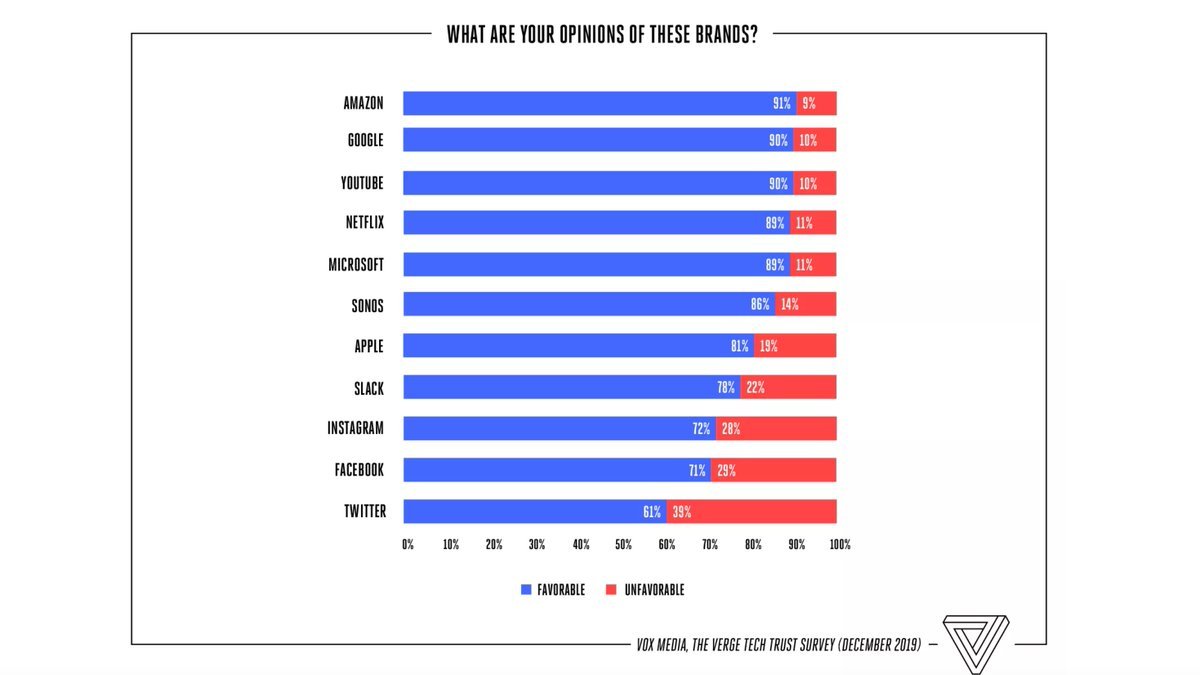

Survey after survey contradicts this narrative, but it somehow manages to persist.

Yes, some politicians in DC hate Big Tech. So do the far left and the far right.

But the vast majority of Americans really like tech.

Survey after survey contradicts this narrative, but it somehow manages to persist.

Yes, some politicians in DC hate Big Tech. So do the far left and the far right.

But the vast majority of Americans really like tech.

Myth #10: “It was obvious that some Big Tech acquisitions were anticompetitive”

This one is pure hindsight bias. To take one example, critics who don’t like Facebook claim that the Instagram merger was anticompetitive and should have been blocked.

This one is pure hindsight bias. To take one example, critics who don’t like Facebook claim that the Instagram merger was anticompetitive and should have been blocked.

Instagram has more than a billion users now and is Facebook’s most valuable.

But when IG was acquired in 2012, it only had 30 million users and no revenue.

Jon Stewart joked, “A billion dollars of money? For a thing that kind of ruins your pictures?"

But when IG was acquired in 2012, it only had 30 million users and no revenue.

Jon Stewart joked, “A billion dollars of money? For a thing that kind of ruins your pictures?"

More detail in my full piece: medium.com/@progressivepo…

• • •

Missing some Tweet in this thread? You can try to

force a refresh