Belatedly catching up with Test & Trace data from yday. Good news is on most metrics the performance of Pillar 2 tests (the private bit of the testing network) have improved from the previous week.

⬇️Time taken to get a test result

⬇️Distance travelled to get a test

⬇️Time taken to get a test result

⬇️Distance travelled to get a test

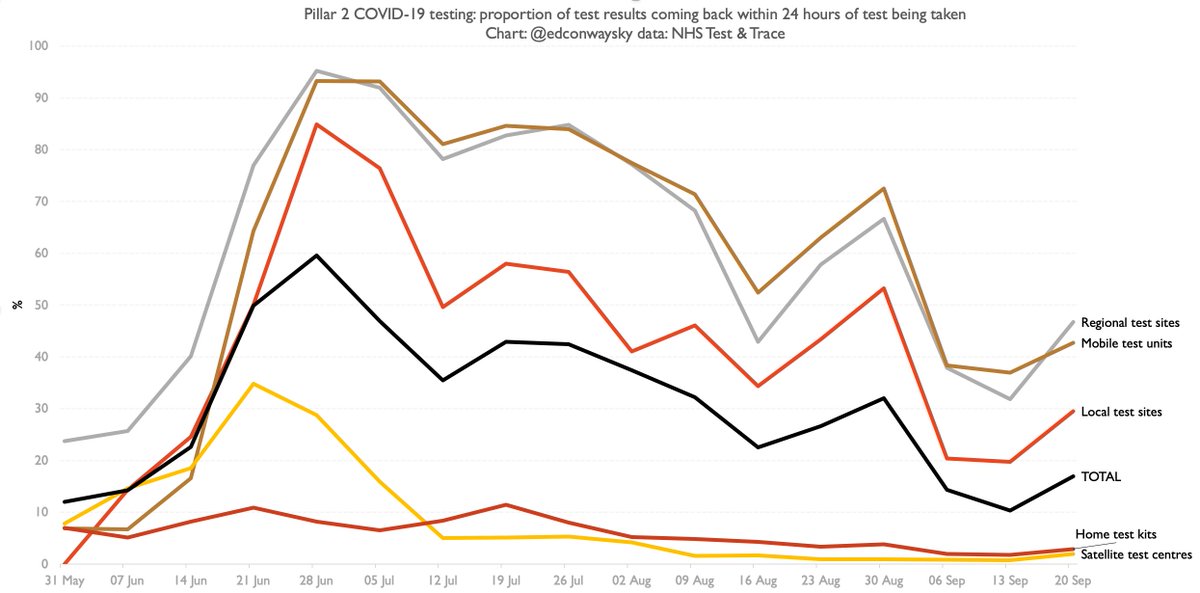

That said, across the whole of pillar 2 in England the percentage of people getting test results within 24 hours of taking a test is still just 17% as of 17-23 Sep (eg last week). That's still a lot lower than earlier this summer as you can see from this chart:

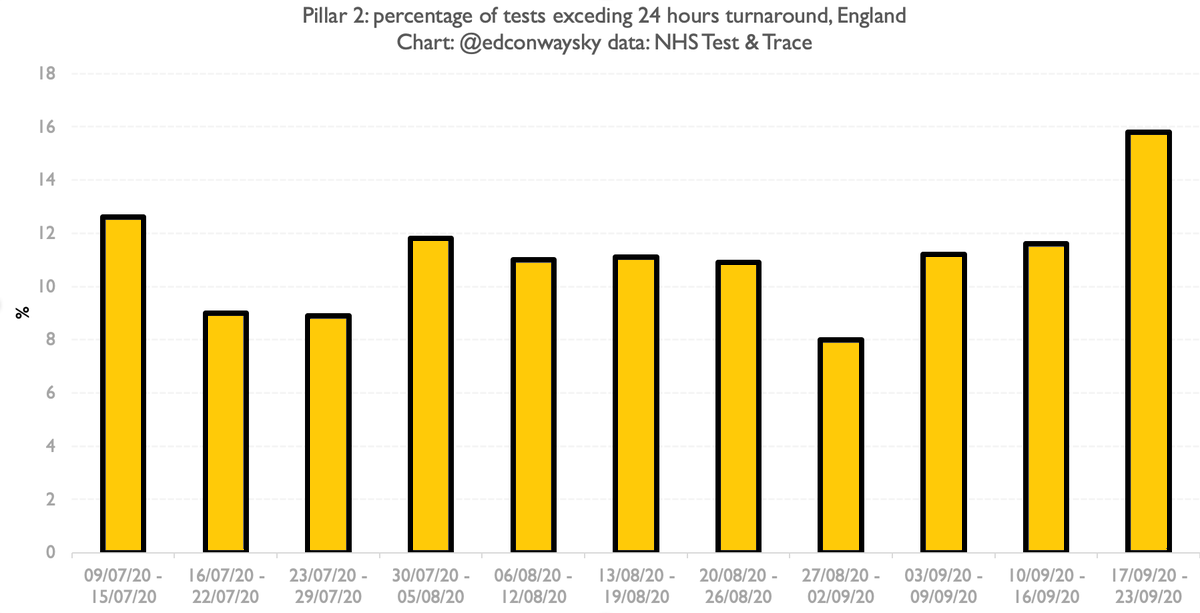

Actually when it comes to test turnaround the one area where test processing/delivery seems to be slowing down is pillar 1, which is primarily hospital labs - the bit of the system that had held up best thus far

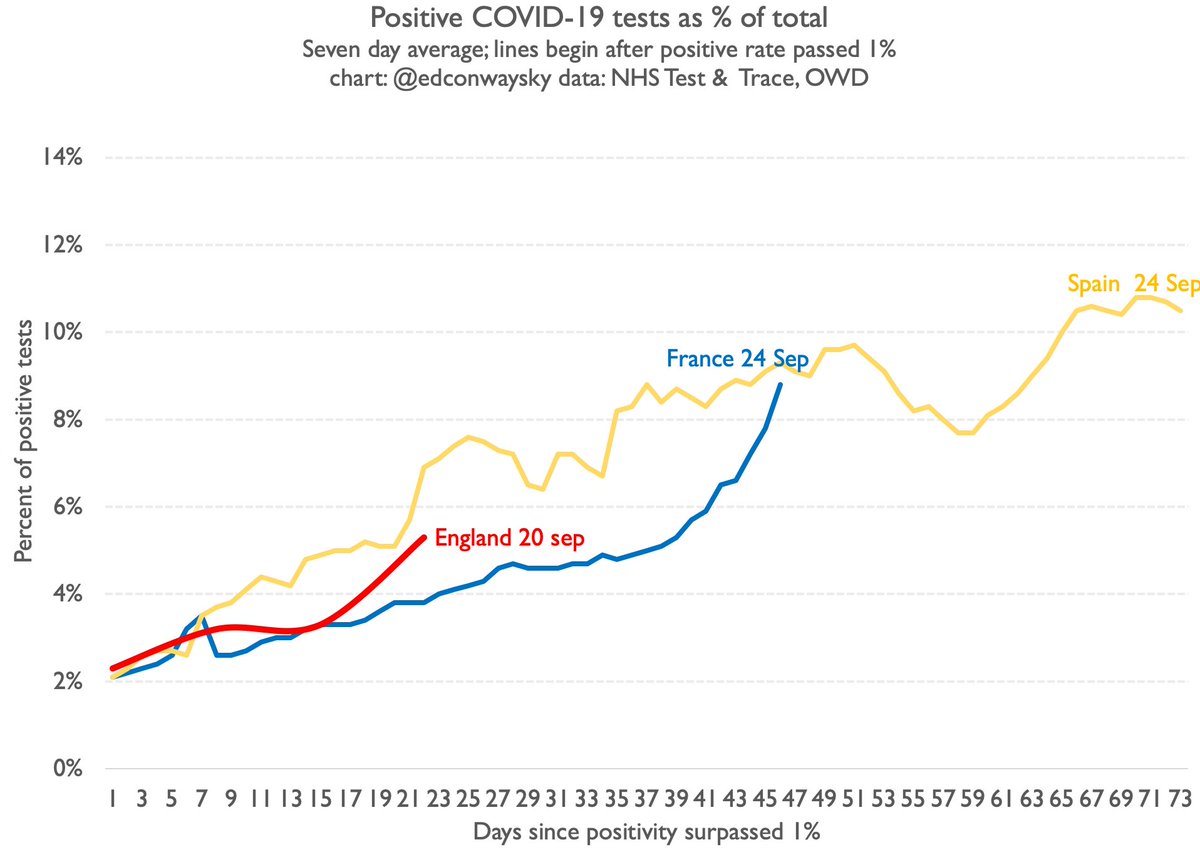

The Test & Trace stats also provide us with a more reliable measure of the percentage of positive #COVID19 tests. A useful sense check of the case data we get each day. Consistent with UK continuing to follow French/Spanish trajectory. Let's also see what @ONS data says shortly

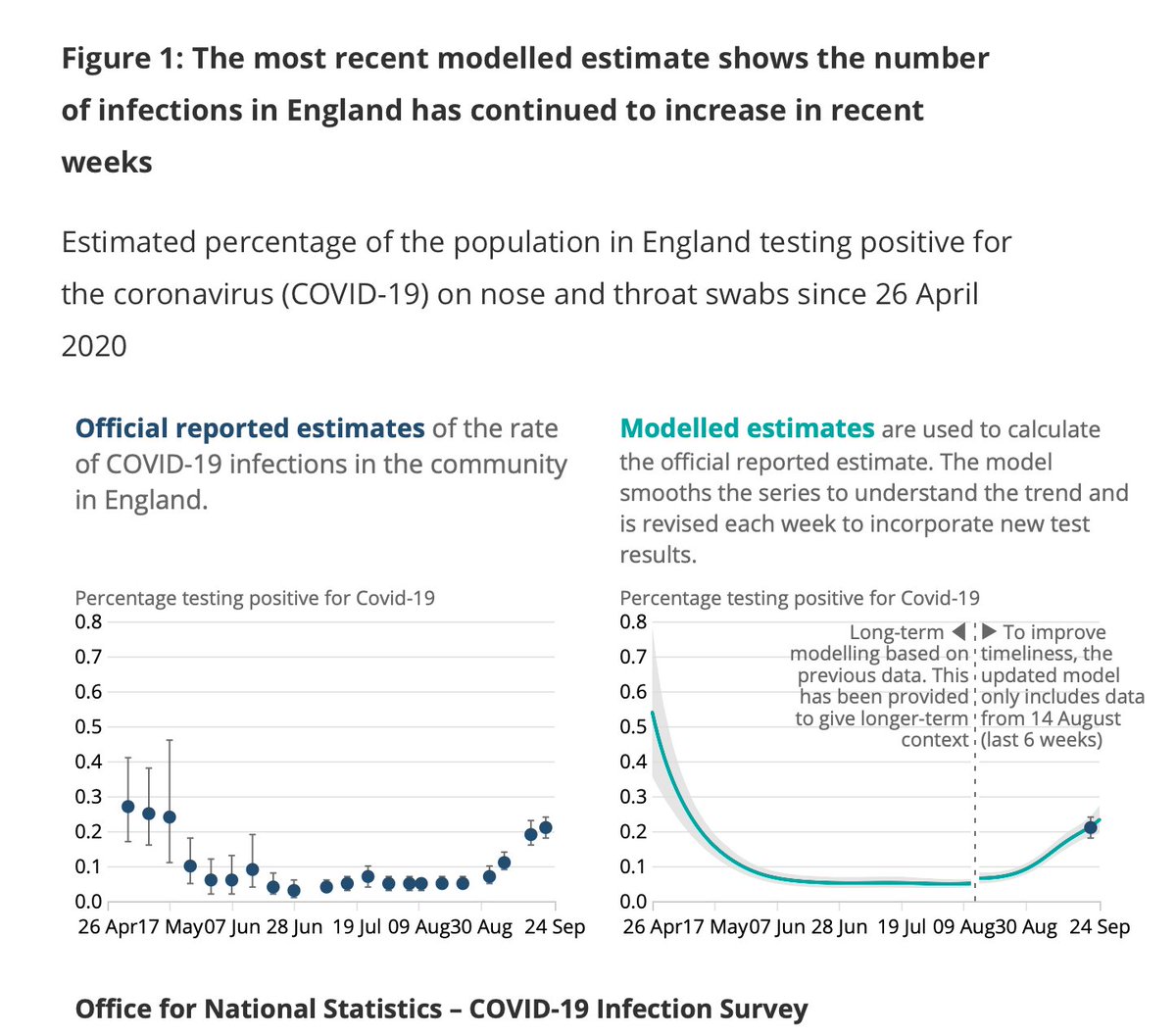

Breaking: @ONS survey of #COVID19 infections in England has been released.

This is the best measure we have of the prevalence of the disease.

And the good news is it seems the growth rate has slowed since last week.

Ties in with what we're seeing elsewhere in the case numbers

This is the best measure we have of the prevalence of the disease.

And the good news is it seems the growth rate has slowed since last week.

Ties in with what we're seeing elsewhere in the case numbers

Important to provisos about the @ONS survey.

It's based on modelling; it can change a lot from week to week.

Even so, the picture painted by today's survey is tentatively reassuring.

The disease is still spreading.

But the rate at which cases are multiplying seems to be slowing

It's based on modelling; it can change a lot from week to week.

Even so, the picture painted by today's survey is tentatively reassuring.

The disease is still spreading.

But the rate at which cases are multiplying seems to be slowing

Poss the most reassuring #COVID19 chart in months.

This is @ONS’s measure of daily new #COVID19 cases in England - the best measure of its spread, unaffected by testing shortages.

Look: it’s still spreading but the growth rate has flattened.

Early days, but this is promising…

This is @ONS’s measure of daily new #COVID19 cases in England - the best measure of its spread, unaffected by testing shortages.

Look: it’s still spreading but the growth rate has flattened.

Early days, but this is promising…

Few reasons to remain cautious despite slowing in @ONS new cases rate:

1. Data can be choppy from week to week

2. #COVID19 still growing; NB we’re talking about the RATE of growth.

3. On basis of what we’re seeing in France/Spain actually getting new cases to FALL takes time…

1. Data can be choppy from week to week

2. #COVID19 still growing; NB we’re talking about the RATE of growth.

3. On basis of what we’re seeing in France/Spain actually getting new cases to FALL takes time…

Finally, it’s clear from the @ONS survey as well as plenty of other sources (eg @PHE_uk data today) that there are hotspots of the disease where, unlike the national picture, it is still spreading.

This is a dangerous disease.

No cause for complacency.

Keep focusing on the data.

This is a dangerous disease.

No cause for complacency.

Keep focusing on the data.

Update: 6,968 new #COVID19 cases in UK in past 24 hours, acc to Gov.uk dashboard.

UK case trajectory remains in line with France/Spain.

Rising - but at a slower rate than previous weeks.

Doubling time for cases currently about 30 days on basis of past week

UK case trajectory remains in line with France/Spain.

Rising - but at a slower rate than previous weeks.

Doubling time for cases currently about 30 days on basis of past week

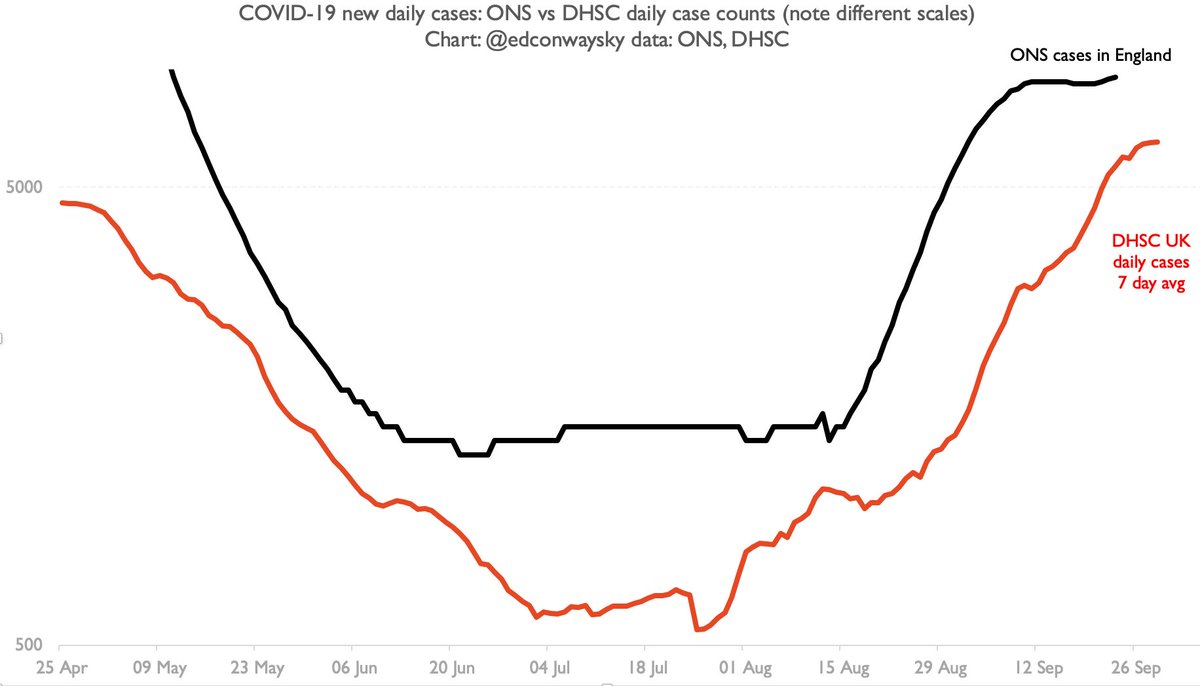

Some people have asked me whether the daily #COVID19 case figs are reliable. Aren’t they distorted by test availability? Here’s one way of gauging that - comparing them (the red line) to the v reliable @ONS survey (black). Key thing is shape - if it’s similar that’s a good sign.

Key thing in this chart is not the difference in levels but the relative similarity in steepness of the recent rise.

The growth in cases we’ve been hearing abt each day isn’t that different from the @ONS one.

Yes that’s a log scale.

Yes it’s England vs UK.

This is a sense check.

The growth in cases we’ve been hearing abt each day isn’t that different from the @ONS one.

Yes that’s a log scale.

Yes it’s England vs UK.

This is a sense check.

• • •

Missing some Tweet in this thread? You can try to

force a refresh