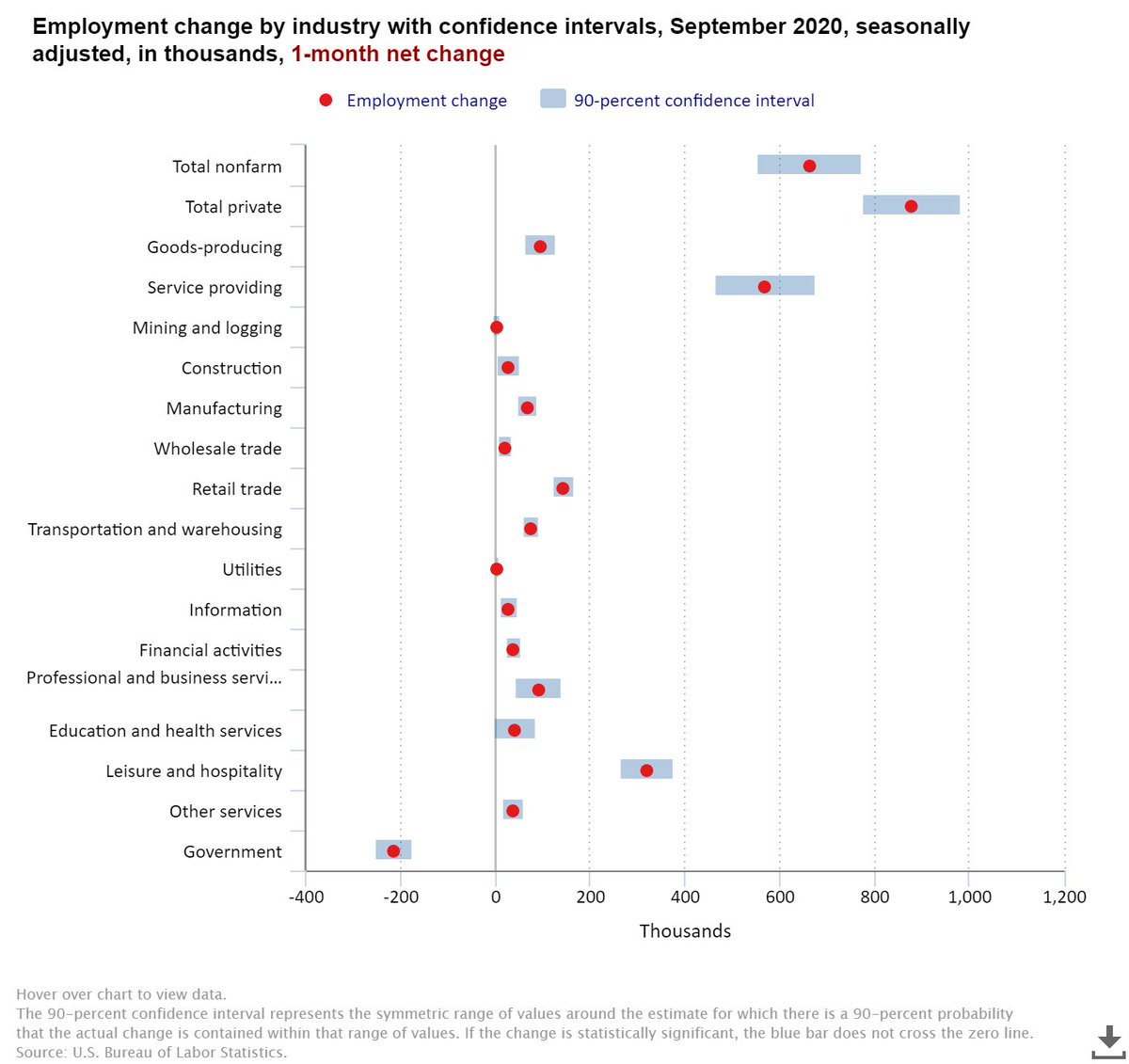

Payrolls rose +661k in September and unemployment fell half a point to 7.9%.

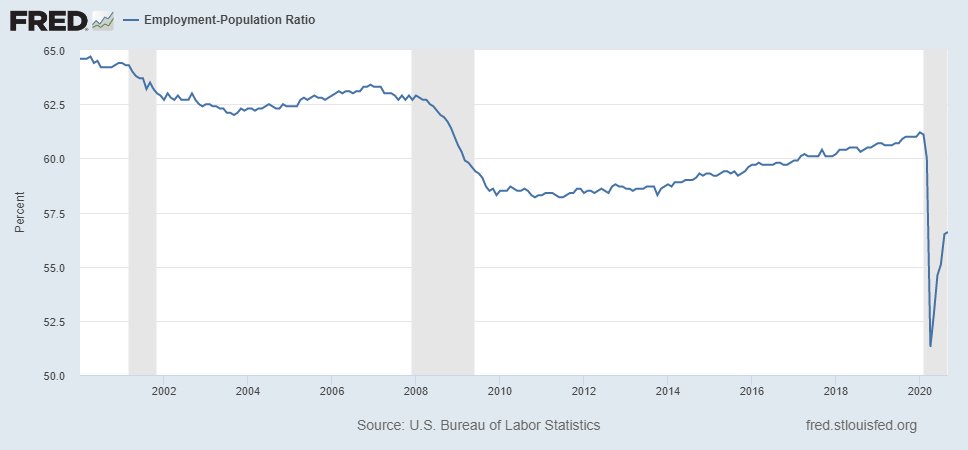

We are still 11 million jobs below the February level -- a larger gap than at the low point of the financial crisis.

The economy is a deep hole, and the rate at which we're digging out is slowing.

We are still 11 million jobs below the February level -- a larger gap than at the low point of the financial crisis.

The economy is a deep hole, and the rate at which we're digging out is slowing.

While unemployment fell sharply (down by -970k), it's mainly because participation plunged, and the labor force fell by -695k.

The easy work of ending furloughs is slowing (temporary layoffs were down by 1.5 million), but the harder work of repairing the more lasting damage is only growing, and permanent layoffs were up by 345,000.

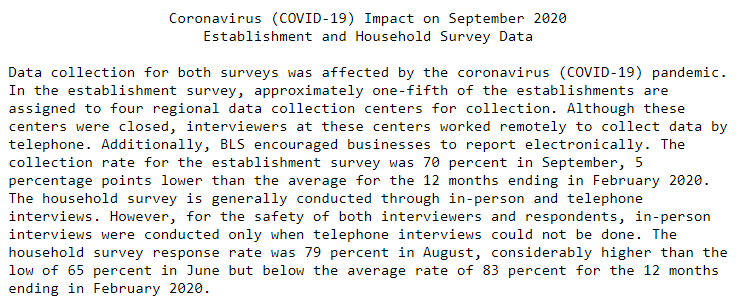

There are also deeper questions whether we really know what's going on in the labor market. The collection rate of the payrolls survey remains substantially below normal. What do you think is happening to the payrolls of those firms that aren't responding to the BLS?

Last few payrolls numbers:

June: +4.8 million

July: +1.8m

August: +1.5m

Sept: +0.7m

See the trend. We're still 10.7 million jobs below February's level. If the recovery slows any further (and there are indications it is), we're in this slump for a long time.

June: +4.8 million

July: +1.8m

August: +1.5m

Sept: +0.7m

See the trend. We're still 10.7 million jobs below February's level. If the recovery slows any further (and there are indications it is), we're in this slump for a long time.

The only real strength in this payrolls report was the leisure and hospitality industry, and retailers returning to work. Not much good news for the rest of the economy. And further progress in the service industry depends on... the virus.

Pretty clear that the single best indicator for the short-term health of the economy over coming months is... data on the virus. When the virus flares, the recovery stalls.

The share of the population with a job remains well below the levels seen even during the darkest days of the 2008 recession. We're in a deep hole, and digging out too slowly.

That was the last jobs report before the election.

We now have 3.9 million fewer jobs than we did in January 2017. Employment has never before fallen over a Presidential term.

Covid plays a major role here, but results in other countries suggest it didn't have to be this bad.

We now have 3.9 million fewer jobs than we did in January 2017. Employment has never before fallen over a Presidential term.

Covid plays a major role here, but results in other countries suggest it didn't have to be this bad.

In the midst of a childcare crisis and a service-sector led downturn, not surprising -- but still depressing -- to see women dropping out of the labor force.

https://twitter.com/nick_bunker/status/1312009454355972096

And remember: This is a downturn that's hurting low-wage workers the most.

https://twitter.com/nick_bunker/status/1312010208613408768

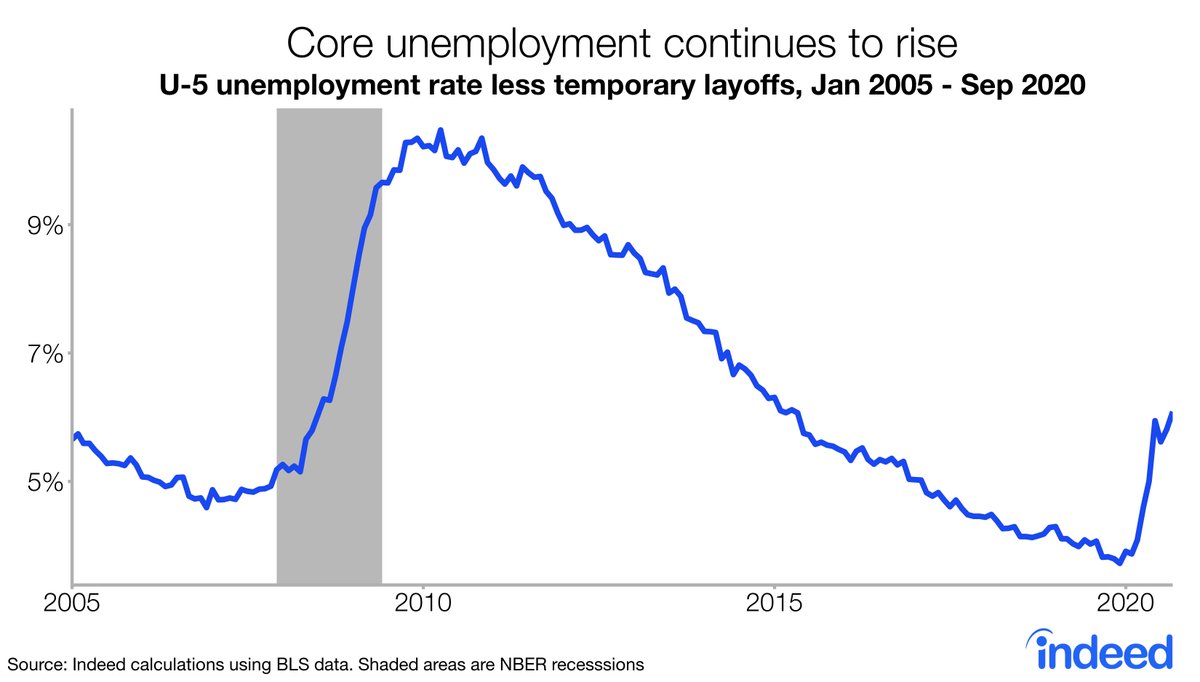

This graph (via @nick_bunker) is what really worries me. One way to look through the shutdown-related fluctuations is to put temporary layoffs to the side, and focus on the rest of the labor force. This measure suggests that labor market fundamentals are continuing to get worse.

Wise words from @jasonfurman on why the recovery is stalling:

https://twitter.com/jasonfurman/status/1312012084910026754

• • •

Missing some Tweet in this thread? You can try to

force a refresh