Professor @UMichEcon & @FordSchool | Senior Fellow @BrookingsInst | Intro Econ textbook author | Think Like an Economist pod | https://t.co/vvrskX2z0e

12 subscribers

How to get URL link on X (Twitter) App

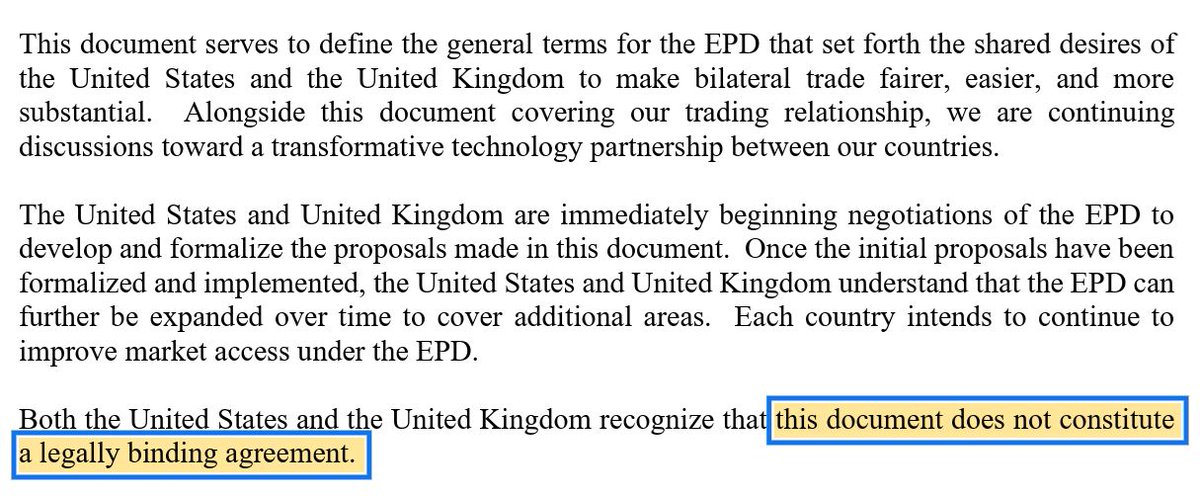

First, arithmetic.

First, arithmetic.

My favorite bit: The filename is:

My favorite bit: The filename is:

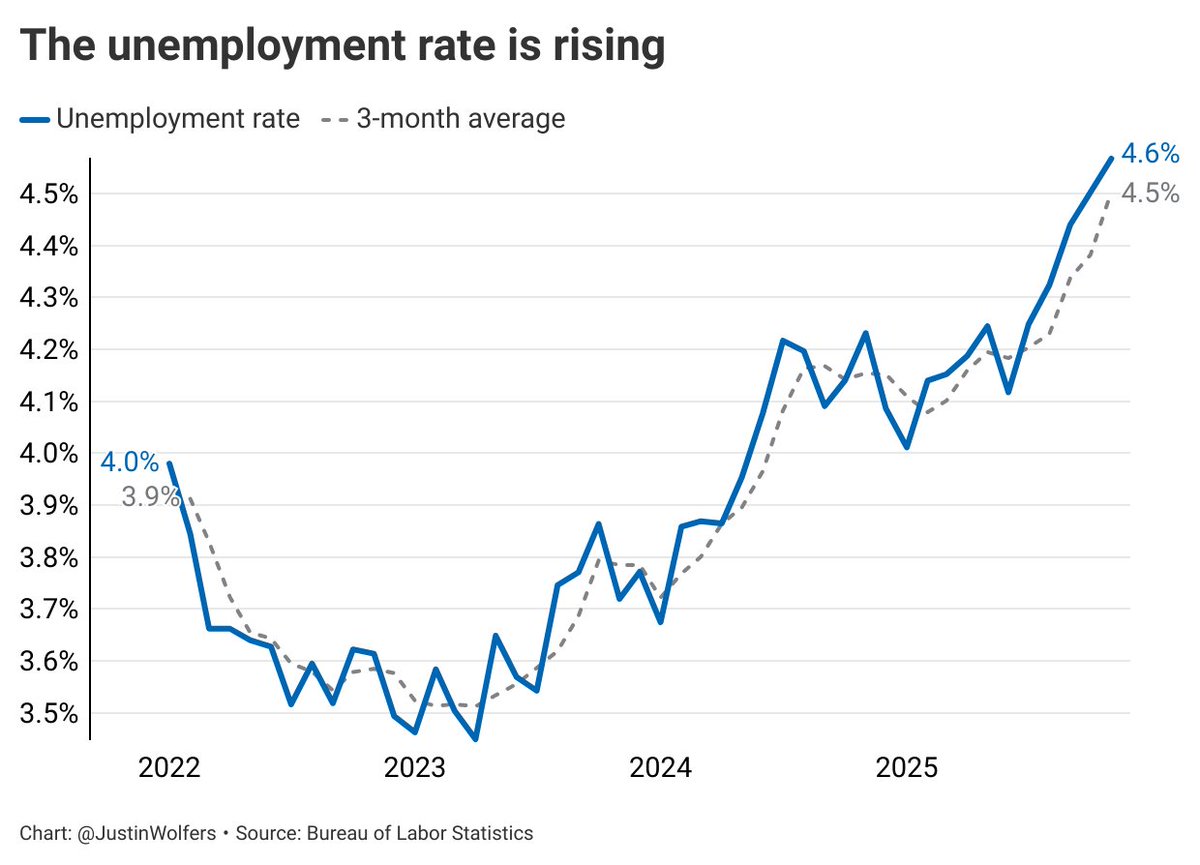

Look into the details, and the GDP report really isn't that bad. (We already know from the jobs data that the economy did okay in Q1.)

Look into the details, and the GDP report really isn't that bad. (We already know from the jobs data that the economy did okay in Q1.)

https://twitter.com/NateSilver538/status/1853322147919180265After all: Is there a principled difference between weighting on age (to ensure that your sample includes youngs and olds) and weighting on past vote (to ensure you get folks from across the political spectrum)?

Let's explore binomial distributions and the standard errors of weighted samples.

Let's explore binomial distributions and the standard errors of weighted samples.

Far fewer of Trump's policy proposals garnered majority support, and almost none were broadly popular (say, >75% support).

Far fewer of Trump's policy proposals garnered majority support, and almost none were broadly popular (say, >75% support).

https://twitter.com/JDVance/status/1844456663413293260

This decline in violent crime is evident in not just the FBI reports, but also an independent survey by the BJS.

This decline in violent crime is evident in not just the FBI reports, but also an independent survey by the BJS.

https://twitter.com/JDVance/status/1841338117506109762

The CBO study @JDVance cites analyzes how immigration improves the *federal* budget.

The CBO study @JDVance cites analyzes how immigration improves the *federal* budget.

https://twitter.com/JustinWolfers/status/1838712445524668818All crime data are problematic. The definition of crimes change over time, as does what people report, and which police depts provide data.

Taking a longer perspective: Violent crime has been declining for decades. After a brief pandemic spike (more on that in a moment), it's back to falling again.

Taking a longer perspective: Violent crime has been declining for decades. After a brief pandemic spike (more on that in a moment), it's back to falling again.

https://twitter.com/TrumpWarRoom/status/1837581418329002260

No yolk, bird flu can eggsplain the whole thing.

No yolk, bird flu can eggsplain the whole thing.

https://x.com/BlueStTrav/status/18245564123427678481. Harris's econ speech was about the economy. Trump's econ speech barely mentioned the economy. Indeed, he had to keep reminding himself that he was meant to talk econ. He was rambling, incoherent, and said almost nothing recognizable as econ.

https://x.com/Acyn/status/1823904506494812539

https://twitter.com/JStein_WaPo/status/1812918420423254480The proposed controls appear not to apply to new construction. And so they still allow the price signal to provide an incentive for new construction.