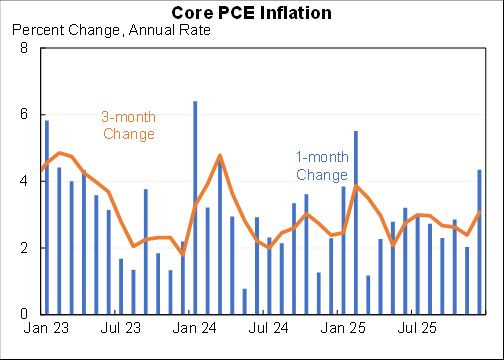

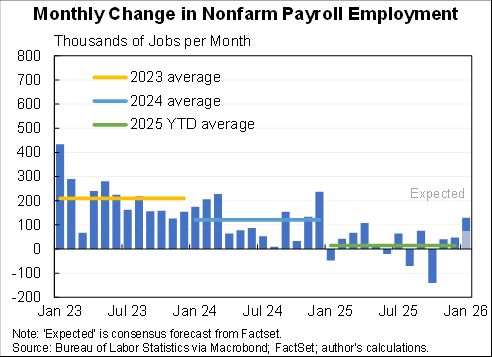

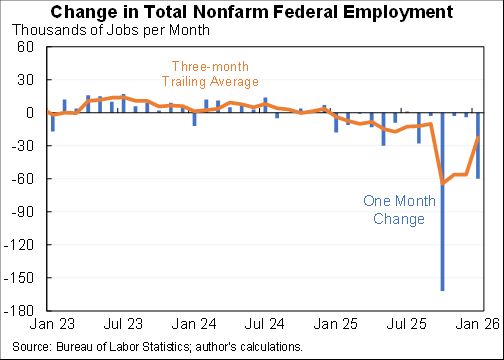

We have an economy with a positive first derivative and negative second derivative—everything is continuing to improve but it improving at a slower pace than before.

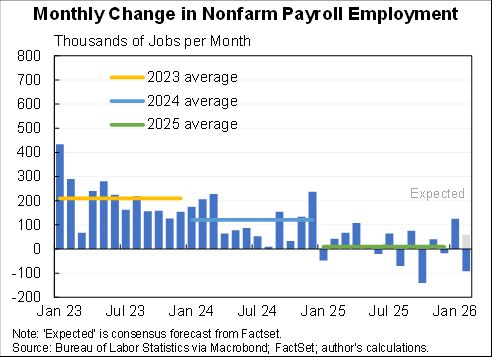

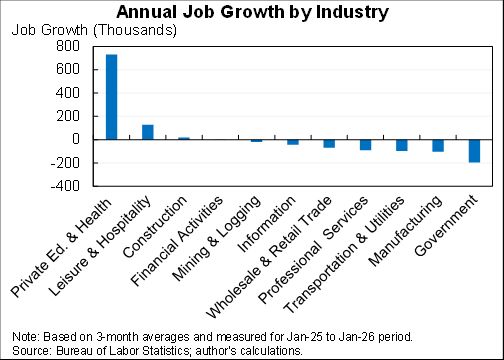

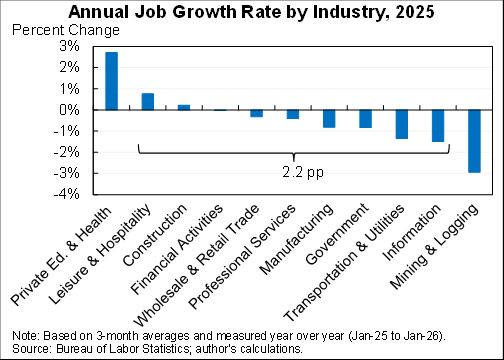

Normally 661,000 jobs would be something to celebrate. But when you’re 11 million jobs short of where you were in February the slowing pace of recovery is a worry.

Three reasons for it:

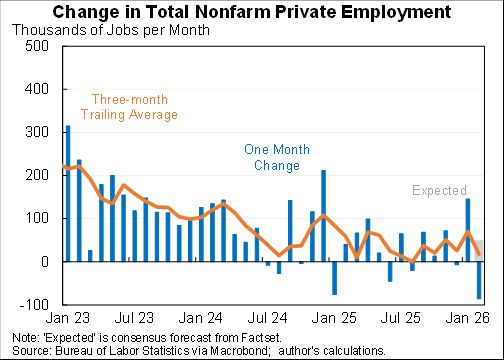

1. Easy recovery already happened. Has been people being called back from temporary layoff, permanent unemployment rising.

2. CARES Act expired.

3. Virus resurgence.

1. Easy recovery already happened. Has been people being called back from temporary layoff, permanent unemployment rising.

2. CARES Act expired.

3. Virus resurgence.

Notably in September there were 661,000 jobs added (payroll survey) while 1.5m reduction in temporary layoff (household survey). That is worrying because the fuel of labor market recovery is going away.

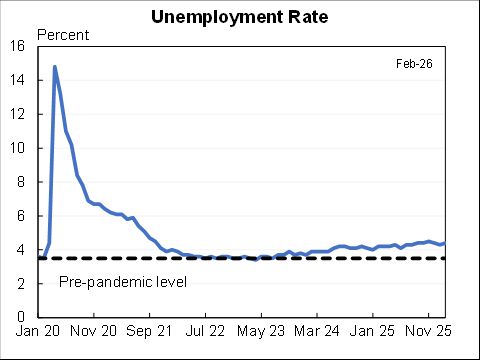

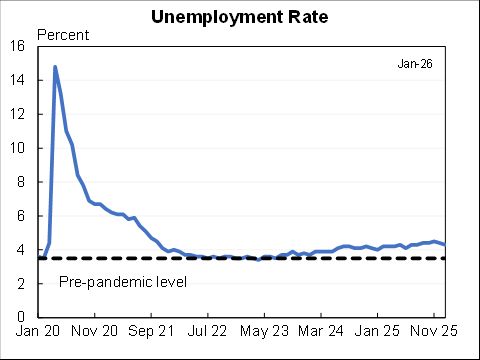

Also notable, the labor force participation rate has not moved since July. Normally we would expect a strengthening economy to have an increase in participation rates. Moreover, if the $600 was having a large disincentive effect that should have raised participation.

• • •

Missing some Tweet in this thread? You can try to

force a refresh