Time for a chat, AB

1/Suncor lays off 15% of workers

"...has been transforming itself in recent years to rely more on data/tech to improve its efficiency, such as using autonomous trucks...had anticipated these changes would lead to a smaller workforce."

calgaryherald.com/business/local…

1/Suncor lays off 15% of workers

"...has been transforming itself in recent years to rely more on data/tech to improve its efficiency, such as using autonomous trucks...had anticipated these changes would lead to a smaller workforce."

calgaryherald.com/business/local…

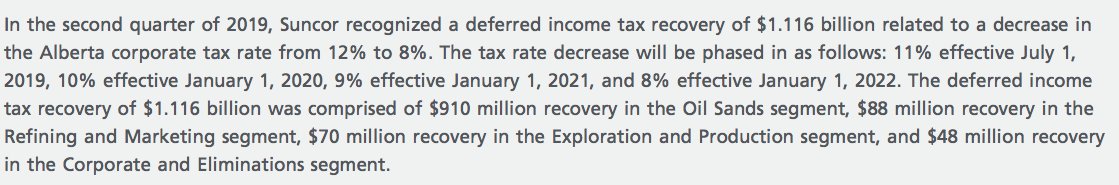

2/@jkenney's corporate tax reductions were supposed to create jobs. Instead, Suncor appears to have used the tax savings to invest in digital tech that will destroy jobs, about 4,500 of them.

All the big oil and gas producers are doing the same.

All the big oil and gas producers are doing the same.

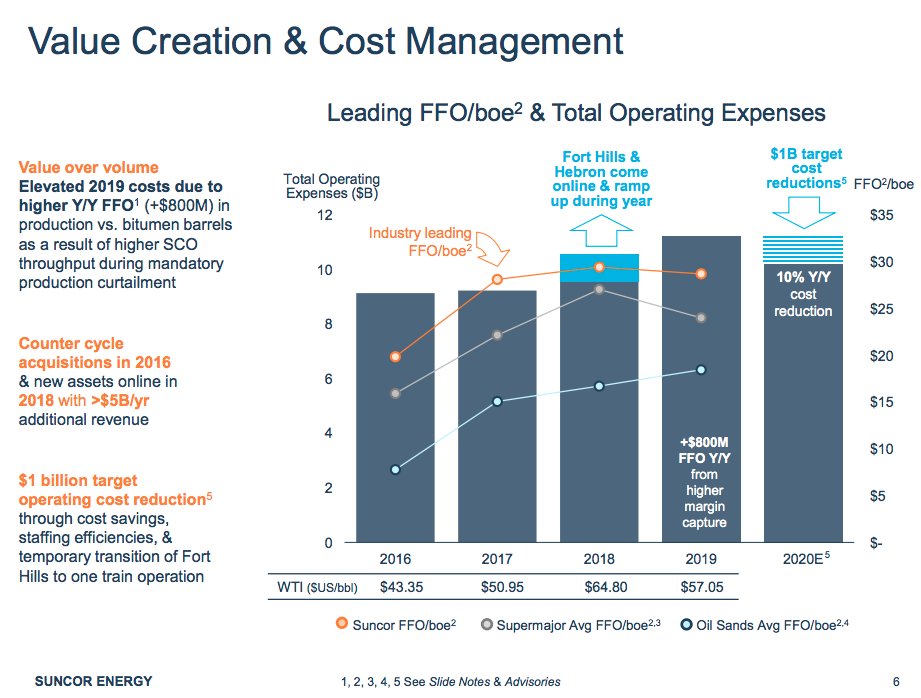

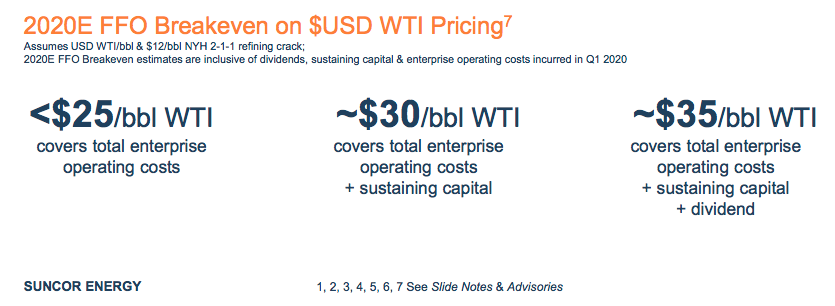

3/This slide from Suncor's July 22, 2020 investor presentations shows that the drive for more efficiency and lower operating costs that lead to a smaller workforce is a deliberate management strategy.

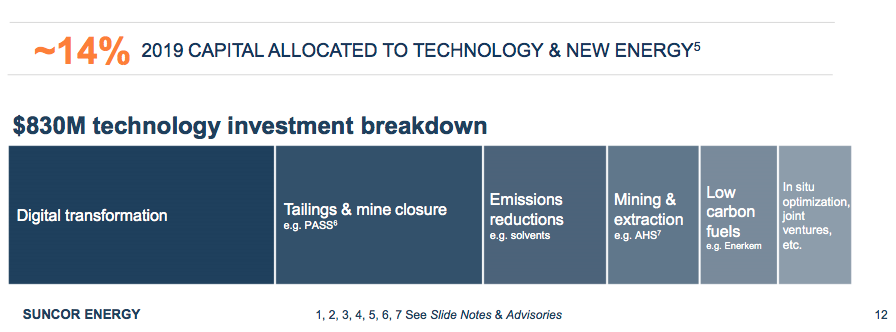

4/Hundreds of millions allocated for "digital transformation" in 2019 alone. And, according to the experts I've interviewed, this is just the beginning.

5/Look at those breakevens. The company can survive at $25WTI and does very nicely, thank you, around $35WTI.

Suncor has no choice. It's seriously preparing for a future that is likely to feature lower prices for longer. If it wants to survive, this is the only strategy.

Suncor has no choice. It's seriously preparing for a future that is likely to feature lower prices for longer. If it wants to survive, this is the only strategy.

6/Of course, Suncor wants to do more than just survive. Investors want growth and growth in oil sands supply. I haven't found a supply forecast yet, but will post it to this thread when I do. Rest assured, it will show more production, not less.

7/I wrote about this trend in my first deep analysis, January 2018. Oil and gas boosters scoffed, said it would never happen.

Well, here it is and once again Alberta has been caught napping.

energi.media/deep-dives/tec…

Well, here it is and once again Alberta has been caught napping.

energi.media/deep-dives/tec…

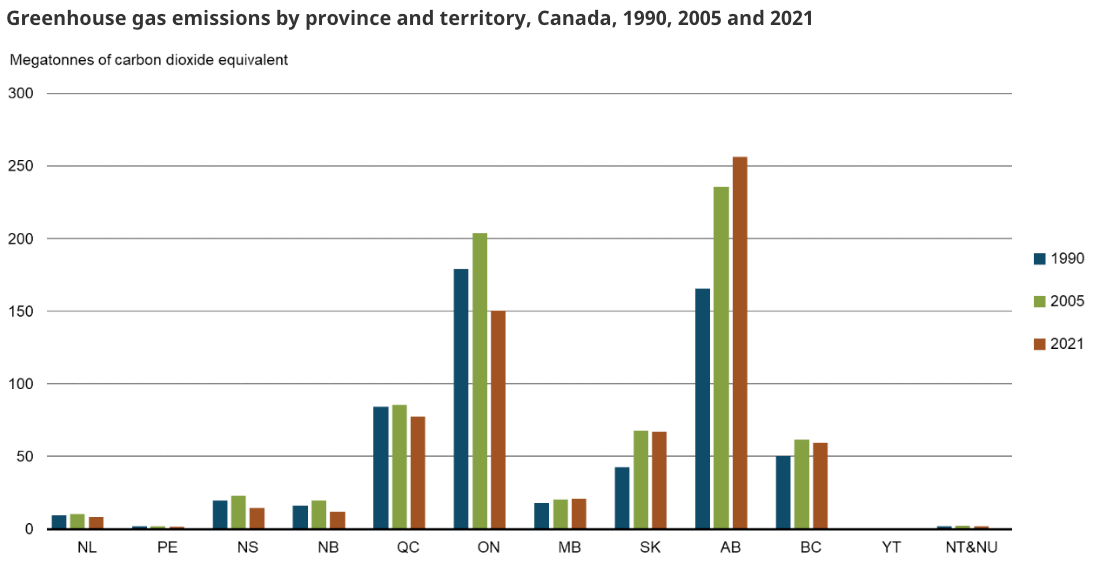

8/This graph shows the royalties becoming a smaller and smaller percentage of ABGov revenue.

So, here's the important question: If oil and gas generate fewer and fewer jobs, and less and less royalties, what's the benefit to the owners, the people of Alberta?

So, here's the important question: If oil and gas generate fewer and fewer jobs, and less and less royalties, what's the benefit to the owners, the people of Alberta?

• • •

Missing some Tweet in this thread? You can try to

force a refresh