Cutting benefit by £1,000 for millions of families - some history lessons... A thread resolutionfoundation.org/publications/d…

It's exactly 5yrs since G. Osborne arrived at Tory conference under fire for plans to cut tax credits by £1,000+. A month later he'd u-turned. Today Rishi Sunak begins his (virtual) conference defending similar plans. He should u-turn too and here's 5 reasons why he probably will

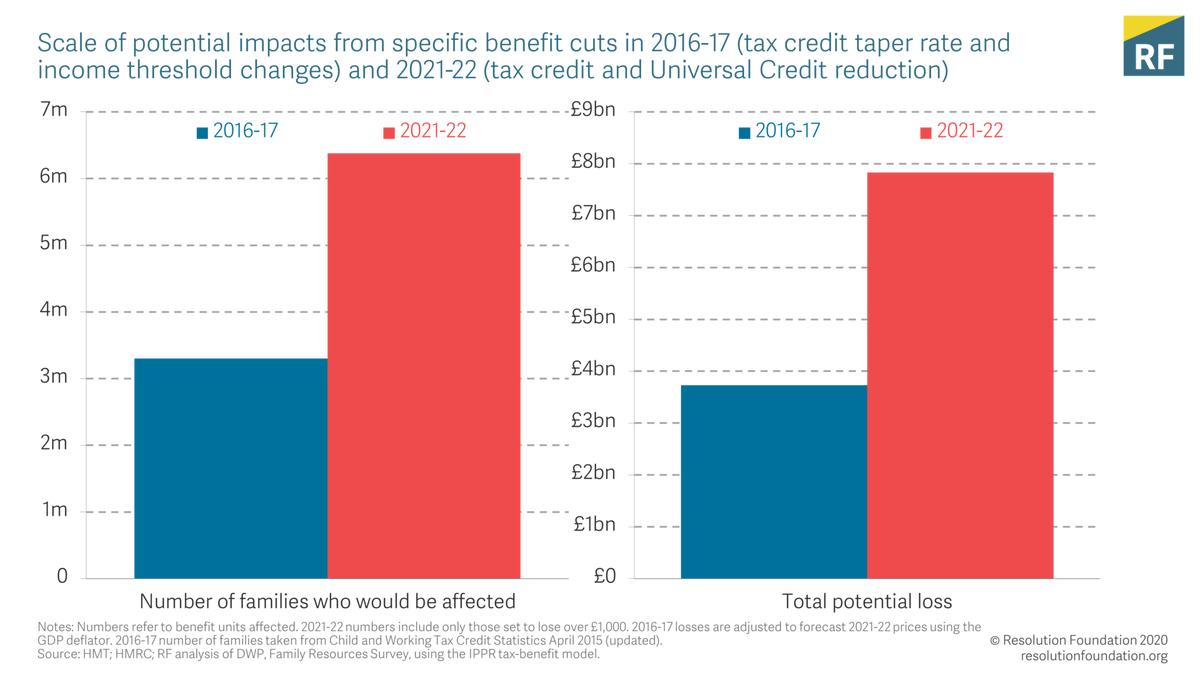

1. Sunak’s planned cut to benefits is MUCH bigger than Osborne’s in 2015. This time 6m households will lose £1,000 each next April vs 3.3 million 5yrs back - that adds up to an £8bn income reduction this time vs less than £4bn last time

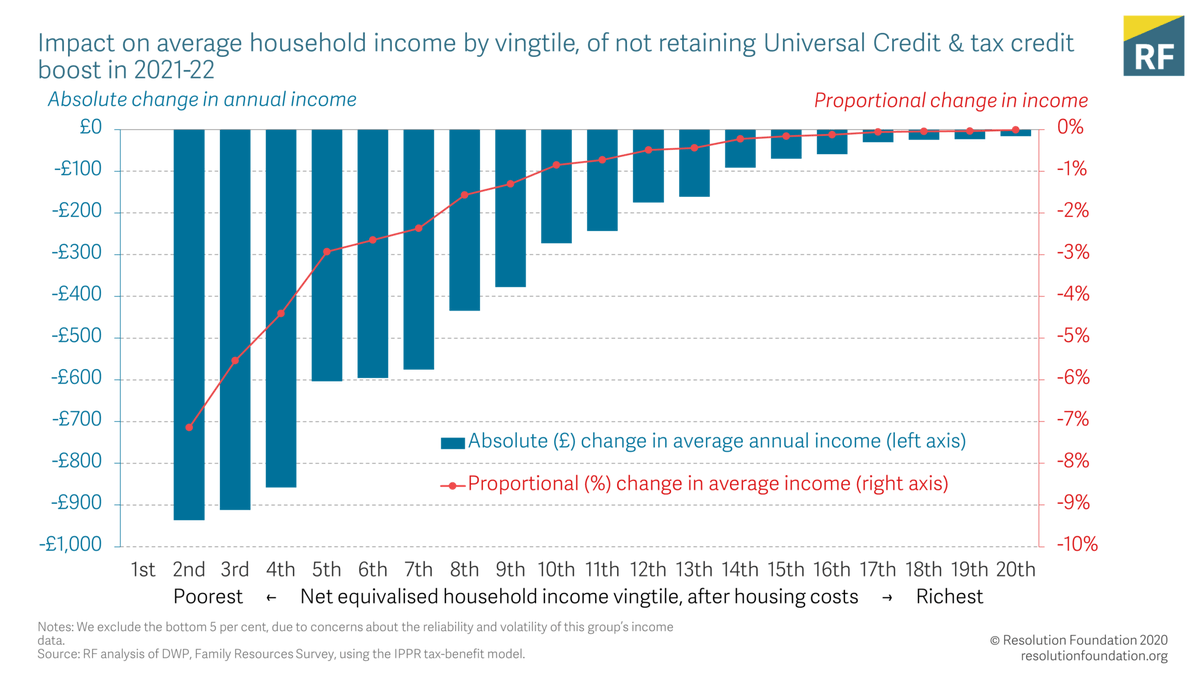

2. This is a huge living standards hit to lower income Britain. Reversing the £20/wk boost to benefits in six months time means the poorest fifth will lose an almost unimaginable 7% of their disposable incomes...

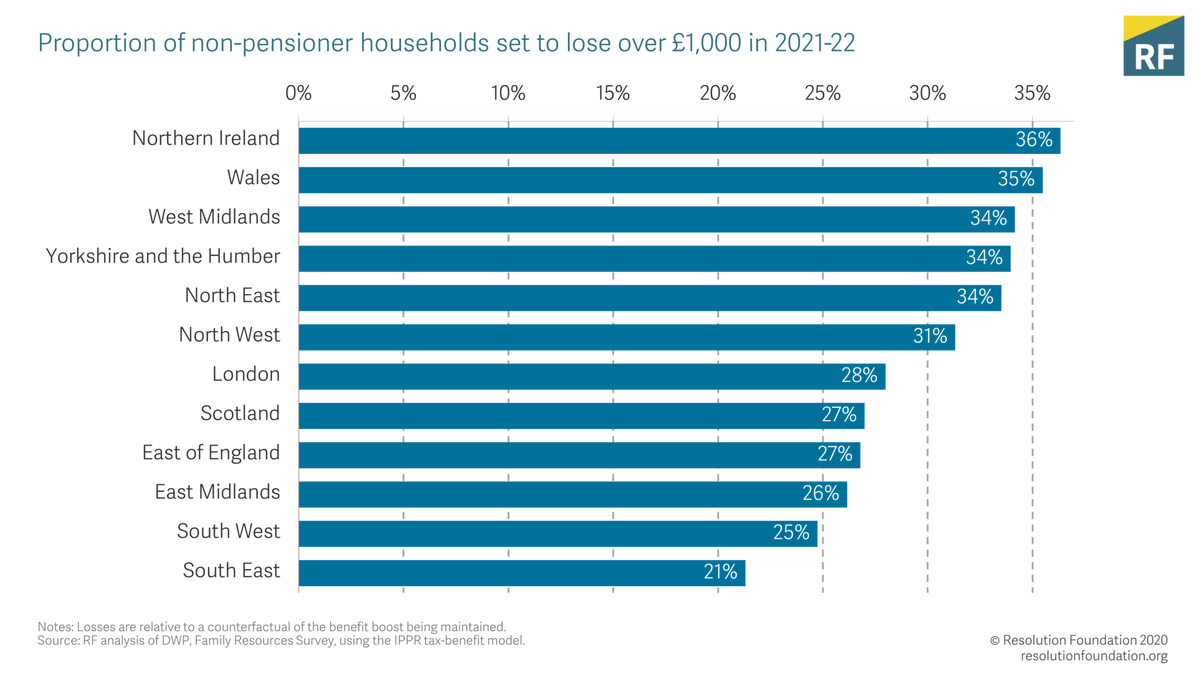

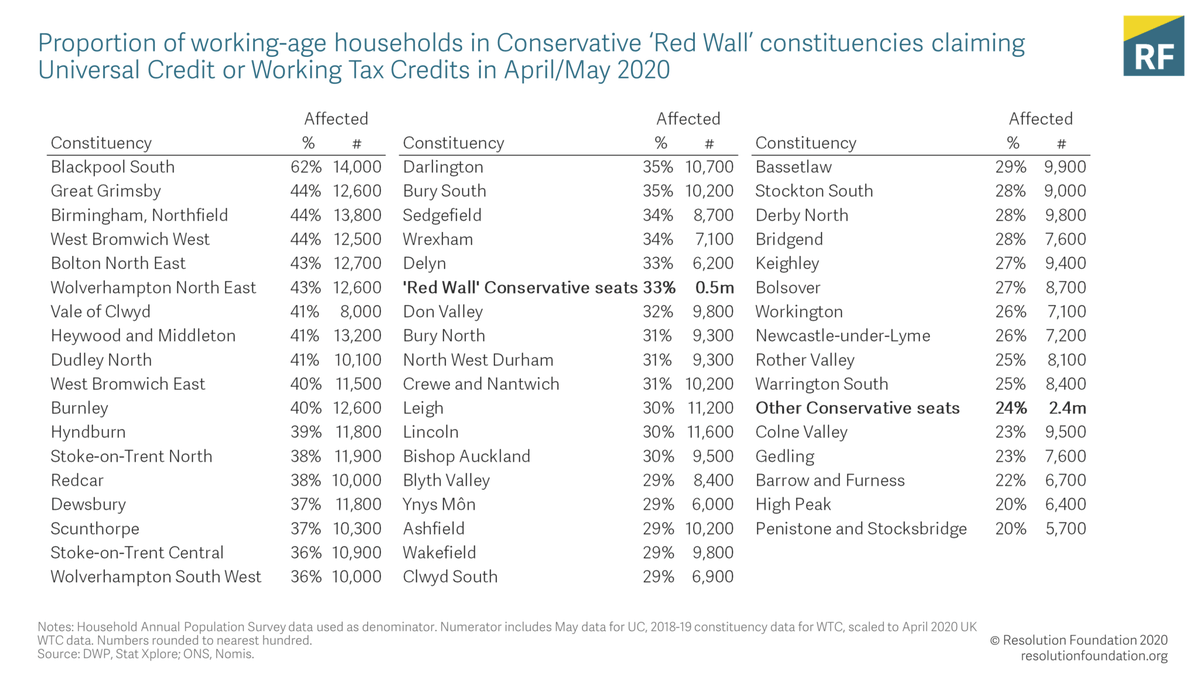

3. Sunak's plans mean taking £1k away from 1 in 3 households in the Red Wall. Lots of new Tory MPs are going to see over 4 in 10 of their constituents lose out

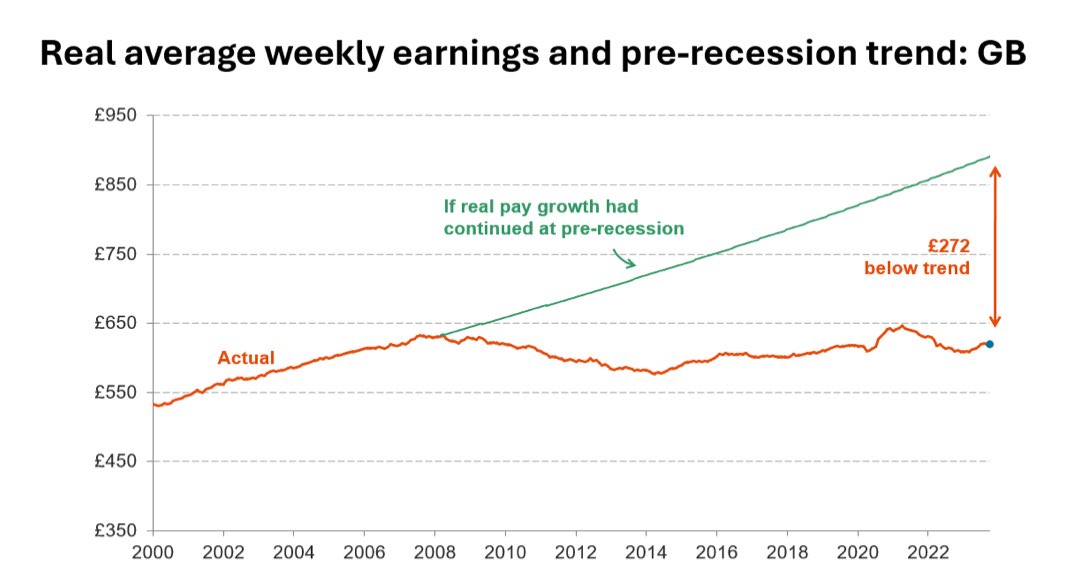

4. When Osborne was cutting benefits employment was rising fast - this time the backdrop is fast rising unemployment. A typical worker had 83% of their income protected by the retention scheme - that falls to 30% on Universal Credit and these cuts will make it just 23%...

5. This is terrible macroeconomics. Just as now is exactly the wrong time to be raising taxes and weakening the recovery, it's an awful time to be taking £8bn out of the economy by cutting benefits - reducing incomes for the households that actually spend it

A final history lesson? Back in 2015 Boris Johnson led the backlash against George Osborne’s cuts, saying the Chancellor should “make sure that hard-working people on low incomes are protected”. He was right then, and it is all the more right now resolutionfoundation.org/publications/d…

• • •

Missing some Tweet in this thread? You can try to

force a refresh