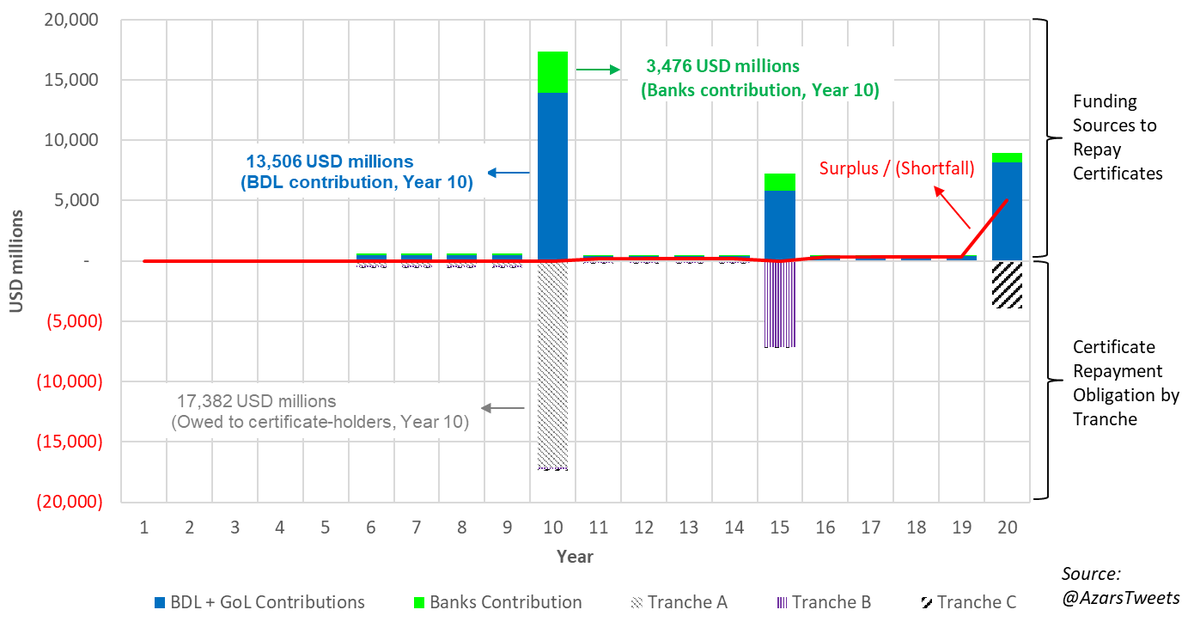

1/ BDL Foreign Assets (FA) decrease $9.8bn from Mar-Sept. FA includes BDL's FX loans to banks (~$8bn). Financial Sector Deposits are also down $5.6bn. We suspected the big decreases in FA was partly due to banks using their deposits at BDL to repay their loans from BDL

https://twitter.com/mzbeeb/status/1311954979515756544

2/ If the full $5.6bn reduction in Financial Sector Deposits is because of its use repaying bank's FX loans from BDL, that leaves $4.2bn real reduction in FX reserves. The trade deficit was supposedly ~$3.6-4bn during this time. That leaves few hundred million dollars unexplained

3/ BDL confirmed the above (that big reductions in FA is b/c of repayment of bank FX loans). But there is no transparency, so it's rational to assume there is capital flight happening. Plus, the trade deficit itself likely contains capital flight b/c it can be easily gamed.

4/ We also don't have visibility into exactly how the $8.x bn in FX loans to banks was used. Those were real dollars that are being repaid using local dollars. Given the magnitude of the crisis, people have a right to know how every single dollar of reserves is used.

5/ Important point below. Potentially a lot more of the decrease in FX reserves is unexplained. The trade deficit is (supposedly) in the range of $3.6-4bn but not all of this is funded by BDL.

https://twitter.com/RamziNassif/status/1312315122510110720?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh