In April 2006, Nigeria paid off all her foreign debt.

It was a good deal, Nigeria essentially paid $12b to settle over $30b in debt, in effect an over 50% discount.

Should Nigeria have used $12b to build rails or pay debt?

A very short trend

It was a good deal, Nigeria essentially paid $12b to settle over $30b in debt, in effect an over 50% discount.

Should Nigeria have used $12b to build rails or pay debt?

A very short trend

Borrowing is front loaded consumption.

When Nigeria Borrowed $30b (principal plus interest) she essentially consumed "tomorrow's $30b earnings "today".

To repay, Nigeria has to take current earnings and apply to current obligations.

What are the current earnings? Crude oil

When Nigeria Borrowed $30b (principal plus interest) she essentially consumed "tomorrow's $30b earnings "today".

To repay, Nigeria has to take current earnings and apply to current obligations.

What are the current earnings? Crude oil

Let's step back, did Nigeria actually borrow $30b?

No

$30b represented principal and accrued intrest..As long as a loan were "open", intrest accrued.

The debt had ballooned not because Nigeria borrowed more but that Nigeria serviced the loan less

..

No

$30b represented principal and accrued intrest..As long as a loan were "open", intrest accrued.

The debt had ballooned not because Nigeria borrowed more but that Nigeria serviced the loan less

..

What would have happened in 2007 if Nigeria owned $30 and crude oil fell to $30b

Well Nigeria will simply restructure $ loan, incurre more intrest and "management fees"

The problem is simple, Nigeria means of repayment (crude oil) is sold at a price Nigeria does not control.

Well Nigeria will simply restructure $ loan, incurre more intrest and "management fees"

The problem is simple, Nigeria means of repayment (crude oil) is sold at a price Nigeria does not control.

Paying off the foreign currency denominated loan eliminated a huge contingent liability for Nigeria.....at a 50% discount.

That 'light" debt sheet was a key reason Nigerian sovereign bonds were priced and added to the JP Morgan Bond index, because debt to revenues were low.

That 'light" debt sheet was a key reason Nigerian sovereign bonds were priced and added to the JP Morgan Bond index, because debt to revenues were low.

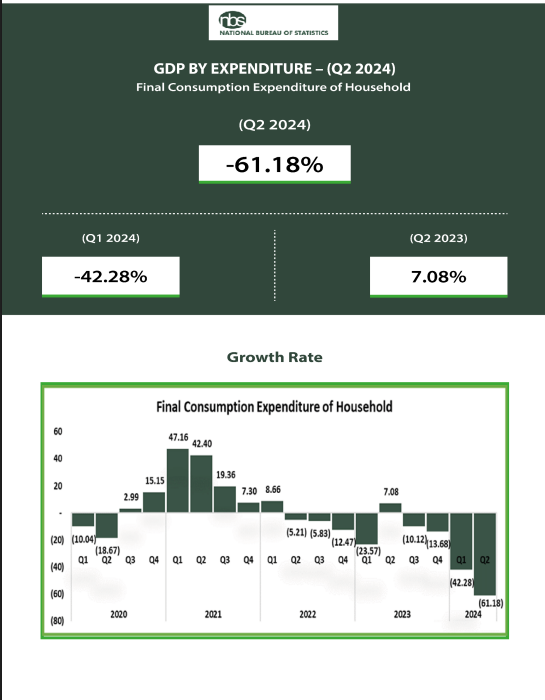

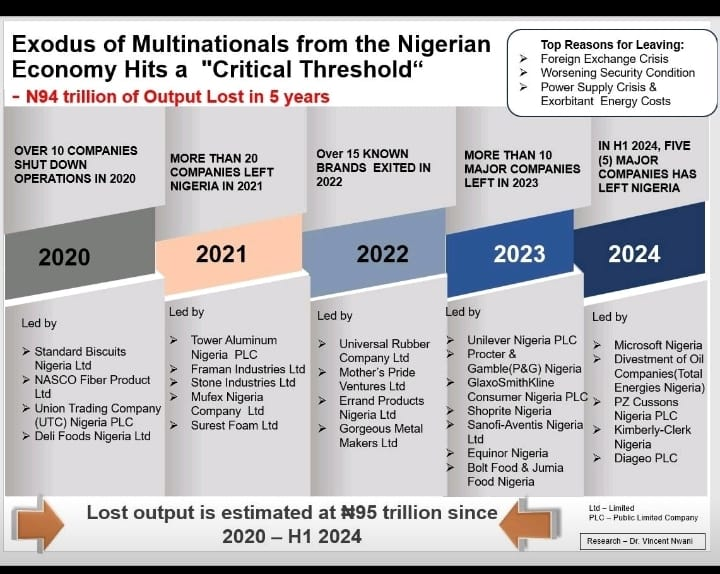

In summary, a $30b debt today plus subsequent foreign currency borrowings would have sucked every cent from the Central Bank of Nigeria to simply meet $ interest payments.

The Naira would have no support and imports and trade would have stalled.

Thank you

The Naira would have no support and imports and trade would have stalled.

Thank you

• • •

Missing some Tweet in this thread? You can try to

force a refresh