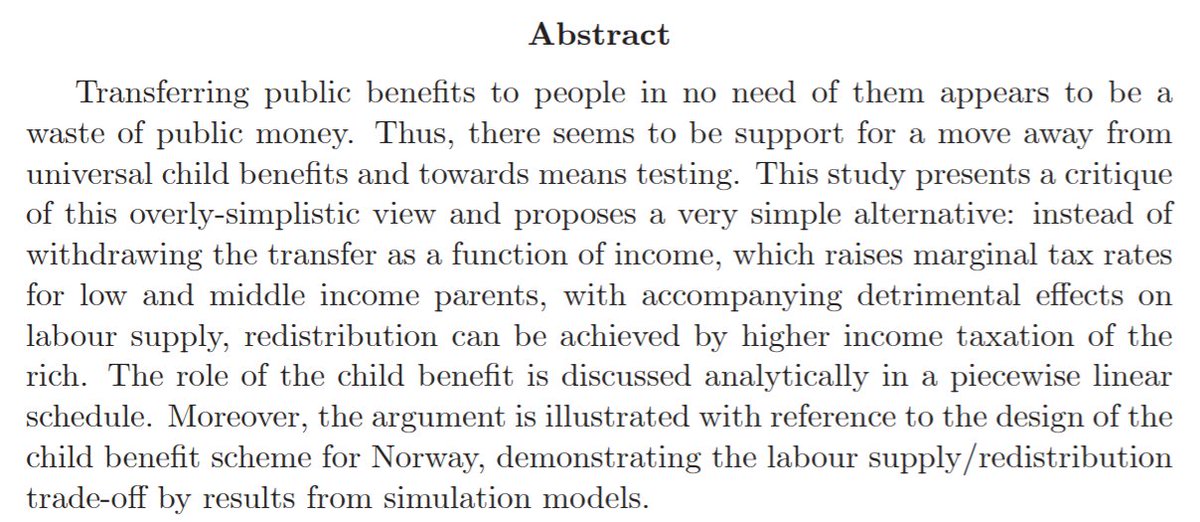

Interesting paper on Norway's wealth tax, suggesting that it hasn't had a negative impact on jobs, and in fact suggests "a positive causal relationship between the level of a household's wealth tax and subsequent employment growth in the firm it controls."

iza.org/publications/d…

iza.org/publications/d…

The mechanism here seems to be that investing in firm employment can be a way of reducing wealth tax liability

Norway's wealth tax is worth studying, because it's been one of the more successful implementations in Europe.

To me, an effectively administered wealth tax is like the holy grail of tax policy. There's no denying there are implementation challenges, but if you can do it well, it'd be extremely good

https://twitter.com/jdcmedlock/status/1302097937632079872

• • •

Missing some Tweet in this thread? You can try to

force a refresh