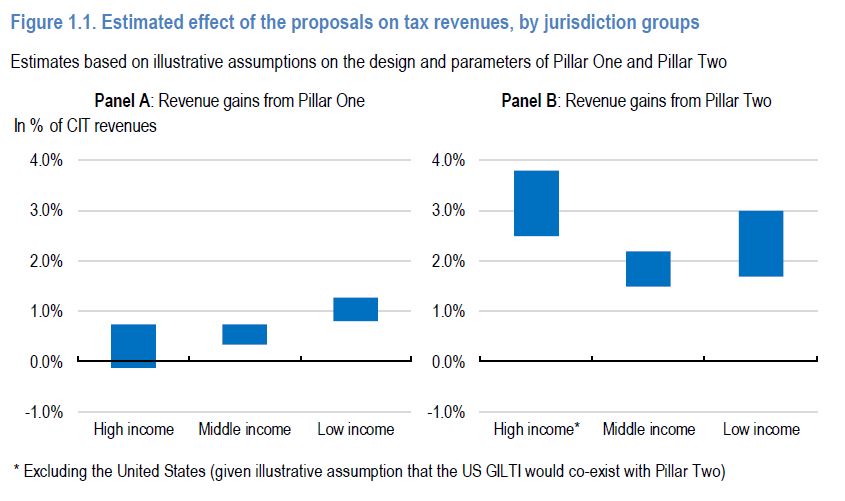

The Impact Assessment finds that Pillar 1 & Pillar 2 could increase global corporate income tax (CIT) revenues by about USD 50-80 bn a year. The combined effect of the reforms & the US GILTI could represent USD 60-100 bn a year (i.e. up to around 4% of global CIT revenues).

Pillar 1 would involve a significant change to the way taxing rights are allocated among jurisdictions, as taxing rights on about USD100 bn of profit could be reallocated to market jurisdictions under the Pillar 1 rules.This would lead to a modest increase in global tax revenues.

On average, low, middle and high income economies would all benefit from revenue gains, while ‘investment hubs’ would tend to lose tax revenues. #OECD #Tax

Pillar 2 would yield a significant increase in CIT revenues across low, middle and high income economies.

Pillar 2 would significantly reduce the incentives for MNEs to shift profits to low-tax jurisdictions, which would generate revenue gains in addition to the direct gains of the minimum tax itself.

The combined revenue gains from Pillar 1 and Pillar 2 are estimated to be broadly similar – as a share of current CIT revenues – across low, middle and high income jurisdictions.

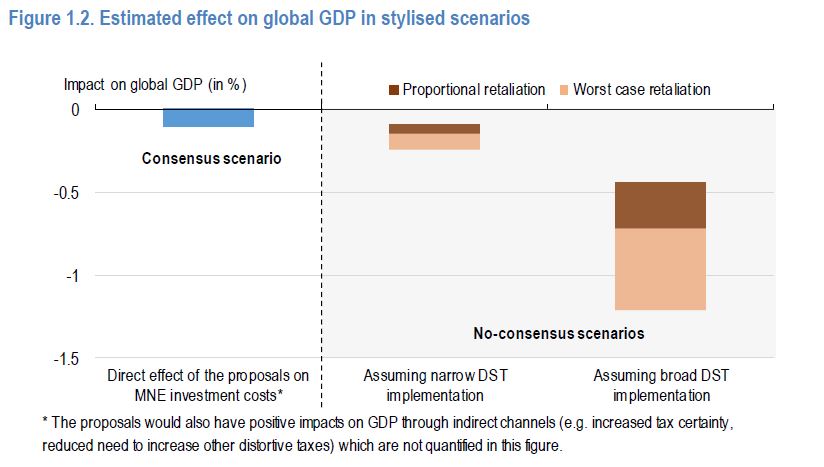

The reforms would lead to a more favourable environment for investment and growth than would likely be the case in the absence of a consensus-based solution.

Failure to reach an agreement would likely lead to a proliferation of uncoordinated and unilateral tax measures (e.g. digital services taxes) and an increase in damaging tax and trade disputes.

The magnitude of the negative consequences would depend on the extent, design and scope of these unilateral measures, and the scale of any ensuing trade retaliation. In the “worst-case” scenario of a trade war, these disputes could reduce global GDP by more than 1%.

• • •

Missing some Tweet in this thread? You can try to

force a refresh