NEW: Leon Black, one of Wall Street's most powerful men, has said his relationship with Jeffrey Epstein was very limited.

In reality: They were close personally and Black transferred Epstein at least $50M in recent years. with @MattGoldstein26 @SteveEder nytimes.com/2020/10/12/bus…

In reality: They were close personally and Black transferred Epstein at least $50M in recent years. with @MattGoldstein26 @SteveEder nytimes.com/2020/10/12/bus…

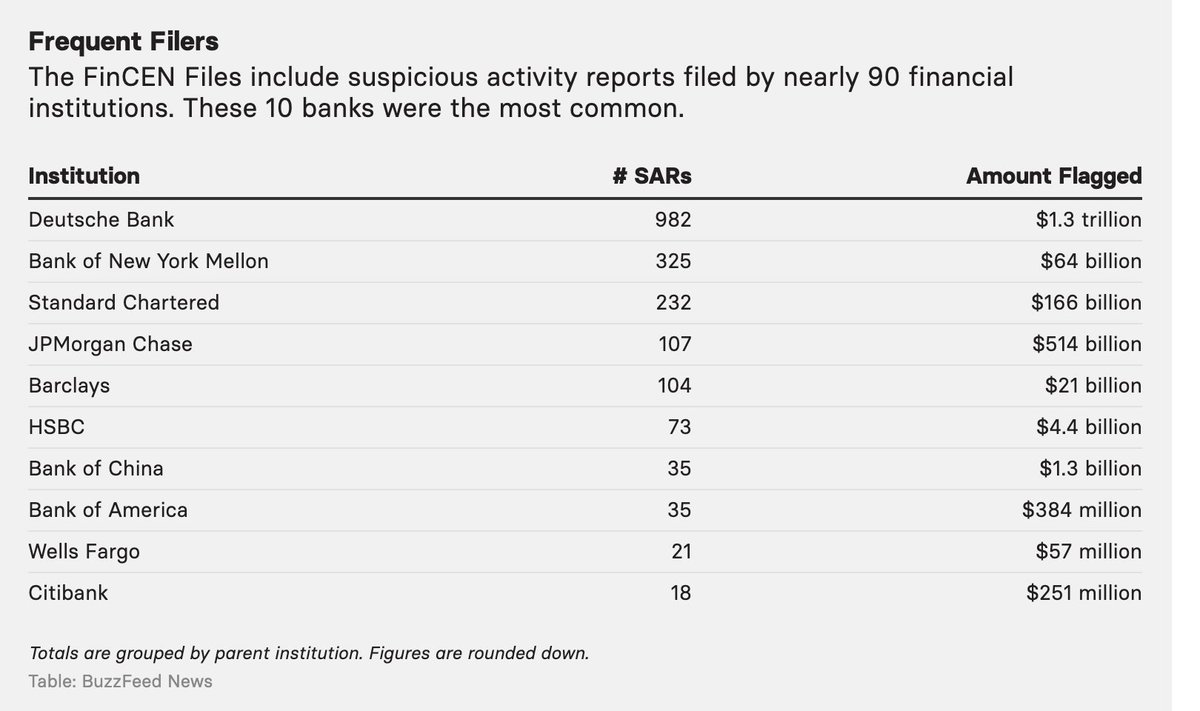

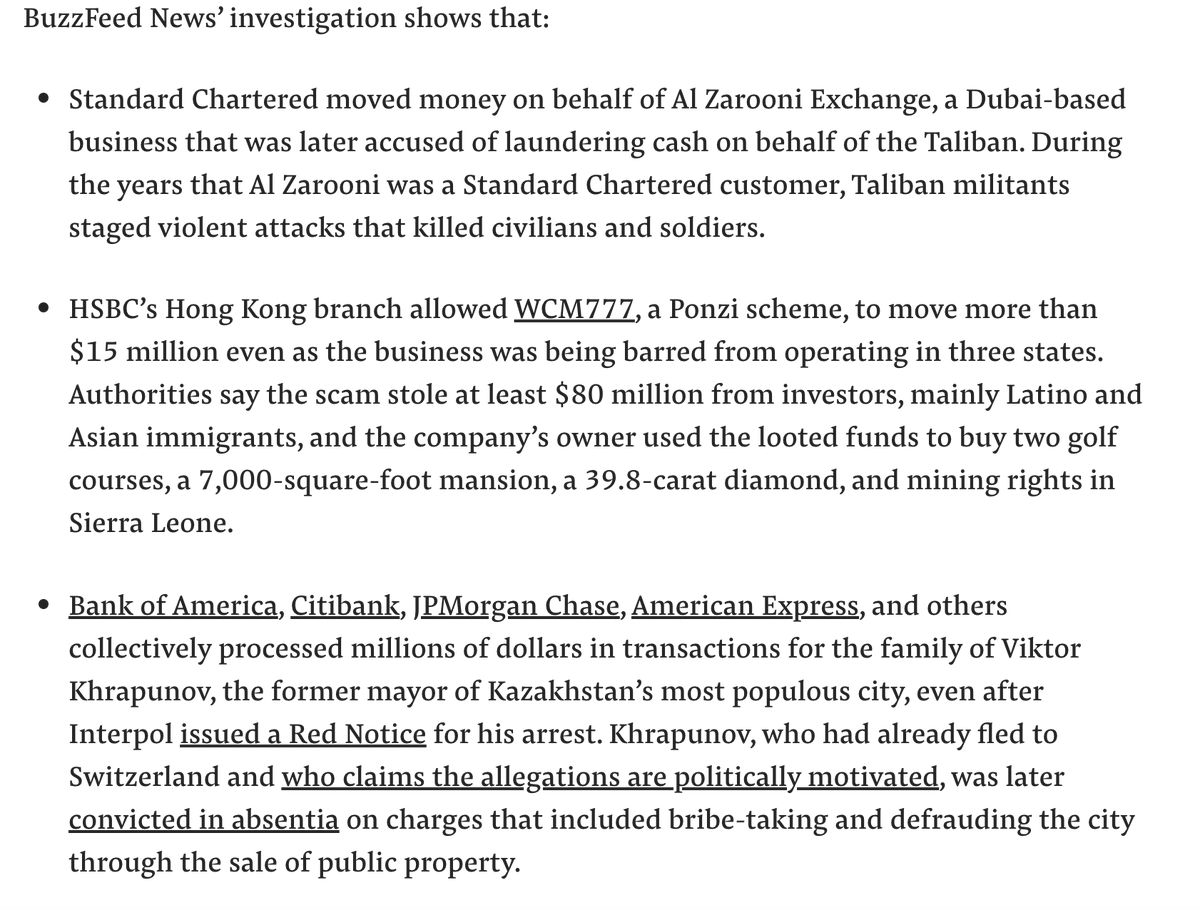

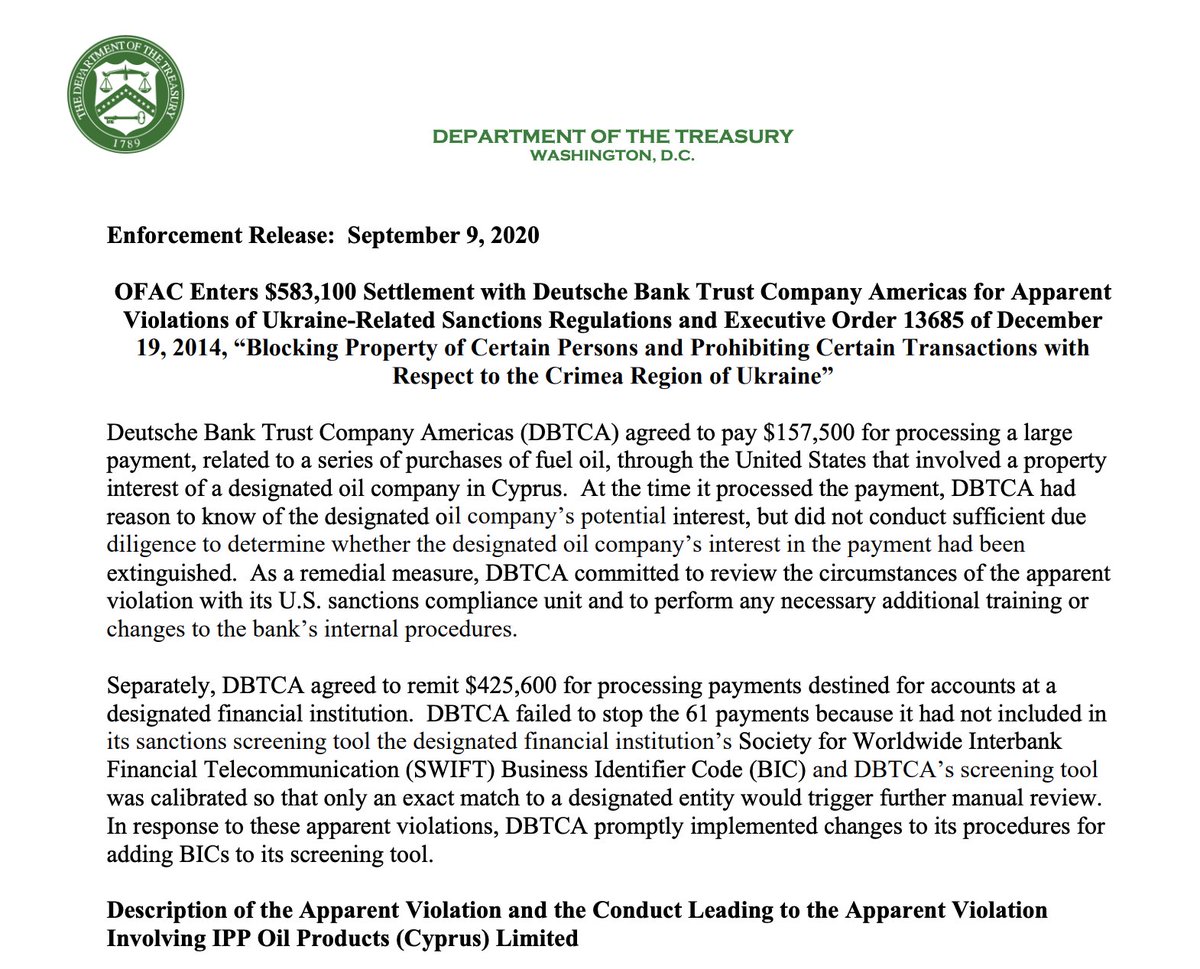

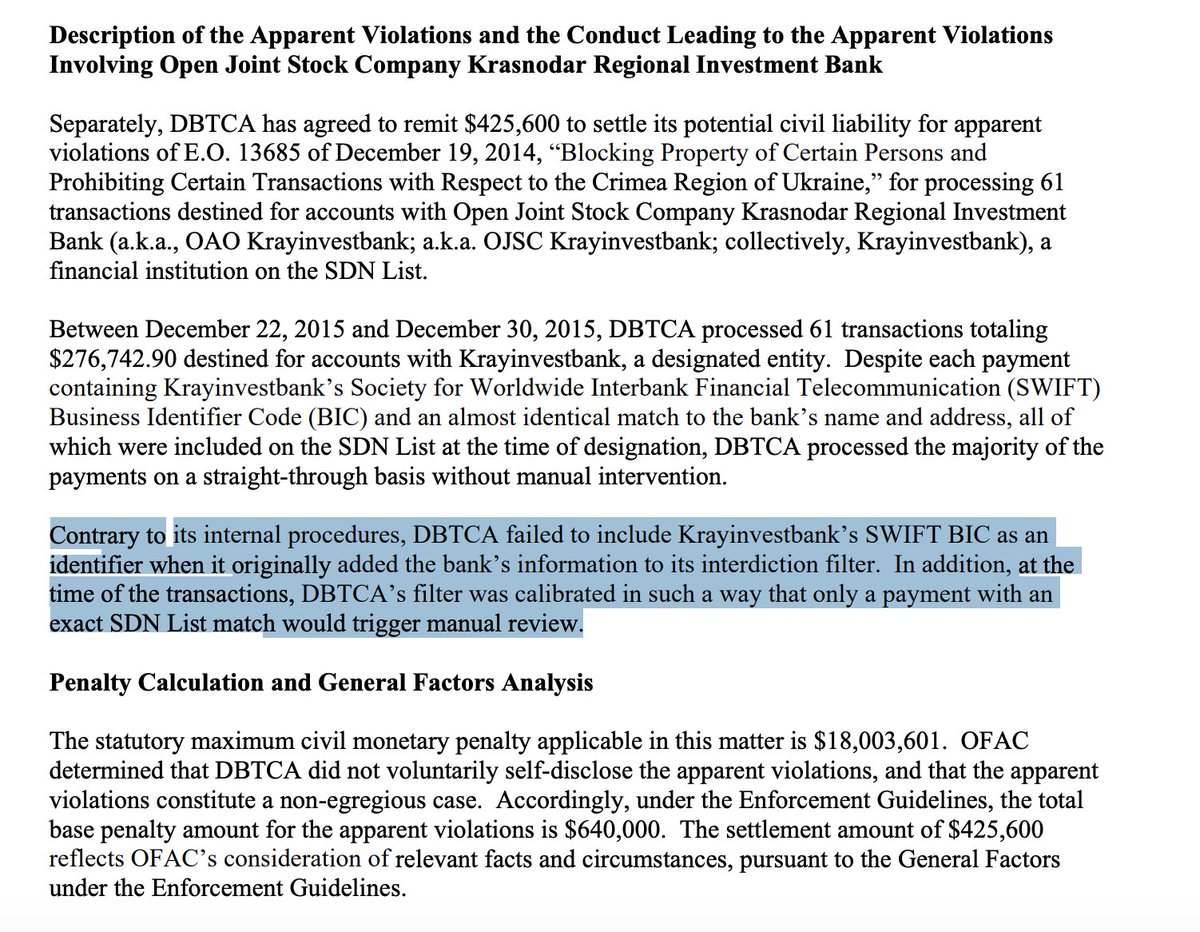

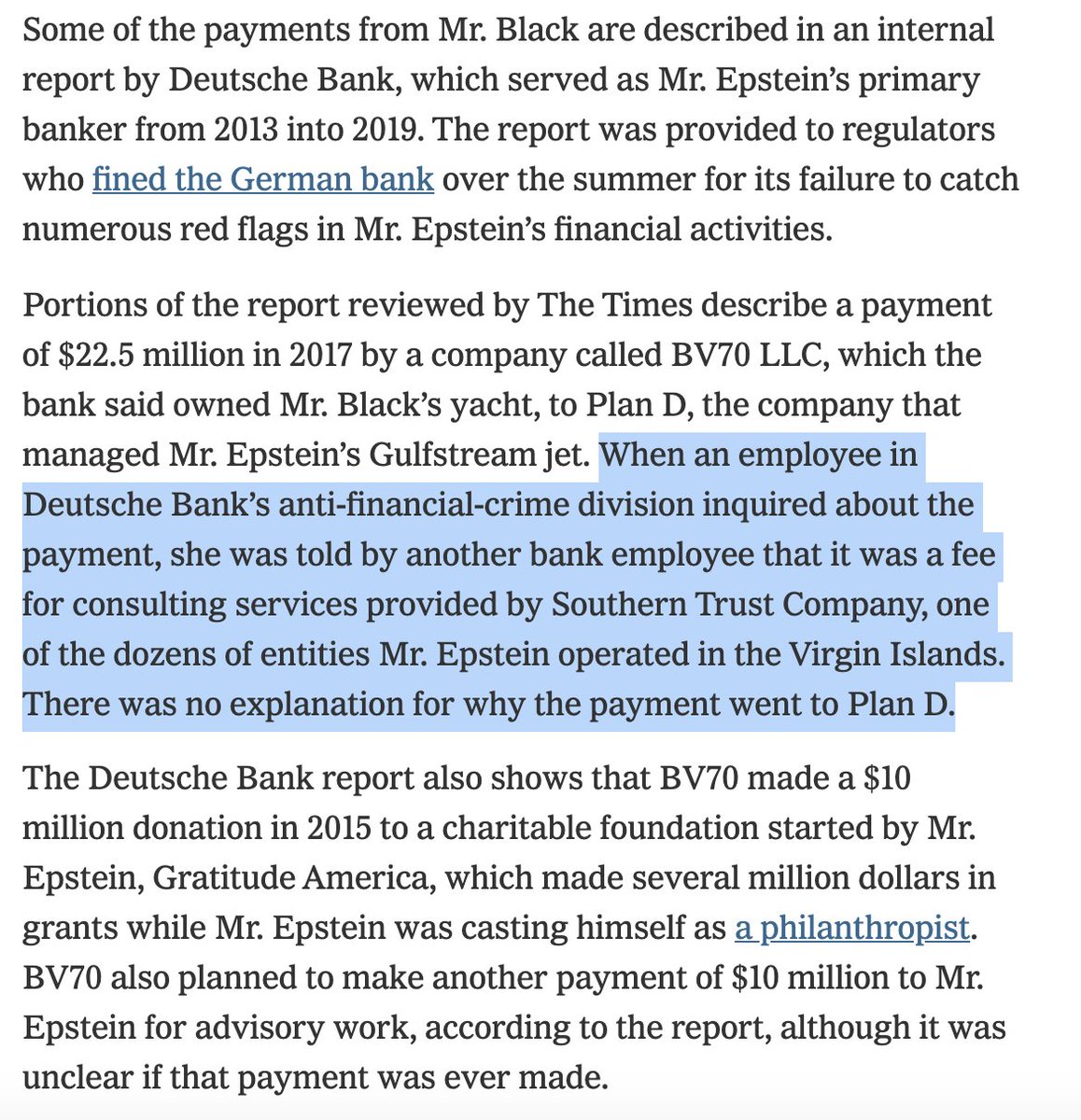

@DeutscheBank found that Epstein's bank accounts received transfers tens of millions of dollars from LLCs controlled by Black – even after the bank's anti-financial crime officers raised questions about the transactions.

We reviewed portions of Deutsche's internal report.

We reviewed portions of Deutsche's internal report.

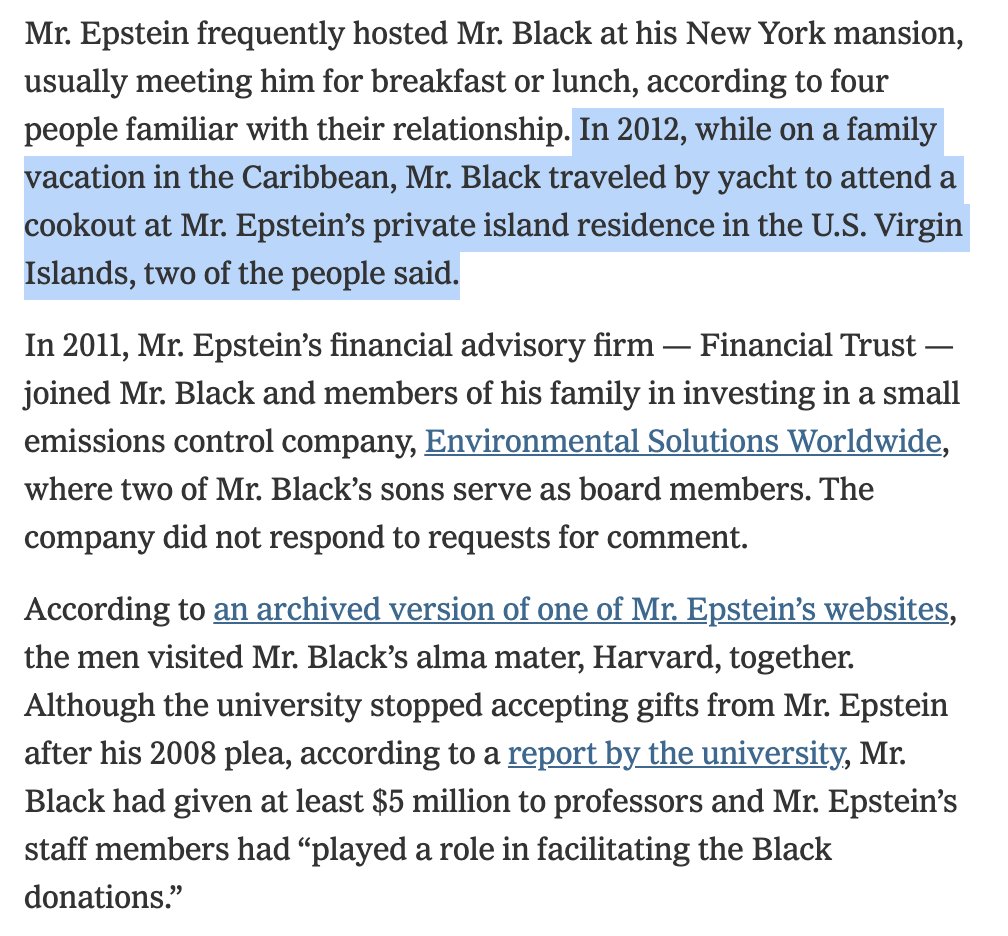

At the same time, Black was socializing with Epstein, joining him for meals, yachting and visits to Harvard.

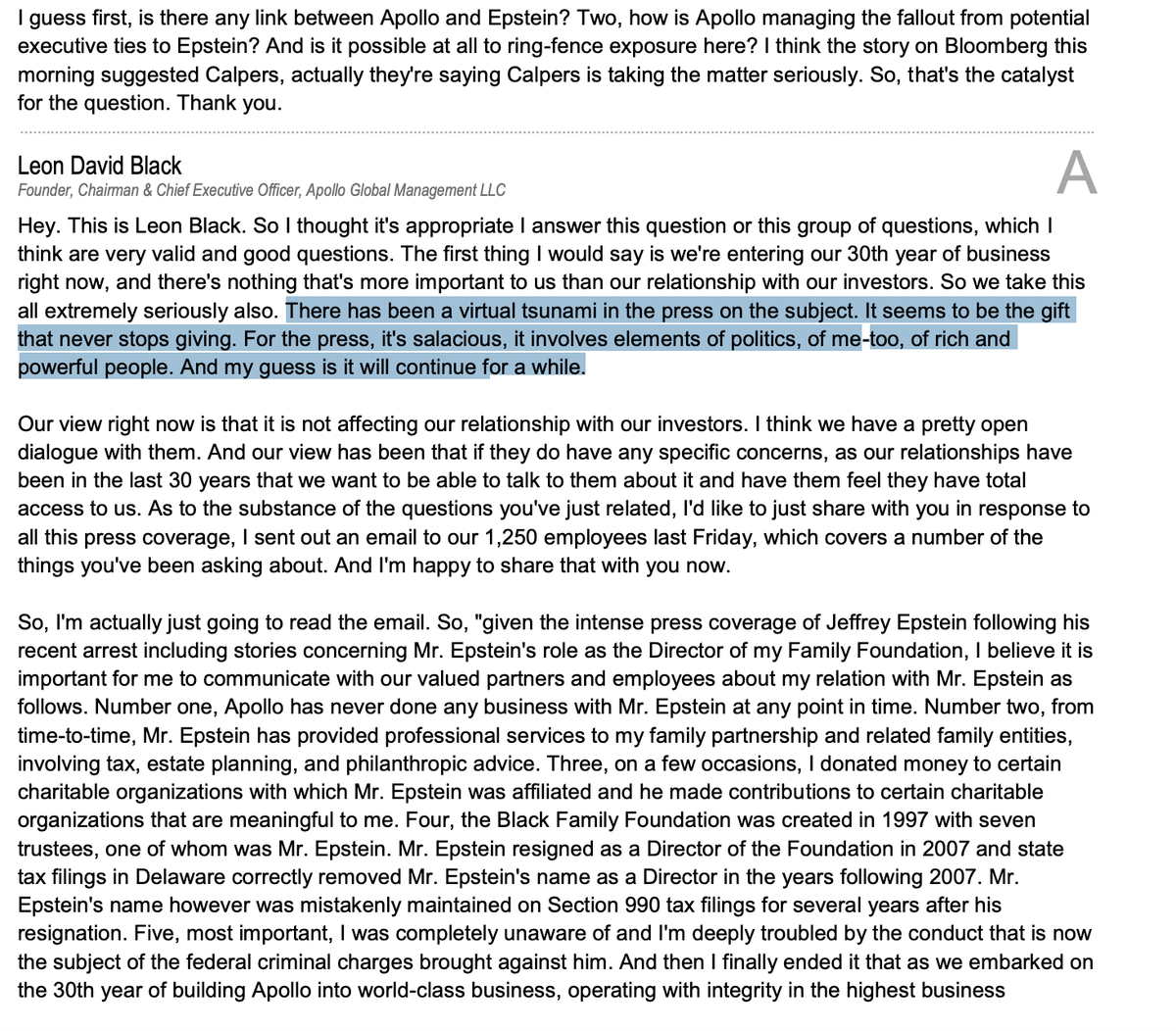

There is a contrast between what we've found in our reporting and how Black described his relationship to investors last year. (Black's firm, Apollo, is publicly traded.)

There is a contrast between what we've found in our reporting and how Black described his relationship to investors last year. (Black's firm, Apollo, is publicly traded.)

All this was happening from 2013-2018. During this period:

- Epstein was a convicted sex offender.

- Epstein was allegedly running a sex-trafficking ring.

- Other benefactors had severed ties with Epstein.

In other words, Black's support for Epstein appears invaluable.

- Epstein was a convicted sex offender.

- Epstein was allegedly running a sex-trafficking ring.

- Other benefactors had severed ties with Epstein.

In other words, Black's support for Epstein appears invaluable.

This is what Leon Black’s spokeswoman says to explain the $50M+ payments to Epstein.

It raises as many questions as it answers.

Also noteworthy that the relationship supposedly ended because of a “fee dispute,” not because of Black having any misgivings about Epstein.

It raises as many questions as it answers.

Also noteworthy that the relationship supposedly ended because of a “fee dispute,” not because of Black having any misgivings about Epstein.

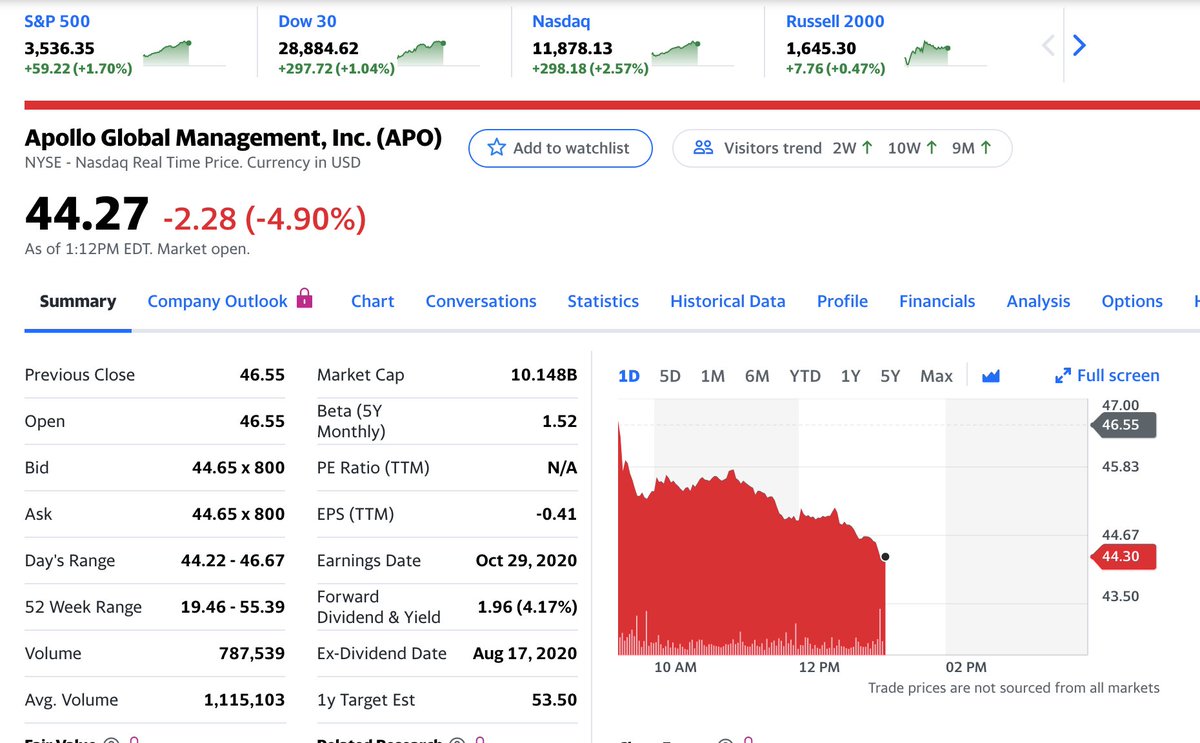

Stock markets are rallying today.

Leon Black's private equity firm, Apollo Global Management, is getting crushed. Its stock is down nearly 5%. That's about $500 million of market value wiped out. finance.yahoo.com/quote/APO?p=AP…

Leon Black's private equity firm, Apollo Global Management, is getting crushed. Its stock is down nearly 5%. That's about $500 million of market value wiped out. finance.yahoo.com/quote/APO?p=AP…

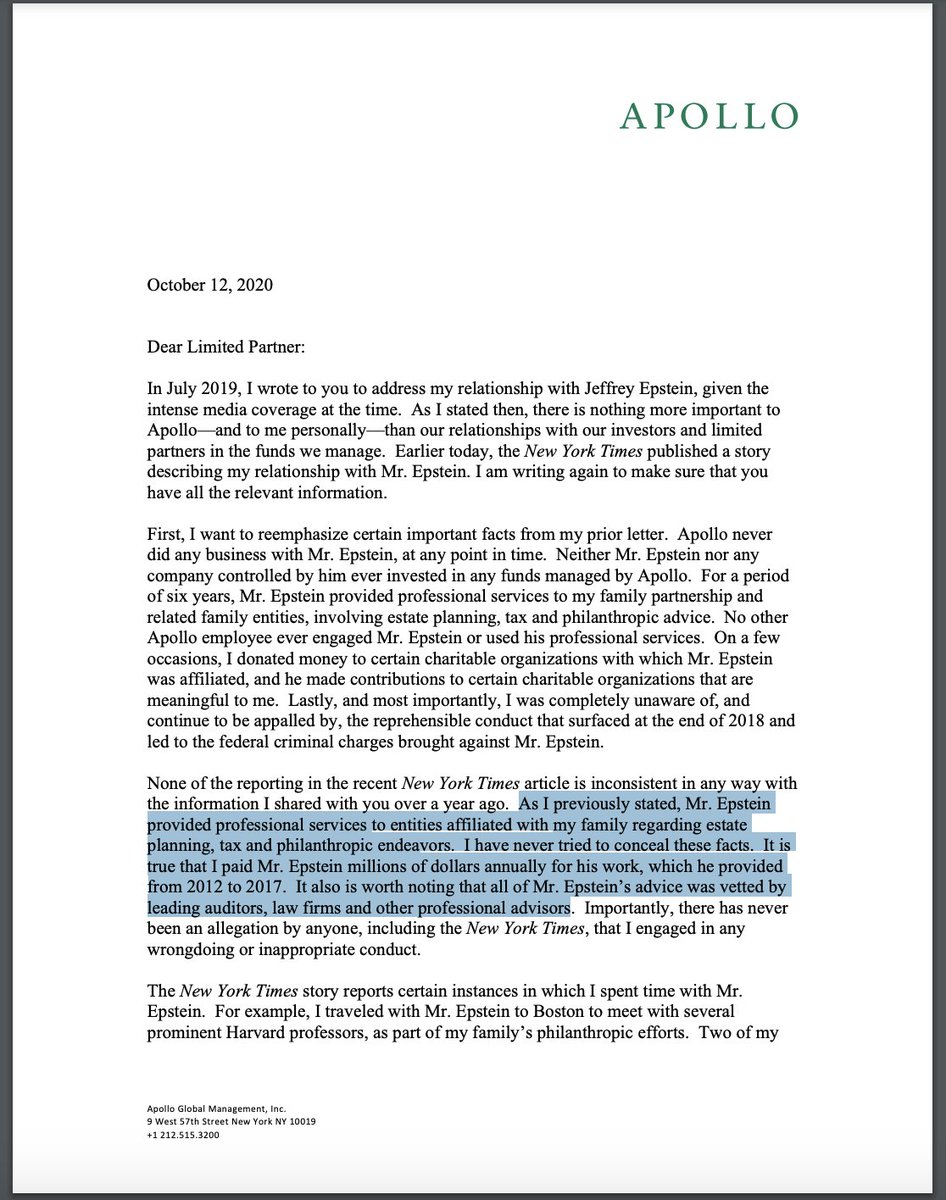

MORE: Leon Black sent a letter to his investors today. @MattGoldstein26 got a copy.

"It is true that I paid Mr. Epstein millions of dollars annually for his work" from 2012 to 2017. (Black also confirms bringing his family to a picnic on Epstein's private island.)

"It is true that I paid Mr. Epstein millions of dollars annually for his work" from 2012 to 2017. (Black also confirms bringing his family to a picnic on Epstein's private island.)

Leon Black on the front page of tomorrow's @nytimes.

Leon Black's Apollo is now more than 9% in the wake of yesterday's NYT article – close to $1 billion of market value gone.

Unanswered questions keep piling up... axios.com/leon-black-jef…

Unanswered questions keep piling up... axios.com/leon-black-jef…

• • •

Missing some Tweet in this thread? You can try to

force a refresh