1) 2020 election odds

2) NOT POLITICAL ADVICE. NOT INVESTMENT ADVICE.

3) What are the odds Trump is reelected?

4) There are lots of approaches here.

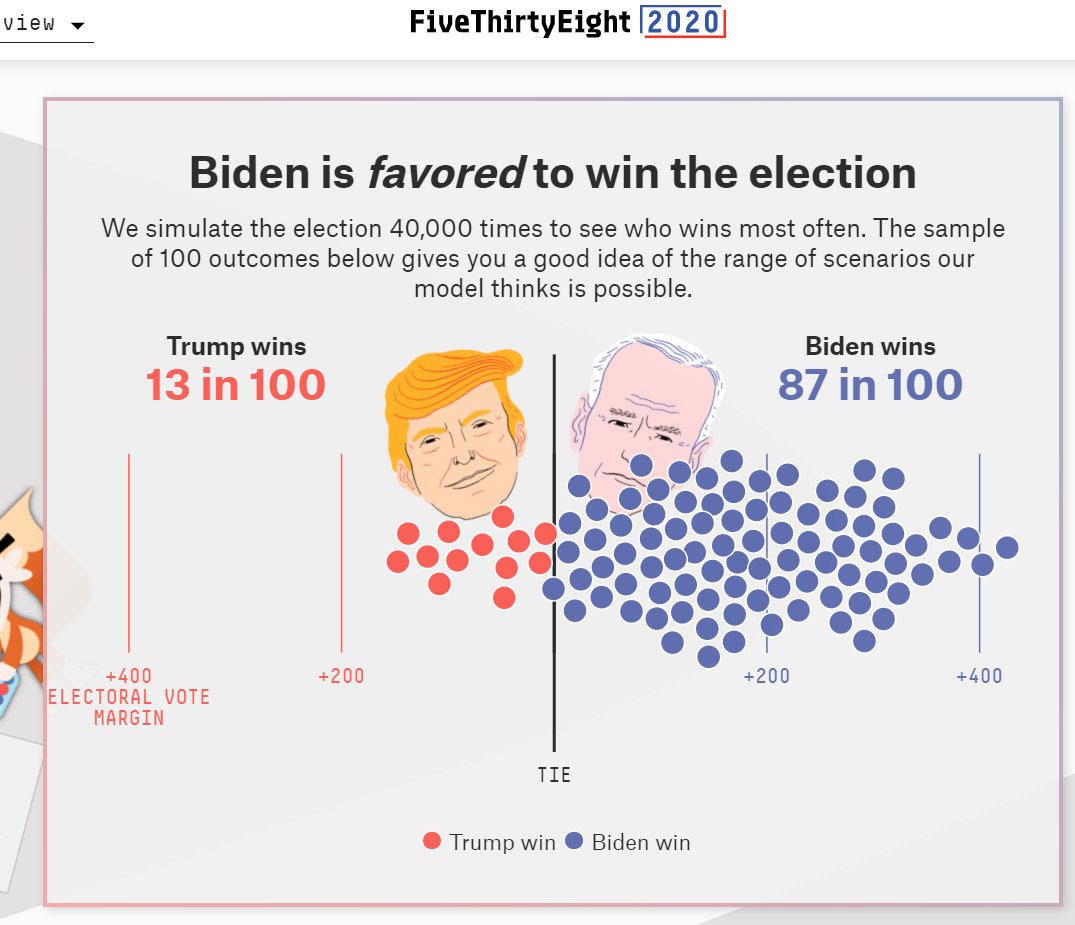

You can read polls, as 538 does; they end up at 13%: projects.fivethirtyeight.com/2020-election-…

You can read polls, as 538 does; they end up at 13%: projects.fivethirtyeight.com/2020-election-…

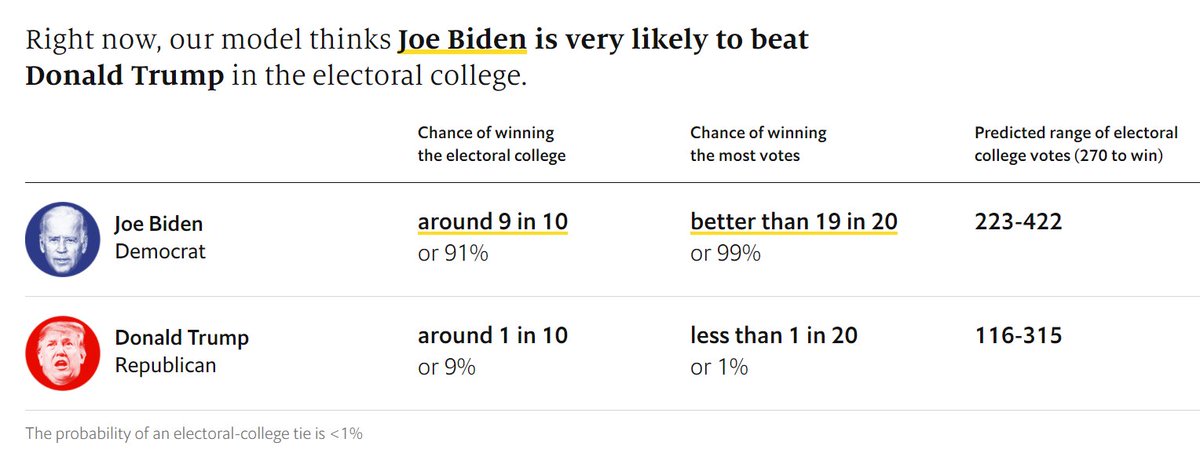

5) You can look at the economy, as The Economist does, and end at 9%: projects.economist.com/us-2020-foreca…

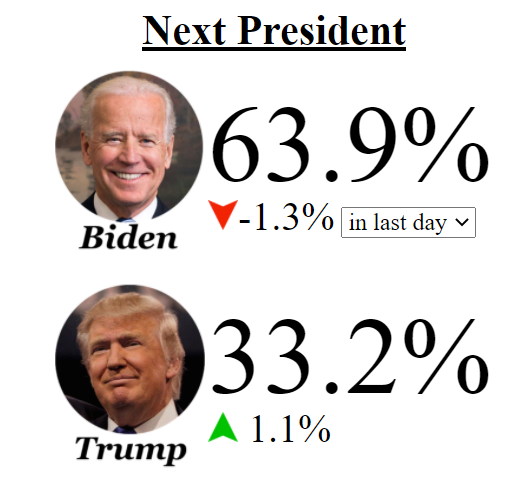

6) Or you can look at what prediction markets say--which have Trump around 33%.

electionbettingodds.com

[Disclosure: FTX owns electionbettingodds.com; the odds there come in part from FTX's market at ftx.com/trade/TRUMP]

electionbettingodds.com

[Disclosure: FTX owns electionbettingodds.com; the odds there come in part from FTX's market at ftx.com/trade/TRUMP]

7) This is a reversal from 2016, where "models" had Trump higher than prediction markets.

So what's right?

I mean, really, who knows. But here are some thoughts.

So what's right?

I mean, really, who knows. But here are some thoughts.

8) First off, @TheEconomist's model seems suspect to me.

They use a fundamentals model.

Their description (projects.economist.com/us-2020-foreca…) beings "A common criticism of fundamentals models is that they are extremely easy to 'over-fit'..."

They use a fundamentals model.

Their description (projects.economist.com/us-2020-foreca…) beings "A common criticism of fundamentals models is that they are extremely easy to 'over-fit'..."

9) To combat this, they:

a) combine two statistical techniques chosen out of who knows how large a set

b) sample 100 values of a parameter and choose the 'best' fit

c) add in an arbitrary coefficient for COVID

d) fit the model to 18 data points

glad they aren't overfitting

a) combine two statistical techniques chosen out of who knows how large a set

b) sample 100 values of a parameter and choose the 'best' fit

c) add in an arbitrary coefficient for COVID

d) fit the model to 18 data points

glad they aren't overfitting

10) @FiveThirtyEight's is way more up-front. It _does_ have a ton of factors in it, but uses much more data and many more data points.

It also is based heavily on polls, rather than fundamentals.

Historically, it's done quite well compared to others.

It also is based heavily on polls, rather than fundamentals.

Historically, it's done quite well compared to others.

11) So between it (13%) and prediction markets (33%) what do I think?

Well, they're not actually predicting quite the same thing.

They might disagree in the case of a contested election--with 538 predicting the ballots cast, and prediction markets reflecting inaguration.

Well, they're not actually predicting quite the same thing.

They might disagree in the case of a contested election--with 538 predicting the ballots cast, and prediction markets reflecting inaguration.

12) That might make up something like 5% difference between them, but I doubt it's 13% vs 33%.

And note--prediction markets get to read 538; 538 doesn't model based on FTX.

Prediction markets are at 33% *after adjusting down* for 538's information. Otherwise they might be 40%.

And note--prediction markets get to read 538; 538 doesn't model based on FTX.

Prediction markets are at 33% *after adjusting down* for 538's information. Otherwise they might be 40%.

13) So what's really going on here?

My best guess, roughly:

There are known unknowns; models capture those.

There are unknown unknowns; models try to model the distribution of those.

My best guess, roughly:

There are known unknowns; models capture those.

There are unknown unknowns; models try to model the distribution of those.

14) And then there are intuitions -- something like "yeah, but COVID".

The unknown unknown unknowns -- the model's uncertainty about how many unknown unknowns are likely to happen this year, relative to others.

Those were high in 2016.

They're way higher now.

The unknown unknown unknowns -- the model's uncertainty about how many unknown unknowns are likely to happen this year, relative to others.

Those were high in 2016.

They're way higher now.

15) What are the odds that mail-in voting turns out very different than expected in an election blowing through records in mail-in voting?

What are the odds there's $5b of Super PAC spending coming on November 2nd?

What are the odds COVID delays the election in some states?

What are the odds there's $5b of Super PAC spending coming on November 2nd?

What are the odds COVID delays the election in some states?

16) 2012 was a pretty 'standard', boring election. Incumbent with average popularity, slightly unpopular challenger, decent economy.

2016 was weird: a candidate unlike what we'd seen before. Almost everyone was off by a bunch there--a few % of the popular vote.

2016 was weird: a candidate unlike what we'd seen before. Almost everyone was off by a bunch there--a few % of the popular vote.

17) How much wackier is 2020 than 2016?

IDK -- probably a lot more.

I sort of think that volatility here should be something like 9x the baseline and 3x 2016.

So, idk, I think my model would be a fair bit less certain than 538 etc.'s, in ways that aren't reflected by polling.

IDK -- probably a lot more.

I sort of think that volatility here should be something like 9x the baseline and 3x 2016.

So, idk, I think my model would be a fair bit less certain than 538 etc.'s, in ways that aren't reflected by polling.

18) And then, take a step back.

How surprised would you be if Trump won--if it turns out polls were off by 5%, Trump lost popular vote but won Electoral college?

IDK -- I wouldn't be shocked.

And if you say the odds Trump wins are 10%--

How surprised would you be if Trump won--if it turns out polls were off by 5%, Trump lost popular vote but won Electoral college?

IDK -- I wouldn't be shocked.

And if you say the odds Trump wins are 10%--

19) idk, I guess I feel like the odds all these models are just kinda busted and this is a wacky election are greater than 10%.

It can be dangerous to trust intuition above numbers, and so I'm definitely fading to the models here.

But 10% kind of fails my smell test.

It can be dangerous to trust intuition above numbers, and so I'm definitely fading to the models here.

But 10% kind of fails my smell test.

20) But, who knows, I might be wrong.

I guess we'll find out.

I guess we'll find out.

21) to be clear here, I think Biden is the heavy favorite -- and *very* heavy favorite for the popular vote.

I think the odds Trump wins aren't that much higher than the odds he loses but tries to say he won.

But I think both of those are above 10%.

I think the odds Trump wins aren't that much higher than the odds he loses but tries to say he won.

But I think both of those are above 10%.

22) Both sides are doubling down, e.g.

If @NateSilver538 is right that @realDonaldTrump's COVID strategy sucks, then Trump very likely loses.

But the public secretly liking it more than they let on is an example of a possible systematic bias.

https://twitter.com/NateSilver538/status/1316002159578828805

If @NateSilver538 is right that @realDonaldTrump's COVID strategy sucks, then Trump very likely loses.

But the public secretly liking it more than they let on is an example of a possible systematic bias.

• • •

Missing some Tweet in this thread? You can try to

force a refresh