cipher.substack.com/p/state-of-blo…

I crunched the numbers to see how blockchain ecosystem numbers are playing. Bulk of this data is oft-maligned with ICO / enterprise numbers so this is purely pre-seed -> series C figures from 2018 to Q3 2020. Some quick observations

I crunched the numbers to see how blockchain ecosystem numbers are playing. Bulk of this data is oft-maligned with ICO / enterprise numbers so this is purely pre-seed -> series C figures from 2018 to Q3 2020. Some quick observations

Much like many other sectors, covid has indeed affected blockchain ecosystem funding in 2020. That uptick in Q1 is the result of Bakkt's $300 million raise.

The number of deals being closed in blockchain ecosystem has been reducing since 2019 in fact. Largely the result of ICO hubris settling down and more technical teams raising from fewer VCs. This does cause a concern for early stage ventures though.

Pre-seed stage today raises less than 1% of all capital raised. Seed stage deals in spite of accounting for close to 55% of all deals, attract less than 20% of capital. This is part of the reason why alternative models like fair launches and DAOs are going to be a necessity.

In other news, its becoming evident that investor preferences for blockchain applications is mostly tied to financial applications. Since 2018 - protocol layers and financial applications raise the most money. Dapper labs' recent raise may change the trend

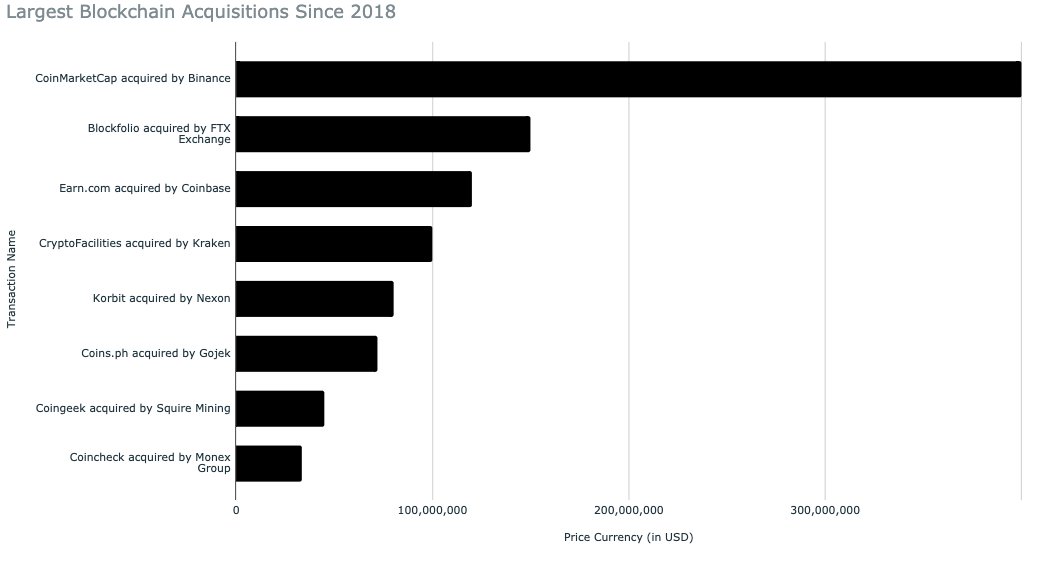

That focus on financial applications is evident when you consider how mergers and acquisitions play out. Its a tough time to be a founder working on anything non-finance right now if engaged with blockchains

All of this leaves me to think there is much alpha beyond just finance. But more importantly, it makes me appreciate the odds founders in the ecosystem are working with. Take a look at the piece and lmk what you think

• • •

Missing some Tweet in this thread? You can try to

force a refresh