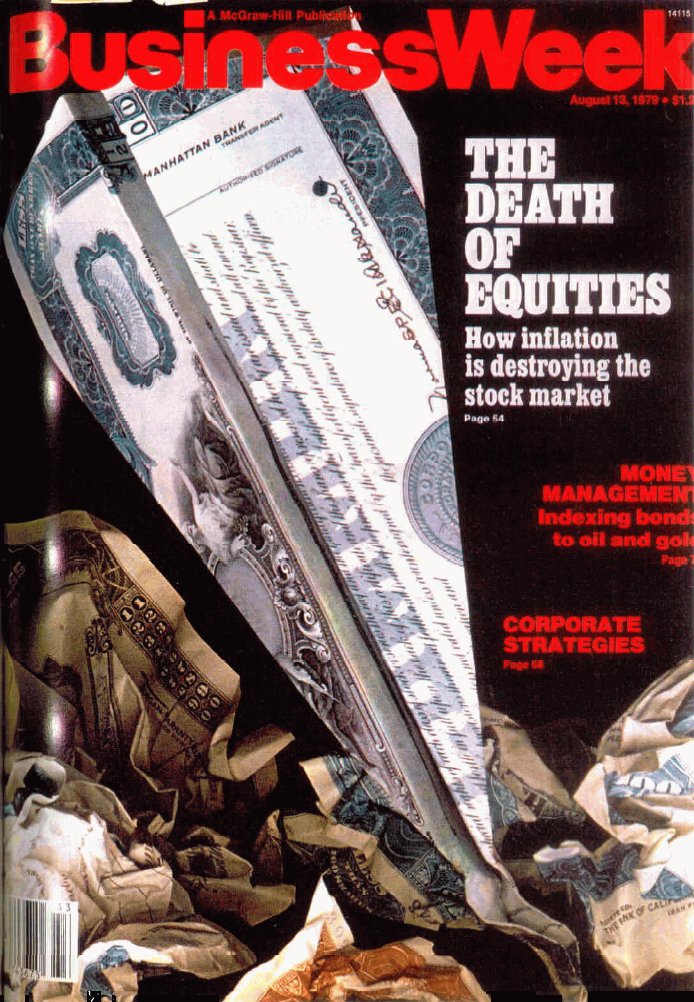

1/ THREAD: Magazine cover predictions, shoeshine boy tips, and other questionable calls

"On Aug 13, 1979, the front cover of Business Week featured a crumpled share certificate in the shape of a crashed paper dart: ‘The Death of Equities.‘ "

"On Aug 13, 1979, the front cover of Business Week featured a crumpled share certificate in the shape of a crashed paper dart: ‘The Death of Equities.‘ "

https://twitter.com/ReformedTrader/status/1308179924230877184

2/ Business Week's dot-com bubble prediction:

https://twitter.com/ReformedTrader/status/1308180840988336128

3/ "Each bull market has its rationale. In 1987, it was that since Japanese stocks were more absurd at 60x earnings, U.S. stocks were held to be safe.

"A bull market is a bit like falling in love: it has never happened to anyone before."

"A bull market is a bit like falling in love: it has never happened to anyone before."

https://twitter.com/ReformedTrader/status/1315099062383771648

4/ 1967: "The Go-Go era reached an epitome with Fred Carr. Carr invested in tiny growth companies and letter stock (unregistered shares, often of highly dubious companies, marked to absurd valuations). He was lionized in the press as “cool and decisive.”

https://twitter.com/ReformedTrader/status/1312463632828002306

5/ Back to Business Week's 1979 prediction ('The Death of Equities'):

In 1983, Business Week flips its stance:

https://twitter.com/ReformedTrader/status/1308179536127827968

In 1983, Business Week flips its stance:

https://twitter.com/ReformedTrader/status/1313586802662338560

6/ "The American media had been wrong on the war from the beginning. Fed by the U.S. War Department, the New York Times in the first weeks after Pearl Harbor was exaggerating small successes of the allies and under-reporting damage to the Pacific fleet."

https://twitter.com/ReformedTrader/status/1283504222307143680

7/ "Predictions from the Iowa Electronic Markets, in which speculators bet on election outcomes, have been much better than those of political pundits and polls. Three-quarters of the time, the IEM was more accurate than results of pre-election polls."

https://twitter.com/ReformedTrader/status/1283507793308221440

8/ Academic research also often seems to be oversimplified and misunderstood when summarized by the media. One example:

https://twitter.com/CliffordAsness/status/1316113936312406019

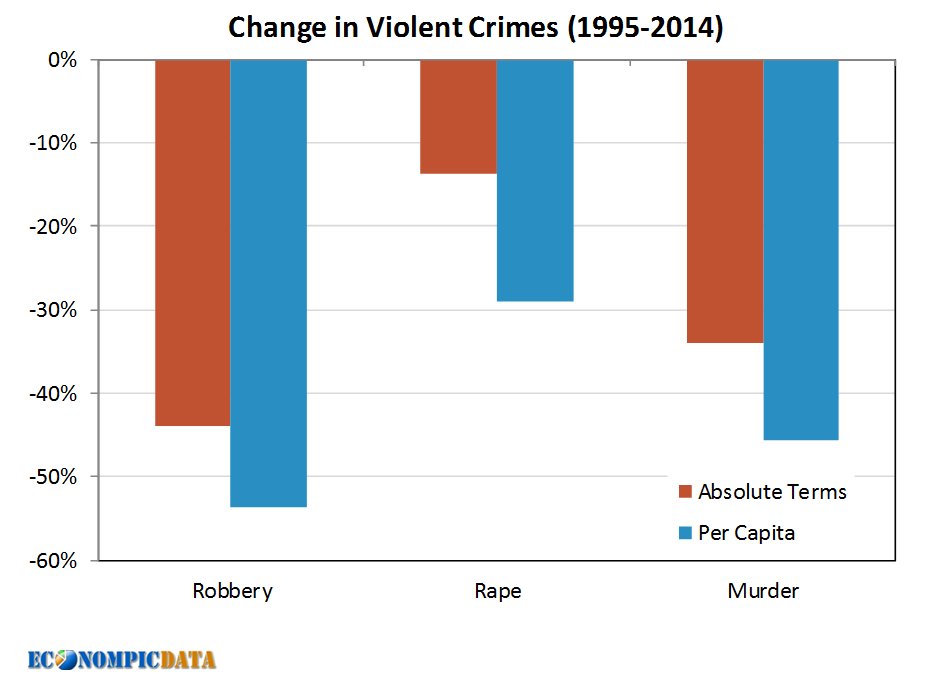

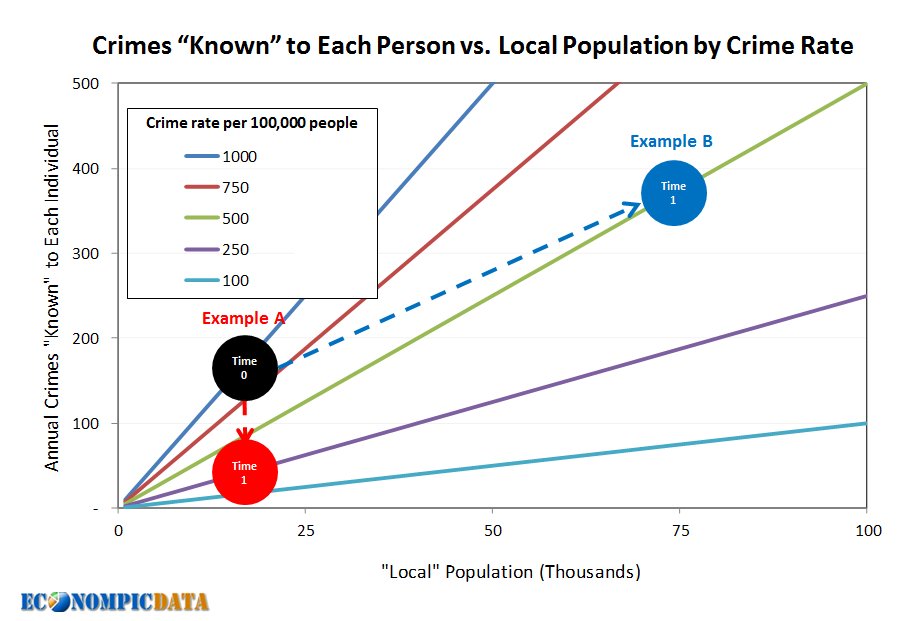

11/ "When the world becomes your local neighborhood [via increasingly worldwide media coverage], a 50% decline in the violent crime rate over the last two decades still means there are tens/hundreds of thousands more opportunities each day to freak out."

https://twitter.com/EconomPic/status/755458531331932160

12/ Flashy stuff wins more attention but lower returns:

https://twitter.com/ReformedTrader/status/1226256259285827585

14/

...

“Why do I believe [whatever]?”

For fiat thought, the answer is always some permutation of “because someone told me so.” Maybe that’s a politician. Maybe it’s a business leader. Maybe it’s a public intellectual or “thought leader.”

...

...

“Why do I believe [whatever]?”

For fiat thought, the answer is always some permutation of “because someone told me so.” Maybe that’s a politician. Maybe it’s a business leader. Maybe it’s a public intellectual or “thought leader.”

...

https://twitter.com/ReformedTrader/status/1106304906481143808

18/ "Contrary to his media image as an investment guru, he has massively underperformed the index over the past 20 years. This hasn't prevented raising tens of billions of dollars: he is always in the papers visiting and opining on emerging market."

https://twitter.com/ReformedTrader/status/1209596018339115008

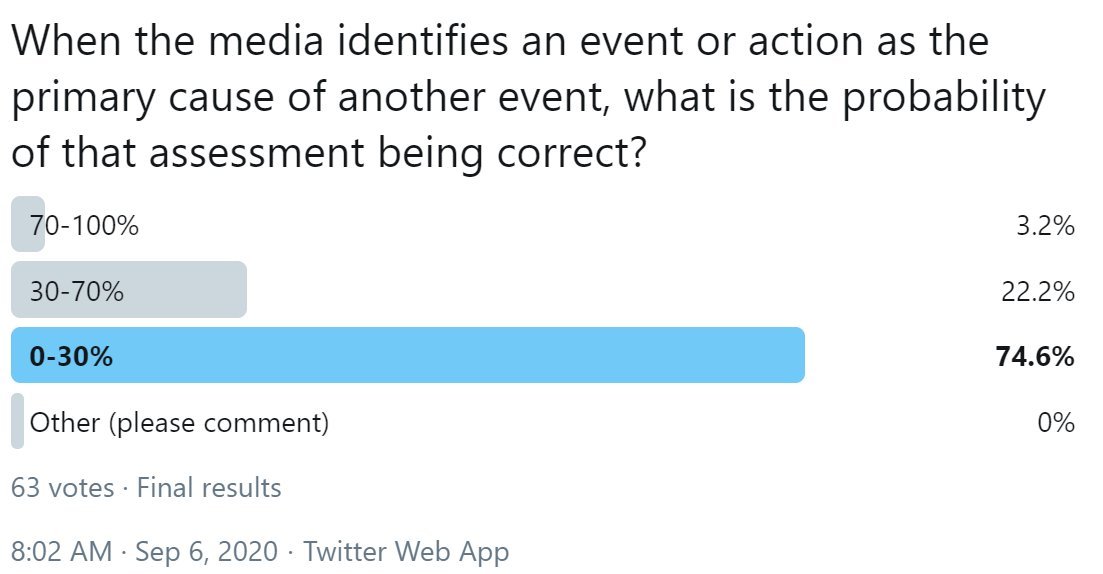

19/ "When the media identifies an event or action as the primary cause of another event, what is the probability of that assessment being correct?"

https://twitter.com/ReformedTrader/status/1303080770571886592

20/ "Media coverage relates positively to perceptions about the economy. Partisan bias produces a 7-9% difference in survey respondents viewing the economy as getting better."

https://twitter.com/ReformedTrader/status/1263925357427609600

21/ "If you were wondering why scientific studies contradict each other all the time, this is why."

https://twitter.com/ReformedTrader/status/1073276039642570752

https://twitter.com/SteveStuWill/status/1069756255835586560

22/ "We jump from bullet point #1 to a currently popular proposed solution without considering all the healthy debate that needs to happen in between.

"Social and news media degenerate to name-calling. Result: less cooperation and understanding."

"Social and news media degenerate to name-calling. Result: less cooperation and understanding."

https://twitter.com/ReformedTrader/status/1090387294983319552

23/ "Negative news gains eyeballs (and sells ads).

"Highlighting positives can sap profits. So if you think, “All I hear or read is bad news!” that’s probably true! But it’s not necessarily because all is bad in the world. It’s media firms making money."

"Highlighting positives can sap profits. So if you think, “All I hear or read is bad news!” that’s probably true! But it’s not necessarily because all is bad in the world. It’s media firms making money."

https://twitter.com/ReformedTrader/status/1309876755310682114

24/ "Most of the world (including the media) just looks at raw returns without adjusting for risk (and then get excited about stock A, B, or C). Sometimes they even look at arithmetic returns one year at at time without considering compounding. It's sad."

https://twitter.com/lhamtil/status/1113435821145841664

25/ "The media actively shape public attention and categories of thought, and they create an environment within which the speculative market events we see are played out." -Robert Shiller

https://twitter.com/ReformedTrader/status/1030523665257881600

27/ "The examples presented to us by mass media and social media typically are of the more extreme and questionable variety. That's what tends to get people's attention and makes the world look extremely polarized - and possibly polarizING."

https://twitter.com/juliagalef/status/1107818464150876160

30/ "Ignore the forecasts of Wall Street strategists. There are three types of forecasters: those that don’t know where the market is going, those that don’t know they don’t know, and those that know they don’t know but get paid a lot to pretend they do."

https://twitter.com/larryswedroe/status/1322171688700837893

• • •

Missing some Tweet in this thread? You can try to

force a refresh