For pivot point enthusiast:

Have done some data analysis on where nifty opens and where it closes in terms of pivot points. Have used 2 parameters

Where nifty opens-[above pivot, above R1, below pivot, below S1]

Where nifty closes-[abv pivot, abv R1, below pivot, below S1] (1/5)

Have done some data analysis on where nifty opens and where it closes in terms of pivot points. Have used 2 parameters

Where nifty opens-[above pivot, above R1, below pivot, below S1]

Where nifty closes-[abv pivot, abv R1, below pivot, below S1] (1/5)

example looking at open location data : -

Opened above pivot - 44%

Opened below pivot - 30%,

Opened above R1 - 18%

Opened below S1 - 8%

If we further breakdown each category in to where nifty closed that day for each category [where it opened] we get few datapoints.. (2/5)

Opened above pivot - 44%

Opened below pivot - 30%,

Opened above R1 - 18%

Opened below S1 - 8%

If we further breakdown each category in to where nifty closed that day for each category [where it opened] we get few datapoints.. (2/5)

Few observations[not all]..

When nifty opens above R1 there is 80% chances it will close above pivot point

When nifty opens below S1 there are 87% chances it will close below pivot point

When nifty open below S1 then there are only 7% chances it will close above R1

(4/5)

When nifty opens above R1 there is 80% chances it will close above pivot point

When nifty opens below S1 there are 87% chances it will close below pivot point

When nifty open below S1 then there are only 7% chances it will close above R1

(4/5)

How you can use??

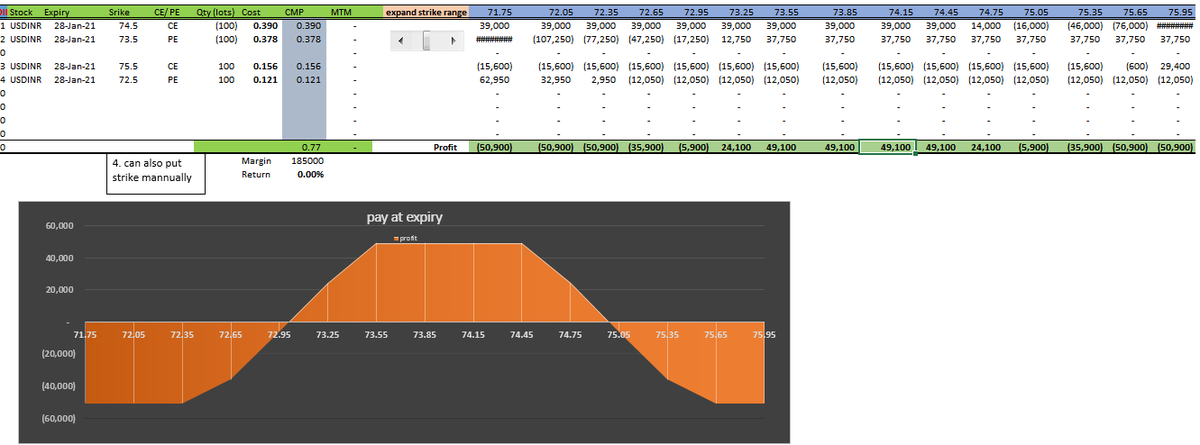

Can be used in strike selection for intraday option selling.

knowing the probability of where it will close looking at open type.

Use your creativity - there are many ways you can use this data.@jitendrajain @yogeeswarpal

(5/5)

Can be used in strike selection for intraday option selling.

knowing the probability of where it will close looking at open type.

Use your creativity - there are many ways you can use this data.@jitendrajain @yogeeswarpal

(5/5)

These are daily pivot points

• • •

Missing some Tweet in this thread? You can try to

force a refresh