1/ How do you save for retirement when interest rates fall through the floor? You have three (not great) options: You can save more, take more investment risk, or (try to) work longer. qz.com/1916348/with-i…

2/ Ben Carlson at @RitholtzWealth says his firm has “racked our brains forever” about how retirement savers should deal with rock-bottom rates. 10-year Treasury bonds are in negative territory when you account for inflation, which has been known to happen.

3/ Giulio Renzi Ricci at @Vanguard_Group says Treasuries are still a shock absorber and a haven when times get tough. But you have to dial back your expectations. The standard portfolio of 60% stocks and 40% bonds isn’t going to return what it used to. qz.com/1916348/with-i…

4/ Jared Woodard at @BankofAmerica says the 60-40 portfolio was dead in 2019 and still dead in 2020. A dollar invested in the entire US stock market in 1950 would be worth $1,763 now, while a dollar in a 60-40 portfolio would have only risen to about $535. qz.com/1916348/with-i…

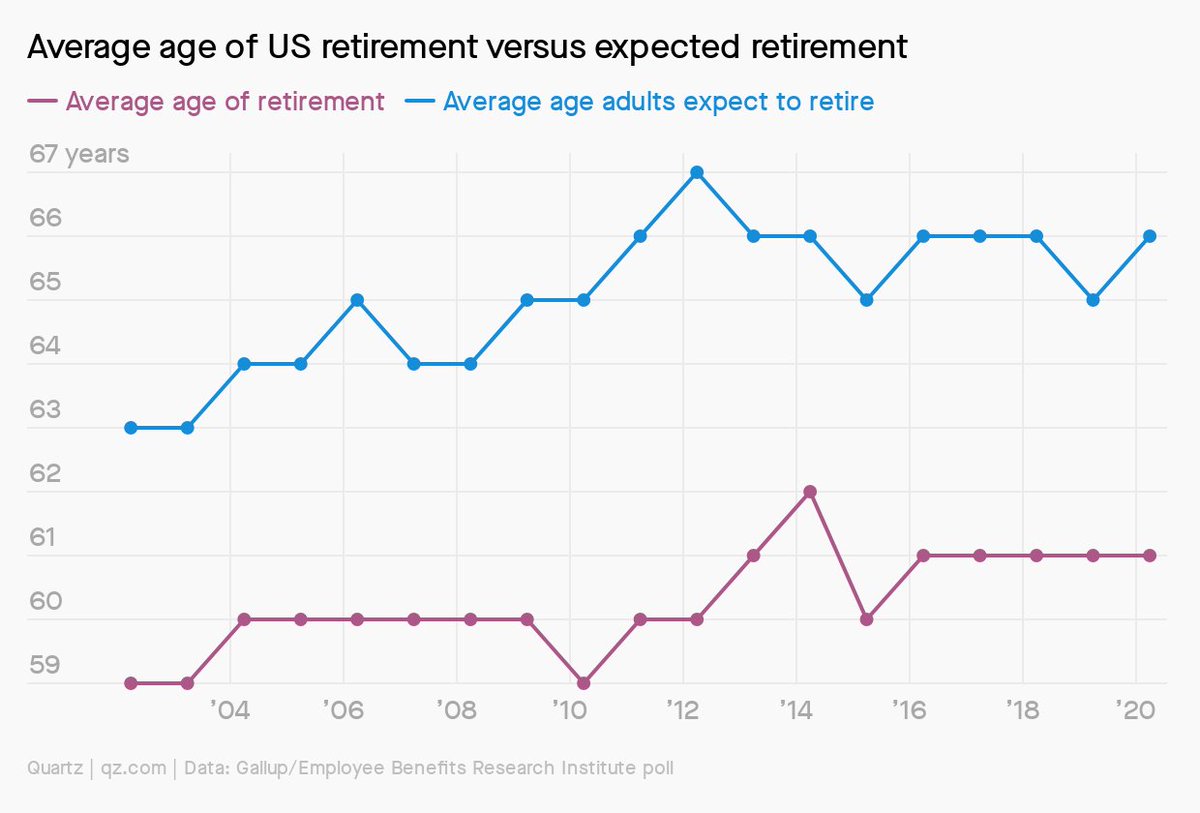

5/ If you can’t afford to save more and you're nervous about stock market risk, then you can try to work longer. But beware. Ppl tend to leave their careers earlier than expected. Maybe because of health, maybe because they lose their jobs.

6/ Carlson at @RitholtzWealth suspects a lot of Americans will end up trying to work longer, and many will end up relying on Social Security more than expected. SS is a major source of income for about 58% of retirees. qz.com/1916348/with-i…

7/ When it comes to retiring, the answer is there is no easy answer. But the sooner you start saving and optimizing your investments, the better chance you’ll have to not outlive your savings. qz.com/1916348/with-i…

8/8 A huge thank you to @awealthofcs, Giulio Renzi Ricci of @vanguard_group, @jaredwoodard, @ericbalchunas, @Gallup, Robert Williams at @schwabresearch, and @AllisonSchrager, whose 60-40 story has stood the test of time.

qz.com/1755700/the-60…

qz.com/1755700/the-60…

• • •

Missing some Tweet in this thread? You can try to

force a refresh