Random Friday history thread.

Today’s thread starts with a question: who is JPMorgan Chase, the largest bank in the United States, named after?

Today’s thread starts with a question: who is JPMorgan Chase, the largest bank in the United States, named after?

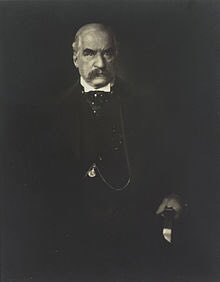

You likely know the first person: John Pierpont Morgan Sr.

Banker to many of the U.S.’s greatest industrialists and inventors, including Thomas Edison. Savior of the American economy during the Panic of 1907.

Banker to many of the U.S.’s greatest industrialists and inventors, including Thomas Edison. Savior of the American economy during the Panic of 1907.

But where does the ‘Chase’ in JPMorgan Chase come from?

Follow me down the rabbit hole:

It comes from Chase Manhattan Bank, which JPMorgan merged with in 2000.

Chase Manhattan was formed by the merger of the Chase National Bank and The Manhattan Company in 1955.

Follow me down the rabbit hole:

It comes from Chase Manhattan Bank, which JPMorgan merged with in 2000.

Chase Manhattan was formed by the merger of the Chase National Bank and The Manhattan Company in 1955.

The Manhattan Company was founded by Aaron Burr in 1799 with the ostensible aim of bringing clean water to New York City from the Bronx River but in fact, designed as a front for the creation of New York's second bank, rivaling Alexander Hamilton's Bank of New York.

Chase National Bank was formed in 1877.

It was named after a guy who had no affiliation with it and never worked as a banker.

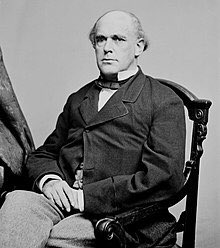

Our protagonist.

Salmon P. Chase.

It was named after a guy who had no affiliation with it and never worked as a banker.

Our protagonist.

Salmon P. Chase.

Here are 12 facts about Salmon Chase, as interesting and contradictory a historical figure as you’ll ever find...

#1 He was a Senator, Secretary of the Treasury, and Chief Justice of the Supreme Court, making him one of the few people in U.S. history to serve in all three branches of the federal government.

He was also governor of Ohio.

He was also governor of Ohio.

#2 He was a lawyer early in his career and became a leading supporter of abolition before, during, and after the Civil War.

He frequently defended runaway slaves in court, earning himself the nickname “Attorney General for Fugitive Slaves”.

He frequently defended runaway slaves in court, earning himself the nickname “Attorney General for Fugitive Slaves”.

#3 He was a central figure in the realignment of America’s political parties immediately before the Civil War.

He left the Whig Party, founded the Liberty Party, founded the Free Soil Party (with Martin Van Buren), and eventually helped form the Republican Party in 1854.

He left the Whig Party, founded the Liberty Party, founded the Free Soil Party (with Martin Van Buren), and eventually helped form the Republican Party in 1854.

#4 He wanted to be President, like super super bad. It consumed him.

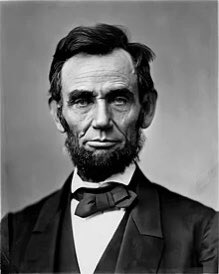

He ran for the Republican nomination for President in 1860, but he (and another contender, William Seward) lost to a guy you may have heard of...

He ran for the Republican nomination for President in 1860, but he (and another contender, William Seward) lost to a guy you may have heard of...

#5 Lincoln saw an opportunity to neutralize his political foes and enlist their talents for his administration.

He nominated Seward to be Secretary of State and Chase to be Secretary of the Treasury.

#TeamofRivals

Over time Seward grew to respect Lincoln. Chase not so much...

He nominated Seward to be Secretary of State and Chase to be Secretary of the Treasury.

#TeamofRivals

Over time Seward grew to respect Lincoln. Chase not so much...

#6 But, he was a kick-ass Treasury Secretary.

He basically created the modern, national banking system in order to sell treasury bonds to finance the war.

He also oversaw the creation and distribution of the first paper currency in the U.S.

He basically created the modern, national banking system in order to sell treasury bonds to finance the war.

He also oversaw the creation and distribution of the first paper currency in the U.S.

#7 But he was also, still, obsessed with the idea of being President.

He used his position at Treasury to consolidate his political power. He put his own face on the paper currency he was printing (including the $1 bill) so people would recognize him.

He used his position at Treasury to consolidate his political power. He put his own face on the paper currency he was printing (including the $1 bill) so people would recognize him.

#8 He offered his resignation 3 times, trying to get free of the Cabinet so he could run for the 1864 nomination.

Lincoln rejected him the first 3 times, but accepted the 4th offer in 1864 (after Lincoln was renominated) and then he nominated Chase to the Supreme Court.

Lincoln rejected him the first 3 times, but accepted the 4th offer in 1864 (after Lincoln was renominated) and then he nominated Chase to the Supreme Court.

#9 This effectively sidelined Chase as a political rival and mollified the radical wing of the Republican Party, who were ambivalent about Lincoln, loved Chase, and hated Roger Taney (the recently deceased, pro-slavery Chief Justice).

Lincoln was a goddamn genius.

Lincoln was a goddamn genius.

#10 As Chief Justice, Chase did good things (admitted John Rock as the first African-American attorney to argue before the Supreme Court) and bad things (dismissed the treason case against Jefferson Davis).

The bad stuff was almost always the product of his ambition.

The bad stuff was almost always the product of his ambition.

#11 He served on the Supreme Court until his death, but he never stopped trying to be President.

He tried to get the nomination of the (pro-slavery) Democratic Party in 1868 and he tried to challenge Grant’s re-election in 1872.

Both attempts failed and he died in 1873.

He tried to get the nomination of the (pro-slavery) Democratic Party in 1868 and he tried to challenge Grant’s re-election in 1872.

Both attempts failed and he died in 1873.

#12 Salmon Chase’s portrait appears on the $10,000 bill, the largest denomination of U.S. currency ever publicly circulated.

The bill was last printed in 1945 and, as of 2009, only 336 $10,000 bills remain unaccounted for.

Perhaps JPMorgan Chase has them...

The bill was last printed in 1945 and, as of 2009, only 336 $10,000 bills remain unaccounted for.

Perhaps JPMorgan Chase has them...

• • •

Missing some Tweet in this thread? You can try to

force a refresh