"How Apprenticeship, Reimagined, Vaults Graduates Into Middle Class" wsj.com/articles/how-a…

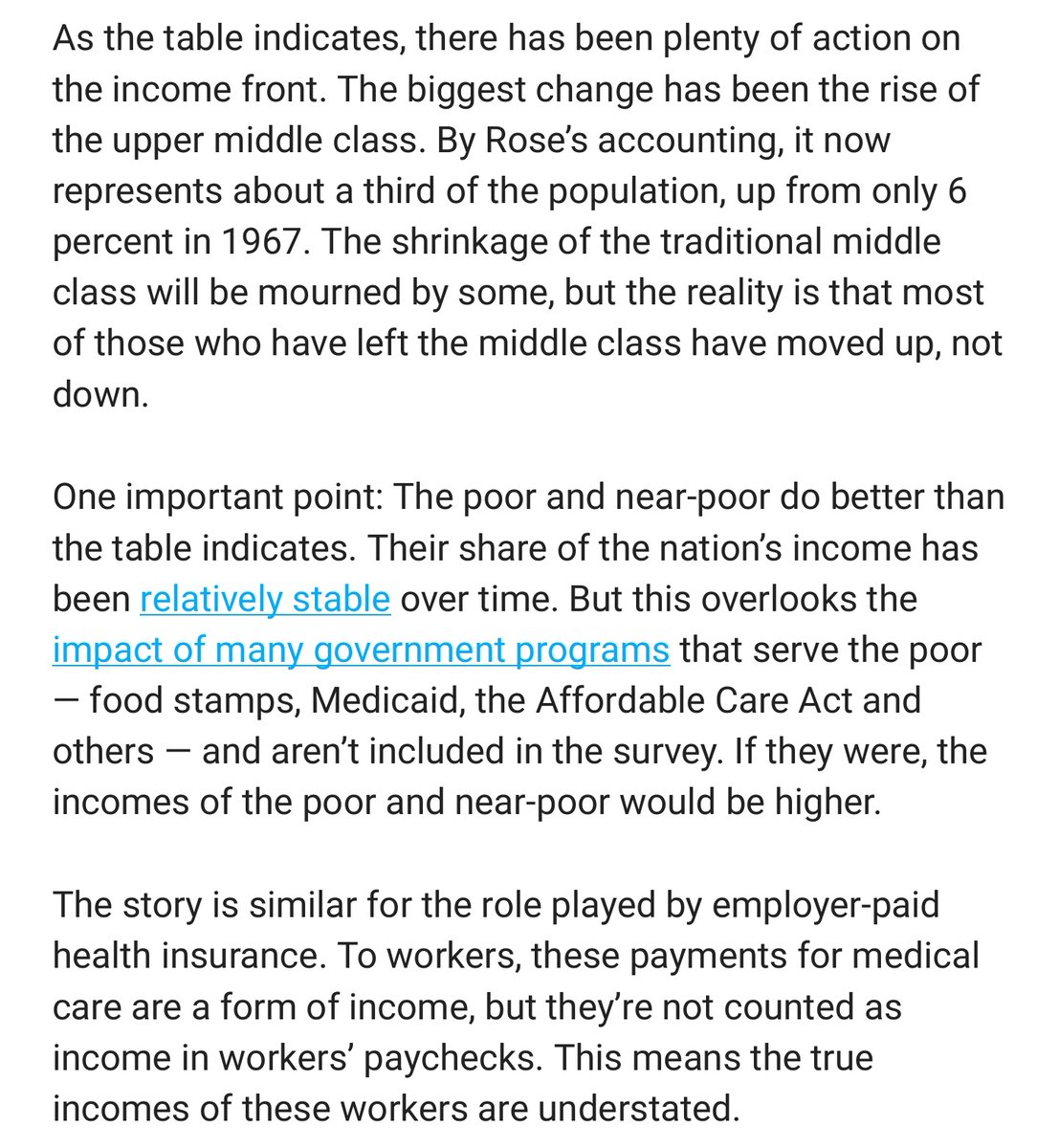

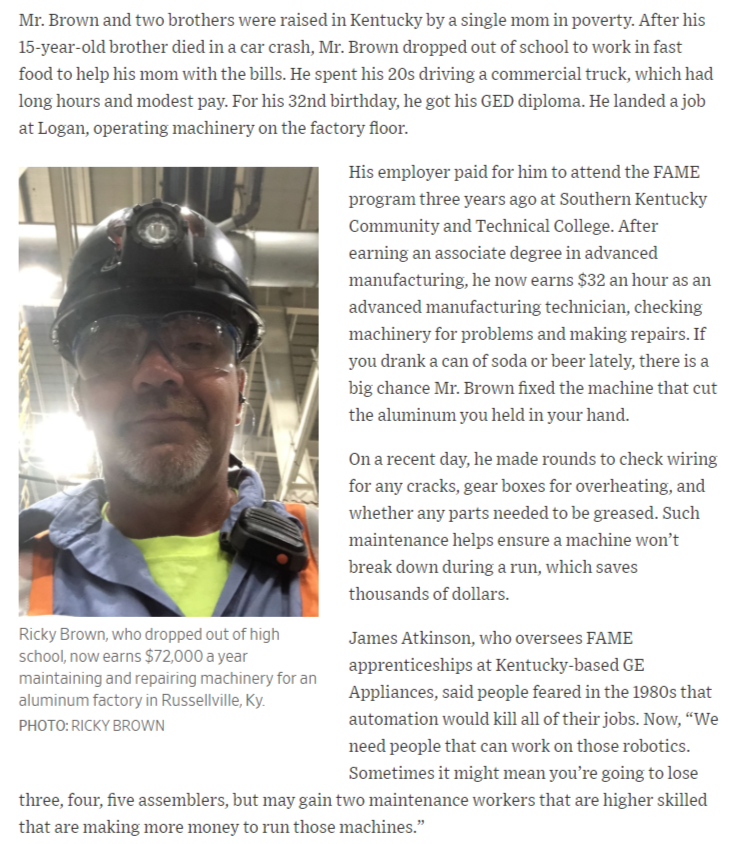

Neat look at the employer-funded FAME program (started by Toyota & others), which promotes modern ("grey collar") skills w/out a college degree. Love that last line.

Neat look at the employer-funded FAME program (started by Toyota & others), which promotes modern ("grey collar") skills w/out a college degree. Love that last line.

The new @BrookingsInst / @opp_america study re the FAME program's success is here: opportunityamericaonline.org/wp-content/upl…

Also noteworthy from that WSJ story: a foreign-owned auto company (which relies on domestic/imported inputs) started the FAME program, AND the highlighted FAME graduate (Mr. Brown) worked for an industry (beverage cans) harmed by... aluminum tariffs.

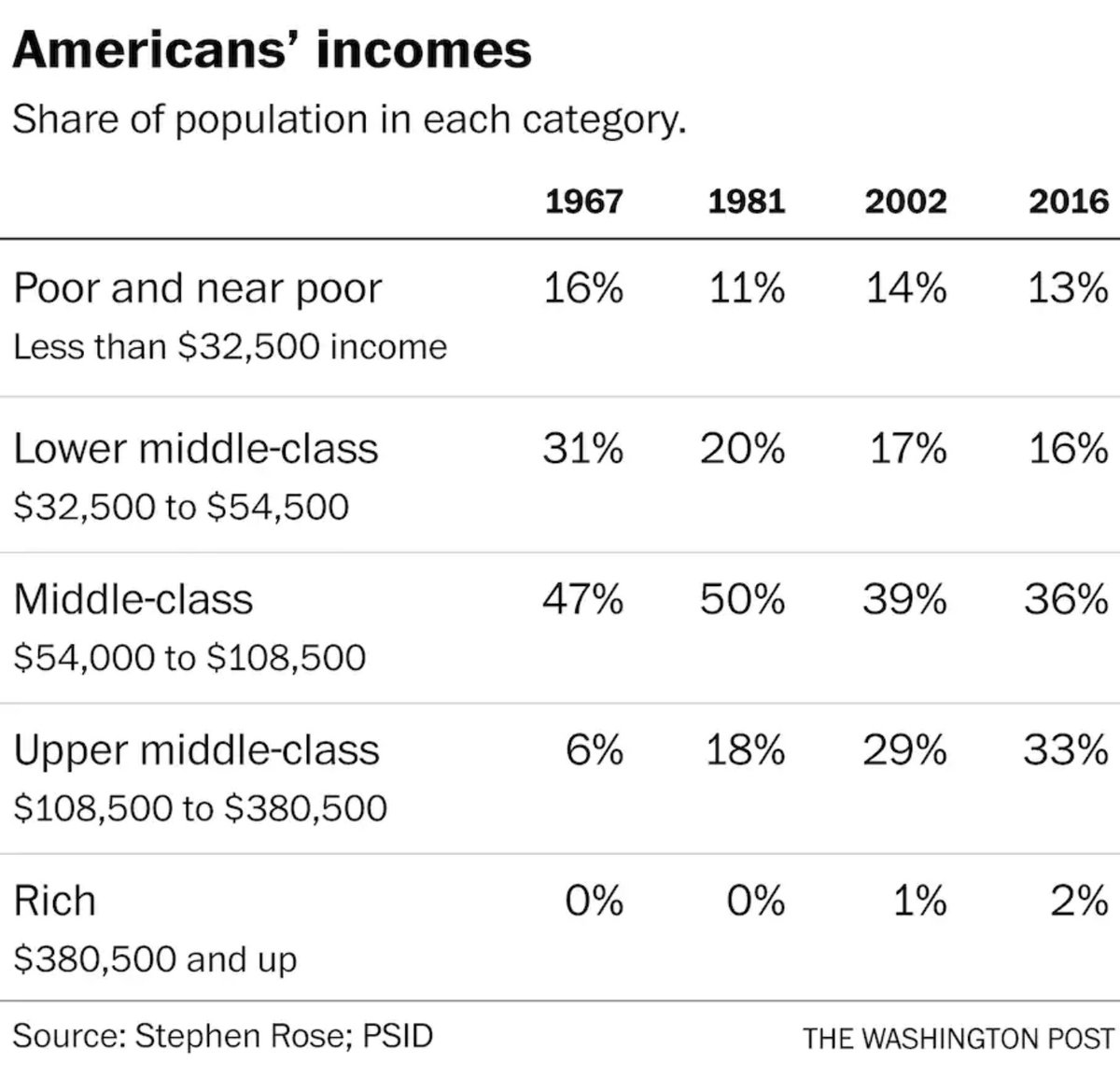

So maybe instead of, you know, closing down America and trying to recreate the industries/jobs of the 1970s, we - you know - remain wide open and let employers/workers prepare for the industries/jobs of the 2020s and beyond?

• • •

Missing some Tweet in this thread? You can try to

force a refresh