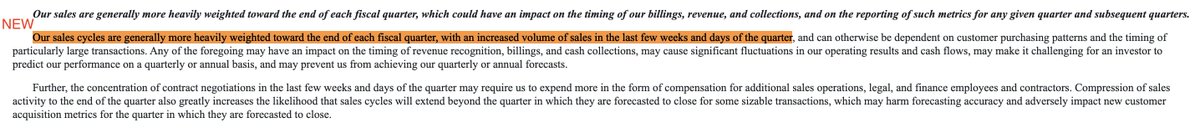

Robert Smith, a co-founder of Vista Equity Partners, recently signed a non-prosecution agreement over alleged tax fraud. Two lawsuits filed by independent directors of Vista’s portfolio companies suggest much bigger problems at the private equity giant.

<thread>

<thread>

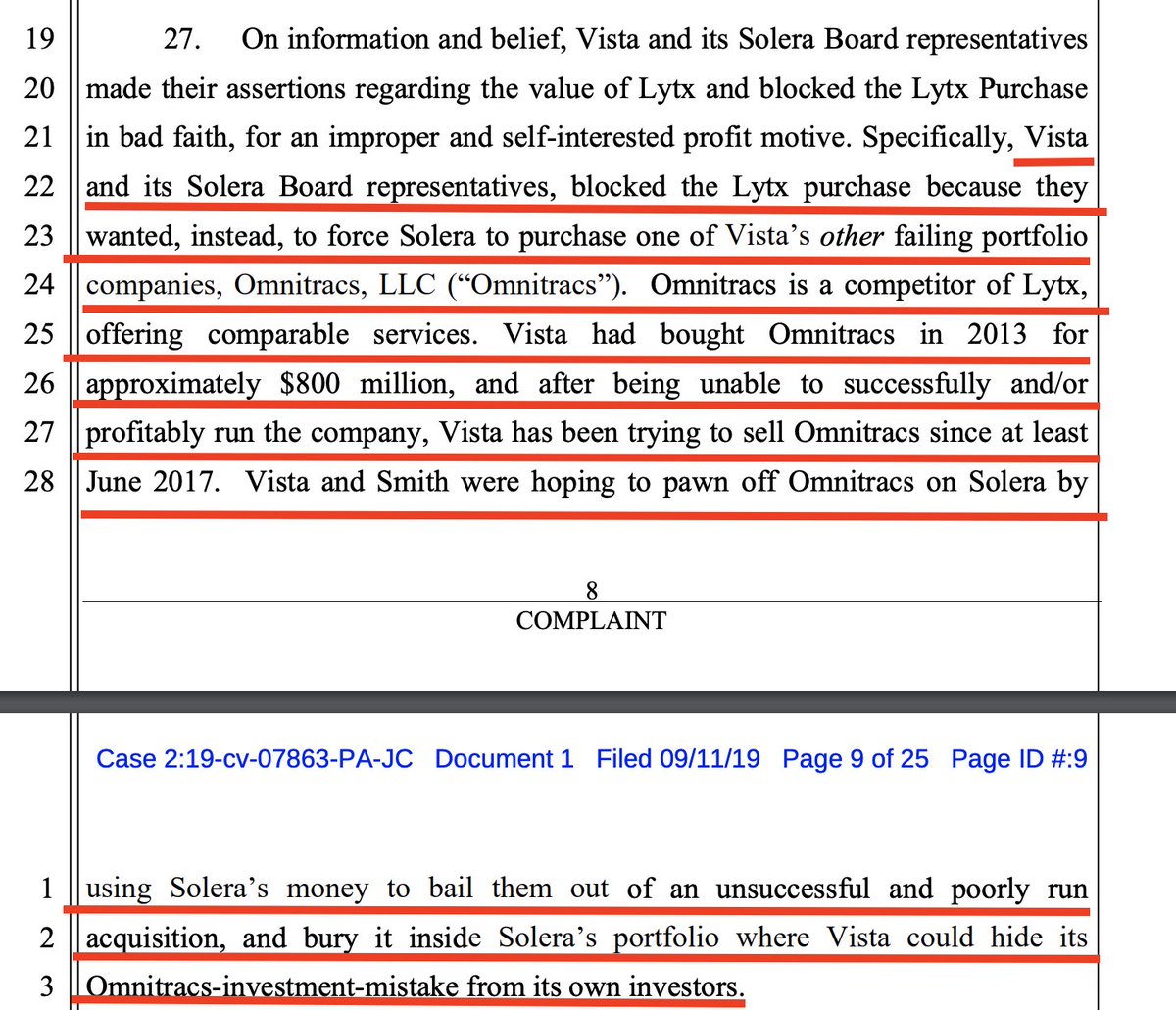

In a 2019 lawsuit, an independent director at Solers Holdings (52% owned) detailed how Vista pushed the related-party acquisition of Omnitracs over Lytx.

The lawsuit also alleged that “Vista’s actions appear designed to mislead current and future investors concerning Vista’s performance” and highlighted an unnamed investment that had $50 million in EBITDA “reduced to zero” after Vista acquired it (see below).

This was not the first time Vista tried to have Solera acquire a Vista-affiliated company. According to the lawsuit, Vista pushed Solera to acquire DealerSocket, which Vista owned.

Earlier this year, the founder of DealerSocket, which provides customer management software for car dealerships, also sued Vista and alleged Vista engaged in “lies, secrets, value manipulation, minority shareholder oppression, bullying, and cover-ups.”

The central issue in the lawsuit was that Vista manipulated the valuation of DealerSocket and diluted minority shareholders at a depressed valuation.

According to the lawsuit in just two months the valuation of DealerSocket fell 95%.

According to the lawsuit in just two months the valuation of DealerSocket fell 95%.

According to the lawsuit, the non-Vista directors at DealerSocket sent an email to Vista directors requesting “an explanation for the drastic fluctuation in valuation” and other information.

In a text, a senior Vista employee said, “Email answers not going to happen”

In a text, a senior Vista employee said, “Email answers not going to happen”

The lawsuit stated, “The only thing clear about these wildly fluctuating valuations is that they lack transparency, accuracy and integrity…”

The lawsuit also claimed Vista's valuation firm was "not truly independent.”

The lawsuit also claimed Vista's valuation firm was "not truly independent.”

Vista's issues go much deeper than 280 characters.

Learn more about these issues, SEC scrutiny, and alleged ties to more criminals in my newsletter.

You can join for free and won't regret it.

thebearcave.substack.com

Learn more about these issues, SEC scrutiny, and alleged ties to more criminals in my newsletter.

You can join for free and won't regret it.

thebearcave.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh