1/ Every morning, millions of people around the world wake up, make their coffee, and check a few key numbers—200 points, $1,100 a troy ounce, $40 a barrel. Those numbers provide clues about how the markets are performing each day.

2/ We include these indicators at the top of every Morning Brew newsletter, but you don't need an MBA, PhD, or fleece vest to understand what they are, how they work, and why they matter

3/ Here's everything you need to know about the three main U.S. equities indexes as well as gold, oil prices, and Treasury notes.

4/ Dow Jones

What it is: The Dow Jones Industrial Average, aka the Dow, is a collection of 30 "blue-chip" U.S. stocks. Blue chip = big, established, and influential companies like Microsoft, JPMorgan, Disney, and McDonald's.

What it is: The Dow Jones Industrial Average, aka the Dow, is a collection of 30 "blue-chip" U.S. stocks. Blue chip = big, established, and influential companies like Microsoft, JPMorgan, Disney, and McDonald's.

5/ How it works: The Dow is weighted by share price, so higher-priced stocks have more influence on the index's total value.

6/ Price-weighting also means that if the price of any stock in the Dow changes by $1, it has the same impact on the index, even though a $1 increase to a stock worth $20 is more significant (relatively) than a $1 change to a stock worth, say, $40.

7/ During stock splits—when a company increases its number of outstanding shares and chops prices by the same factor—a company's influence in the Dow can fall even if their market value doesn't change.

8/ The Dow has some mechanisms to account for stock splits, but they can still lead to a shakeup in the index (like what happened last summer).

9/ Why it matters: At 124 years old, the Dow has had plenty of time to cement its reputation as a leading indicator of the stock market. But with only 30 stocks representing a smattering of U.S. corporate titans, it's not exactly representative.

10/ Nasdaq

What it is: The Nasdaq Composite is an index composed of 2,500+ stocks as well as other equities such as American depositary receipts and real estate investment trusts.

What it is: The Nasdaq Composite is an index composed of 2,500+ stocks as well as other equities such as American depositary receipts and real estate investment trusts.

11/ This can get a little confusing, because it's not the only Nasdaq: The Nasdaq Composite tracks securities on the Nasdaq exchange.

12/ How it works: Unlike the Dow, the Nasdaq weights by market cap (number of outstanding shares a company has multiplied by the share price), a setup that gives extra-large companies an extra-large impact.

13/ The Nasdaq is also heavily skewed toward tech companies, which account for nearly half the index's total value

14/ Why it matters: As the world's first electronic exchange, the Nasdaq has historically attracted more tech-focused companies.

15/ While the index tracks more stocks than the S&P and Dow combined, tech's heavy influence means the Nasdaq doesn't always illustrate how other industries are faring. The index can also be volatile because it includes more small, speculative companies.

16/ S&P 500

What it is: Investment company Standard & Poor's maintains an index of 500 stocks from the largest companies listed on the Nasdaq and New York Stock Exchange.

What it is: Investment company Standard & Poor's maintains an index of 500 stocks from the largest companies listed on the Nasdaq and New York Stock Exchange.

17/ To be eligible for consideration, companies have to meet certain criteria—including a market cap of $8.2+ billion, a U.S. headquarters, and positive earnings for at least four consecutive quarters. They can be kicked out if they slip

18/ How it works: Companies are weighted by their market cap, specifically their float-adjusted market cap (which only counts shares that are theoretically available for retail investors to buy).

19/ That means the S&P skews toward larger cap companies, and tech stocks now account for over a quarter of the index's total value.

20/ Why it matters: With 500 stocks covering a broad range of industries, the S&P is widely considered the best indicator of large-cap stocks in the U.S.

21/ While the S&P's weighting-by-market-cap method is more common than the Dow's weighting by share price, it does introduce some risk that overvalued stocks will inflate the overall index.

22/ Oil

What it is: Exactly what it sounds like. The North American crude oil benchmark, known as West Texas Intermediate (WTI), is one of three main oil benchmarks used around the globe.

What it is: Exactly what it sounds like. The North American crude oil benchmark, known as West Texas Intermediate (WTI), is one of three main oil benchmarks used around the globe.

23/ While WTI is sourced primarily from Texas, it's considered one of the highest-quality oils and is often refined into gasoline.

24/ How it works: WTI is the physical commodity behind oil futures contracts traded on the New York Mercantile Exchange. Oil futures = financial instruments that allow investors to buy "abstract oil."

25/ When the futures contract expires, that investment is converted into IRL oil, cashed out, or rolled into a future futures contract.

26/ Why it matters: Oil prices are affected by economic conditions, good ol' supply and demand, and geopolitical forces. The coronavirus pandemic caused a historic collapse in prices this spring, and while prices have stabilized, the outlook is shaky.

27/ Gold

What it is: With its use as a commodity tracing back to Ancient Lydian merchants over 2,500 years ago, gold has the most staying power of any indicator on this list.

What it is: With its use as a commodity tracing back to Ancient Lydian merchants over 2,500 years ago, gold has the most staying power of any indicator on this list.

28/ When investors talk about gold prices today, they're most likely referring to the price per ounce of gold bullion (those gold bars bad guys keep in briefcases).

29/ How it works: Gold is priced in U.S. dollars around the world. Investors can buy physical gold in the form of bullion or coins or go for more intangible gold securities, such as futures, ETF shares, or investments in gold mining companies.

30/ Why it matters: In a 21st century economy where currencies aren't pegged to the gold standard and credit cards are the medium of exchange, some investors argue gold is a relic

31/ But others turn to the metal for diversification or as a "safe-haven asset"—something to buy during times of geopolitical or economic uncertainty because it holds onto its value.

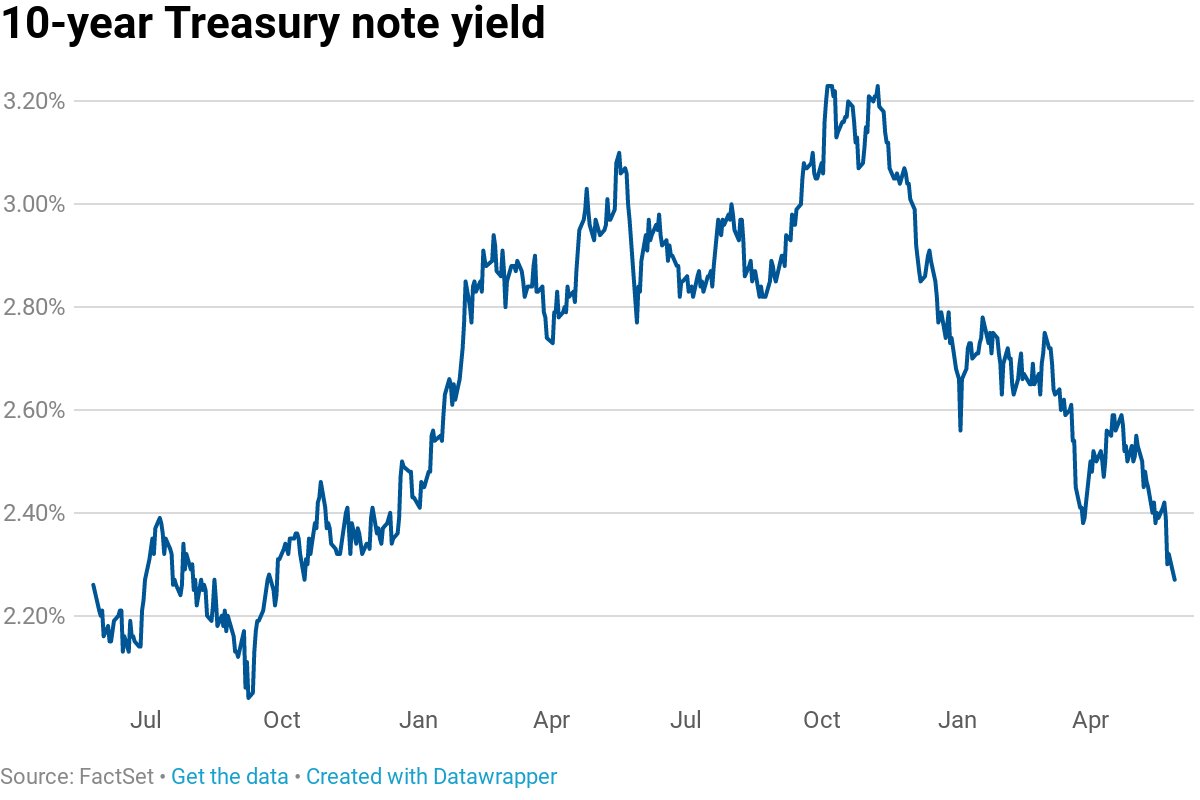

32/ 10-Year

What it is: The 10-year Treasury note is a debt instrument the U.S. government issues to fund itself. The Federal Reserve closely watches the "yield" (i.e. the return on investment) as a benchmark for other interest rates.

What it is: The 10-year Treasury note is a debt instrument the U.S. government issues to fund itself. The Federal Reserve closely watches the "yield" (i.e. the return on investment) as a benchmark for other interest rates.

33/ How it works: The U.S. Treasury issues bonds that are auctioned to investment banks by the Federal Reserve; banks can then sell those bonds to investors.

34/ The 10-year matures over—you guessed it—10 years, with interest paid out every six months until the full value is paid out at the end.

35/ Why it matters: The 10-year is considered another safe-haven asset for investors. But as demand goes up, the yield goes down.

36/ Investors can even end up paying more than the face value of the Treasury note (but some are willing to accept the tradeoff for the low-risk investment).

Credit to @its_ahickey for putting this epic guide together

read her full article here

morningbrew.com/daily/stories/…

read her full article here

morningbrew.com/daily/stories/…

37/ And that my friends is the Morning Brew Markets section, explained

Hope you learned something

Hope you learned something

• • •

Missing some Tweet in this thread? You can try to

force a refresh