Seems like a tie between 1984, Rationalist circling and LGBTQ rights discussion.

The answer is.. Rationalist Circling.

Thread for proof 👇

The answer is.. Rationalist Circling.

Thread for proof 👇

https://twitter.com/lillianmli/status/1319281201195069445

LGTBQ rights is a getting a lot of traction in the younger generation.

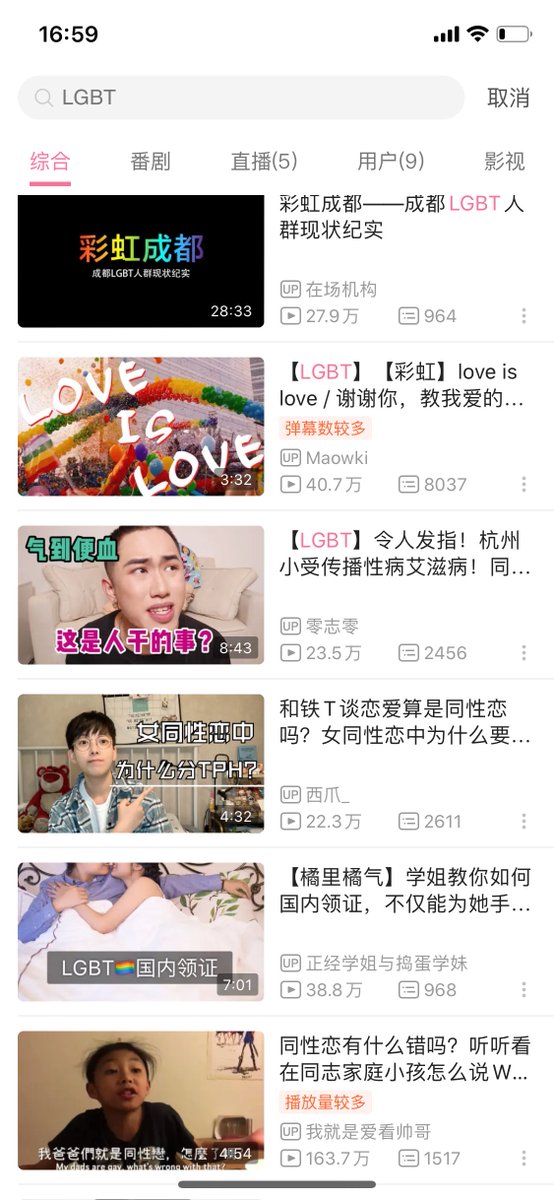

Quick search for Bilibili reveals the following results, all with 100K+ of views.

Also breaking into the mainstream with Alibaba running this supporting ad over lunar new year. scmp.com/news/china/soc…

Quick search for Bilibili reveals the following results, all with 100K+ of views.

Also breaking into the mainstream with Alibaba running this supporting ad over lunar new year. scmp.com/news/china/soc…

Anti-capitalist sentiment - again, plenty of Bilibili videos on how 'Capitalism must die' and 'The corruption of capitalism'.

• • •

Missing some Tweet in this thread? You can try to

force a refresh