1/x For US investors seeking investment ideas in the fast paced casino & betting sector, let me tell you about the most impressive company you've never heard of.

Evolution Gaming $EVO or $EVVTY is a $14.5B market leading B2B live casino & gameshow provider from Sweden.

Evolution Gaming $EVO or $EVVTY is a $14.5B market leading B2B live casino & gameshow provider from Sweden.

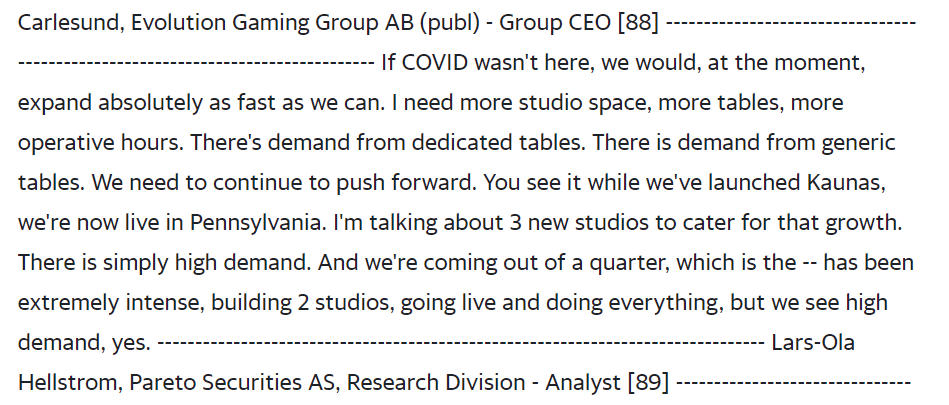

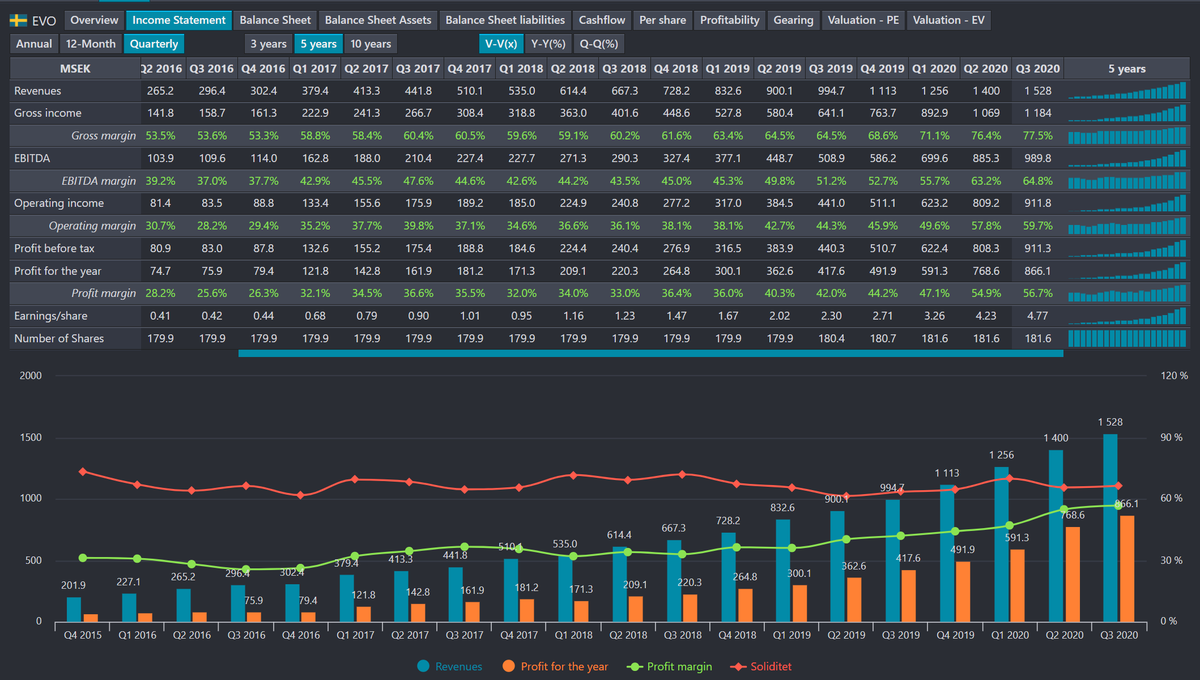

2/x A quick fundamental overview;

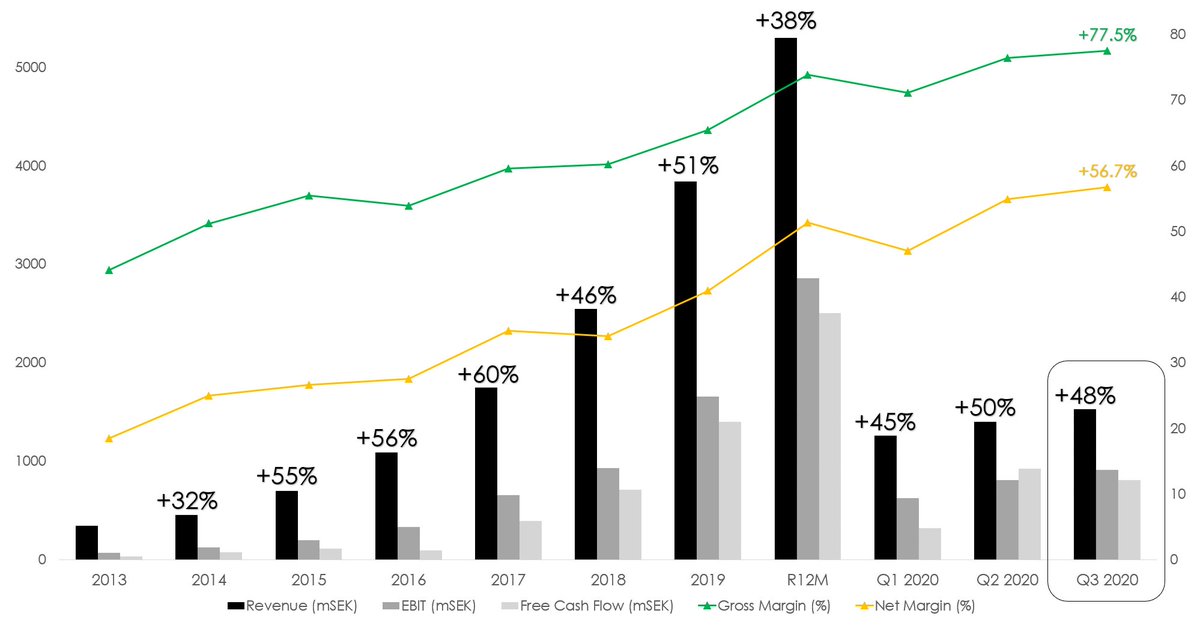

Growth CAGR 45% since 2013 and ~50% in 2020.

Gross marg. 70%

EBIT 60%

Net income 48%

FCF 45%

RoIC 160%

RoC 170%

RoE +60%

Net debt -38%

Almost all metrics above has been increasing *every quarter* since IPO (2015). Insane scalability.

Growth CAGR 45% since 2013 and ~50% in 2020.

Gross marg. 70%

EBIT 60%

Net income 48%

FCF 45%

RoIC 160%

RoC 170%

RoE +60%

Net debt -38%

Almost all metrics above has been increasing *every quarter* since IPO (2015). Insane scalability.

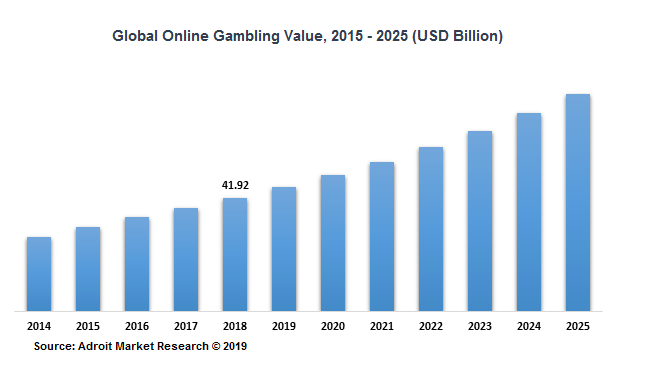

3/x Of the gigantic global casino market, live casino accounts for about 2% as of today according to CEO. And in 2019 the live segment of online casino represented about 20-25%. The whole market for LC (live casino) is growing at a ~30-40% clip, with EVO leading the pack.

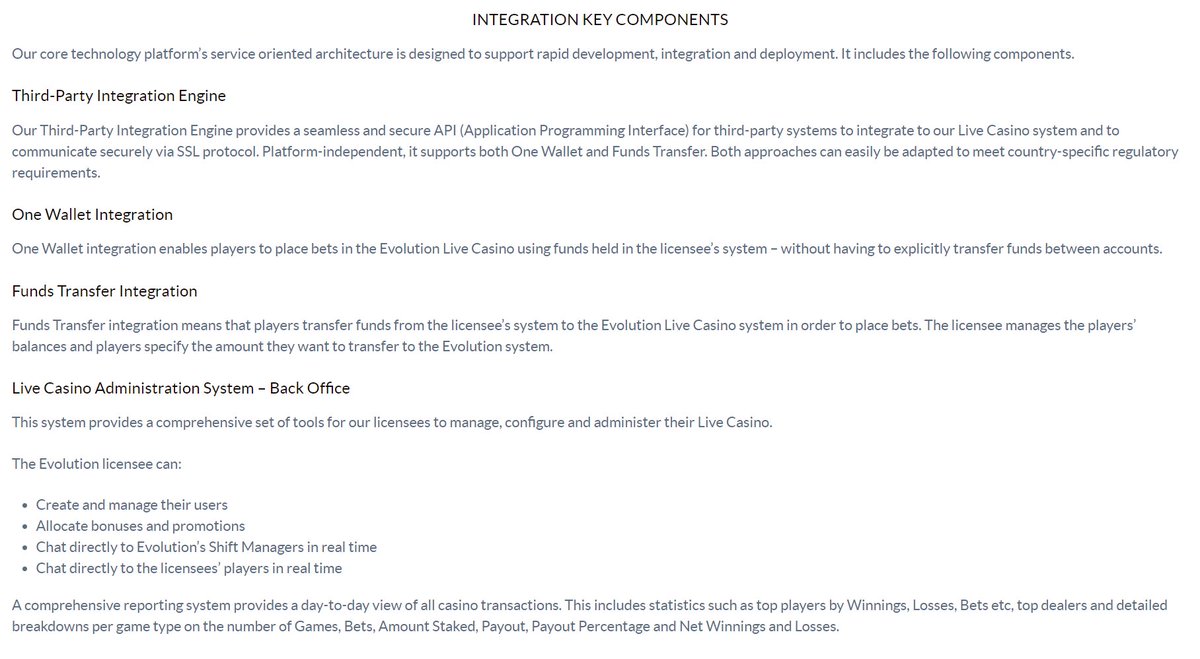

4/x The $EVO business model looks like this, where they deliver the complex customer optimized gaming experience to the gaming operators B2B (customers like $DKNG or $PENN), and then earn fees off their B2C gaming/gambling revenue.

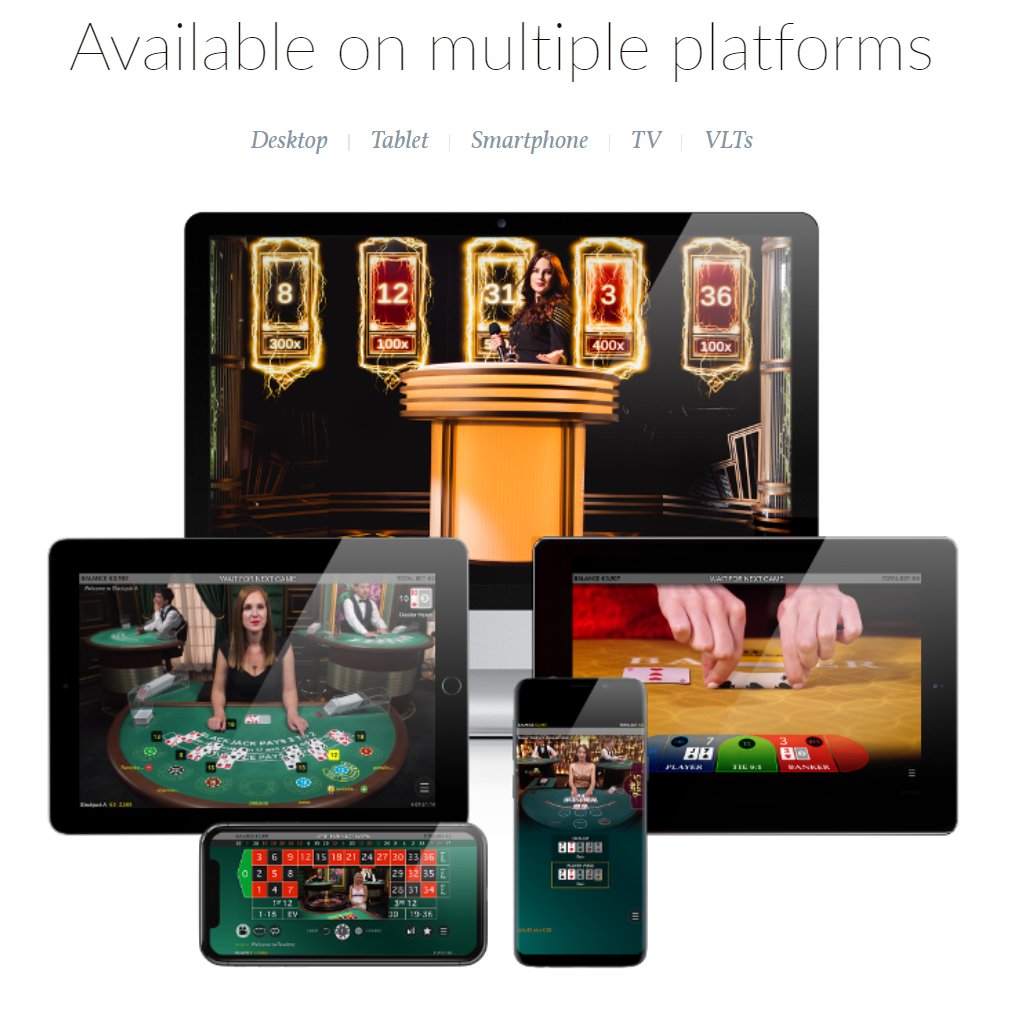

5/x The first thing that comes to mind when looking at the EVO casino games is "But, anyone can do that? Just film someone deal cards, let people bet and put it online", but after all these years of crushing competitors it's obviously *much* more technical than one thinks.

6/x The six pillars of the EVO business strategy is

*Product innovation

*Customer optimisation

*Operational excellence

*Regulated markets

*Land-based casinos

*Increase the gap (to competition)

Today they are by far the biggest LC player, and the gap just keeps getting bigger.

*Product innovation

*Customer optimisation

*Operational excellence

*Regulated markets

*Land-based casinos

*Increase the gap (to competition)

Today they are by far the biggest LC player, and the gap just keeps getting bigger.

7/x The innovative and transparent EVO company culture is well transmitted by their fantastic COO Todd Haushalter in this interview. I can't recommend this one enough if you love listening to inspiring people who really love what they do. open.spotify.com/episode/17x4ec…

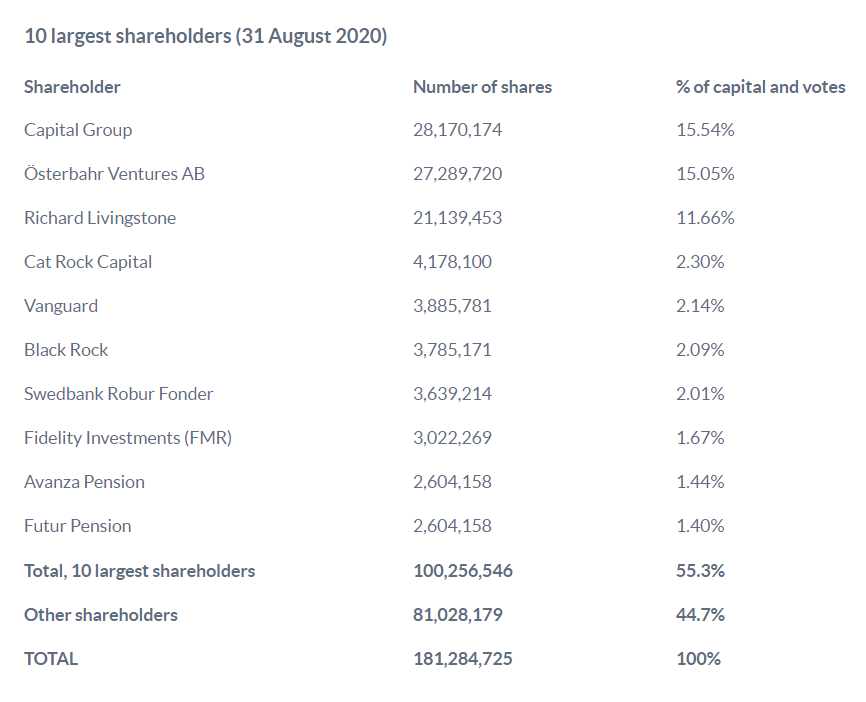

8/x Evolution has a great customer base with 300+ operators spanning all over the world with already mentioned big names like $DKNG, $PENN, Rush Street $DMYT. Both land based casinos who want to go online and the digitally native players choose Evolutions tailor made solutions.

9/x The "Live" in Live Casino is what's making the execution so hard for the providers, and also why the players are so much more engaged (i.e. spend more money). That is to combine the technical part, legal parts, money transfer parts as well as the physical studios together.

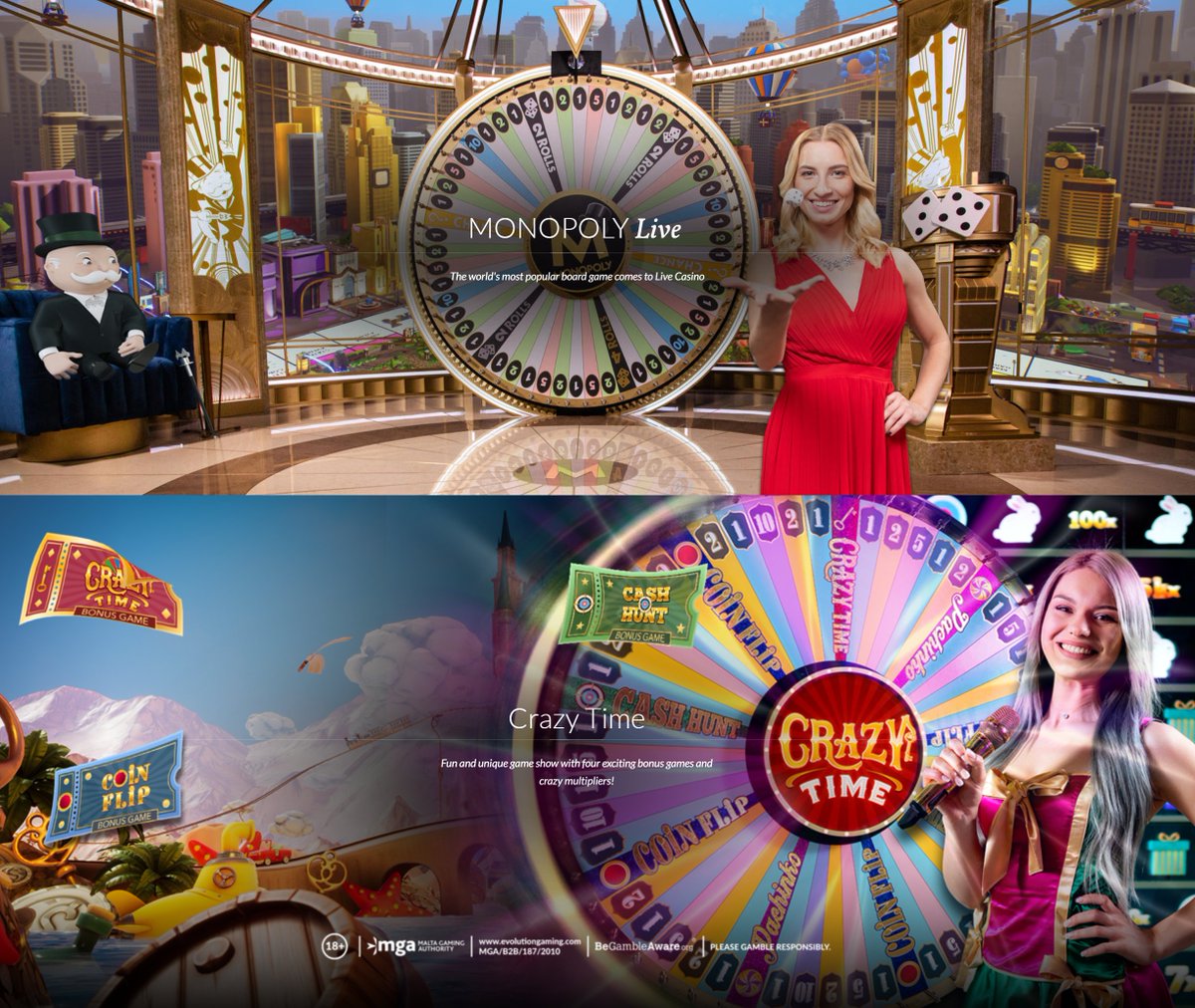

10/x Listening to COO Todd speak I think it's pretty safe to say that games like Monopoly Live and Crazy Time isn't the last LC innovations we will see from EVO. These games looks more like "the price is right" than classic betting/casino games, and is extremely popular.

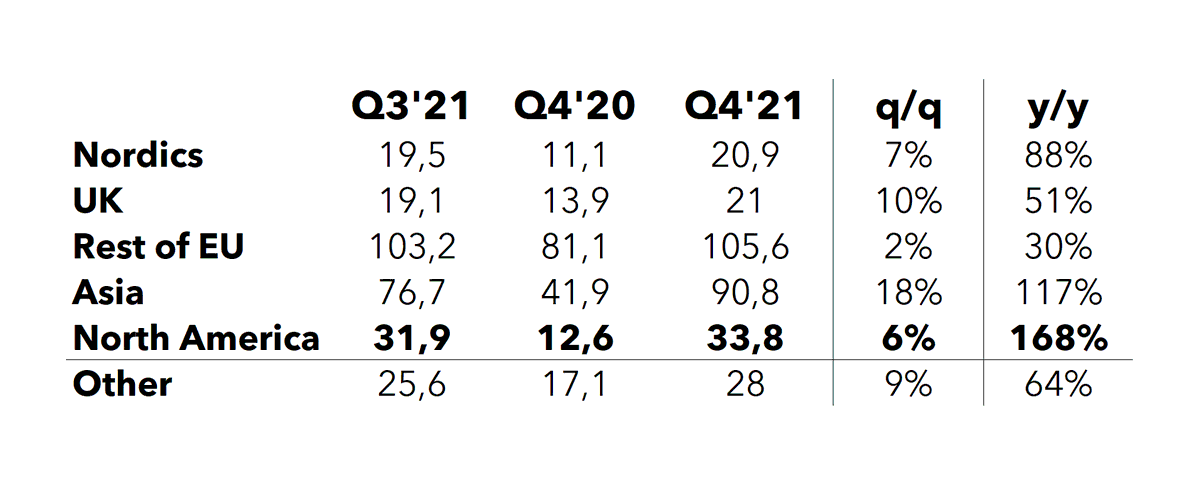

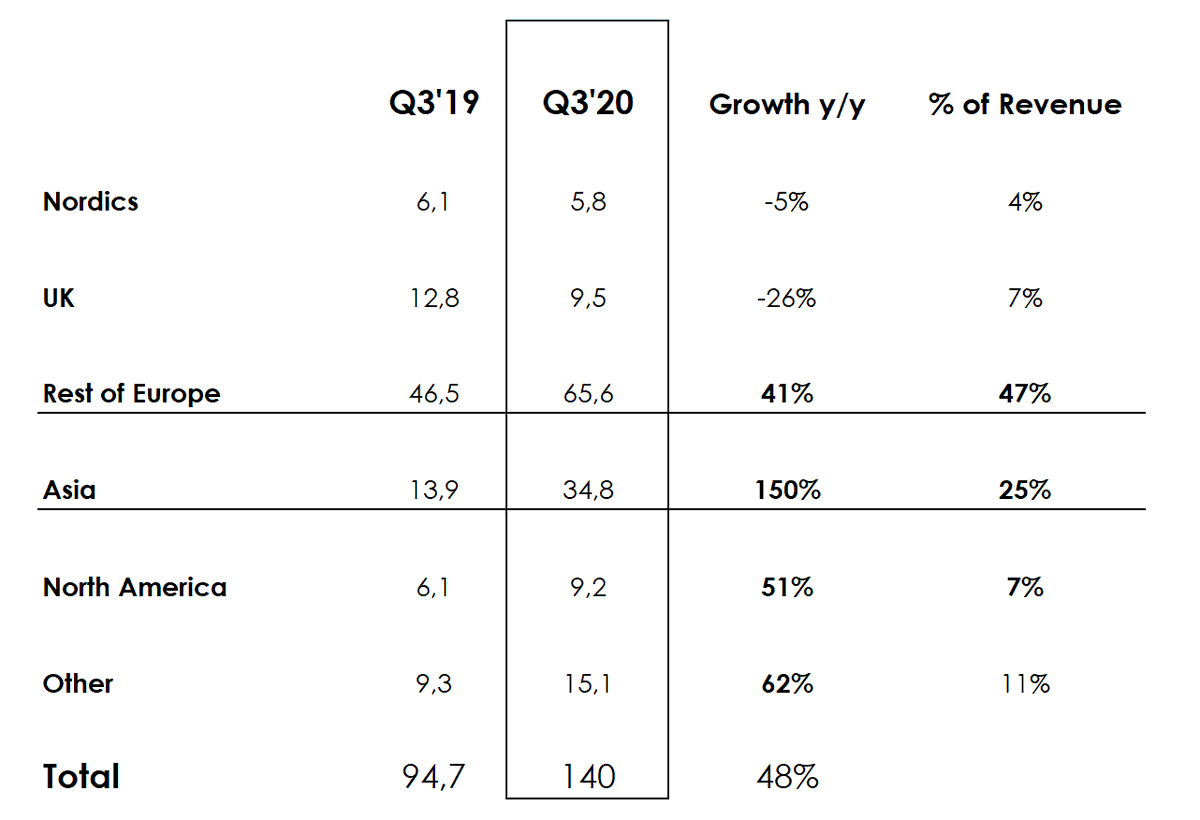

11/x The geographic revenue split looks like this (Q3 came last week). With the US market opening up and Asia growing (already 25% of revenue, up from 15% in Q3'19) like crazy I expect Evolution to have a huge growth runway ahead of them. The m/s in US is probably 100% atm.

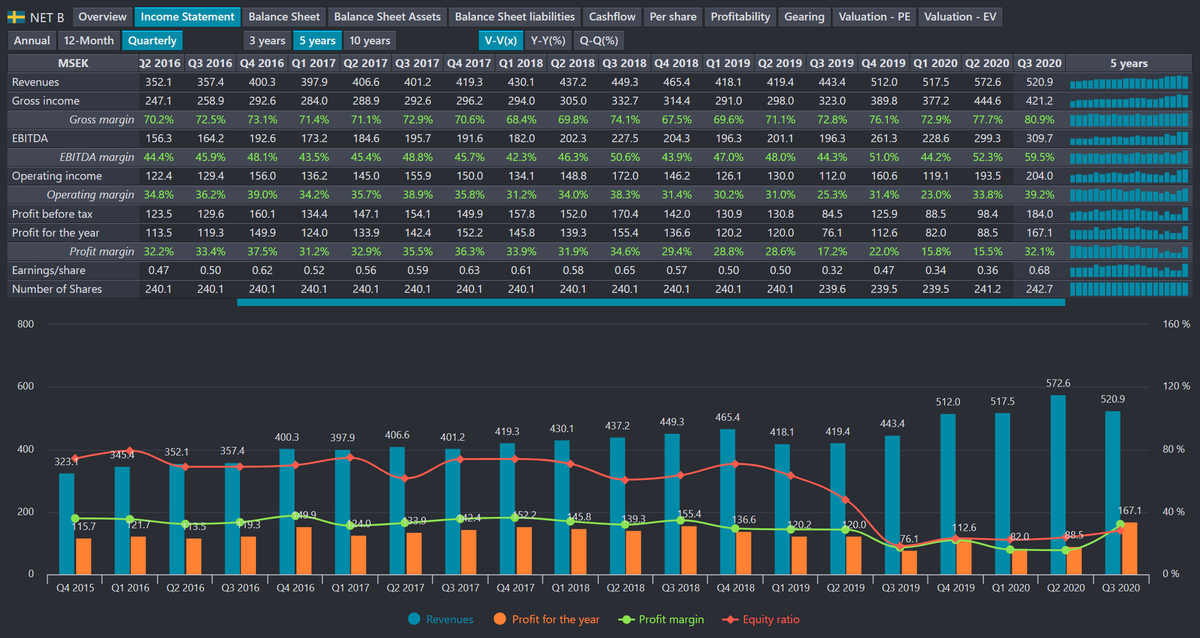

12/x And speaking of the US market, in the earnings call last week CEO Martin Carlesund sounded more than optimistic about future growth in the region. The need for physical presence in every active state is a very costly barrier for competitors to overcome. Building moats.

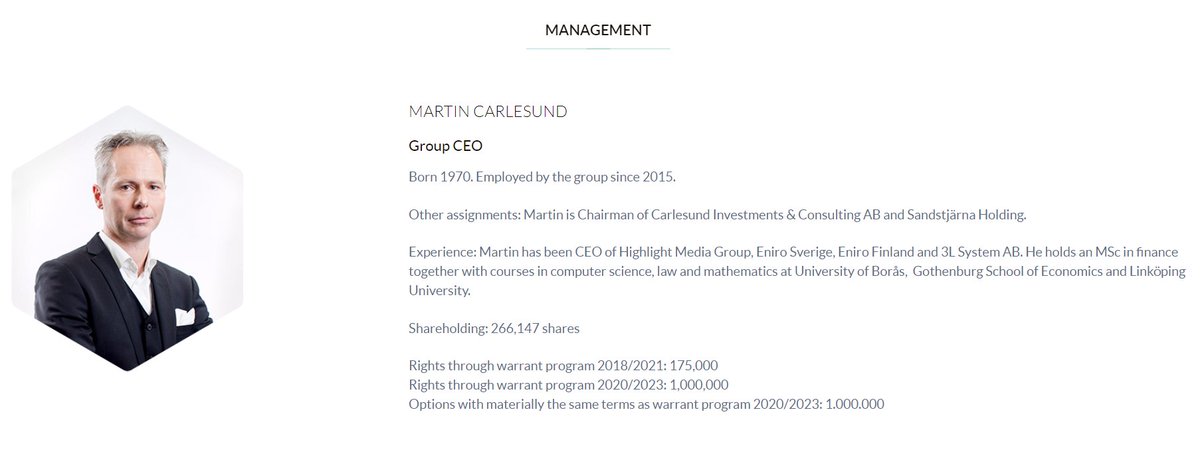

13/x And to put emphasis on their US focus they recently acquired NetEnt $NETB who are really big in the US slot market. I was sceptical at first sight, but really trust management have great plans to blend together Live and Slots + use NetEnt relationships entering US.

14/x I haven't done a Pro Forma with Evolution+NetEnt, but it will definitely have an impact on the groups topline once the acquisition is greenlit. $NETB had just gotten big traction in the US when EVO put forward the offer, and looking at Q3 margins it looks like a good bet.

13/x Skin in the game! Management and the BoD owns huge amounts of shares and warrants in the company which, imo, is key for building a great organization. For example; CEO owns 266k shares and +2m warrants/options. Chairman owns 15% of the whole company.

evolution.com/corporate-gove…

evolution.com/corporate-gove…

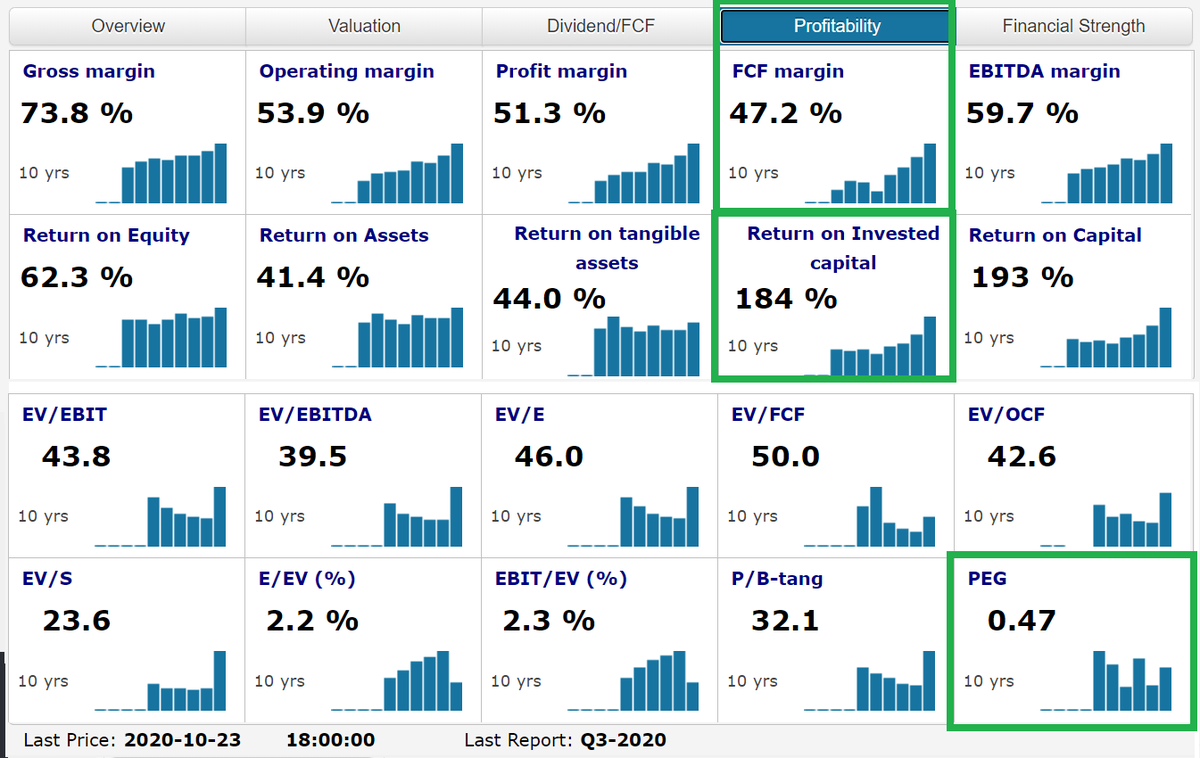

14/x I almost can't grasp the scalability in this business. One would think the physical studio parts of the business would press down margins, but...👇🏻 In the last twelve months $EVO generated as much in free cash flow as they did revenue in 2018. That is just insane.

15/x So obviously I'm a shareholder (and have been since almost three years back) and therefor may have "rose colored glasses" when looking at it , but I really can't see what's going to stop Evolution for the next couple of years at least.

16/x Valuation

The stock trades at around P/E 47 or EV/EBIT 44 LTM, but considering that almost all revenue growth goes straight down to the bottom line I think 30-35x NTM multiples is more than fair for this type of market leading company with world class economics.

The stock trades at around P/E 47 or EV/EBIT 44 LTM, but considering that almost all revenue growth goes straight down to the bottom line I think 30-35x NTM multiples is more than fair for this type of market leading company with world class economics.

17/x Ping @LiviamCapital @BrianFeroldi @chitchatmoney @TidefallCapital @CliffordSosin @GreenhavenRoad @richard_chu97 @7investing @brettbivens @Beth_Kindig

And yes, I forgot to mention that we are just starting to see interest from US institutions. Both Bank of America and Morgan Stanley initiated coverage in the last ~two months or so. I think more and more of 🇺🇲 investors will find $EVO, so I'm therefor giving fintwit a leg-up.

Speaking of Bank of America.. They just raised their target price to 980 SEK (715) and kept their buy recommendation, seing 40% upside from here in the next 12m. 🇺🇲💥

*seeing, ofc

Felt like adding some color to the $EVO growth story with my own charts. Here's the insane y/y growth rate for topline revenue and EBIT every quarter since IPO. Revenue run rate LTM around $620m, with +50% growth.

A chart capturing the margin expansion (EBIT, right) with a truly scalable business model. Worst growth rate (left) since IPO for this monster is +41% y/y, and that was in Q1'18.

Earnings Per Share har grown +4236% since Q1'14, or +402% since Q1'18 to put it in perspective. The company *always* looks expensive on trailing multiples but cheap on next years earnings.

And like I said before, Evolution now generates (LTM) as much in Free Cash Flow as they did revenue in 2018.

• • •

Missing some Tweet in this thread? You can try to

force a refresh